7investing guest writer Nick Maxwell features three Australian tech stocks to put on your investing radar.

March 25, 2024

Disclaimer: Nick Maxwell is a guest writer and a friend of 7investing. He is based in Melbourne, giving him a unique and insightful perspective on Australia’s market and its tech companies.

We believe this is an educational piece that introduces ideas from an entirely different hemisphere of the world. If you are considering investing internationally, please consult your brokerage as the trades may include additional fees or commissions.

The Australian economy is dominated by homes and holes in the ground.

Consequently, the Australian Stock Exchange (ASX) reflects this dominance, with a significant emphasis on mining and banking sectors. Influential players like global miners BHP Group (ASX: BHP) and RIO Tinto (ASX: RIO) wield substantial influence over market returns. Technology businesses tend to fly under the radar, the scarcity of high-quality tech increases demand, prompting funds seeking exposure to Aussie tech to elevate multiples on top-tier tech companies.

Far from the global giants of Nvidia (NASDAQ: NVDA) and Microsoft (NASDAQ: MSFT) these ASX listed small cap companies have been showing impressive growth and are approaching inflection.

Three companies who could be worth a closer look are Audinate Group (ASX: AD8), RPM Global Holdings (ASX: RUL), and Dropsuite (ASX: DSE) Could these three companies be poised to join the ranks of high-quality technology enterprises in the near future?

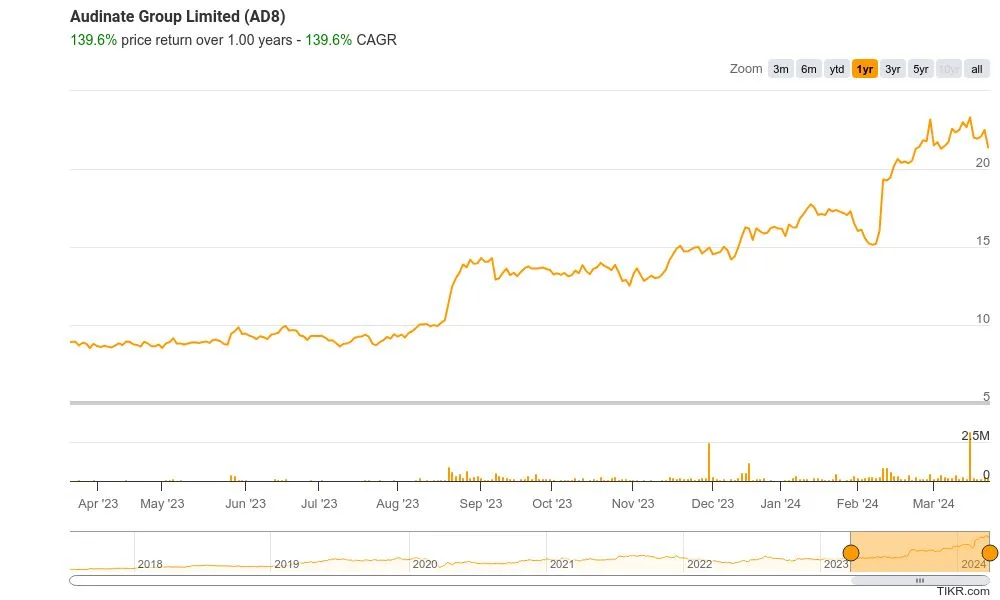

We’ve seen how crucial chips are becoming in today’s world. Audinate is a niche market leader whose sales growth is through the roof.

Audinate Group stands as a global market leader, specialising in Audio Visual (AV) technologies through its innovative Dante platform.

Dante, encompassing software, chips, cards, and modules, is seamlessly integrated into the AV products of Original Equipment Manufacturer (OEM) clients. This platform facilitates the distribution of digital audio and video signals across computer networks, bringing IT networking advantages to the professional AV sector. While Dante remains the software of choice, manufacturers will have no choice but to include its chips creating a significant barrier to entry for its competitors and potential pricing power.

With entrenched market presence and a superior position in audio products, Audinate’s strategic move into video has seen remarkable progress, outpacing the early days of the audio segment’s adoption.

Supply chain issues and chip shortages had a significant impact on the company during the pandemic.

With these headwinds now passed the company has returned to strong revenue growth. The company grew its first half US dollar revenue by 47.7% to $30.4 million. Customers are invoiced in US dollars making the metric a better judge of performance. AUD revenue increased 51% to $46.6 million with profit before tax of $5.6 million, a $6 million improvement.

The company has seen a decline in gross margin following supply chain difficulties. In the most recent report gross margin was at 71.8% with management targeting a return to 75%. Audinate has a strong cash position following a recent capital raise with the intention to expand the video segment and hunt for acquisitions. The company had a strong cash position prior to the placement which raised eyebrows.

