After a rough start to 2021, growth stocks are back. But can they possibly keep running higher?

Mark this day, growth investors. After a frustrating start to 2021, your favorite category of stocks have largely closed the gap between their value-oriented peers. And I continue to think both growth and value may have more room to run from here.

But before we get there, some perspective is in order.

Four months ago, in April 2021, I highlighted a humbling question for growth-style investors: Is “value” the the new “growth?”

More specifically, I explored whether the exceptional start to 2021 for value stocks — or those that tend to trade at relative discounts to their intrinsic value and financial performance — was an indication that they had perhaps taken the mantle from growth stocks as the best-performing (and most-favored) category in today’s markets.

My short answer then was: “Not necessarily.”

After all, growth stocks had just enjoyed an incredible run in 2020 — with the iShares Russell 1000 Growth ETF climbed 37% last year, for example, while its value-based counterpart ended the year roughly flat. So I argued at the time:

I think we’ve witnessed a reversion to the mean for previously underperforming value plays (whether it’s complete or ongoing, and for how long, remains to be seen), coinciding with a healthy consolidation for some of the most expensive growth stocks that was likely necessary to enable longer-term gains to resume. If I were a betting man — and coupling this scenario with a waning pandemic and our rebounding economy — I’d suggest this could indicate the stage is set for a broader rally in both value and growth stocks where the strongest companies in each realm will continue rising to the top.

Indeed, growth stocks appeared to be staging a healthy comeback by the halfway point of 2021 — prefaced by transitory inflation concerns and predictions that the pandemic was largely in the rearview mirror for the world’s largest economies — leading me to go out on a limb in June to predict their rebound might be just getting started.

Of course, it’s never quite that simple. From today’s Delta COVID variant fears to supply chain headwinds, geopolitical strife, cybersecurity attacks, and even China’s recent regulatory crackdowns, investors are now left with more noise than ever as they try to gauge the health of their favorite publicly traded businesses.

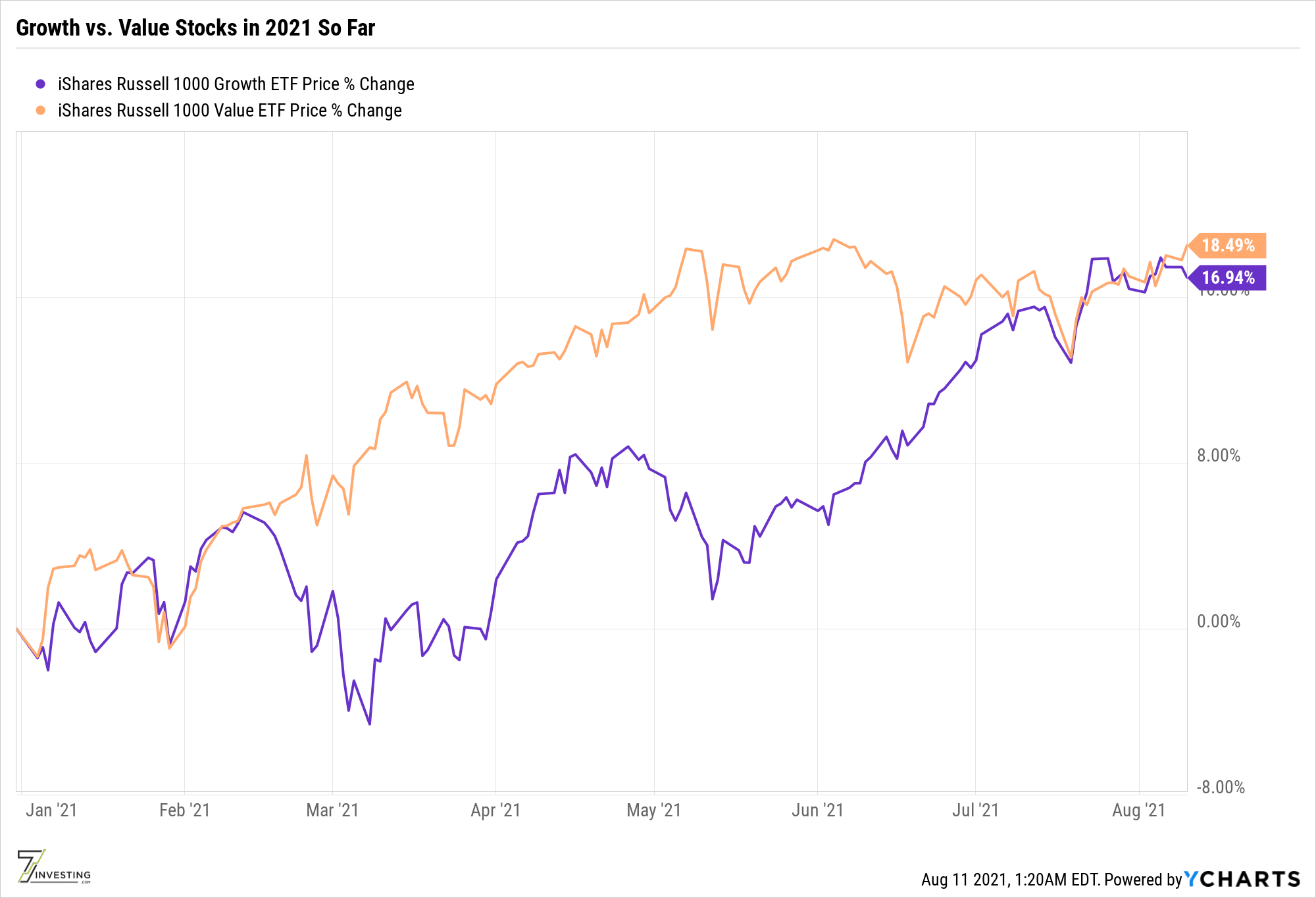

Circling back to my lede — and just as I’d predicted in both April and June — you’d be forgiven if you hadn’t noticed that growth stocks have quietly closed the gap with the performance of value stocks in recent days. And this even as value stocks have continued to rally:

There are some caveats to this remarkable, broad-based recovery.

Both of the ETFs displayed above are focused primarily on large- and mid-cap stocks in their respective categories, so the chart above doesn’t necessarily reflect the relative underperformance of many individual small-caps (or even those mid-caps on the smaller end) that have yet to meaningfully participate in this year’s rebound. Part of that underperformance can certainly be chalked up to the steep valuations and increased risk profiles that accompany many of these smaller, yet-to-be-profitable, high-growth names — as well as a general reluctance by many investors to take on that risk as long as the pandemic continues to rage on and heightened uncertainty prevails.

In fact, I’ve watched patiently as several companies in this small- to mid-cap range have plunged even in the face of overwhelmingly positive news: Consider C3.ai (NYSE: AI) and its impressive second quarter progress, or Virgin Galactic (NASDAQ: SPCE) plummeting more than 40% from its highs even after sending founder Richard Branson to space and reopening ticket sales at $450,000 apiece. Or more recently, the market’s sour reaction to a stellar Q2 report from Lemonade (NASDAQ: LMND).

Thankfully I’m a patient, long-term oriented investor who celebrates the chance to open and add to my positions over time at attractive prices. And I continue to believe that as the world works through the aforementioned headwinds and our global economic recovery persists over the next several quarters, the recent rally in larger growth and value names should ultimately trickle down to the smaller, riskier growth stocks as well. As per usual along the way, I plan to continue choosing my recommendations accordingly.