Anirban digs into the valuation of 5 popular software stocks -- CrowdStrike, MongoDB, Okta, Twilio, and Zscaler -- and evaluates whether or not they are worth buying today.

Industries: Enterprise Software

Software has some beautiful properties that make them fantastic investments. They tend to be incredibly sticky, especially if it gets embedded into their users’ workflow. Low churn translates into long usage timeframes. Therefore, spending a percentage of the customer’s lifetime value upfront to acquire them makes sense. After all, once a piece of code is written, in theory, it can be seamlessly distributed to hundreds of thousands of users, potentially even millions, with no additional cost for developing it.

Of course, significant sales and marketing investments are needed to gain market share. But it is okay to spend upfront on customer acquisition, provided those long-term relationships work out. In other words, the spending is generally frontloaded. Operating leverage starts showing its magic once these businesses hit scale, which translates into growing operating income and free cash flow.

Over the past half-decade, we have seen tremendous growth in software, and there has been considerable interest amongst investors. The Covid-19 pandemic highlighted the importance of having a digital strategy, and many businesses, irrespective of their size, adopted software at a frenetic pace. Some companies saw sales increase exponentially through the pandemic, in some cases pulling forward several years of sales. It was the perfect opportunity for the best-in-class software technologies to showcase what they could do, and in general, they didn’t disappoint.

Mr. Market, too, saw that software was growing gangbusters, and it bumped up the multiples it was willing to offer.

The macro-environment has dramatically changed with Covid-19 in the rearview mirror, rampant inflation, and war in Eastern Europe. The US Federal Reserve is positioning itself to lift interest rates (which means future cash flows that software companies will generate will have a lower present value). In this environment, we have seen software multiples pullback. In some cases, the retreat has been dramatic.

We will focus on 5 companies I follow closely, namely CrowdStrike (NASDAQ: CRWD), MongoDB (NASDAQ: MDB), Okta (NASDAQ: OKTA), Twilio (NASDAQ: TWLO), and Zscaler (NASDAQ: ZS). However, the general discussion that follows, at least the approaches to valuation, can be broadly applied to other software as a service (SaaS) style businesses.

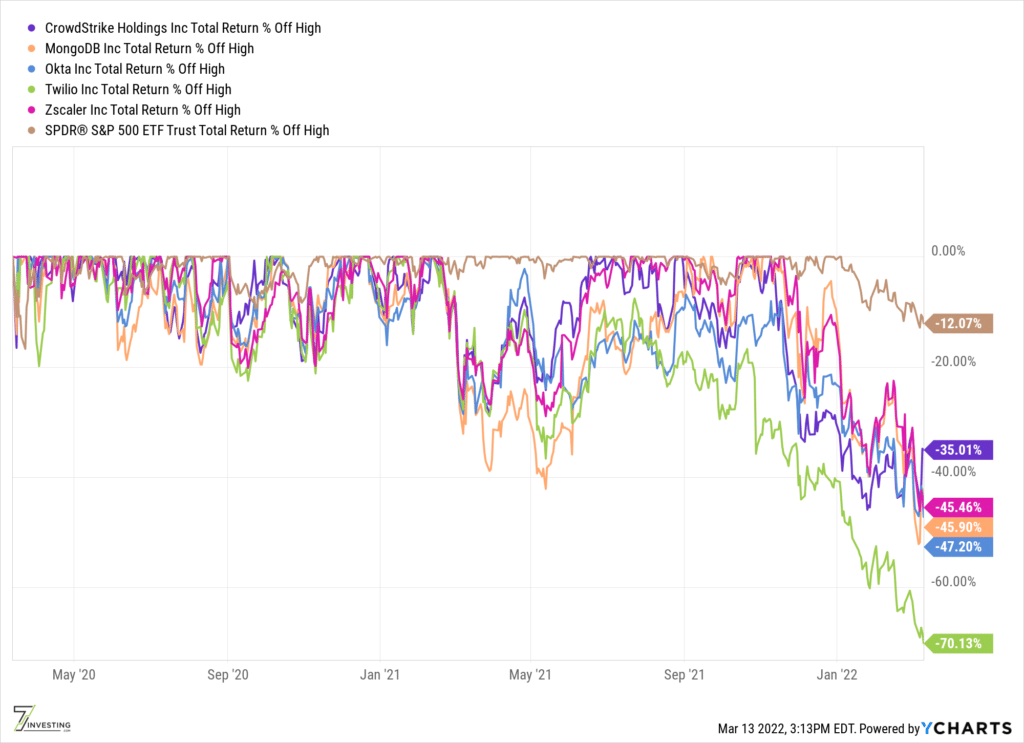

Source: Ycharts

If you look at how much stock prices are off from recent highs over two years, the current market pullback seems to have hit software companies really hard. While the S&P 500 is down about 12%, our companies are off anywhere between 35% to 70% from their highs. In fact, I will go restate what I have mentioned before in our subscriber calls, podcast, and Twitter. The biggest technology businesses such as Apple (NASDAQ: AAPL), Alphabet (NASDAQ: GOOG), and Tesla (NASDAQ: TSLA) are masking the broader pain felt in the small to mid-cap growth space.

