No, that’s not a typo or a misplaced decimal. Rocket Lab (Nasdaq: RKLB)’s stock really does have the potential to become a five-bagger.

This disruptor of the space economy got its got its roots by launching small satellites into orbit. Its carbon composite Electron rocket could carry payloads of up to 300 kilograms. That’s just enough for smaller customers — the kind who have always been ignored and underserved by SpaceX — to place a satellite exactly where they want it and exactly when they want it.

Rocket Lab doesn’t need to become SpaceX to be successful. Elon’s Falcon Heavy and Starship rockets will serve mega-missions that carry 150 ton payloads. That gives Rocket Lab the opportunity to focus on smaller customers, who don’t require such a heavy lift or don’t want to wait around to rideshare.

That focus on small customers is currently providing just enough money to keep the business running. Last year, Electron was used for ten missions and brought in an average of $7.2 million in revenue per launch.

Building and launching rockets is expensive though, and the company incurred an average cost of $7 million per launch. That means it just barely eeked out a gross profit…before even accounting for its operating expenses.

Fortunately, Rocket Lab’s business is scaling very quickly. Its dedication to innovation and its ambition of becoming an “end-to-end space” company are rewarding it with larger contracts from larger customers. Recent acquisitions of component providers like Advanced Solutions, SolAero, and Planetary Systems have unlocked a new “Space Systems” revenue stream — where Rocket Lab is now also designing and building the satellites for its customers. It will soon also be managing the satellite’s operations — including handling their communications, providing power, and preventive maintenance.

Think of it like a cable company or a website host. They take care of all of the equipment and the infrastructure. Then they just charge you a monthly fee to ensure performance and zero downtime.

Regarding those larger contracts with larger customers, it recently signed a $143 million contract to design and build 17 satellites for MDA for satellite-based communications and then a record-setting $515 million contract to design, build, and manage the operations of 18 satellites different space vehicles for the US Space Development Agency. That’s making the pie bigger, to capture much more than $7.2 million in revenue per mission.

To keep up with the growing demand, Rocket Lab has set out to design an even larger rocket. “Neutron” will be able to carry payloads of up to 8,000 kgs, which is nearly 30 times the capacity of Electron. This will be perfect for customers or government agencies who want to place an entire satellite constellations in a single launch.

All of the above is exciting and intriguing and it’s helping the top-line grow at an accelerated pass. But will the massive costs associated with building, launching, and then operating satellites generate any bottom-line profits for investors?

Introducing the Discounted Cash Flow Valuation

To answer that question, we need to bring in a useful new tool.

