Long-Term Investing Ideas in a Volatile Market

Simon recently spoke with a $35 billion global asset manager about how they're navigating the market volatility. The key takeaways are to think long term, tune out the noise...

The 7investing Team debates whether DocuSign or Sea Limited - both of which were chosen by you on Twitter - is the best opportunity for long term investors in this month's mock deep dive!

January 26, 2021 – By Samantha Bailey

Every month, our team of advisors each choose what is their very best idea in the stock market, and then presents that recommendation to their fellow lead advisors. We then, as a team, have the chance to ask questions about the opportunities, as well as the risks, of that particular stock. And on the eighth day of every month, we release the recording of those conversations to our subscribers! Our members agree that this is one of the highlights of a 7investing subscription.

While our actual Deep Dives are only accessible to our premium members, we wanted to give those who haven’t joined us yet a glimpse into how our market beating recommendations are selected.

In December, the team presented a mock Deep Dive on Tesla to showcase our extensive research process. For January, we decided to switch things up and present two companies, with a vote at the end as to which one is the better investment opportunity.

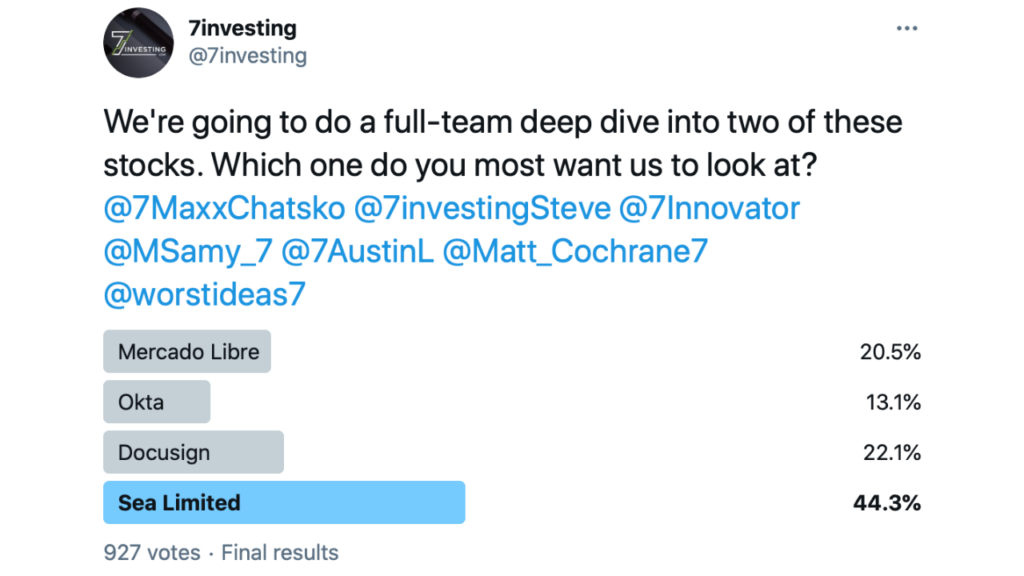

We asked on Twitter for you to choose which two companies to dive deep into: Mercado Libre, Okta, DocuSign, or Sea Limited.

With Sea Limited and DocuSign as the winners, we dove head first into both companies as if they were official 7investing recommendations. Dan Kline took the bull case for DocuSign while Steve Symington played devil’s advocate and presented the bear case. Austin Lieberman discussed why he believes Sea Limited is an excellent investment opportunity, with Simon Erickson following up with his potential concerns.

In the end, with a vote of 4-2, the team decided which company poses the greatest benefits to long term investors. Did we sign off on DocuSign? Or are we all in on Sea Limited? Tune into this episode of the 7investing Podcast to hear our thoughts!

If you are interested in either DocuSign or Sea Limited as an investment, this video will provide you with several important factors to consider. Please note that neither company is an official recommendation of 7investing, and this video is intended only to illustrate our Team Call process.

