Our results at 7investing so far have been phenomenal, but Matt Cochrane explains the importance of maintaining a long-term view.

Last July, I wrote that while the 7investing team’s record was certainly enviable, the gap between the S&P 500’s performance and our own would almost surely narrow over time. At the time, after just four months of stock picking, the collective record of our recommendations were up about 34%, beating the S&P 500 index by 25 percentage points. While I expected (and still do!) our record to beat the market’s performance over a long enough time period, I thought that such a jump out of the gates and lead over the market was simply unsustainable.

Fast forward six months and the collective performance of all our stock recommendations is now up 55%, beating the market by an even more incredible 35 percentage points. Such a record is almost unheard of! (Personally, it pains me to say that my recommendations are “only” beating the market by 25 percentage points, meaning I’m actually dragging down our team’s performance!)

These gains are to be celebrated. I can’t tell you how happy we are when we hear from members how we’re helping them accomplish their financial goals! That’s why we do what we do. On the other hand, I would be remiss if I did not add that you should not expect 55% gains every ten months (no matter how good your team of humble lead advisors is at 7investing).

The American stock market is not a rigged game of chance, guaranteed to come up with winning numbers every single year. Going back almost 100 years to 1926, the year when the S&P 500 was conceived, the average annual gain of the index has been just over 10%. Not only are these the long-term gains the stock market has seen for nearly a century, but the gains are far from consistent too. Some years, the market rockets up, only to be followed by years it drops precipitously. It is constantly a game of two steps forward, one step back.

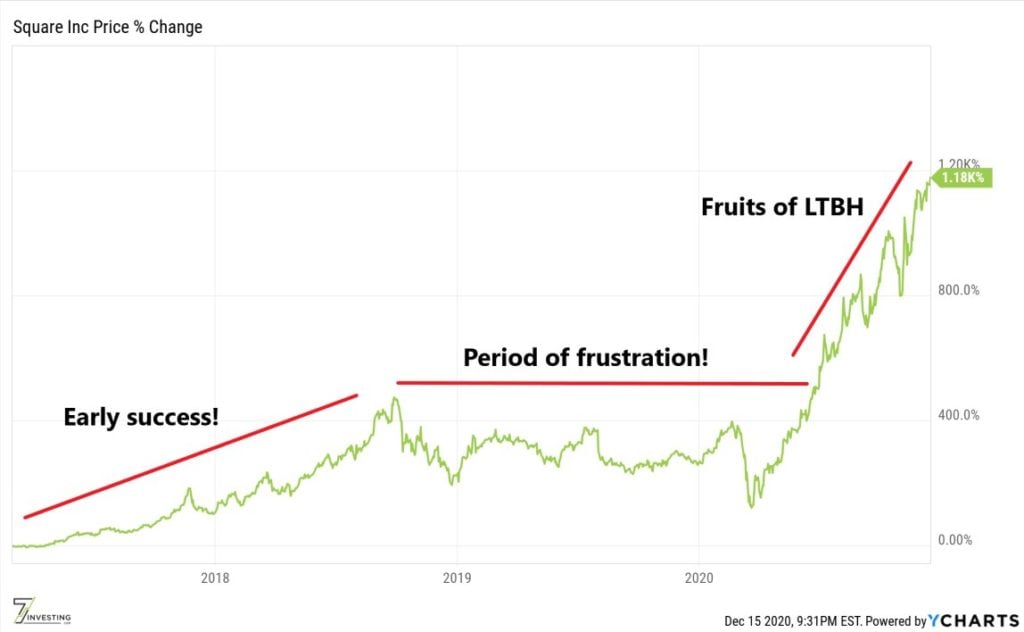

This isn’t just how the stock market operates, but individual great companies in the market as well. As I’ve mentioned in the past, Square (NYSE:SQ) is a great example of this. Founded in 2009, Square introduced the capability for merchants of accepting card payments via mobile devices. Since that first product launch, it has only added new innovative features to create an entire ecosystem for small businesses. At the same time, it also launched a mobile payments app around which it built a consumer finance ecosystem. Both platforms took off and the company rapidly and steadily grew its top-line.

How has the stock performed over the past four years, about how long I’ve been a shareholder? Well, after seeing the stock price explode, it then lagged for almost two years, even while the business continued to outperform. The thesis never broke, and the company consistently grew its revenue by more than 30%, yet a combination of factors kept the stock from regaining its October 2018 highs for 20 months.

Stocks won’t always go up. They certainly won’t go up 55% every ten months, even when the companies themselves continue to do well. As we expound on in our second investing principle, stocks represent ownership stakes in real businesses, not digital tickers on a computer screen.

Owning great businesses gives shareholders the chance to be richly rewarded as those businesses grow, appreciate, and return capital to their investor base. As we explain in our fourth investing principle, this takes time. It isn’t an overnight phenomenon!

There are years where it’s really fun to be an investor. There are other years where it seems like a futile and painful process. Over time, if historical trends hold true, you will be able to look back and see the fruitful results in your portfolio. In the meantime, enjoy the good years, endure the bad, and remember to keep in mind the long term.

[su_button url="/subscribe/" style="flat" background="#84c136" color="#ffffff" size="6" center="yes" radius="0" icon="" icon_color="#ffffff" desc="Get full access to our 7 best ideas in the stock market for only $49 a month."]Sign Up Today! [/su_button]