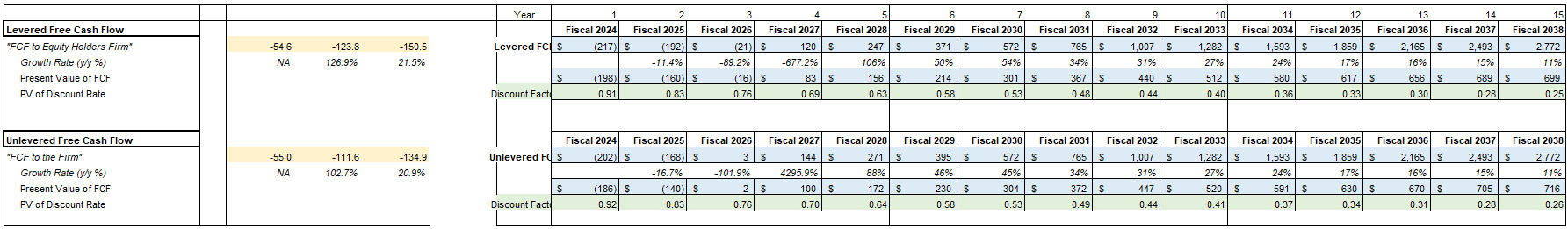

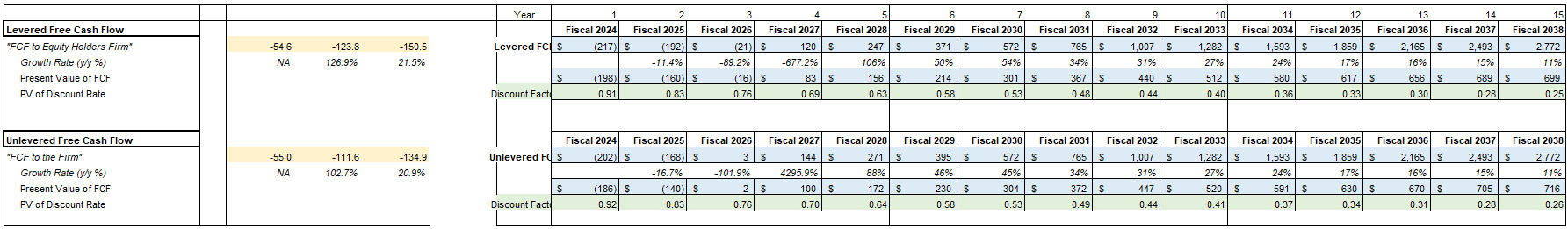

Doing so involves a discounted cash flow analysis. A DCF estimates future free cash flows — i.e. the cash that a company generates after paying all of its operational and capital costs — and then discounts them to the present day. The end result is a fair value, representing what that shares are worth for investors to pay to be the owners of those future free cash flows.

DCF models are the primary way that Wall Street firms set price targets for stocks. They’re not simple and are a huge time commitment to do properly. Here’s a quick look at the financial magic and voodoo that’s being run in the models.

I’ve spent the past two weeks working on my Rocket Lab DCF, which was a dedicated effort that was absolutely necessary. With this being a popular company who attracts a lot of media coverage (which is typically either overly euphoric or dreadfully pessimistic), now is the right time to take an objective look at the forecast and come up with a quantitative stand on what the shares are worth.

So that said, I built my DCF from scratch, without looking at any other reports or price target estimates in order to avoid bias. I wanted make sure the objective inputs of my model were guiding the price target, rather than vice versa. Going into this exercise, I had no idea what the result would be of what the fair value of the shares would be worth.

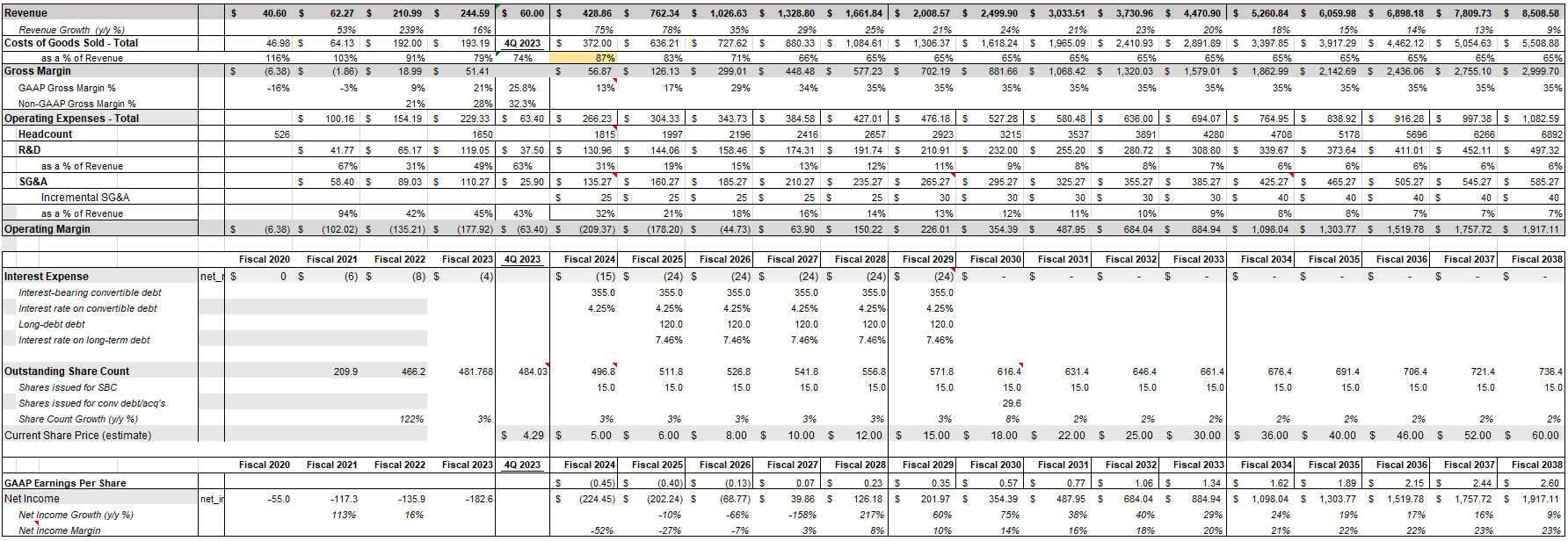

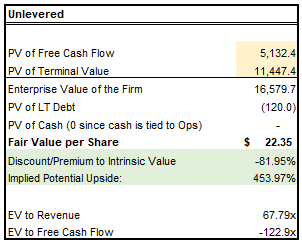

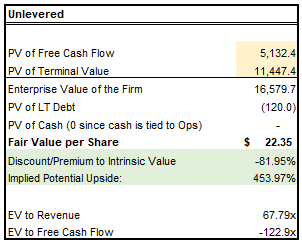

I’ll jump right in to the punchline. I came up with an equity valuation of $22.35 per RKLB share. That implies that Rocket Lab’s shares have 453% upside from today’s price of $4.04. This makes it one of the stock market’s most undervalued and intriguing opportunities of 2024.

