The "data in motion" innovator got punished by the market for weak guidance. Is this a buying opportunity for investors?

November 6, 2023

Confluent’s (Nasdaq: CFLT) shares were take to the woodshed following the release of its third-quarter report and earnings call late last week. The conference call raised some intriguing questions around the general state of as a service offerings and some pointed issues about Confluent’s opportunity with Kafka.

To recap, despite beating earnings per share (EPS) estimates by $0.02 and surpassing revenue expectations with $200.2 million in Q3 (compared to the estimated $194.8 million), the market reacted adversely to the cautious guidance for Q4, projecting a growth of only 21% to 22%, as well as the outlook for fiscal 2024 at around 22%.

Let’s take a closer look at what’s going on.

Confluent is a “as a service” selling open source Apache Kafka. They have a fully managed Kafka re-engineered for the cloud version called Confluent Cloud and self-managed enterprise distribution called Confluent Platform. Confluent Cloud is tailored for companies transitioning to the cloud, while Confluent Platform caters to on-premises deployments due to various factors like regulatory compliance or data governance concerns.

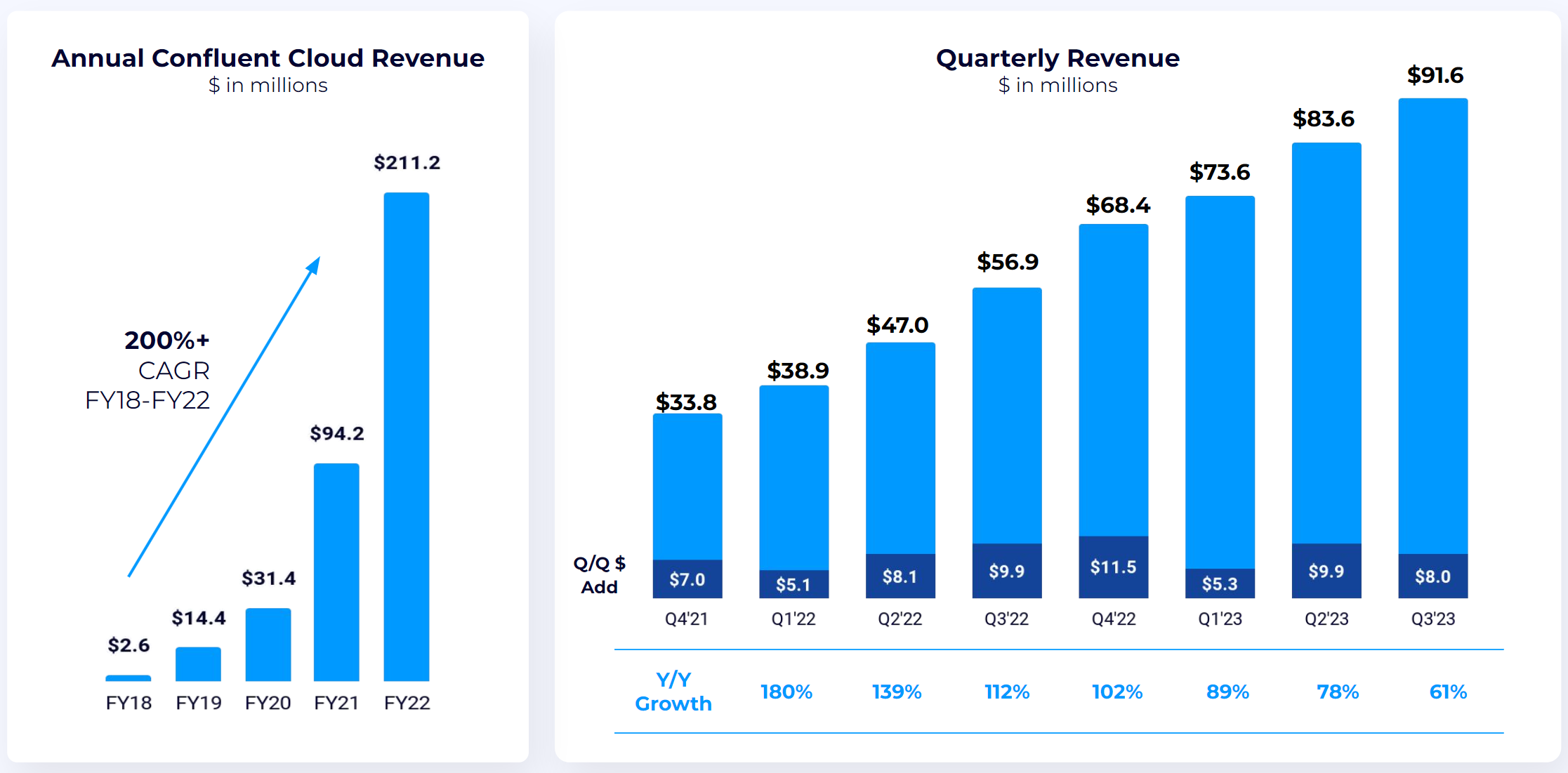

Confluent often highlights the total cost of ownership, a common selling point for open source as-a-service technologies, and the availability of exclusive enterprise features. Confluent’s Cloud business has exhibited rapid growth, albeit starting from a relatively small base. It saw a 61% year-over-year increase, reaching $91.6 million in Q3 2023, with an annual run rate of $360 million, indicating robust customer adoption, both from new and existing clients. A Cloud net retention rate exceeding 140% suggests that customers tend to stay and spend more over time.

However, the guidance for next quarter along with the colour around it certainly raise some yellow flags.

For the upcoming fourth quarter, Confluent Cloud is expected to grow by 43%, implying a sequential addition of $6 million. That sequential net add of $6 million isn’t cataclysmic in itself; there have been recent quarters where the net addition to their cloud revenue was less than that figure.

But the colour around the cause raised a few flags. Confluent attributed the slowdown to a large gaming customer repatriating its workload back to its own data center, sparking questions about a potential trend of cloud repatriation. Cloud repatriation is when companies move their workloads back to their own data centers for reasons like cost savings, security, data governance, and performance. Although it occurs occasionally, it’s not widespread. The earnings call mentioned Dropbox (Nasdaq: DBX) and CrowdStrike (Nasdaq: CRWD) as examples, with each having specific considerations, such as hardware control for cost management in Dropbox’s case. In the gaming company’s instance, they reverted to open source Kafka instead of choosing Confluent’s self-managed enterprise version, which is a concerning sign.

