Volatility is normal in the stock market. Embrace it. It is our ticket for outstanding long-term returns.

Industries: General

The recent ups and downs in the market might be giving even seasoned investors seasickness.

And volatility on some of the high flying growth names has been incredible, with good earnings greeted at best with a yawn and a miss on the execution resulting in an unforgiving shellacking.

That we have this kind of volatility shouldn’t be unexpected. We could say it was bound to happen because shares of some companies have run up hard. They are potentially detached from their fundamentals. And thus, a “correction” was likely.

I wholeheartedly agree but …

I agree that prices for some companies look steep. They have been pricey for a while.

What I think we couldn’t have known, however, are two things:

I put this game of trying to figure out a sweet entry spot in the “too hard” bucket. Instead, I accept that volatility is just part of the investing game. If one has enough time on hand and the ability to dollar cost average over time, investing in the stock market is perhaps the best place for seeking returns.

Don’t believe me?

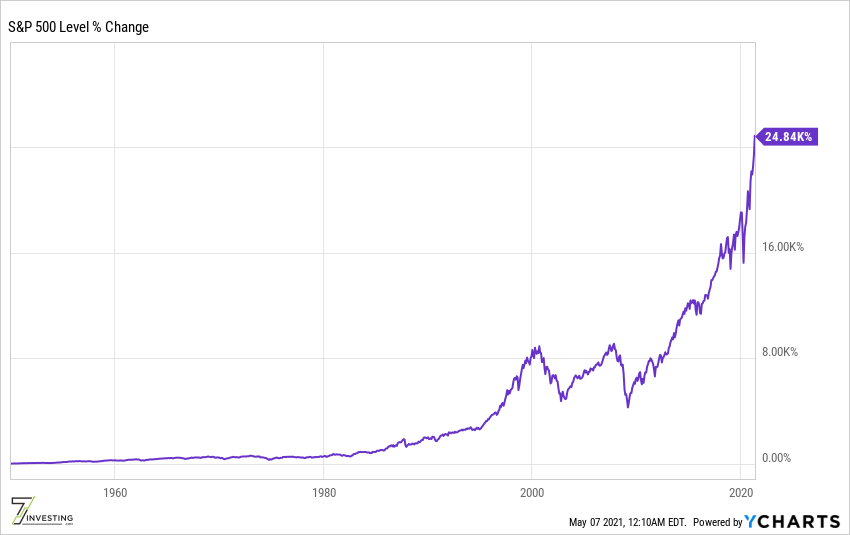

Look at this long-term chart of the S&P 500 index. That’s an incredible 24,840% gain over the measurement period.

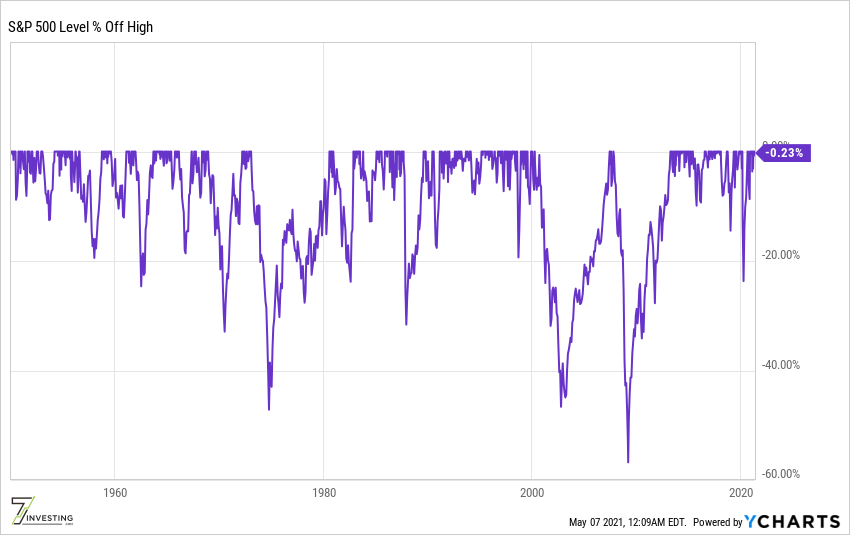

Now, look at how often the S&P 500 has fallen from recent highs and by how much. A 10% drop from recent highs is quite common. A fall of 20% isn’t uncommon either. Even more significant drawdowns of 30% do happen. That’s volatility.

And yet, despite those falls, the long-term results look like a beauty!

I like to say this. Stocks don’t go up in a straight line. If they did, it would be simple, and the returns we see over the long term would dissipate. Volatility is the price we pay for long-term returns.

My mantra remains the same. Buy great companies for the long-term. Add to them over time, opportunistically when the market sells them off for not-so-good reasons. Or add to them when the results and execution are excellent. As long as the long-term opportunities are there, a basket of these ideas will deliver good returns over the long term.