Free Preview

The therapeutic modality is well-suited to create vaccines for infectious diseases. What about other therapeutic areas?

The pandemic has shined a spotlight on mRNA tools and begs an important question: “What is the potential of mRNA therapeutics beyond vaccines for SARS-CoV-2?”

7investing Lead Advisor Maxx Chatsko says, “mRNA is a no-brainer therapeutic modality for infectious disease vaccines. But there are three (3) considerations for investors to consider,” which were discussed on the Sept. 13 edition of “7investing Now” and are listed below:

- Therapeutic area: A vaccine designed to treat an infectious disease is relatively straightforward. A vaccine designed to prime the immune system to recognize cancer, or an mRNA therapeutic designed to increase protein levels in a rare disease, faces unique challenges. For example, the first mRNA vaccines for melanoma delivered underwhelming clinical results compared to existing treatment options.

- Tissue type: A vaccine designed to treat an infectious disease is delivered intramuscularly and essentially only has to make it into your bloodstream to trigger an immune response. That might not work for treating specific types of cancers or specific types of rare diseases. For example, if a rare disease is caused by insufficient protein production in the lungs or pancreas, then the mRNA therapeutic has to be delivered to the lungs or pancreas — a challenge that drug developers have yet to solve for genetic medicines. Moderna (delaying clinical entry) and Translate Bio (failed a phase 1 study in cystic fibrosis) have been thwarted by lung diseases to date.

- Commercial realities: This will become a leading therapeutic modality, but mRNA won’t always be the best tool among the competitive landscape (see: mRNA treatments for cancer), many companies are investing in mRNA tools, and the red carpet treatment for COVID-19 vaccines (expedited development, guaranteed selling prices, and risk-free manufacturing contracts) won’t exist for future mRNA medicines. For example, Moderna might successfully commercialize a seasonal influenza vaccine one day, but it’s likely that BioNTech / Pfizer, Merck (acquired AmpTec), Sanofi (acquired Translate Bio), Arcturus, Replicate, and many others will do the same — and the world will need many billions fewer doses, at significantly lower prices, compared to COVID-19 vaccines.

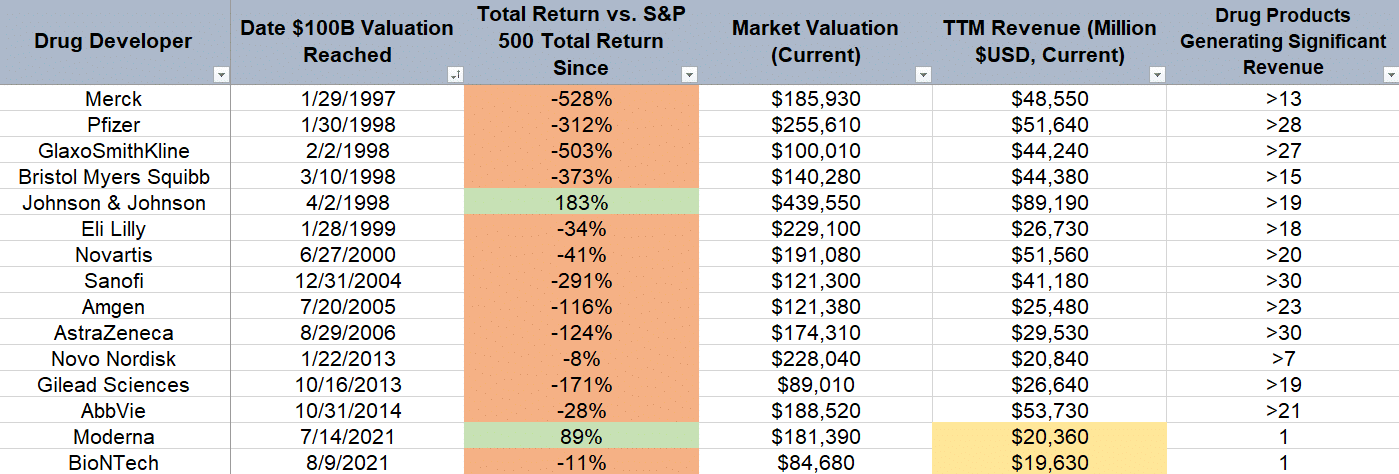

With these three considerations in mind, Maxx explains the challenges and opportunities facing mRNA while also breaking down the unlucky history of drug developers that reach a $100 billion valuation using the following graphic.

A full transcript follows the video.