00:00 – Introduction

02:06 – Dan’s Bull Case for DocuSign

19:17 – Steve’s Bear Case for DocuSign

26:20 – Austin’s Bull Case for Sea Limited

38:59 – Simon’s Bear Case for Sea Limited

44:00 – Questions from Maxx and Manisha

Simon Erickson 0:00

Good morning, everyone! Welcome to our 7investing team call for January. Here at 7investing our mission is to empower you to invest in your future. I’m 7investing founder and CEO Simon Erickson. Now, every single month, our team of advisors goes out and finds our very best opportunities in the stock market. We then bring those back, we write reports about them, and we provide those for our subscribers. In addition to those reports, we also as a team discuss each one of those picks all together. We talk about the opportunities, and also the threats for each one of those companies. And we’ve been having fun these past couple of months actually putting a public facing version of our team calls out for everyone to watch. Last month, we talked about Tesla, and this month, we’re going to be doing something even more fun. We’re going to be picking two companies that you told us you want us to discuss, and then weigh the merits and the risks of each of those companies and ultimately decide which of the two we think is the best investment opportunity right now. And so those two companies when we asked you on Twitter that you wanted to talk about, you responded by saying you wanted to hear about Sea Limited and DocuSign. So on today’s call, I’m very thankful to be joined by my team of 7investing lead advisors. That’s Dan Kline, Maxx Chatsko, Austin Lieberman, Manisha Samy, and Steve Symington. Our other lead advisor Matt Cochrane is actually in the middle of a family trip right now, and not able to join us, but he is here in spirit. So everybody, are you ready to get started? We’ve actually for this call cued up a bull case and a bear case for each one of those companies. We’ve picked one of the advisors to pick the bull case, the other to pitch the bear case. Ultimately, we’re going to vote on which one our favorite of the two is. Is everybody getting ready to get started for our team call here for January? Oh, let’s go. Okay, well, first up is DocuSign. The ticker on this one is $DOCU. This is a company that is bringing a lot of paper management and paper contracts online to the cloud. Dan, this is a $48 billion company right now you have the bull case, for DocuSign. Please, the floor is yours.

Dan Kline 2:06

So the only negative I have here Simon is the amount of times I type it as doc-u-sing is pretty, pretty significant. So that’s a negative here. But DocuSign makes signing documents easier. I know that sounds like it’s a small thing, but if you’ve ever been through a mortgage – my maybe like three mortgages ago, we bought our last house in Connecticut before moving here to West Palm Beach. I sat for four hours because I had to sign my name, and I had power of attorney to sign my wife’s name because she was at work. I had to like write something – I signed like I’ve had a stroke, there’s no benefit to it. Now with DocuSign, when we decide we’re selling a condo now, and this is a very minor use of DocuSign, but it’s kind of the gateway drug. The entry into the company. When we decided to sell our condo, our real estate agent sent over an electronic document. We went through and you hit the sign button, and basically, my signature looks like I’m signing the Declaration of Independence. Like it’s a beautiful thing. And you can go through it very quickly, you can also bring the document back up, you can save it, create a folder. Selling a house is not easy. You have your agreement with your realtor, then you might get an offer that you have to accept, then you might get – you know other papers you have to deal with. Here there’s HOA is to deal with. So it’s so many things where you would have had to meet the person physically, that now you can just do electronically, and it’s safe and it’s verified. I’m going to share my screen here and this is always always an adventure when we do this. Okay, so bringing this up, and let me just change it to the slideshow view.

Simon Erickson 3:42

Live demonstration everyone! Present.

Dan Kline 3:46

Okay, so the symbol is DOCU. It’s traded on the NASDAQ. That is the easy part of this. I’m gonna figure out where to move you guys so I can actually see my presentation. And the industry is a enterprise software. I don’t think there’s a lot of risk here. I think the the question is “how high can it go”. Not “is somebody else gonna come in and stamp on them”. There’s not a lot of reason for say like real estate companies or lawyers to form their own version of DocuSign. This isn’t an add on that helps them. It wouldn’t make sense for them to sort of go into it. It’s a growth investment. And this is a large cap stock. These, by the way, are the forms we use when we do our regular calls. So this is a company that provides a needed service. They get rid of a pain point and as their CEO Dan Springer said, COVID-19 has sped this up. My co-working space – I’m actually next to a title company, and one of the challenges for the title company has been that sometimes they need signatures, and I would hear them being like “okay, let’s meet in the park. I’ll leave the document on the bench, you’ll sign it, then I’ll walk over and get it.” DocuSign takes all that away. I keep harping on real estate because that’s how I’ve used it, but it for insurance, it works for any industry where you need verifiable signatures. So even something as simple as, hey, Simon, if you’re going to join the gym, you need to sign this document that says you won’t sue the gym if a weight falls on your foot. That’s all going to be done with DocuSign. I say that because I came very close to dropping a weight on my foot yesterday. This has just become the default. It is used across so many industries, and we’ll get to some of the customers in a second here.