Yet of course, DCFs are like all models and are “BS in, BS out.” In other words, they’re only as good as the research you do, the inputs you use, and the assumptions you make.

So in the next few sections, I’ll share all of my inputs and assumptions. Several of them are purposely conservative, and most of them have at least a moderate degree of uncertainty.

Before we jump in (and I’d highly recommend a strong cup of coffee), I’d like to quickly promote our 7investing service. The institutional-level research of this article is only possible to be distributed for free because of our generous paying subscribers. If you find value in this article, please take a moment to consider joining 7investing for just $1 and getting similar research on every company we officially recommend for our scorecard. A 7investing membership also includes access to our Community Forum, where our advisors and other investors are discussing stocks on a 24/7 basis.

Now, let’s jump into the trenches and get into the details of my Rocket Lab DCF.

Inputs and Assumptions

Revenue and Costs of Goods Sold

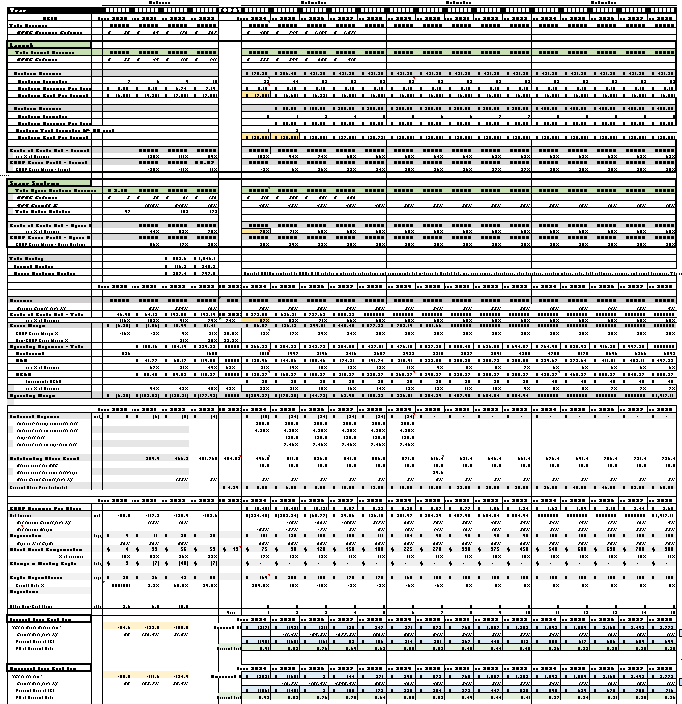

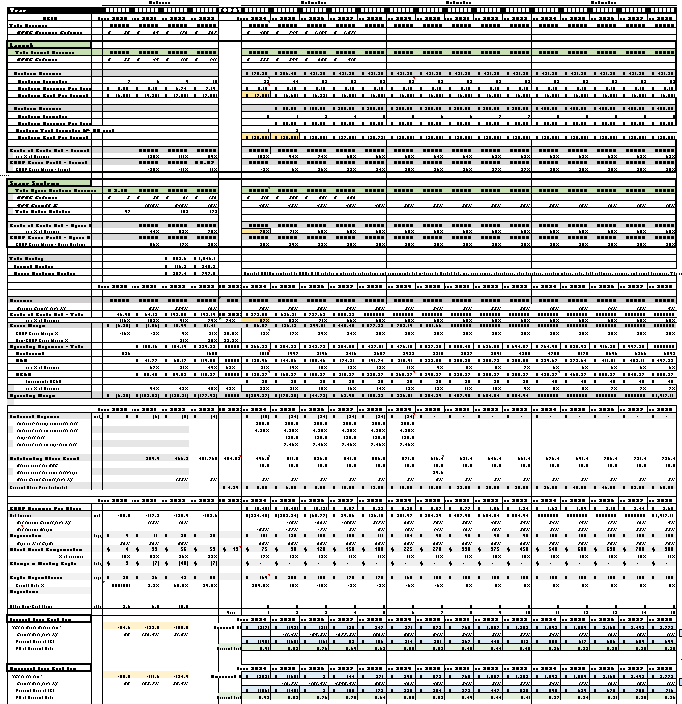

Rocket Lab’s overall revenue is primarily a function of the number of satellites they launch (their “Launch” segment) and the number of spacecraft they build (“Space Systems”).

