Free Preview

7investing advisor Luke Hallard breaks down the House's recent Inflation Reduction Act (IRA), especially what it will mean for addressing climate change.

On August 12th, the US House of Representatives passed the Inflation Reduction Act (IRA), initiating the single largest action ever taken by the US government to combat climate change.

While it remains to be seen whether the IRA will effectively combat inflation, the tax breaks supporting the transition to clean energy are a huge achievement for climate campaigners worldwide, and a signature win for the Biden administration after the Democrat party’s markedly similar ‘Build Back Better’ policy reforms were killed earlier in 2022.

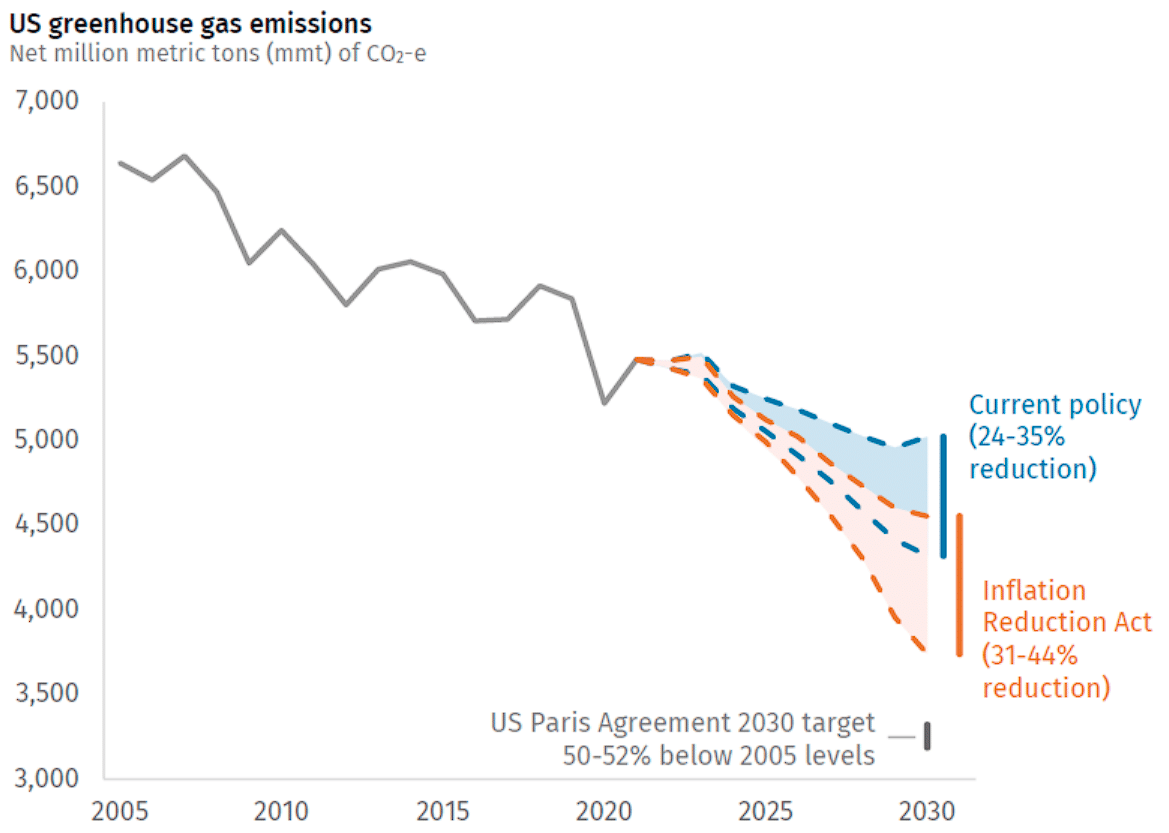

As part of its ‘nationally determined contribution’ to the Paris Climate Agreement, the US has committed to an economy-wide target to reduce its net greenhouse gas emissions to 50-52% below 2005 levels by 2030. It is hoped that the IRA tax breaks supporting investment in clean energy will bring this goal within striking distance.

Source: Rhodium Group

The Inflation Reduction Act calls for $369 billion in strategic investments over the next ten years to combat climate change. Key policy measures include:

- Investments in clean energy generation, including 950 million solar panels, 120,000 wind turbines, and 2,300 grid-scale battery plants.

- Lowering energy costs for households through tax credits for electric vehicles and solar installations, and rebates to buy heat pumps and other energy-efficient home appliances.

- Advancing clean energy projects at rural electric cooperatives serving 42 million people.

- Strengthening climate resilience and protecting nearly two million acres of national forests and coastal habitats.

- Supporting job creation in the clean energy sector.

- Granting the Environmental Protection Agency more authority to regulate carbon dioxide and other greenhouse gases, as well as to promote renewable energy forms.

Today, around half of the US’s carbon-free electricity is provided by nuclear power. The IRA tax credits, which start in 2024 and last until 2032, are expected to support the creation of a new range of ‘small modular reactors’ — nuclear power plants that will last at least 60 years and gradually replace the existing 92 nuclear reactors that are operational in the US today.

The impact that the Inflation Reduction Act will have on the clean energy transition within the US and internationally is difficult to predict, but it is undoubtedly one of the most significant pieces of US legislation in the last decade, expected to deliver a ten times greater climate impact than any other single piece of legislation ever enacted.

To echo Dana’s comments in her recent health care article, for a long-term investor interested in supporting the world’s transition to clean energy, this may prove to be an exciting time!