Free Preview

The leader in corrective vision has a stock that's significantly undervalued.

See my previous Discounted Cash Flows for Coupang , Rocket Lab , Tesla, and The Trade Desk.

Some investors describe themselves as “growth investors” while also refer to themselves as “value investors.”

But in my opinion, it’s best to be both.

The stock market is a giant auction where people are bidding on prices every day.

There are plenty of large companies out there which are efficiently priced. Large companies who are easily modellable attract a large following of Wall Street analysts. It’s rather straightforward to predict how many coffees Starbucks (Nasdaq: SBUX) will make or how many burritos Chipotle (Nasdaq: CMG) will serve in any given quarter.

Things get more interesting for smaller companies who are less predictable and aren’t as closely followed. Because they have greater uncertainties, their consensus price targets are more scattered — due to the variance of the inputs that are used in institutional valuation models.

And the best of both worlds is to find mispriced growth companies. These misunderstood, underfollowed innovators are the prime hunting ground for potential 10-baggers.

One innovative and underfollowed company on my radar right now is STAAR Surgical (Nasdaq: STAA).

STAAR is the global leader in implantable collamer lenses. An alternative to LASIK, ICLs are lenses placed within the eye to permanently improve a person’s vision.

STAAR is already well-established and is quite popular in China, Japan, and South Korea. But it’s just now gaining traction in the United States, where it still has less than 2% share of the refractive surgery market.

Vision correction is elective — typically not covered by insurance and costing several thousands of dollars out-of-pocket. And while LASIK procedures have globally been on the decline for several years, STAAR’s ICLs have bucked the trend and shown steady growth on multiple continents.

This is a unique company in a unique market. Now’s a great time to put a full valuation model to work and to determine just how much STAAR’s shares are fundamentally worth.

Introducing the Discounted Cash Flow Valuation

To answer those questions, we need to bring in a useful new tool.

Doing so involves a discounted cash flow analysis. A DCF estimates future free cash flows — i.e. the cash that a company generates after paying all of its operational and capital costs — and then discounts them to the present day. The end result is a fair value, representing what that shares are worth for investors to pay to be the owners of those future free cash flows.

DCF models are the primary way that Wall Street firms set price targets for stocks. They’re not simple and are a huge time commitment to do properly. Here’s a quick look at the financial magic and voodoo that’s being run in the models.

This past year, I’ve published DCFs on small-satellite launch provider Rocket Lab (Nasdaq: RKLB), on South Korean e-commerce leader Coupang (NYSE: CPNG), and on the great disruptor-of-everything Tesla (Nasdaq: TSLA).

In all cases, I build my DCF models from scratch. I don’t look at other reports or price target estimates because I want to avoid any bias. My inputs are purposely conservative, to result in a price target that investors should be very comfortable in paying. Using conservative assumptions will ultimately result in a lower price target, though certain drivers could provide significant additional upside if they come to fruition.

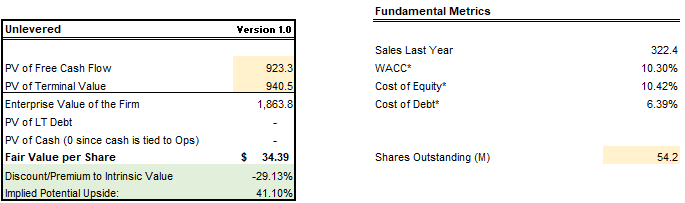

So all of that said, let’s jump right to the punchline. I believe STAAR Surgical’s stock is worth $34.39 per share and has around 41% upside from its current price.

STAAR is Shining Bright

The stock has been trading hands at $24 lately, suggesting that shares are currently quite undervalued. But as I’ll discuss in the following sections, STAAR is entering and is performing well in its most important new market — and that could unlock a lot of value for its investors.

And before we get into the trenches of my entire model, I’d like to quickly promote our 7investing service.

This article contains institutional-grade research and is only possible to be published for free because of our generous paying subscribers. Please consider joining 7investing for free to get similar research reports on all of our official stock recommendations.