They have landed massive contracts in recent years and already have more than $1 billion in backlog on the books.

Some of the most important factors here will be the annual launch schedule for both Electron and Neutron, as well as how quickly they can grow their Space Systems business.

Here are the specific expectations that I’ve built into my model:

Launch

- Modest growth in Electron launches, from 22 in 2024 to 52 in 2026 and beyond.

- An average of $8.1 million in revenue per Electron launch and a cost per launch of $7 million in 2024. That will decline to $6 million per launch by 2027, based on cost savings from reusable rockets and components.

- Neutron will have three test launches: one in 2024 and two in 2025. These will not be revenue generating but will cost $30 million apiece (recognized as COGS). These test launches will be necessary, as a way to demonstrate Neutron’s credibility for paying customers.

- Neutron begins its first commercial launches in 2025. It will have just one launch in that first year, two in 2026, and eventually ramp up to 8 per year by 2034.

- An average of $50 million in revenue per Neutron launch and a cost per launch of $30 million in 2025. That will decline to $25 million per launch by 2029.

- The gross margin of the launch segment will decline from 11% in 2023 to (3%) in 2024, due to the expensive Neutron test flights. But gross margin then grows to 6% in 2025, 26% in 2026, and reaches 38% in 2034 and beyond.

Space Systems

- Space Systems has a backlog already lined up, largely thanks to the MDA and SDA contracts that were recently signed.

- The segment experiences 45% growth in 2024. Annual growth slows a bit after that, to 30% by 2031, 20% by 2034, and then 10% by 2038.

- Gross margin of the SS segment was 25% in 2023 but expands to 35% in 2027 and beyond based on operational improvements and efficiencies.

I believe several of these are rather conservative assumptions. It’s likely that Rocket Lab gets the costs per Electron to be far less than $6 million per launch, or that they pack a greater payload onto Neutron to bring in more than $50 million in revenue per launch. It’s also quite likely that the company will make more acquisitions in order to expand its capabilities and to win more lucrative government contracts.

One final note: My top-line revenue expectations are lower than those that the company explicitly forecast in its initial SPAC IPO prospectus.

