My 7-Point Recap of Zscaler’s First-Quarter Results

7investing advisor Anirban Mahanti breaks down the cybersecurity leader's recent results.

December 6, 2023

Here my quick 7-point recap of cybersecurity specialist Zscaler’s (Nasdaq: ZS) first quarter 2024 conference call:

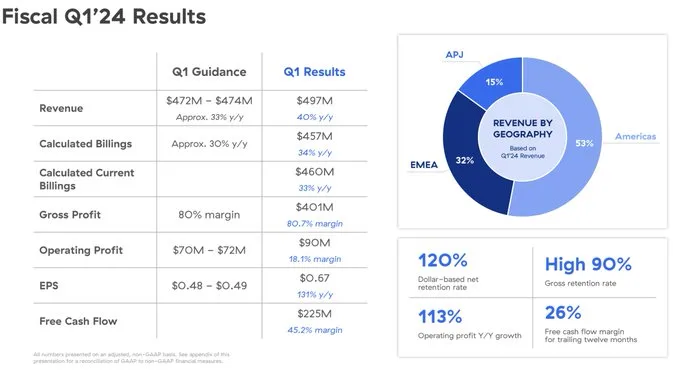

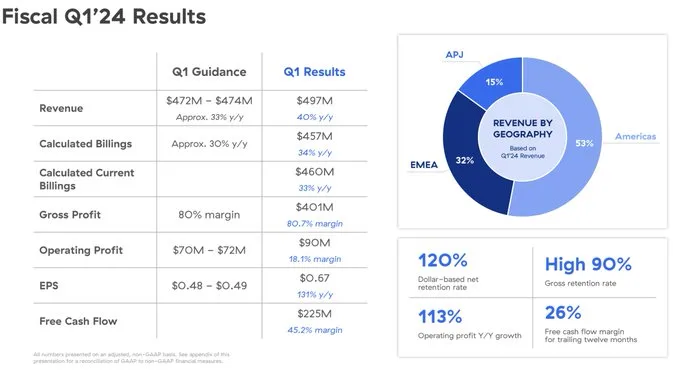

- Zscaler exceeded its guidance with 40% YoY revenue growth to $497 million. Non-GAAP operating income more than doubling to $89 million and free cash flow was a record $225 million. LTM free cash flow ~$463 million for a FCF margin of 26%. Some big numbers at scale.

- Traction with large customers continued with a Q1 record of 14 $1M+ new logo customers added in the quarter. Zscaler now has 468 of these large customers, up 34% from last year.

- Broader platform strategy is at work with ~50% of new customers purchasing the bundle of ZIA, ZPA and ZDX. Management highlighted “More customers are adopting our broader platform to consolidate multiple point products, increasing our average deal size. As a result, we are actively working on more large, multiyear, multi-pillar opportunities than ever before.”

- Emerging products like ZDX for monitoring and analytics and workload communication for securing workloads highlight strong growth avenues. Its CEO called out ZDX as pivotal in a large hospital deal valued at 7 figures of ACV. Also noted over 1/3rd of customers have purchased initial workload products with expectations for rapid expansion over time. Emerging products present large cross-sell/upsell opportunities within existing customers.

- A record quarter for pipeline generation, despite macro uncertainty. The company has several tailwinds on its back: Increasing frequency of high-profile breaches, new SEC disclosure requirements pertaining to material cybersecurity incidents, and US President’s executive order on zero-trust security are driving cybersecurity expenditure, with significant attention at the executive/board level. Further, there’s a push towards platform level solutions which are displacing point solutions.

- Zscaler’s recently launched Risk360 product for risk quantification and mitigation driven by AI appears to be timely given incidences of cyber attacks and new SEC disclosure requirements.

- Nonetheless, management guides with “prudence”, given its appointment of two new execs (a CRO and a CMO) who are going to help the company get to its stated goal of $5 billion in Annual Recurring Revenue.

Already a 7investing member? Log in here.