[su_button url=”https://7investing.com/subscribe/?marketing_id=18024″ target=”blank” style=”flat” background=”#96C832″ color=”#000000″ size=”6″ center=”yes” radius=”0″ icon=”https://7investing.com/wp-content/uploads/2021/04/7Investing-3.png” icon_color=”#000000″]Sign up with 7investing today to get access to our 7 top stock market recommendations every month![/su_button]

Dan Kline: But Maxx, let’s move on to mRNA which I incorrectly spelled in all of our documents. It does a little m and then capital RNA not Mr. Na as I more or less wrote it in our documentation. So that would be a really good name for a mysterious wrestler who messes you up so much he changes your DNA. I’m working on this as we go. Are we going to see a lot more mRNA-based vaccines?

Yeah, absolutely. So I think as the pandemic showed, you know, mRNA as a technology platform is perfectly suited for making vaccines for infectious diseases. So absolutely, then we’re gonna see more but investors have to take into consideration a couple different things, right? Because, you know, in the news we’re talking about Moderna (NASDAQ: MRNA) is combining different vaccines into one right? So maybe you’d have a pan flu booster, meaning like can protect us against different strains of the flu, whatever is circulating that season.

Maxx Chatsko 10:21 Maybe that same injection would also include a booster for Coronavirus, whatever shrinking or variant might be around at the time, and actually included another vaccine. For RSV. It’s a different type of virus, something that older individuals need to be protected against. So it’s interesting, right? It opens up these new opportunities to combine things into one shot for for more convenience, all of your protection at once. Seems like a no-brainer there from an infectious diseases standpoint.

However there’s so much like people are really misinterpreting I think a lot of this right. We develop these vaccines for the pandemic was we had to, we also prioritize their development. They unveiled it that is going to now be in development, this, you know, flu-coronavirus vaccine combo, but it’s going to take years to develop but they’re not going to have this on the market in a year or two or anything like that.

By the time this eventually might be on the market Coronavirus might not even really be that big of a threat. I think most people would probably have protection for it by then. So investors do need to kind of keep their expectations in check. And historically, I mean vaccines are big business, but not anywhere on the order of what Moderna is going to pull in on an annual basis. In this year, maybe next year from the Coronavirus vaccine, that’s you know, $20 billion, maybe even $30 billion. But for things like the flu vaccine, there’s so many different companies like offering products for that it might peak at like $5 billion per year. So there’s going to be an issue with trying to replace the revenue from this year next year, as that kind of starts to fall off.

Dan Kline 11:55 And Maxx, there’s been some fool’s gold here for investors, right, like, so company has a hit drug, it gets up to a to a huge valuation. And then it sort of doesn’t always or almost never live up to that you actually created a chart if you want to launch into that.

Yeah, so JT, let me pull this up. So of all the drug developers that have ever reached a $100 billion valuation, if you track their returns from that day, that day they’ve crossed that $100 billion mark against the S&P 500, and you include a total return so dividends for each, almost none of them have actually gone on to outperform the s&p 500 from their total returns, only Johnson & Johnson (NYSE: JNJ) and now Moderna have done that, of course, Moderna has a very small sample size we’re tracking Well, it’s about two months, from the time it hit a $100 billion mark, all of these other companies also outperformed the S&P 500 in their first two months after reaching $100 billion valuation.

Maxx Chatsko 12:48 So if we look over there on one of those columns, about the revenue, and this is really what it all comes down to, there is kind of a limitation. There’s a ceiling on drug developers. These aren’t tech companies, they have drug revenue. Drug products will ramp in the marketplace, they’ll generate hundreds of millions or maybe billions of dollars, if you’re lucky. But eventually there’s competition, there’s new technology, there’s new drugs, there’s, there’s whatever it is.

So eventually, your new products are just generating revenue, it’s replacing revenue, that’s from older products. So there is that ceiling. And this is something that I don’t think people really understand for Moderna, and it’s gonna hit the ceiling much more quickly. Because, you know, two, three years from now, we’re not going to need, you know, hundreds of millions of doses of Coronavirus vaccines.

So the company is gonna have a really tough time replacing, you know, 10-15, maybe $20 billion of revenue come 2024-2025. The rest of its pipelines in the early stages of development, those products are many years away from hitting the market if they do at all. So the valuation right now makes sense based on the revenue from this year, next year. But it’s not a sustainable amount of revenue, because it’s coming from one product, it’s not going to be needed in three or four years. So investors do have to keep that in mind.

Dan Kline 14:03 And Maxx, we talk a lot about Moderna and Pfizer (NYSE: PFE), and Johnson and Johnson to a lesser extent, for obvious reasons during the pandemic. But without making it clear that none of these are recommendations. We’re just talking about stocks here, or maybe they are, but we’re not endorsing any of these particular stocks on the podcast here. There are other players in the mRNA space, right?