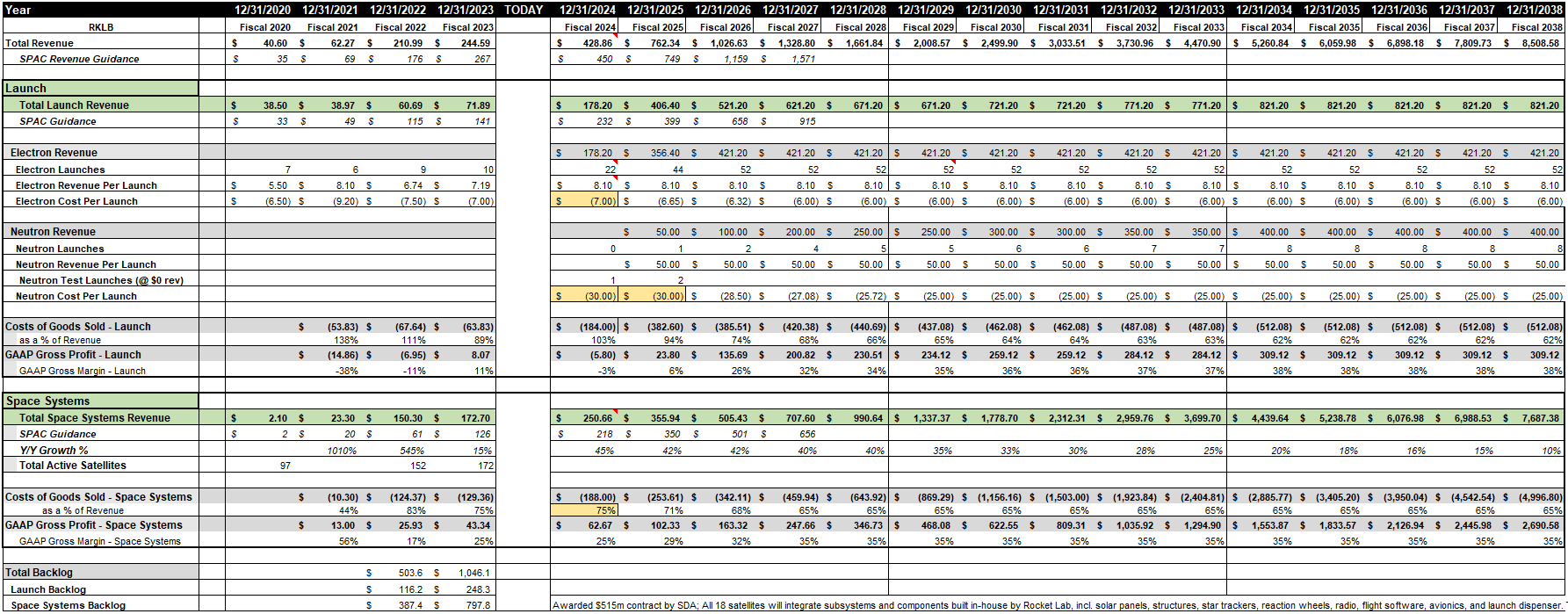

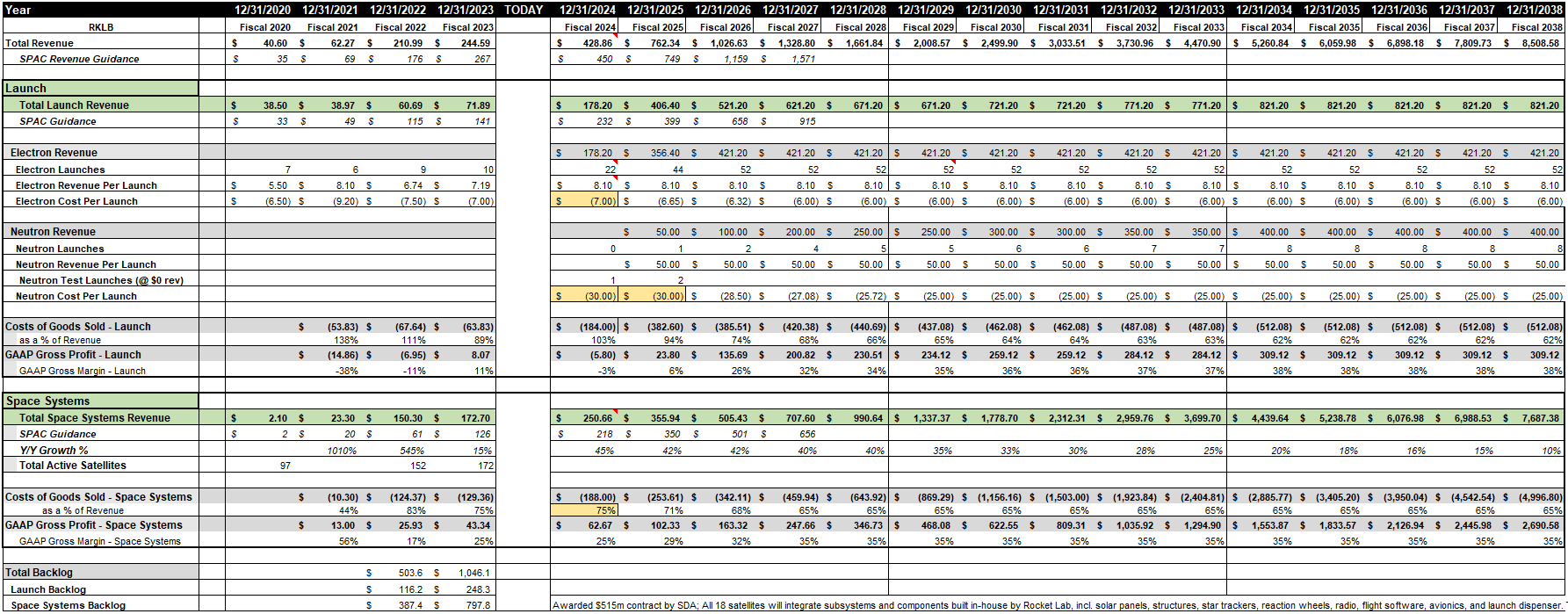

Operating Expenses

Rocket Lab must invest heavily in research in development, specifically for its latest-and-greatest Neutron rocket to be ready to go by this year or next.

CFO Adam Spice recently reiterated that his initial projection from back in 2021. He said three years ago that they expected to spend $300 million annually on the combination of R&D and Capital Expenditures by the year 2024. He confirmed that again recently, stated they have been “remarkably intact on the estimates.”

I’ve pulled that projection into the DCF model. Which has a combined R&D + CapEx spend of $300 million this year.

R&D and overhead costs are roughly tied to headcount, which has tripled in three years from 526 people in 2020 to 1,650 in 2023. I’m estimating they’ll have 1,815 employees this year and will grow at 10% per year up to 4,280 employees by 2033.

While the absolute costs related to R&D and administrative are increasing, they’re actually decreasing as a percentage of revenue (i.e. Rocket Lab is getting more efficient). R&D was 49% of revenue last year based on the hard work being put into Neutron. I project it will represent only 7% of revenue by 2033.