Your 7investing membership also includes complete access to our Community Forum, where our advisors and other investors are discussing stocks on a 24/7 basis.

Now, let’s get into the details of my STAAR Surgical DCF.

Inputs and Assumptions

Revenues

STAAR is a very different investment than most other companies I come across.

Most companies grow their sales when their overall market is expanding. They ride the tide and capitalize on a new and growing trend. Examples have included Apple, NVIDIA, Palantir, or Tesla.

But STAAR is a different beast. It’s growing its unit volumes and sales even though its overall market has been contracting.

By definition, that means it’s been expanding its market share in recent years — especially in China (now 23% market share of all refractive surgeries) and in Japan (73% market share).

STAAR’s gains have largely come at LASIK’s expense. LASIK has been the primary form of refractive surgery in the US, but has been on the decline for several years. STAAR still has only 2% market share in the US and believes it can grow this to 10-20% over time. LASIK has similarly been on the decline in several other developed markets, though the absolute size of overall refractive surgical procedures have held rather steady. In other words, people are opting for fewer LASIK procedures and are instead turning to STAAR’s ICLs and other options like SMILE, PRK, and custom solutions like RxSight.

So to model out revenue in a methodical way, we should recognize that all of the countries STAAR sells to are not equivalent.

In some like Japan, it already has a very high market share and will have limited future growth. In others like the US, it has a very low market share and will likely grow quickly. And China is somewhere in the middle; with a pretty strong market share today but also fueled by government-sponsored support in its quest to correct myopia.

I’ve segmented STAAR’s international sales by region, which each have their own price point, procedure volumes, and market share. STAAR is by-far getting the best global pricing on the new EVO ICLs it sells to the US (which is nearly 4x higher than many other markets). And even though refractive surgery procedures were stagnant last year, I see them modest growing in aggregate for most of the next decade. One important assumption is 10% market share in the US within 10 years. That’s a pretty low bar right now that STAAR will likely surpass.

I took things a step further and modeled out the overall growth of each of those geographies.

In other words, how many total procedures would STAAR do in each country it operated in? And how did that procedural market share compare with the bigger-picture of what was happening within refractive surgery?

Costs of Goods Sold and Operating Expenses

From there, I added an element of scalability that will come as STAAR sells more units globally.

Specifically:

- Due to the higher price of EVO in the US, gross margin expands from 78% today and peaks at 85%.

- Operating leverage of fixed costs kicks in. Headcount growth lags revenue growth by 2% annually; G&A growth lags headcount growth by 2% per year.

- Sales efficiency kicks in. STAAR takes a closer look at how it’s spending its sales & marketing dollars and improves the revenue growth per S&M spent annually

- Operating profit peaks at 29% in 2037; up from 9% today.

- Capital expenditures lag revenue growth by 1% annually.

- Outstanding share count increases by 1% annually due to stock-based compensation.

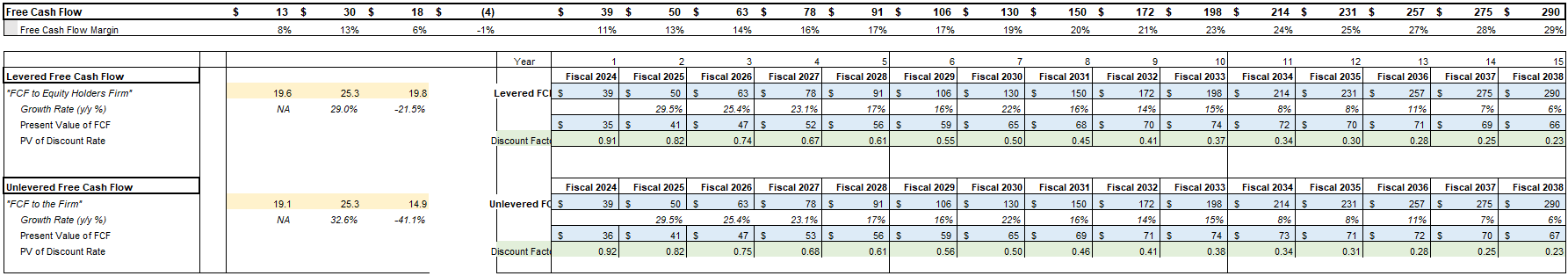

Converting Operating Profit into Free Cash Flow

Finally, we need to make a few adjustments to convert STAAR’s on-paper profits into the actual cash that gets deposited into its account:

- Depreciation scales up from 30% of capital expenditures in 2024 to 95% in 2038. This is because the CapEx the company spends is used less for future growth and more for routine maintenance of fully-depreciated equipment.

- Stock-based compensation consistently remains as 7% of revenue through all years of the forecast.

- No acquisitions.

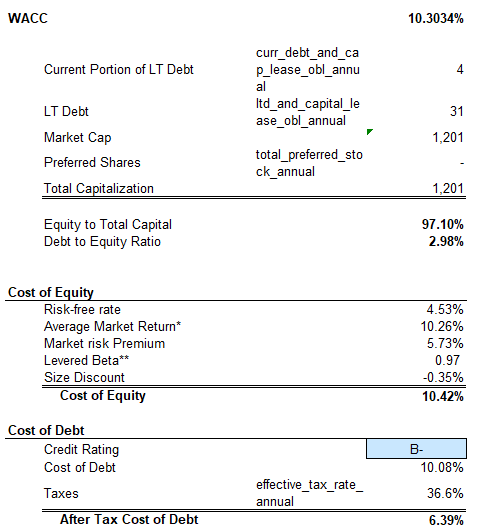

I then turn to the discount rate. Cash flows in the future are worth less than cash flows today; so we need to discount them all back to the present.

I used a discount rate of 10.3%, which is based upon 97% of capital being contributed from equity and a beta value of 0.97.

Using a 15 year growth window and assuming a terminal growth rate of 3% for the cash flows beyond 2038, I then discounted all of those future cash flow back to the present.

So…What’s STAAR Surgical Worth?

Now that we’ve gone through all of the inputs, let’s circle back to that punchline. I estimate STAAR Surgical’s present equity value is worth $34.39 per share. This represents the fair value of what STAAR Surgical’s shares are worth today.

STAAR’s current stock price is around $24, suggesting its shares are quite undervalued. That could be due to various reasons; such as other investors not expecting as much future growth or not as much scalability that would generate future cash flows.

That’s pretty much been par for the course though. This company always feels expensive whenever looking at its current multiples. And yet it outperformed earnings expectations in every single quarter of 2024.

All of this is just the beginning. DCFs evolve over time and I’ll be updating my model accordingly to keep up with the digital ad industry’s ongoing changes.

I’ll be sharing all of those updates on our 7investing Community Forum. And I’d love to invite you to join in on the conversation.

Want to discuss Simon’s assumptions on STAAR Surgical directly with him and with other investors?

“Thanks a lot, Simon, for all the work. It would have surprised me if the stock was fairly valued or undervalued given it’s P/S ratio above 20 and “relatively modest” growth for that multiple. The discussion on SBC and the headcount that you provided were quite interesting. I don’t have a full position yet but am not building up at these prices.”

“Thanks for doing this. So much work goes into these models, that this kind of financial calculus on individual stocks is worth the price of admission by itself.”

“Thanks a lot for working through this publicly, really an excellent exercise.”

This is a great company but an average stock at this moment in time. If you build out a position at these prices it will likely take great execution and time to outperform the market. It is a tremendous company so when the stock experiences significant corrections I add trade positions. But I trim them back away upon recovery.

“Thanks for the modeling!”

“Thanks for the hard-work, 7innovator! Would be interesting to see if this impacts the conviction rating..”

These are actual posts from actual members in our Community Forum. Click here to join 7investing’s Community Forum today!