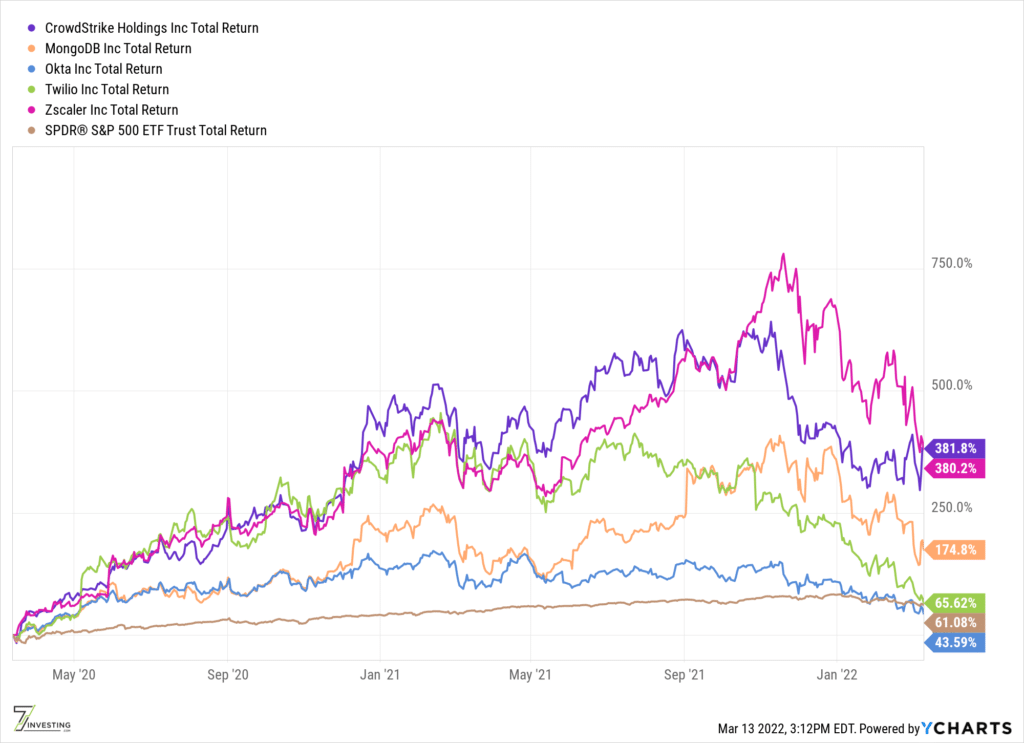

Of course, the relative drawdowns don’t tell us much. Some stocks can be “correcting” more because their valuations have become overstretched. In fact, if we look at these 5 ideas over two years, all of them, barring Okta, are still beating the market. Yes, that includes Twilio, which is down a whopping 70% from its recent highs!

Source: Ycharts

In general, it has been a profitable journey for those who jumped in early on the software bandwagon. But investing is all about the future returns, which depends on how attractive the prices are today.

