Guest writer Alan Soclof makes the case for the DTC healthcare apparel company who is growing quickly and has excellent profitability.

June 24, 2022

Alan Soclof runs The Crossover newsletter and appears as a guest writer as part of our investing outreach program. We are excited to build bridges with other long-term investors who share our mission of empowering others!

If you are interested in being a guest writer for 7investing, please let us know at info@7investing.com.

Today I am going to be breaking down a stock I recently added to my watch list, FIGS Inc. (NYSE: FIGS), a direct to consumer healthcare apparel and lifestyle company.

In my eyes, FIGS presents a unique opportunity to invest in a company with significant revenue growth, high gross margins, and generating Free Cash Flow. The difficult macro headwinds that the company is facing appear to be temporary and present an intriguing opportunity for investors.

FIGS is focused on creating stylish, functional, and comfortable clothing for healthcare professionals – AKA looking to give them something more exciting to wear than scrubs.

The company was founded by Co-CEO’s Heather Hasson and Trina Spear in 2013 and still lead the company today. FIGS is a DTC company where 98% of the company’s products are sold via the company’s mobile and web app.

The company’s core business surrounds 13 scrubwear styles that come in 6 styles. This component of the business was responsible for over 80% of the 2021 sales. 5% of 2021 revenue came from limited editions and styles of scrubs. The other 14% came from lifestyle apparel and non scrub offerings including lab coats, underscrubs, outerwear, compression socks and more.

FIGS ultimately IPO’d on May 21 2021 at a $4.57B valuation. Currently, the stock trades at a $1.4B valuation, representing a ~70% decrease in equity value over this past year.

You might be thinking that this is just yet another small-cap company that took advantage of a crazy IPO/SPAC market who has some serious cash burn, however, the numbers tell a totally different story.

At the end of Q4, the company had over 1.9M active customers, representing 46% YoY growth to 2020 where FIGS had 1.3M active customers.

Additionally, the company saw strong double digit growth in the average revenue per customer as well as the average order value.

The average order value for Q4 ‘21 was $113, representing a 15% YoY increase while the net revenue per customer in Q4 was $224, representing 11% YoY growth.

What is so powerful about the FIGS model is that the company shares that 60% of their traffic is a result of word of mouth advertising. The company estimates that their return on advertising spend was 7.2x in 2021 vs. 6.8x 2020 – both incredibly strong numbers.

The company also saw a strong increase in repeat purchases which increased to 68% YoY vs. 62% in 2020.

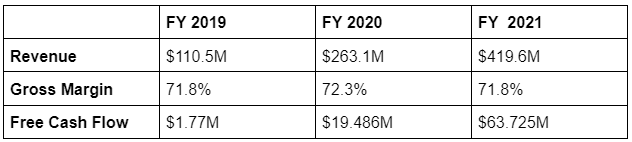

Check out FIGS key financials over the past 3 years (FY19-FY21):

As you can see, FIGS has a lot going for them:

Also, FIGS has a strong balance sheet represented by ending 2021 with $197M in cash and $0 in debt.

Management feels that the significant and profitable growth is just getting started. The company has shared long-term goals of $1B in revenue by 2025, 70%+ gross margins, and a +20% EBITDA margins.

In many ways, this sounds too good to be true. How could this company be trading at only $1.42B? What are we missing?

A significant top line miss in Q1 and a significant decrease in guidance and profitability.

On May 12, FIGS announced disappointing Q1 earnings:

FIGS also significantly revised their guidance and not in a good way. The company shared that they now expect 2022 revenue to be between $510M-$530M along with an EBITDA margin in the teens – a stark contrast to the $550M-$560M revenue guidance and 20% EBITDA margin the company guided for at the end of Q4 ‘21.

This news sent the stock down more than 20% the day after earnings and another 10% since.

What caused FIGS to revise their guidance? Is the long term thesis still in tact or did something significantly change.

On the earnings call, management shared that there were serious supply chain and macroeconomic headwinds that ramped up significantly during the quarter.

Here is what CEO Trina Spear had to say on the supply chain issues:

“However, since early March, we’ve seen an intense and persistent surge in the volatility of ocean transit times for receiving our products, largely due to vessels being unexpectedly rerouted by carriers while in transit. Shipping times began to vary, ranging from as fast as 30 days to upwards of 120 days, and it’s difficult to see this unpredictability ending soon.”

To combat these increases in transit times, the company has aggressively shifted to using airfreight as a significant mode of transit. Air is a much more expensive mode of transportation and therefore is the reason for the 400 basis point reduction in the EBITDA margin.

Additionally, the company pushed back multiple product launches due to the unpredictability of the supply chain – another key factor in the revenue miss.

FIGS also shared that they were “not immune” to the rising inflation and shift in consumer spending that was a significant theme in Q1. However, CFO Daniella Turrenshine shared that

“We believe these headwinds are temporary and do not structurally change our long-term margin profile. While we anticipate these challenges to continue throughout the year, we believe they will ease in the future, and we will return to our long-term target.”

I agree and the company’s continued execution this quarter is a big reason why I am intrigued by the long term prospects of the company. Here are some key operating metrics:

The company’s ability to execute in a difficult environment like this actually makes me more confident in its future. If projected revenue growth in the low 20%, gross margins in the high 60s, and achieving profitability, is the worst it gets? I am in.

Also, the company is putting their customers first, taking a bottom line hit, to ensure that their “Awesome Humans” (the title FIGS gives to their medical professionals) are clothed and feeling good is a testament to management’s desire for long term success and maintaining a strong relationship with their consumers.

Another reason that I have confidence in the company in the long run is due to their industry thematics and growth prospects.

Zooming out from Q1 and looking at the bigger picture, there are two major thematics that serve as strong tailwinds – Healthcare professional growth & healthcare apparel growth.

In 2020, the US healthcare professional market was the largest and fastest growing labor sector domestically with over 20M professionals. The BLS expects this number to grow by 15% by the year 2029 vs. other professions around ~4%.

The healthcare apparel growth market domestically is expected to grow from $12B in 2020 to $16B by 2025. Internationally, the number of medical professionals is expected to grow from 118M to 124M by 2025.

Not only does the company have these tailwinds but also there are also other, non-thematic focused, growth levers.

Firstly, it is important to recognize the potential disruption in the existing markets. Per FIGS calculations, they have only penetrated 3.5% of the domestic market.

Additionally, the company cites how early they are in their lifestyle, non-scrubwear, push. In Q4, the lifestyle brands made up only 16.9% of their business vs. 14.7% in 2020. The company achieved this with less than 10 products and in their words have “have just begun to scratch the surface.”

In conclusion, there is a lot to be excited about for FIGS including the strong revenue growth, high gross margins, Free Cash Flow generation, and strong thematic tailwinds. If the company can successfully navigate this difficult macro environment, there is a chance FIGS can make a sweet investment!

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. Alan is not a 7investing advisor and his views may not match those of the rest of the team. Any companies mentioned in this article may or may not be official 7investing recommendations. If you’d like to get started with a 7investing membership today, please click here.

Already a 7investing member? Log in here.