Free Preview

In this second-round matchup, the global consumer device maker goes head-to-head against the EV innovator. Click here to read our analysis and to vote in our real-time poll!

Welcome to our 7investing Market Madness competition!

Throughout this campaign, we’re matching popular stocks up against one another to determine which will be the best investment over the next three years. And then, by voting in the poll at the bottom of the article, you can help us determine which stock will go on to the next round.

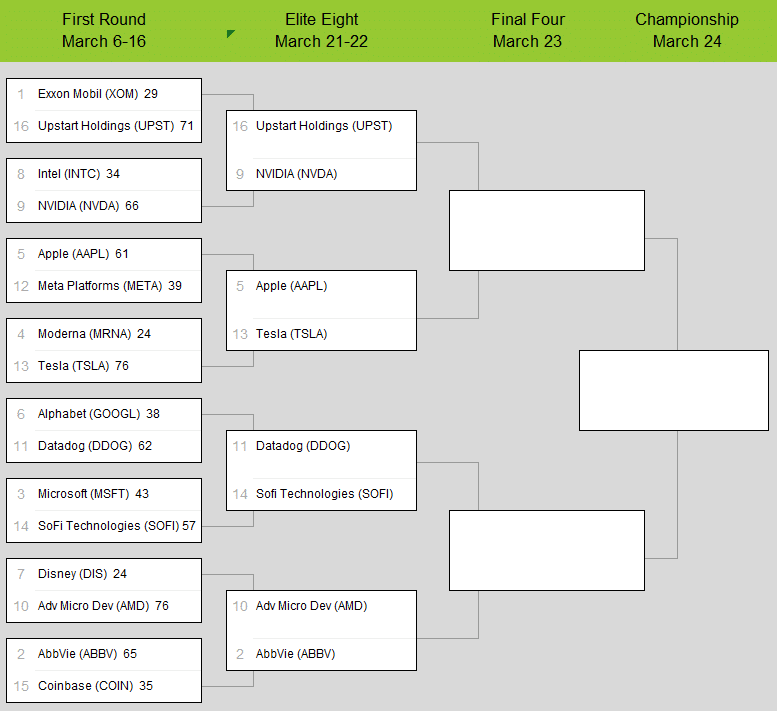

Our first round is now completed and it was quite eventful. By the numbers, we saw upsets in six of the eight pairings. As a reminder, our rankings are based upon 2022 performance — where the top seed had the highest total investing return last year. And our scores/outcomes correspond to the actual voting results that came from our interactive Twitter polls.

Here is a full recap of our first round matchups and where we stand today:

- UPSET: Upstart Holdings (our #16 seed) defeated Exxon Mobil (#1 seed), 71-29

- AbbVie (#2) defeated Coinbase (#15), 65-35

- UPSET: SoFi Technologies (#14) defeated Microsoft (#3), 57-43

- UPSET: Tesla (#13) defeated Moderna (#4), 76-24

- Apple (#5) defeated Meta Platforms (#12), 61-39

- UPSET: Datadog (#11) defeated Alphabet (#6), 62-38

- UPSET: Advanced Micro Devices (#10) defeated Disney (#7), 76-24

- UPSET: NVIDIA (#9) defeated Intel (#8), 66-34

Our first-round voting results suggest that hope still exists for a market recovery. While 2022 was a market that rewarded stable Blue Chips and often punished higher-beta smaller-caps, our voting audience appears to have a much more bullish tone for the upcoming three years.

On to the Second Round

Our March tournament marches onward, and our second-round matchups are quite a bit harder! The winners of the first round now go head-to-head in our Elite Eight pairings:

- Upstart Holdings (#16) vs NVIDIA (#9)

- Apple (#5) vs Tesla (#13)

- Datadog (#11) vs SoFi Technologies (#14)

- AMD (#10) vs AbbVie (#2)

In this second-round matchup, the Cupertino fruit company Apple (Nasdaq: AAPL) pairs (/pears?) up against the electric vehicle innovator Tesla (Nasdaq: TSLA).

7investing advisor Anirban Mahanti noted the sweetness of Apple‘s global ecosystem. There are now more than 2 billion connected i-devices, which continue to expand at a double-digit rate every year. With a market capitalization of $2.5 trillion dollars, Apple has become more than just an electronic products company. It has become a symbol of progress, creativity, and limitless possibilities.

With a tenured history of producing strong cash flows, Apple has rewarded shareholders through share buybacks and a rising dividend. Even amidst concerns about a global recession, the King of Consumer Devices seems well-poised to produce excellent investing returns during the next three years.

Anirban’s alter-ego also represented the other side of this matchup as well, arguing that Tesla was accelerating the world’s transition to sustainable energy. Tesla has already reached an impressive production run rate of 1.75 million vehicles per year, yet it continues to drive even faster as it aims to increase its vehicle output by 50% between 2020 and 2030.

Tesla is a “once in a century” type of business who transcends its own size and somehow grows faster even as it gets larger. While its brilliant CEO Elon Musk often finds himself in controversial situations (including his tweets on Twitter, which he recently brought private), there’s no denying that his execution has been excellent. Rising competition from traditional automakers could woo away a few EV drivers, yet Tesla’s ambitions in energy and AI will solidify its leadership role as one of the market’s most innovative companies.

Cast Your Vote!

Which of these two stocks do you believe will provide the greater forward three-year return? Cast your vote in our poll below!

Welcome to our @7investing Market Madness tournament!

We're now in Round TWO, where the matchups are even harder. Matchup 2 is Apple $AAPL vs Tesla $TSLA.https://t.co/YyvYFRo9cZ

Which of these two companies will provide the greater investing return over the next 3 years?

— 7investing (@7investing) March 21, 2023

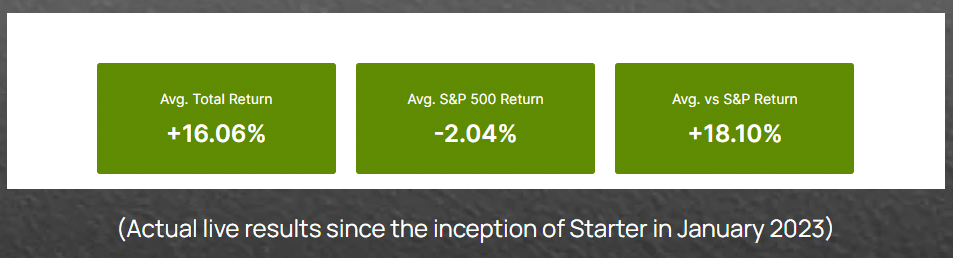

Our Market Madness tournament is in support of our new 7investing Starter membership, which we are giving away free during the entire month of March. To learn more about Starter — including how and why it’s already outperforming the S&P by 18 percentage points (as of today, March 21st) — click here to automatically apply your “madness” promo code and to get started today!