Free Preview

The pizza chain's stock went on sale today, though it still doesn't look particularly appetizing.

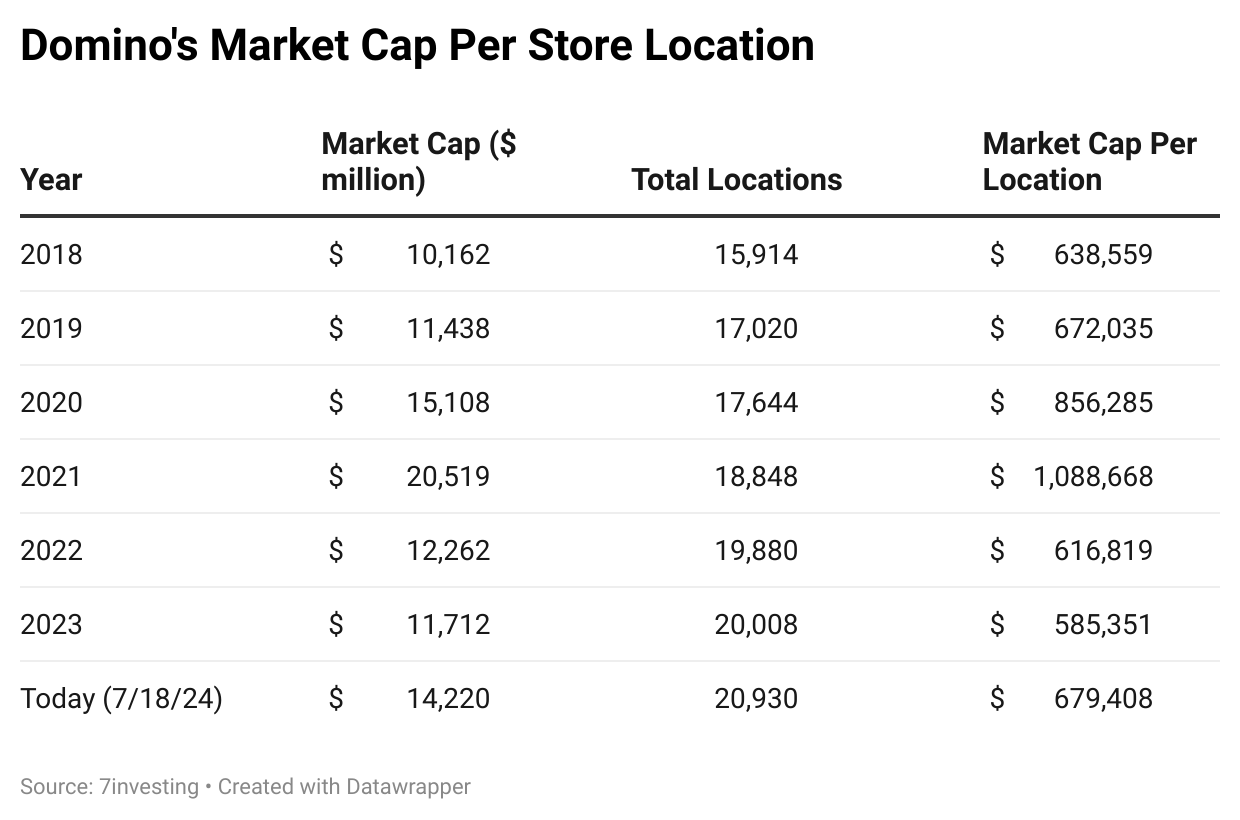

Domino’s (NYSE: DPZ) is the world’s largest pizza chain. Now with 20,930 locations, it’s serving dough, sauce, and toppings to more than 1 million people every day.

The company runs a franchise model. 99% its stores are operated independently, but pay royalties up to the parent corporation of 5.5% of sales for the operational license + another 6% of sales for national marketing campaigns.

As such, one interesting way to asses the company’s valuation is to look at how much the market is paying per store location.

Even though Domino’s stock is selling off around 15% in Thursday’s trading session, it still doesn’t appear to be as “cheap” as it’s been in recent years.

Want to see all of our investing insights on Domino’s? If so, join 7investing’s premium membership for just $1 today!