Long-Term Investing Ideas in a Volatile Market

Simon recently spoke with a $35 billion global asset manager about how they're navigating the market volatility. The key takeaways are to think long term, tune out the noise...

7investing Lead Advisor, Luke Hallard, is joined on the podcast this week by Adam Mead, CEO and Chief Investment Officer for Mead Capital Management

August 9, 2022 – By Samantha Bailey

7investing Lead Advisor, Luke Hallard, is joined on the podcast this week by Adam Mead, CEO and Chief Investment Officer for Mead Capital Management, and author of “The Complete Financial History of Berkshire Hathaway”, a chronological history of Berkshire Hathaway, from its inception as a Textile Conglomerate in the 1950s to its status today as one of the world’s largest and most respected companies.

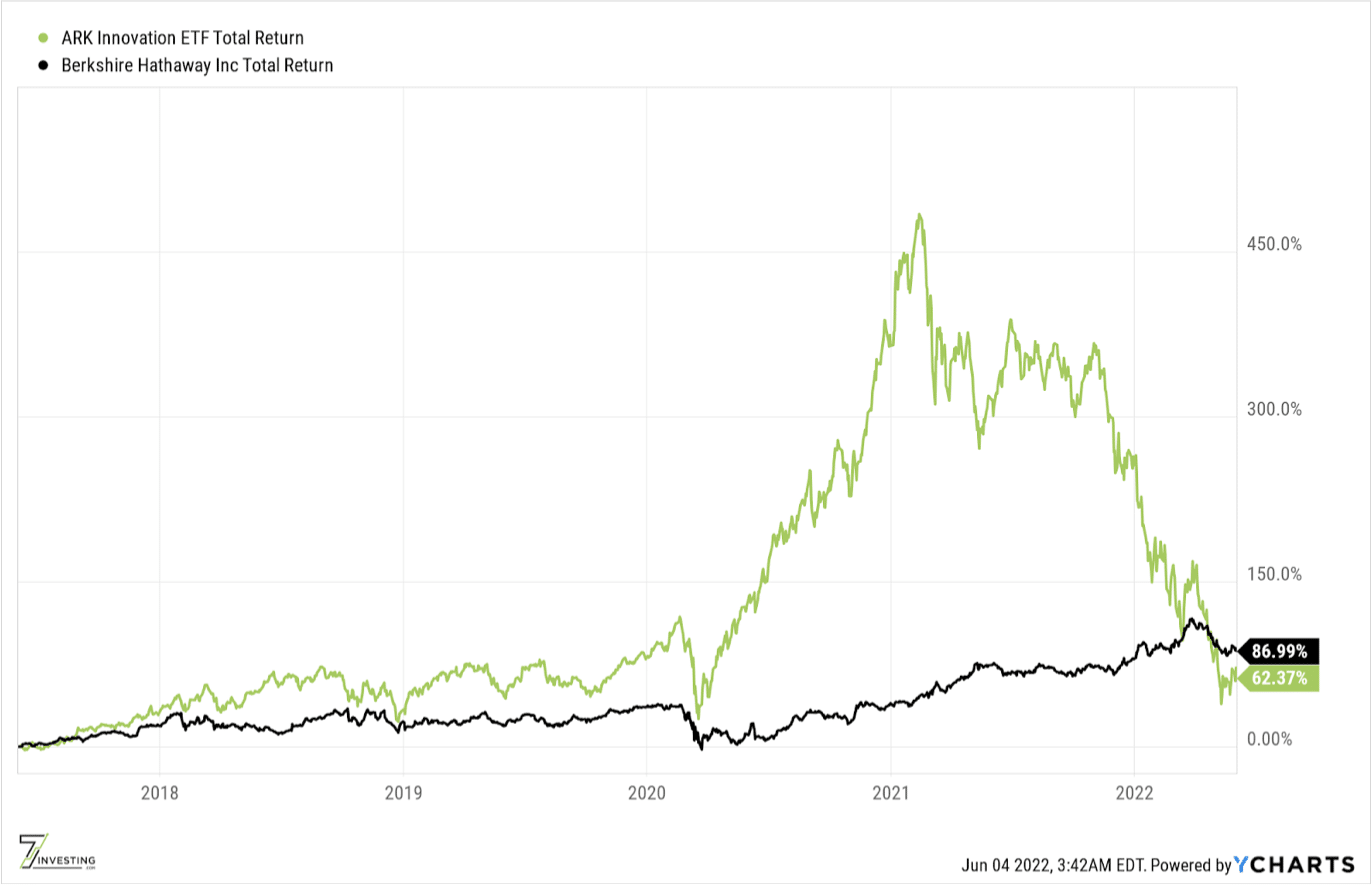

The last eight months have been a pretty tough time for growth investors, and perhaps the best example of this is the performance of the Ark Invest fund, which is currently underperforming Berkshire Hathaway over pretty much every timeframe. In his conversation with Luke, Adam draws out five key lessons from the last seventy years of Berkshire’s history that any growth investor can apply to improve their investment returns.

In the discussion, Adam discusses why simple businesses can often make the best investments; the importance of focusing on the right variables, and tracking the business performance rather than the stock price. Luke and Adam also discuss the power of patience, and why a ‘fear of missing out’ can be a wealth-destroying trap for any investor

.Adam can be found on Twitter @BRK_Student, at his YouTube channel ‘The Oracles Classroom’, or at his investment newsletter, ‘Watchlist Investing’. The Complete Financial History of Berkshire Hathaway can be purchased at Amazon.

Simon recently spoke with a $35 billion global asset manager about how they're navigating the market volatility. The key takeaways are to think long term, tune out the noise...

Anirban and Matthew were joined by Alex Morris, creator of the TSOH Investment Research Service, to look at seven former market darlings that have taken severe dives from...

On episode 5 of No Limit, Krzysztof won’t let politics stand in the way of a good discussion - among many other topics!