Sales, general, and administrative costs (“SG&A”) will increase at more of a fixed rate, from $110 million in 2023 to $360 million in 2033. As a percentage of revenue, this similarly decreases from 45% in 2023 to just 8% in 2033.

The combination of the above results in Rocket Lab’s operating margin expanding from ($177) million in 2023 to $64 million in 2027 and then $1 billion per year by 2034. Rocket Lab will report its first year of positive GAAP earnings per share in 2027.

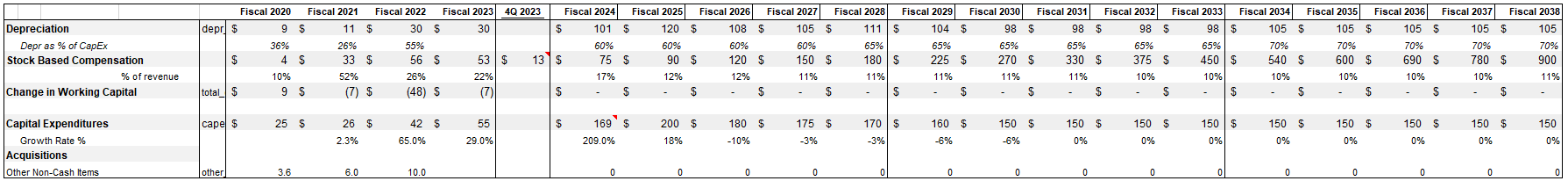

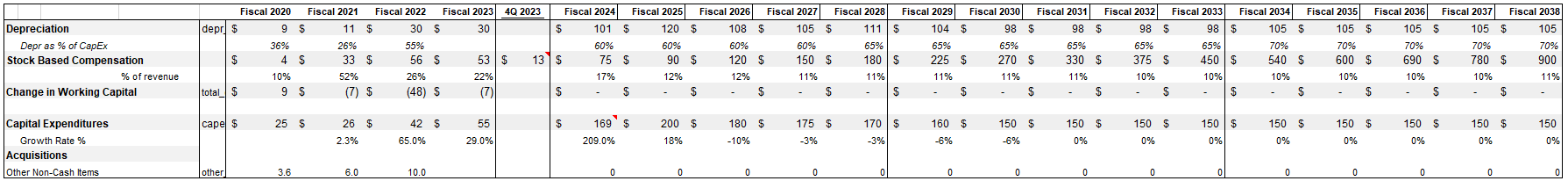

Capital Expenditures, Depreciation, and Stock Based Compensation

Launching rockets and satellites into space is a capital intensive process! Rocket Lab must invest in equipment for its satellites and rocket producing factories in New Zealand and Virginia, as well as for the development of Neutron in Alabama.

Capital Expenditures (“CapEx”) are the money used for expenses like these, which then show up as assets on the balance sheet.

I project Rocket Lab’s CapEx to ramp up quickly right now, during its expansion phase and the work required to get Neutron to the launch pad. But then it slows down again in later years, as the company matures and it doesn’t need to spend quite so heavily.

CapEx was $55 million in 2023 and I’m expecting $169 million in 2024 (together, this + R&D will total $300 million this year). CapEx reaches a high of $200 million in 2025, but then falls back to $150 million in 2030 and beyond.

I also made some assumptions around depreciation, which is estimated as a percentage of CapEx that rises from 55% last year to 70% by 2034.

Stock-based compensation is defined by the proxy and has historically resulted in around 15 million new shares being minted every year. I’ve held that constant throughout my model and have estimated a steady rise in Rocket Lab’s stock price — which similarly increases the SBC expense in future years.

Rocket Lab also just issued $355 million in convertible debt — which is paid back through interest payments for the first five years but will convert to equity after that.

And lastly, I’m currently assuming no further acquisitions.

To be honest, I’m fairly sure they will do make more M&A deals. Yet it’s difficult at this time to model who they’ll acquire and how much they’ll pay. If we trust that Rocket Lab will be a good steward of our capital and make good allocation decisions, future these acquisitions would be a net-positive and boost the equity value per share even higher than what is predicted by this model.