Maxx Chatsko 14:24 Yeah. And so this is the thing like I showed you that the chart we just looked at with all the drug developers that have ever reached a $100 billion market valuation. The difference with Moderna, and this is probably gonna be true for other genomic medicine modalities as well, is that it’s a technology platform, right? It’s mRNA. So we can throw that out infectious diseases, they may be thinking about throwing that as certain types of cancers. They can use it maybe for protein replacement for rare diseases, maybe even some common diseases.

Maxx Chatsko 14:51 So you can deploy this technology broadly across a lot of different therapeutic areas. That’s a difference from what maybe you know, Eli Lilly, or Merck or Johnson & Johnson have. So theoretically like, you know, that’s an advantage. And over time, I think some of these companies could set a higher ceiling than we’ve seen in the past. So companies with technology platforms.

The other thing to think about, though, is when you have a technology platform in genetic medicines like mRNA, RNA interference, gene editing, anybody can use those tools, right? Yeah, sure, there’s IP, but for the most part it’s very easy to reproduce those, those results. So there’s a lot of companies that are using mRNA. And we’ve seen just recently a lot of acquisitions. So obviously, we have Moderna. And then we talked about Pfizer, but the tech actually came from BioNTech, the German company, it’s actually also publicly traded. So that ticker is $BNTX, it also actually reached a $100 billion valuation this summer, shortly after Moderna.

So those are the two that develop these vaccines that we have now, obviously, but then there’s a lot of others. I mean, Merck went out and acquired AmpTec, Sanofi went out and acquired Translate Bio just a few months ago. CureVac is another one working on mRNA. There’s Arcturus another publicly-traded company. And there’s a whole host of privately traded companies, for instance, Replicate is one kind of similar to Arcturus.

They have something called self-replicating, self-amplifying mRNA technology and tools that just came out of stealth mode with some money recently. So there’s gonna be a lot of players in this space. And you know, again, like we’re gonna use mRNA for like the flu vaccine eventually, right? That makes total sense, it’s way easier to use, you’re probably gonna get better results, way easier to manufacture. But we’re also going to have like a half a dozen or more flu vaccines based on mRNA. So it’s not just going to be Moderna that has the whole market opportunity to itself, or just BioNTech, or Pfizer, there’s going to be all of these companies trying to get their piece of the pie as well.

Dan Kline 16:53 Maxx, let me ask sort of one last question from an investing point of view here is, we don’t talk about selling all that much. But if you look at one of these companies, and they get to that 100 billion mark, do you then look at like the long term viability of what they have coming to decide if that’s a sell point? Maybe that’s the goal line that are not likely to stay at?

Yeah, I don’t know. It’s tough, right? Because historically companies that have reached that milestone, that $100 billion mark, in the long run, they don’t tend to actually outperform the S&P 500. That makes sense, again, in the context of drug developers are not tech companies, and a lot of the S&P 500 returns now are driven by tech companies that don’t have the same capital constraints, they have much different operating margins, they can scale to much greater levels than a drug developer can, you know, they’re less regulated as well.

Maxx Chatsko 17:45 So I mean, I don’t know, I guess I would stop short of saying you should sell a company, a drug developer, just because it gets to a $100 billion market valuation. But this does affect how I go about investing in this space, I tend to look at companies that are much smaller than that, because I keep that in mind. Once the company gets to a certain market valuation, even in the 10s of billions of dollars, it is harder because that’s factoring in, you know, expectations for drug revenue from products that may or may not even be on the market yet.

So your returns are going to be limited at a certain point. So that’s why I tend to just look at smaller companies that are less proven that seems to be when you have the best returns rather. So again, like if you invested in Moderna a year ago, or four years ago, then you really have no reason to sell right now. Right? But if you invested three weeks ago, and you think it’s gonna just go to a $1 trillion market valuation or something, I have some bad news for you.

Dan Kline 18:40 I look at it a little bit like the way I look at the movie business, that unless you’re Disney, which has these sort of Cornerstone IPs that you can just kind of mine forever. The number two player is Comcast, and Comcast, like their top franchise, like probably doesn’t even like make it into like a Disney theme park. So I understand drugs are different because there’s exclusivity period, like you control the Avengers for like 200 years, you don’t control a drug for that long.

Dan Kline 19:04 But that is sort of how I view it. This is a space that looks like there’s a ton of opportunity. And there is but there’s also a ton of losers. And a ton of, especially we’ve seen this during the pandemic, fool’s gold. Oh my god, this company might come up with a COVID whatever, magic COVID detector, and the valuation jumps up by you know, half a billion dollars in a weekend. Well, that’s not really how these things work.