Why do hyper growth companies tend to be great buys for long-term, volatility-tolerant investors?

Industries: General

Exponential thinking doesn’t naturally come to us.

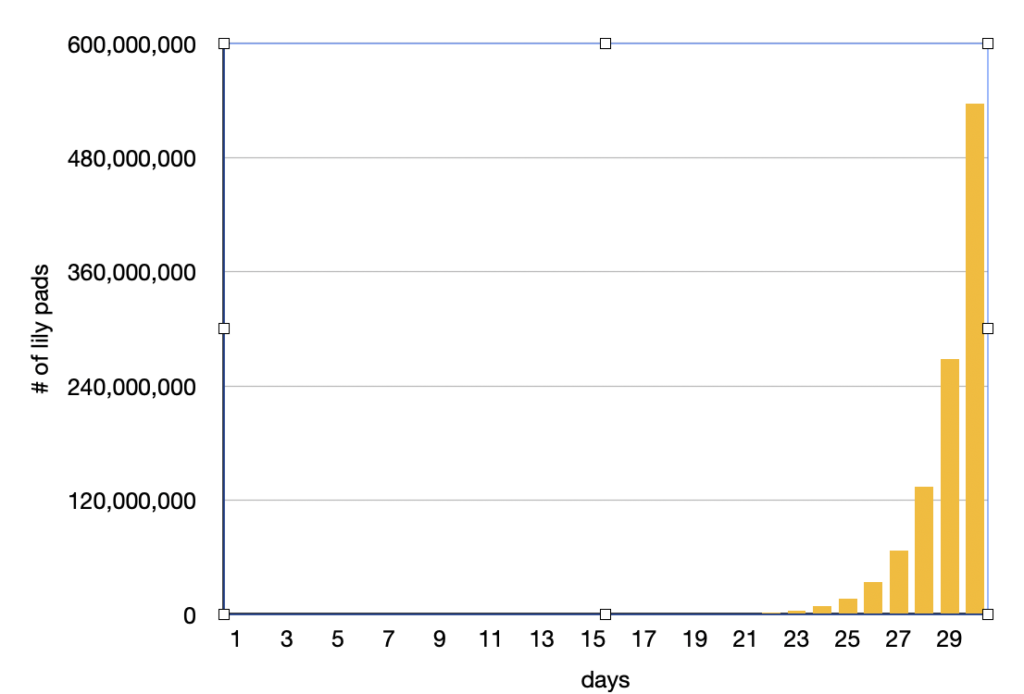

Consider this famous riddle. Assume that the number of lily pads doubles every day. And let’s say it takes 30-days to cover the pond fully. How many days until the pond is half full?

Often, the off-the-cuff response for this type of riddle is 15-days. If the lily pads fill the pond in one month, then 15-days sounds about right for half-full. But that would be true for linear growth, which we are accustomed to, not exponential. But the correct answer is 29-days. Remember, it doubles every day, so it is half the size just one day before!

Even crazier is to imagine the total number of leaves in the pond. For this example above, we will have 536,870,912 lily pads in one month. Yup, that’s right, in just 30-days starting with just one leaf!

So, what’s the connection between lily pads and investing? Glad you asked. I call it growth, at scale.

Let’s do some time traveling.