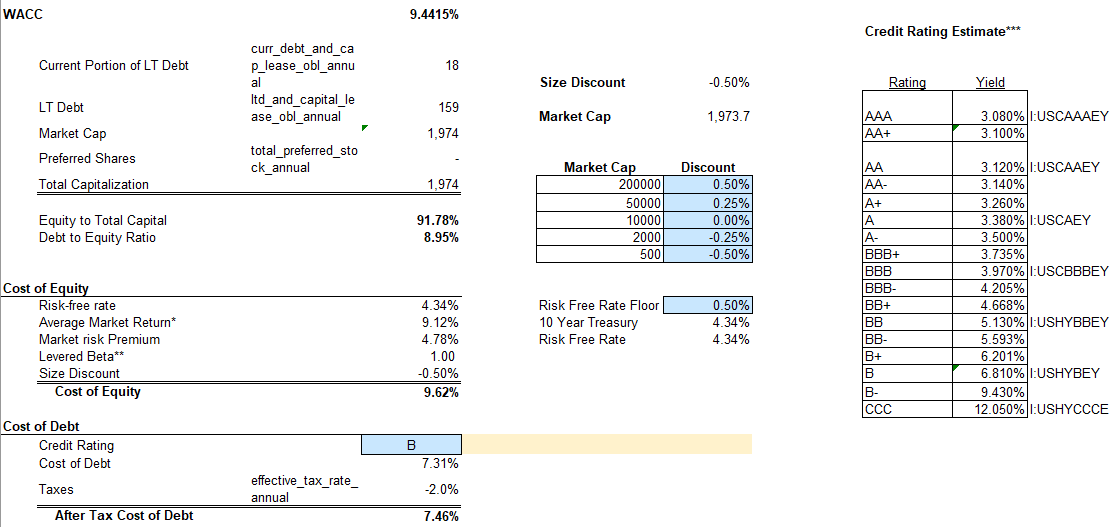

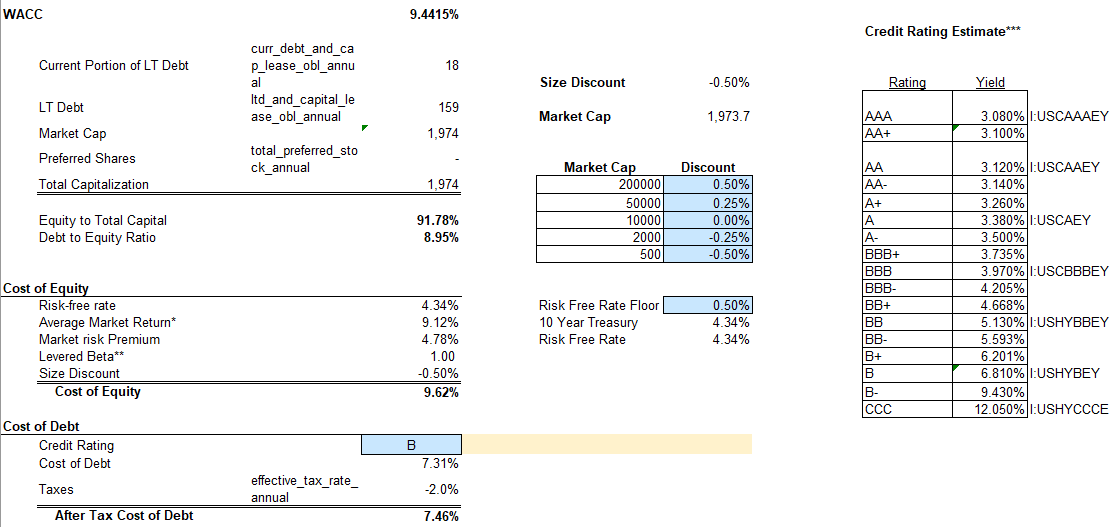

Debt and the Weighted Average Cost of Capital

Rocket Lab had $244 million in cash and short-term investments at the end of last year and it just raised $300 million (net of costs) with its recent convertible debt offering. The convertible debt will cost them 4.25% interest through 2029, but will then fully convert into 29.6 million additional shares after that.

It also has a $120 million equipment financing debt facility available with Trinity Capital. I expect they’ll tap this in full during 2025 to fund their rising operating costs and Neutron’s late-stage development.

The company did a fantastic job of raising money at exactly the right time. It brought $770 million of cash onto the balance sheet in its 2021 SPAC IPO, which valued the business at a rather elevated $4.8 billion at the time.

This capital provided by the IPO and from the recent convertible debt offering has allowed Rocket Lab to remain largely debt-free, even in a capital-intensive business. It is currently 92% funded by equity and only 8% by debt.

Assuming a “B” credit rating, a 7.3% current cost of debt, and a 9.6% cost of equity results in an overall weighted average cost of capital of 9.44%.

