Free Preview

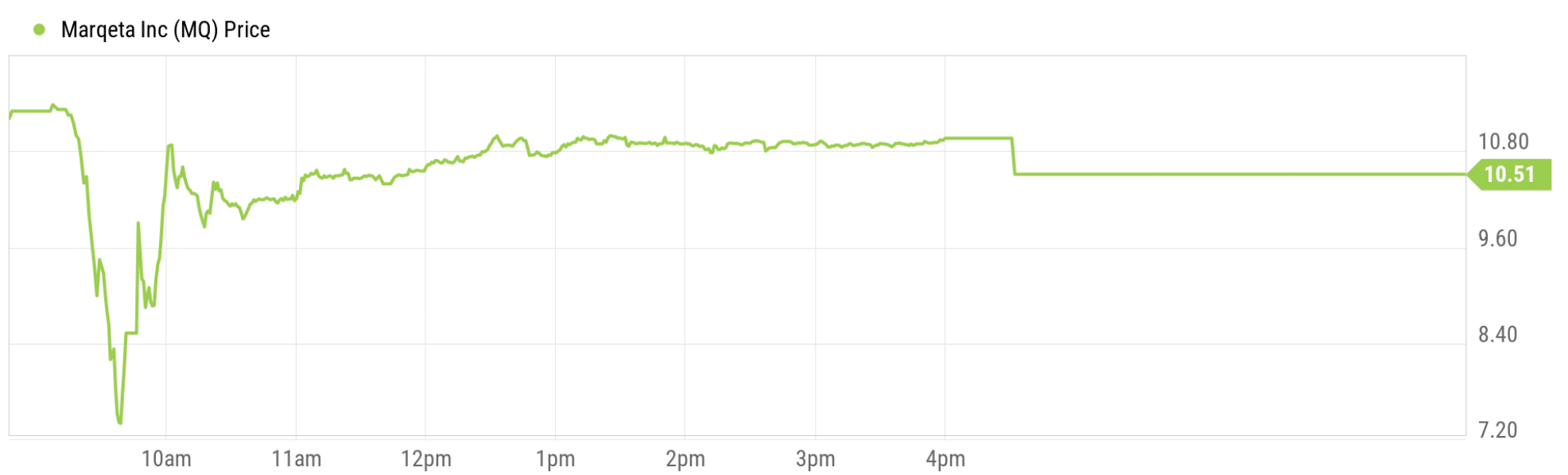

At 9:30am on Thursday 4th August, Marqeta’s stock price crashed 34%, halting trading and wiping $2 billion off the value of the company. By 10am, the stock had recovered back to near previous levels. In this article, Luke explores what happened, and discusses the importance of understanding risk when investing.

Founded in 2010, Marqeta (NASDAQ: MQ) pioneered ‘modern card issuing’, simplifying the process for its customers to issue physical and digital credit and debit cards, and providing innovative new features that established its reputation as a fintech leader. Today, it is a $5.8 billion company, supplying services to customers including DoorDash (NYSE: DASH), Uber (NYSE: UBER), JPMorgan Chase (NYSE: JPM), Affirm (NASDAQ: AFRM), and Instacart.

At 9:30am on Thursday 4th August, Marqeta’s stock price crashed 34% within a matter of minutes, halting trading and wiping $2 billion off the value of the company. By 10am, the stock had recovered back to near previous levels.

This ‘flash-crash’ resulted from an ill-judged comment made in the Thursday morning Q2 earnings call for one of Marqeta’s competitors, Fidelity National Information Services (NYSE: FIS), where it shared “another exciting win for us, Block recently selected our national payments network to power their Cash App Card”. Investors were spooked by the announcement, interpreting it as termination of the existing agreement between Marqeta and Block (NYSE: SQ), a single customer that provides 66% of Marqeta’s revenues!

Although FIS’s announcement was entirely outside of Marqeta’s control, the root cause for the crash lies in the potentially catastrophic customer concentration risk that the relationship with Block represents. For perspective, sourcing more than 10% of revenue from a single customer is typically considered to be a high level of concentration. The market’s reaction to the announcement was subsequently proven to be a misunderstanding, but it serves as a timely reminder to investors of the material impact that losing Block’s business would have on the company.

Marqeta’s existing agreements with Block expire in March and December 2024, however, until the company can diversify its revenue streams, an investor constantly faces the risk of a contract being cancelled, or simply not renewed. The 4th August volatility demonstrates what would happen if this risk were to materialise, and a 34% retraction in the stock price may just be the start of Marqeta’s problems – losing two thirds of revenue could prove to be an existential risk to the company, hampering its ability to reinvest in future growth and critical capabilities such as research and development, and ultimately perhaps resulting in its demise.

All investments carry risk – a company’s value might rise or fall due to market conditions or sentiment; corporate decisions, such as a planned merger or acquisition could impact the perceived future value of the joint company; companies may also be exposed to macro events, and a PESTLE analysis can be a useful tool to evaluate the key external factors (Political, Economic, Sociological, Technological, Legal and Environmental) that can influence an organisation.

The most fundamental skill as an investor is to weigh the risk of an investment versus its potential return, and to ensure that this is reflected in the allocation as part of an overall portfolio management strategy.

Are you comfortable you fully understand the risks in your investment portfolio?