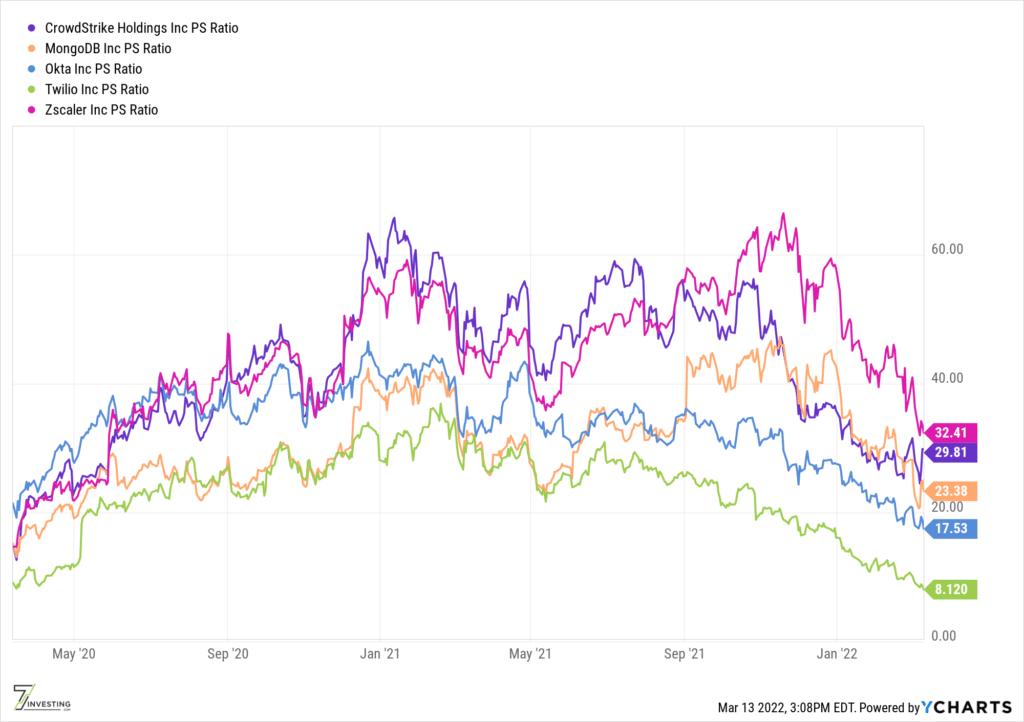

Given many of these high-flying upstarts don’t yet have earnings, and even if they do, they are still meager and growing quickly, investors often look at Price to Sales multiples for valuation. As shown below, there’s no doubt that the price to sales ratios has pulled back.

Source: Ycharts

As the chart above shows, some of our stocks have seen rapid compression in valuation. Companies like CrowdStrike and Zscaler, which generate operating profits and free cash flow, are commanding higher valuations versus those still loss-making. Twilio’s valuation might seem out of place at 8x sales, but note that its gross margins are lower at the mid 50% range versus the others, which tend to be above the mid-70% mark.

Just looking at the multiples tells us that these stocks today are relatively more attractive than they were six months ago. But it doesn’t tell us whether or not these companies are beautiful long-term opportunities.

Before I write anything else here, I want to remind readers of a line from the famous statistician George Box:

All models are wrong, only some are useful.

In the spirit of Dr. Box, my goal is to make this exercise insightful. It is not about precision but about figuring out a range of probable outcomes.

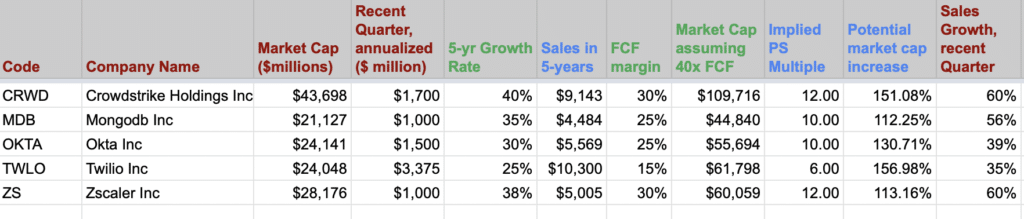

Let’s pick the company with the middle-of-the-road price to sales multiple, namely MongoDB. MongoDB is on a $1 Billion annual revenue run rate. Its recent quarter saw sales grow at a stunning 56%. How fast can sales increase over the next 5-years? I think a 35% per annum growth over the next half-decade seems reasonably doable. In all likelihood, MongoDB delivers more, but let us stick with our assumption. Then, in 5 years, the business will be on a $4.5 billion run rate; I would think it would still be growing at around a 20% per year pace then and be nicely free cash flow positive.

What’s a reasonable assumption regarding free cash flow margins? I will go with a 25% free cash flow margin. Note that CrowdStrike, currently on a $1.7 Billion sales run rate, generates a 30% free cash flow margin today, so a 25% margin might be conservative.

How much would the market pay for MongoDB under those circumstances? Assuming a 40-times free cash flow multiple, the market capitalization would be somewhere around $45 Billion. That’s a handy double, and I think those assumptions are conservative.

How about cross-checking the implied Price to Sales multiple at a $45 Billion market cap assuming $4.5 Billion in sales? The multiple shrinks to 10, and we still see the potential for a healthy return.

Using the methodology outlined, you can do your own calculations based on how you think things might pan out. For our quintet, I produce below one of my estimates.

Source: Google Finance, company filings, analyst calculations.

