What we think about The Trade Desk (TTD)

The Trade Desk in Three Words: Programmatic, ROI-Maximizing, Platform

Discuss The Trade Desk in our Community Forum

Background

Is it time for the internet’s walled gardens of Google and Facebook to topple down? The Trade Desk certainly thinks so.

As a programmatic demand-side platform that supports the open internet, The Trade Desk’s mission is to help large agencies maximize the ROI of their advertising spend. That means placing the right ads in the right place — on websites, into podcasts, or within streaming television shows — and maximizing the chances of the viewer taking an action to convert into a paying customer.

Its “Universal ID 2.0” is replacing the soon-to-be-phased-out third-party cookie as the identifier of choice for the internet, respecting data privacy while also giving businesses performance-based metrics. The company’s AI gets smarter after processing each of its 12 million query requests every second.

Its recent OpenPath initiative gives large advertising customers a direct connection to the inventory of large publishers, bypassing the online auctions and improving the ROI of ad dollars spent due to eliminating 5-wasteful spending on the middlemen. OpenPath is already live with dozens of publishers – including USA Today and The Washing Post – and represents more than 11,000 website, TV, and audio destinations.

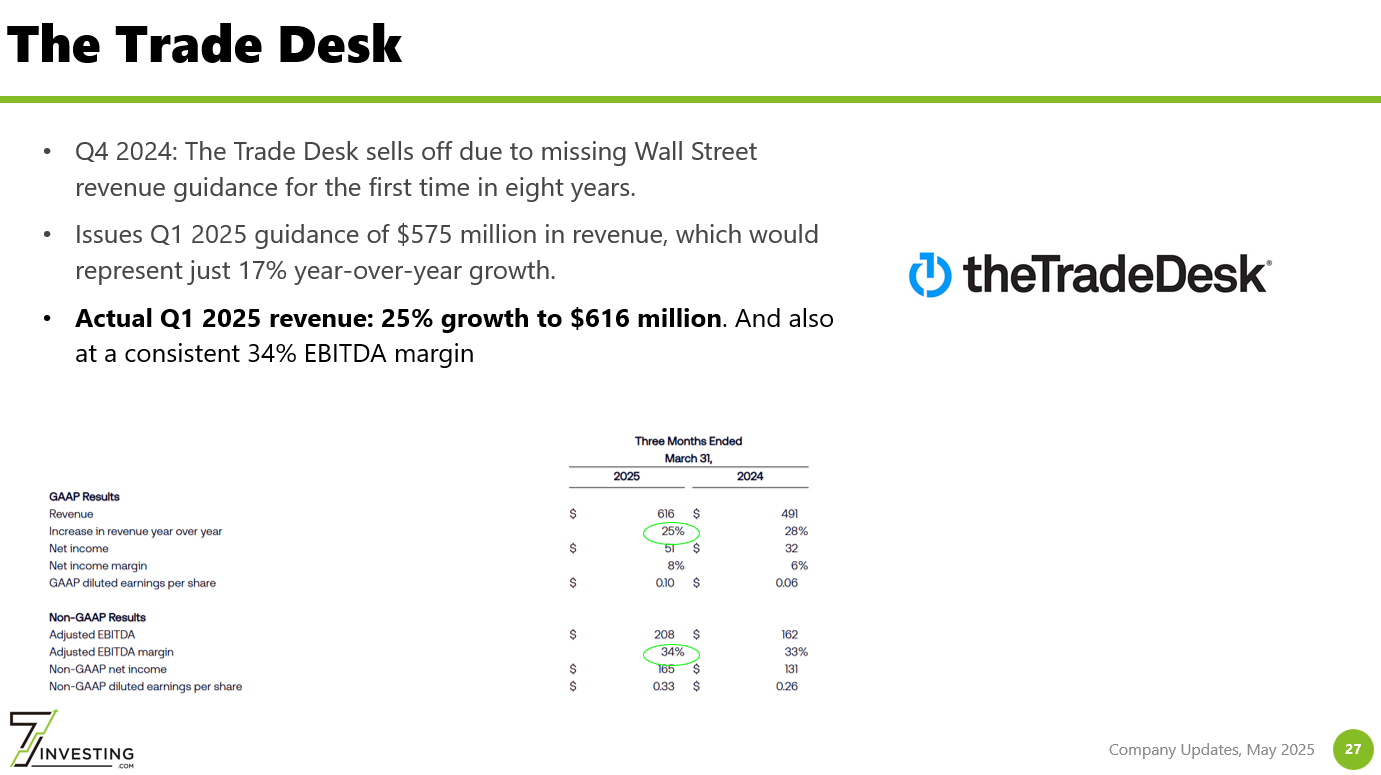

Connected Television has become the most popular new medium for creative advertisers and now accounts for more than 40% of The Trade Desk’s overall revenue. In the first quarter 2024, The Trade Desk reported 28% revenue growth (up from 25% last quarter) and an adjusted 33% EBITDA margin (down from 40%).

Thoughts on Current Valuation and Capital Allocation

In mid 2024, I estimated The Trade Desk was worth $62 per share. I assumed The Trade Desk and Google would be a two-horse race when it comes to the DSP buy-side and that the entire Open Programmatic segment would grow at 10% annually as advertisers transition their budgets from traditional TV, Print, and Radio.

There will also likely be consolidation and a shift in market share, as smaller/regional Buy-Side platforms can’t compete with the sheer amount of data and ROI efficiency of the larger players.

I estimate The Trade Desk will place $97 billion of gross ad spend by 2038 and capture $19 billion in revenue from that (a 20% take rate).

See 7investing's complete Trade Desk valuation model

Conviction Rating Changes:

Join 7investing to get access to this section

The Trade Desk was upgraded from _____ to ____ on March 3, 2025....

Recent Company Updates:

Join 7investing to get access to this section