Did this gaming company not derive any benefit from Confluent’s enterprise software offering? CEO Jay Kreps did point out that this gaming company has made a strategic decision to use its own infrastructure to save costs and it wasn’t a Confluent specific decision.

This situation nonetheless raises a broader question: if this gaming company could make the switch, could other businesses consider similar moves to reduce costs? This approach may not suit every company, as digital-native businesses are better equipped for such transitions.

The real challenge for Confluent might not be the risk of churn but rather the assumption that many Fortune 100 companies using open source Kafka will transition to Confluent’s as-a-service offering. On the other hand, Confluent’s cloud business continues to grow steadily, even after losing the gaming company and experiencing a slower ramp from another top 10 customer undergoing acquisition.

Dollar-based net retention rates remain high, and the business thrives despite a general slowdown in cloud adoption among hyperscalers.

My guess is that the cloud repatriation thing is a head fake.

Nevertheless, Confluent faces the task of convincing customers of its value proposition, which involves both refining its go-to-market strategy and further developing its product offerings. On the go-to-market front, Kreps announced that they are speeding up the transition of the sales compensation from a focus on large upfront commitments (which shows up in Remaining Performance Obligations) to winning new logos and new workloads (or additional consumption).

This, I do think, is the right move and it is something others like MongoDB (Nasdaq: MDB), Snowflake (NYSE: SNOW), and Datadog (Nasdaq: DDOG), etc — primary the usage-based cloud services — have already done.

But like any change, this has the potential for disrupting the velocity of sales for the company. Then on the product front, there are some interesting developments. Confluent announced a lower priced Kafka cluster offering, which is good for enterprises looking to begin their Kafka journey. It lowers the entry barrier, which is a good thing.

It’s other big card is Flink, which is like the de-facto stream processing framework that simplifies the process of developing stream processing applications. Confluent acquired Immerok, another as a service company started by the Flink developers, in January 2023. Immerok can be thought of as the upstream opportunity for Kafka. Like Apache Kafka, Flink too is used by some of the biggest names in town.

The lingering question remains – how successful will a combined Kafka-Flink as-a-service offering be? It’s not merely a matter of technology; while Kafka and Flink are established standards, Confluent must offer significant value-add to lead the way in Kafka/Flink as-a-service solutions.

Only time will unveil whether Confluent can attain the status of other prosperous businesses built upon open-source software.

Already a 7investing member? Log in here.