What we think about Taiwan Semiconductor Manufacturing Company (TSM)

Taiwan Semiconductor in Three Words: Global Chip Manufacturer

Breaking Update: TSMC has just unveiled its newest 1.4 nanometer process technology that is based upon GAA nanosheet architecture .

Discuss Taiwan Semiconductor in our Community Forum

Background

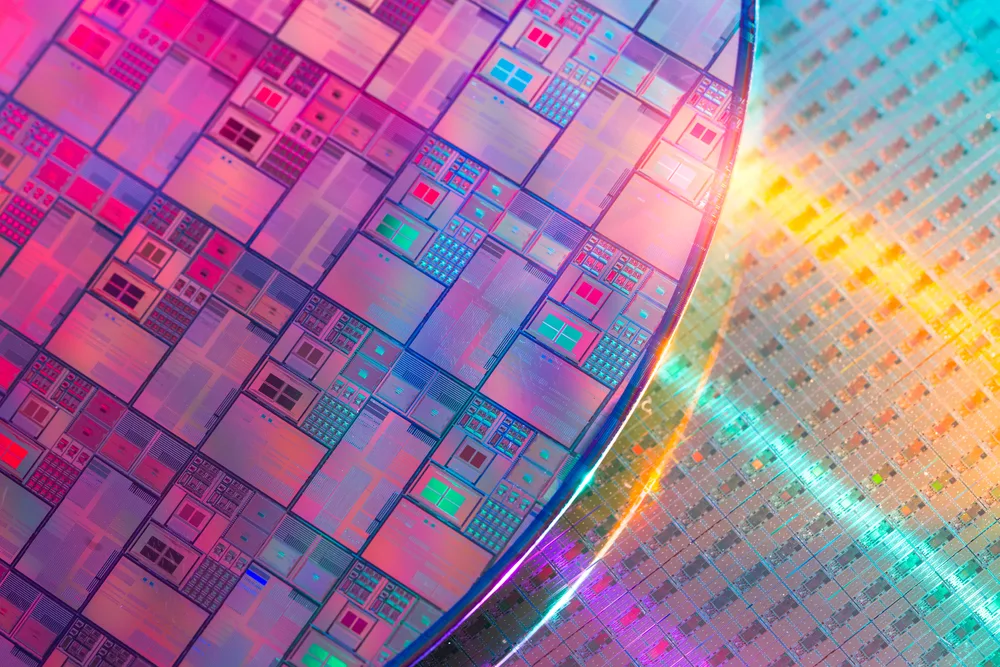

Taiwan Semiconductor is the world’s largest chip manufacturer. With 35 years of operating experience and intellectual property research, it has vastly surpassed its competitors in manufacturing the world’s highest-performance chips. This provides it with extremely strong competitive advantages and protects the relationships and revenues it obtains from its loyal customers.

TSMC has become the backbone of the semiconductor industry, manufacturing more than half of the world’s cutting-edge microprocessors that enable Smartphones, high-performance datacenters, and AI.

TSMC benefits from an IP lead in process technology – i.e. the ability to manufacture chips of the smallest transistor size that can be most densely packed and are used for the most demanding of applications. Moore’s Law is slowing down and it’s becoming increasingly difficult to manufacture smaller transistors economically, so the company is transitioning from its iconic FinFET architecture to a new “Nanosheet” approach for transistor nodes that are smaller than 2 nanometers. Its competitors – namely Samsung, Intel, and Global Foundries — are still far behind when it comes to the IP know-how and manufacturing capabilities to woo the chip industry’s most important customers like Apple and NVIDIA.

Taiwan Semi is benefiting greatly from AI overtaking the datacenter. High-performance processors — including CPUs, GPUs, and custom-designed “XPUs” — are designed and built on Taiwan Semi’s cutting-edge process technology which can now manufacture transistors less than 3 nanometers in length. TSMC is plotting a different course than Intel in the foundry space, holding off on embracing ASML’s new high-NA EUV technology and preferring instead to stick with its existing lithography setup as it transitions from FinFET to Nanosheet architecture. Following a short-term slip in demand from Smartphones and a supply disruption caused by Taiwan’s largest earthquake in 25 years, the company issued very healthy guidance of 28% revenue growth and a 41% operating margin for the upcoming second quarter.

CEO CC Wei mentioned the revenue contribution from several AI processors would more than double this year, and would grow at a 50% CAGR during the next five years and account for more than 20% of total revenue by 2028. That’s a huge sign of trust from customers, in an industry that’s growing incredibly quickly. The stock now sells for 33x training earnings and 22x trailing operating cash flow. Management has traditionally spent 66% of those cash flows on CapEx (building new fabs is expensive!) and paid out 20-25% as a dividend.

The stock currently yields 1.5%, and I expect the dividend to grow at a double-digit CAGR going forward.

Conviction Rating Changes:

Join 7investing to get access to this section

Recent Company Updates:

January 16, 2025: Taiwan Semi, the world's largest chipmaking foundry, just issued the largest CapEx forecast of its company's history. Does this mean the chip industry is finally escaping from its cyclical lows, and is ready for a rebound in 2025?

TSMC's fourth quarter 2024 results showcased a 38% year-over-year increase in revenue and a 57% increase in earnings.

Those were good numbers, but there might be even better news on the horizon. Management has approved a capital budget for 2025 of between $38 billion and $42 billion. 70% of that is dedicated to "advanced technology production" -- i.e. building new fabs to manufacture the cutting-edge chips to do the advanced computing demanded by AI.

TSMC is the world's largest chipmaker, and this aggressive CapEx forecast is...

Join 7investing to get complete access to this section