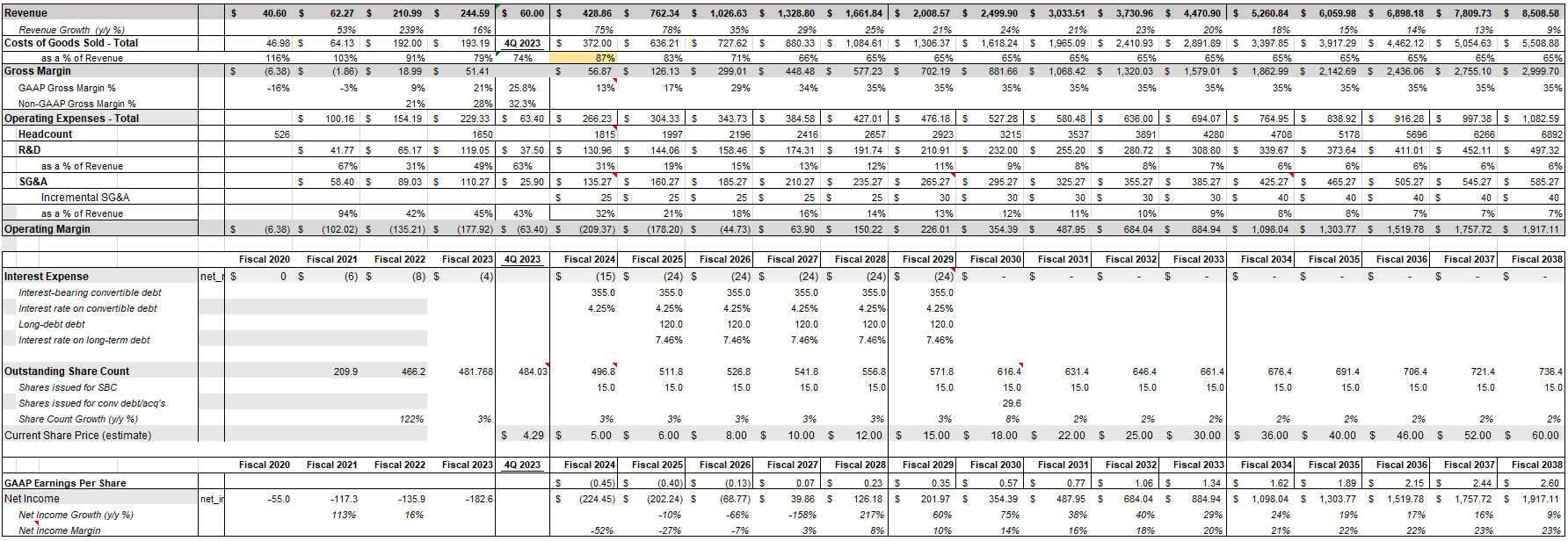

Other Key Assumptions

Recapping much of what I’ve mentioned above, here are a few of the key assumptions of this model:

- $8.1 million average revenue per Electron launch and $50 million average revenue per Neutron launch

- Cost per launch declines to $6 million for Electron and to $25 million for Neutron

- Reaches profitability in both earnings and cash flows by 2027

- Limited use of debt; convertible offering results in 29.6 million new shares in 2029

- $150 million per year in capital expenditures at steady state

- No acquisitions

I used a 15 year growth window and assumed a terminal growth rate of 3% for the cash flows beyond 2038. I then discounted all of those future cash flow back to the present.

So What’s Rocket Lab Worth?

So now that we’ve gone through all of the inputs, let’s circle back to that punchline. I estimate Rocket Lab’s present equity value is worth $22.35 per share. That represents the fair value of what Rocket Lab’s shares are worth today.

Of course, there’s no guarantee that the market will agree with that. There’s a high degree of risk with launching rockets, so those future revenues and cash flows carry significant uncertainties. There’s potential reputational risk from a rocket exploding, or financial risk if project costs shoot up and suddenly require expensive financing. In other words, there’s no sure things in the stock market and no guarantee that Rocket Lab’s stock price will ever increase.

Yet it’s also worth pointing out that there’s a huge disconnect between $22.35 and Rocket Lab’s recent price of just $4. If this DCF model is even in the ballpark of how things will actually play out in the future, Rocket Lab’s stock is significantly undervalued and currently represents an excellent opportunity for risk-tolerant investors.

Want to discuss Simon’s assumptions on Rocket Lab directly with him and with other investors?

“Thanks for doing this. So much work goes into these models, that this kind of financial calculus on individual stocks is worth the price of admission by itself.”

“Thanks a lot for working through this publicly, really an excellent exercise.”

“Thanks a lot, Simon. I feel like some of your assumptions are quite conservative, and it is astounding that you get to such a crazy upside anyway. What really makes me believe that the upside is possible is that they keep performing and delivering on their promises.”

These are posts in our Community Forum posts from actual 7investing members. Click here to join 7investing’s Community Forum today!

Already a 7investing member? Log in here.