Free Preview

Did Apple's June quarter earnings set the cash register on fire? We dive into the Cupertino giant's results to see what records were shattered and where the company was found lacking.

Apple‘s (NASDAQ: AAPL) third quarter (Q3) 2022 revenue was up only 2% year-over-year to $83 billion. While that performance might appear mundane at the surface, under the hood, it was a quarter that set many records despite the foreign currency headwinds, supply chain troubles, and macroeconomic uncertainties.

At the company level, a new June quarter revenue record was set.

On a geographic basis, the company set June quarter records in the Americas, Europe, and the rest of Asia Pacific. Interestingly, the U.S., Mexico, Brazil, Korea, and India set new all-time records. The growth Apple is experiencing in the emerging economies is something to watch.

Apple’s Services business continues to boom. It was up 12% year-over-year to $19.6 Billion, despite an almost 500 basis point foreign exchange headwind. Services gross margin was 71.5%, and its growth is good news for shareholders as gross margin on hardware is significantly lower, coming in at 34.5% this quarter.

Sticking with Services, the new records were set in each important category. Interestingly, Apple set all-time records for Music, Cloud Services, AppleCare, and Payment Services.

The strength of Apple’s installed base is sometimes unappreciated. While the company only periodically provides pointers to how the company’s 1 Billion-plus installed base is growing, CFO Luca Maestri did provide some color noting:

“The record level of performance of our Services portfolio during the June quarter reflects the strength of our ecosystem on many fronts. First, our installed base has continued to grow, reaching an all-time high across each geographic segment and major product category. We also saw increased customer engagement with our Services during the quarter. Our transacting accounts, paid accounts and accounts with paid subscriptions all grew double digits year-over-year.”

While we usually think about companies like Netflix (NASDAQ: NFLX) and Disney (NYSE: DIS) as kings of the subscription game, there’s probably one emperor, and it is none other than Apple. The Cupertino giant added 160 million subscribers to its base during the past year, bringing the total to 860 million paid subscriptions.

Of course, no discussion of Apple is complete without a look at the company’s prodigious cash generation. Over the trailing twelve months, it has produced 107.6 billion in free cash flow! Operating income for the quarter was $23.1 billion, and free cash flow was $20.8 billion.

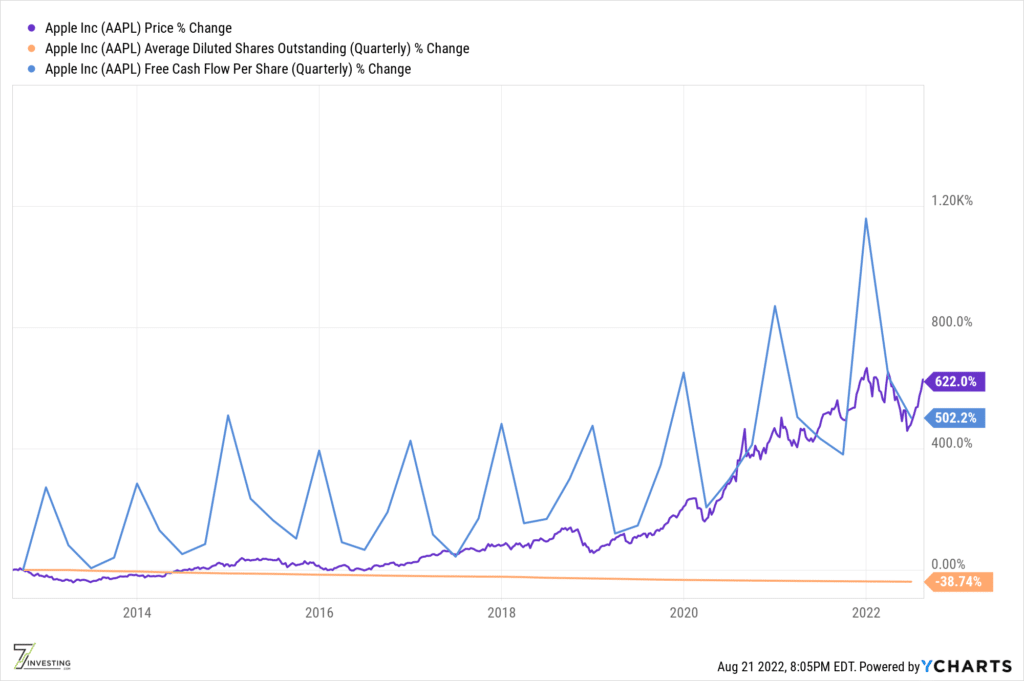

Source: YCharts.

Over the past decade, Apple has been gushing cash, lots of cash. No wonder the company sports a fortress-like balance sheet. The company had $179 billion in cash and equivalents, and total debt of $120 billion, for a net cash position of $59 billion. Apple’s cash pile has reduced over the past decade thanks to its ambitious capital return program. During the third quarter, Apple paid $3.8 billion in dividends and used $21.7 billion to repurchase shares. More specifically, the business repurchased 142.7 million shares at an average price of $150 per share.

As the chart above shows, Apple’s free cash flow per share has increased by 500% in the past decade, partly aided by a 39% decrease in outstanding shares. Long-time holders have enjoyed a 600% gain over this timeframe.