We could argue whether or not the 40x free cash flow multiple is reasonable. If it went lower, the returns too go lower, although I would wager that my assumptions around growth are likely to be conservative. And if these businesses continue growing for a decade, just as many enterprise software companies have done in the past, then waiting longer will seriously compound our returns. As such, I think today’s valuations offer us a significant margin of safety for market-beating returns.

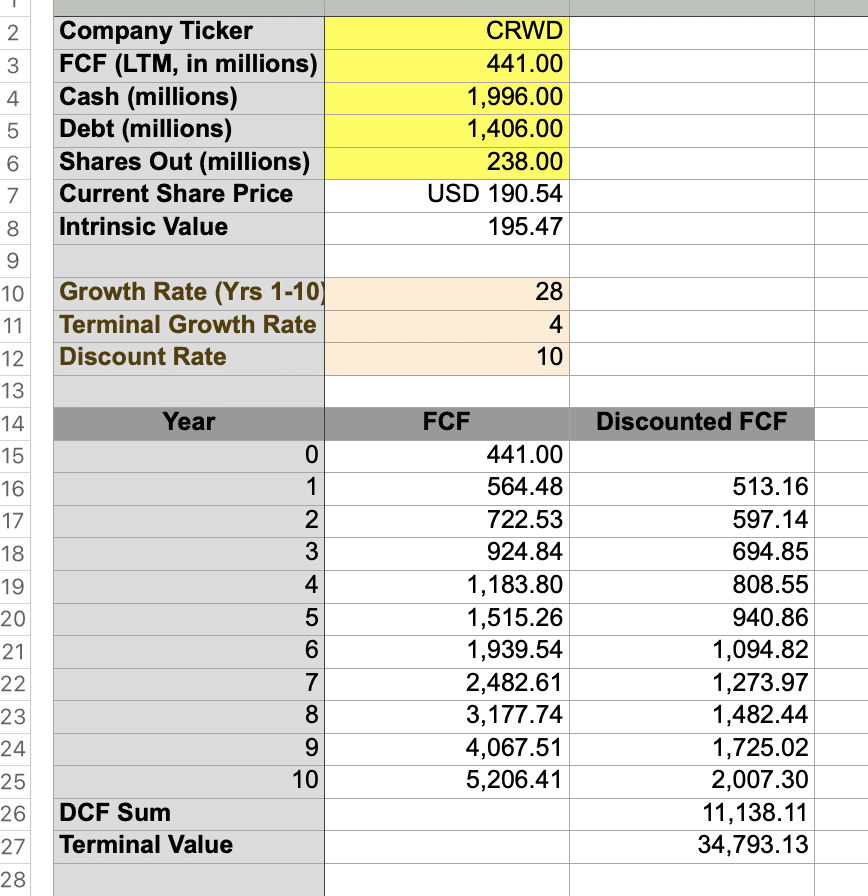

I am a big fan of the reverse DCF (discounted cash flow) model. We know that valuation today is the sum of all discounted free cash flows. However, instead of estimating what the future cash flows might look like, as we did above, we can instead look at the free cash flow assumptions baked into today’s price. In other words, we use today’s valuation to compute free cash flow growth rates assuming the price today is fair.

Source: Analyst calculations, company filings.

This exercise works well for businesses that are already producing gobs of cash. Let’s use CrowdStrike as the guinea pig. Here are some assumptions:

We compute the implied free cash flow growth rate for the next decade using those assumptions. The implied cash flow growth for the next 10 years is around 28% at the current share price. Do you think this is fair? If yes, the stock is reasonably valued. But this is a company with a dollar-based net expansion of around 125%, sales growth of 60%-plus, and several billions of remaining performance obligations. The company is rapidly expanding outside of its core endpoint protection area, which has the effect of growing stickiness, addressable market, and more opportunities for the land-and-expand sales motion. Finally, note that the expectation is 28% free cash flow growth. Cash flow growth can outpace sales because of operating leverage, so all in 28% seems like a lowball hurdle for CrowdStrike.

We can argue about dilution via Stock-Based Compensation. But I also ignored the one-time effect of the Humio IP tax on our starting free cash flow number. What would a business like this throwing off so much cash do? They would probably buy back shares, perhaps even pay a small dividend. In fact, it is possible the share count actually decreases over time.

The purpose of this exercise wasn’t precision. It was more about thinking through the possibilities, what is likely baked into the valuation, and thinking about the model in a couple different ways to give us confidence in our analytical framework. Having studied the SaaS model closely and working through valuations, I believe a basket of best-of-the-breed software companies will likely deliver outstanding returns over the next decade.