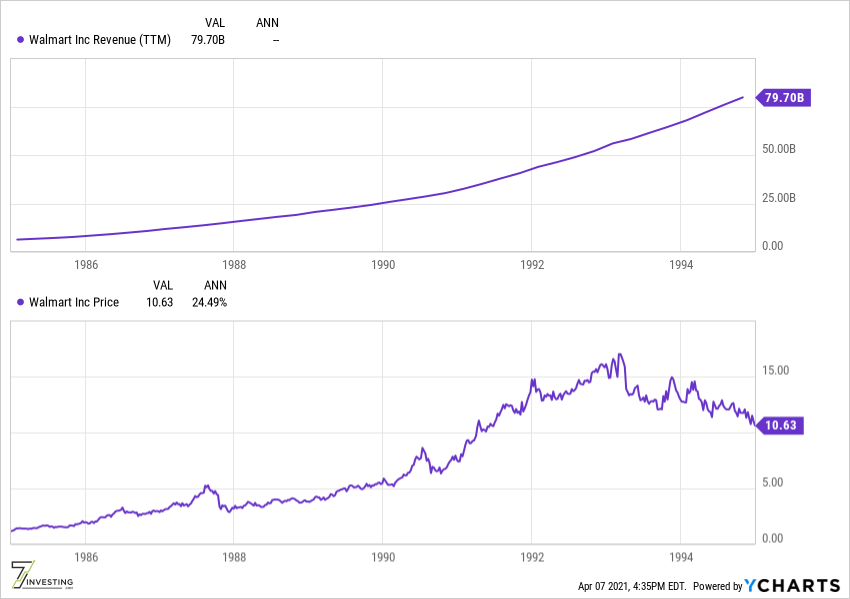

The year is 1985. Walmart has annual sales of $6.4 Billion and is growing at about 35%.

Could you guess for how long it managed to compound sales at 20% or more? The answer. 10-years, crossing $80 Billion in sales by 1995.

And Walmart didn’t come to a screeching halt in 1995. For the next decade, Walmart managed to keep growing at 10% or more each year. By 2005, it had over $280 Billion in sales. Over those 20-years, patient long-term investors returned 19% per annum, easily trouncing the market.

How about Amazon.com back in 2005? Amazon then had sales of about $8.5 Billion, with revenue growth bouncing in the ballpark of between 25% and 35%. Amazon’s growth trajectory pretty much continued as is since, and in fact, in recent years has even witnessed accelerated growth. Today this juggernaut sports sales around the $380 billion mark, with sales in the most recent quarter up 37% over the prior year.

If one was building a Walmart model in 1985, I doubt it would assume 20% growth for a decade. And past the 10-year point, I would think most models would take terminal growth rates of around 4% (if not lower).

Similarly, in 2005, it would have been hard to put thy neck out and assume that Amazon can grow at 20%+ each year for the next two decades!

The main point is — it is hard for us to assume rapid growth will continue for an extended period. Compounding over time makes the numbers very large, and it is natural for us to doubt those possibilities. Exponential assumptions make our models appear reckless, and thus we tend to stick with more linear models for growth.

Not too many investors, even today, consider the possibility of 30% per annum growth for a decade or more. When Elon Musk says that Tesla will grow vehicle volumes at 50% per annum for the next decade, people laugh. And therein is our opportunity.

Of course, not all companies are special enough to experience high growth rates for a very long time. The big-box discount retail format of Walmart disrupted thousands of mom-and-pop stores. It was a huge market opportunity. Amazon’s online retail model disrupted physical retail. It was a new innovative format for retail sales; the company was able to tap into an enormous market enabled by the Internet’s rise.

And while I used Amazon and Walmart as examples, there are plenty of others. Netflix revolutionized video content distribution. Later on, it revolutionized content creation. Apple invented the smartphone ecosystem. Salesforce, the granddaddy of Software as a Service, is another example. These companies have all maintained high growth for very long periods. In general, category-creating disruptive innovation companies are great places to look for multi-bagger opportunities.

Often, we find these class-leading bleeding-edge companies are expensive on most trailing metrics. Yet history shows us that these companies’ stock price tends not to reflect their class-leading growth potential. And seldom is any optionality baked into the share price.

Bottom line. Invest in today’s most innovative businesses and companies that are inventing the future. Invest in the best.

[su_button url=”https://7investing.com/subscribe/?marketing_id=79194″ target=”blank” style=”flat” background=”#84c136″ color=”#000000″ size=”6″ center=”yes” radius=”0″ icon_color=”#000000″]To see our stock market recommendations, subscribe to 7investing today![/su_button]