At the time of writing the company’s market cap is over AUD $1.8 billion. If it can maintain growth of 30% for the full year and reach sales of over $90 million at the current price it will be trading on an eye watering multiple of 19 times sales! Incredible pressure to maintain these high standards of growth.

The worldwide movement to become a cleaner and greener planet requires efficiency through technology. Mining is set to play a prominent role in renewable infrastructure and RPMGlobal has positioned itself in this space as a global player in mining software.

RPM Global Holdings is a global mining software and consulting business providing licensing, consulting, implementation and support and technical, advisory and training services.

The company first listed on the ASX back in 2008 but has been in business for over 50 years delivering its services in over 125 countries. RPM’s mission is to create safer, more efficient and more sustainable operations for its customers. Its focus is to provide advanced mining technology, together with deep domain expertise across the mining lifecycle.

RPM is at the tail end of its transition from perpetual licensing to a subscription model for its software.

The move from lumpy one-off licences to a Software-as-a-Service style of revenue has taken time and often muddied the waters of its improving revenue. The company is now in a better position to pass on price increases and provide upgraded services to clients. RPM has a significant advisory business, so it couldn’t be considered a fully fledged SaaS business.

The company had an impressive run in share price in the lead up to its results release.

RPM delivered an increase in revenue of 20.6% with software revenues growing at 26.2%. Profit before income tax grew by 369% to $7.5 million. It’s worth noting that profit was inflated with the company having received a $3.1 million buyout of a potential future software revenue royalty stream.

Management has for some time had the belief that the company is undervalued. It has continuously been buying back shares, helping further accelerate the earning per share growth. That growth came in at an increase of 470% to 2.79 cents for the first half of 2023 compared to the prior period.

A combination of invoice timing and short term incentives lead to a cash flow result that is heavily weighted to an improved second half. The company delivered an operating cash flow outflow of $5.3 million compared to an outflow of $3.9 million in the corresponding period. Despite the cash burn the company remains well capitalised with $23 million in the bank.

One of the disappointing aspects of management is their “Profit Before Tax Excluding Management Incentives” which makes it difficult to gauge what profit will actually be.

If RPM can replicate a similar earnings per share result in the second half and get to ~5.6 cents per share at the current price of $2.21 the company trades at a lofty 39 times earnings. I feel that this is fairly conservative as it doesn’t take into account further growth in the already improving operating leverage or impacts of further buy-backs.

With increasing sophistication in cyber-crime and mounting cases of data loss and breaches the back up of data is becoming mission critical. Dropsuite specialises in the back up, recovery and protection of important business information whilst being profitable and growing at a rapid rate.

Dropsuite plays in the enormous cyber-security space securing backups and restoring Email, Microsoft 365, Microsoft 365 GovCloud, Google Workspace, and QuickBooks Online.

Hardly a sexy business, it serves an incredibly important function providing defence against data loss and cyber attacks, allowing for operation continuity. In a large and highly competitive market Dropsuite is reliant on its partner-led business model, generating its revenue through Managed Service Providers (MSPs) who integrate the company’s packages for clients Office 365 packages. It does impact Dropsuite’s gross margin, which sits at 68% lower than a classic software company.

Dropsuite recently released its full year results for 2023 with the company growing revenue at 48% while improving annual recurring revenue (ARR) by 35%.

The company continues to favour reinvestment within its product with Managing Director and CEO, Charif Elansar commenting:

“Our growth momentum will be sustained by continued investment in research and development as well as go-to-market functions in FY24. However, our investment will be balanced by our desire to maintain positive cashflow and profitability in line with levels delivered in FY23.”

As mentioned, Dropsuite finds itself in a huge market. Within a huge market comes huge players like Microsoft. In July last year Microsoft announced their Microsoft 365 Backup and Microsoft 365 Archive which at the time sent shares tumbling. Management reassured shareholders that Dropsuite’s unique value proposition, cost-effectiveness, and focus on disaster recovery set it apart from Microsoft. It does make you ponder the question, if you already use Microsoft for all your products should you really be using it as a backup too?

At the current price of $0.30 Dropsuite has a market capitalisation of over AUD $200 million, most recent profit of $1.5 million putting it on a price to earnings (P/E) multiple of over 130 which is extraordinarily high although given the level of growth I don’t believe P/E is the best metric to use. The pressure is on the company to maintain significant revenue growth. If it can achieve this while continuing to wind back reinvestment the company could begin to see significant profit growth and scale.

While these small cap companies have shown impressive growth it’s no guarantee going forward. Results can be volatile and at expensive valuations there is immense pressure for these companies to continue to perform.

I believe the underlying businesses are great and I own all three of these companies so please consider the potential bias! This write up should be considered as a starting point for further research and is not investment advice.

Already a 7investing member? Log in here.