Dan Kline 5:29

Okay, so this is already the number one e-signature solution company in the world. Who the number two e-signature company is….I have no idea. I don’t think there’s any competition here. They have 822,000 customers that’s all around the world. Why is that important? Because right now, many of those customers are just using the basic signature service. That can be grown. So every new customer they get is a marketing opportunity. They say it’s a $50 billion total addressable market. I always find TAM’s a squishy number, you know, but it’s it’s being able to prepare documents, being able to manage documents, its legal review, all the different things that could layer on top and the the Q3 numbers were great. Revenue was up 46% overall, 19% internationally. Billings were up 61%, operating margin (non gap) 10%, and net dollar retention 122%, meaning existing customers are spending 22% more money than they did previously. That is a really good sign. They’re cashflow positive. Their numbers are a little squishy in that area, but they have been improving sequentially. So when you look at it, these are all the areas here where agreements matter like sales. So every aspect of the sales flow process requires signatures, requires document management, marketing, human resources. “Okay, we’ve offered you a job, Simon. You’re going to come in and you’re going to be the new assistant parking attendant at our hotel. Sorry for the demotion there, and you need to sign all these papers, you need to agree to a drug test. That’s gonna be dicey. Just kidding. You know, you’re gonna need to sign all this stuff, you need to get it back to us, especially now during the pandemic, that’s valuable. But even when there’s not a pandemic, do you really want someone sitting in your office for 20 minutes leafing through papers and signing them? Would you rather just send them something and the whole process can become automated so obviously legal, IT, procurement creating a chain on okay, Simon, I need a new camera for taping 7investing now. You send that to our purchasing department. I think that’s in the purchasing building, I’m not sure which part of the 7investing that – we don’t have a purchasing department, but you can create all this paperwork, have it all documented, be able to follow where everything is going. It sounds small, but it actually makes everything really, really simple. If you’re not clicked on it, it doesn’t turn. So right now we talked about this, they fix a broken manual process. They started with the sign, that second column, but now they can do things like help you build your documents. So think of like the stock document. A lease is a pretty stock document. You can go get one, or DocuSign can have this whole library of things available for you that you can modify. They can also help you do things with those documents, like starting to bill you or to trigger other processes. That means okay, once this documents done, here’s the five things that happen next. Probably the best thing about all this is they can manage all this. Documents, I mean, you know, I’m sitting at a desk that has no papers on it. My wife upstairs has a desk that looks like a paper factory exploded. The more you can automate things, the faster things go, the better it works. So it starts with a signature. That’s what gets people in the door. He signatures faster. They say 50% faster. You can save 82% of time in one day. It’s obviously easier. It’s cheaper. And because it’s a standard process, there’s a trail, there’s an audit trail. You don’t have to go “geeze, where did I put that that finished document? Is it in the folder? Is it on my desk? Is it in a drawer somewhere? Even if you have printed a copy, there’s always an electronic copy, but this is how you get people in the system. There are a lot of areas where this can grow. So, you know, they talk about the ability to to identify the ability to be a notary, the ability to be the analyzer. What does an analyzer mean? That means they can look at your document and say, “hey, Simon, this clause they put in there, that’s a little unconventional. It says they can terminate your your position if you’re two minutes late to work. That’s one you should maybe fight back on.” They can manage payments. They can also integrate with everything from Salesforce to Microsoft Office to Google to Workday and hundreds of others. They have API’s that are built in. We’re going to talk about that a little bit more. I’m trying to go a little bit quickly here, because we do have a lot to get to today. So right now, you know, they’re doing about a billion dollars in the the sign business. They think that is potentially a $25 billion business, and then all the things they can add upon that, they also see another $25 billion there. Again, those numbers are somewhat meaningless, but there’s a lot of room for growth.

Dan Kline 10:28

So they’ve been improving their profitability and cash flow. They were losing money, same quarter year ago. Now there, they have slightly profitable operations, their cash flow is getting better – their free cash flow is getting better. Some of this is helped by the pandemic, but do you really think that people who are electronically sending documents and put that process and are like, “hey, the pandemic is over, let’s go back to having to drive around our documents and have lots of meetings.” It doesn’t make a lot of sense. Okay, so they have their next step is what’s called the agreement cloud. And that’s this idea that in the cloud, they can integrate with all these different software providers, and they can help you with all your business processes. So we talked about HR and onboarding, you know, there could be something like a training everyone has to take, we have to document that. There’s also the sales process where, okay, I’ve made the contact now, that triggers in Salesforce that this document goes out and everything can be stocked, everything can be prepared. We’ve all dealt with this at different employers where you go and you make the deal, You sit down with some major company, and they’re going to partner with you. Then it takes like a month for legal to get back to you with documents. This can make all this much more standard, and sort of forcE the process along. So okay, I approve the document. Then I approved the deal. Then it goes to Joe in legal who gets the stock document, makes his changes, that goes to Joe’s boss at super legal, and then it goes out to the client. Then it comes back to me. They can manage all of that. So let’s look at their path to success. They IPO’d in 2018. They’ve made some strategic acquisitions along the way, and they’ve just steadily grown their business. They have not been hesitant to buy generally small companies that add functionality. It’s sort of that Apple approach, like, okay, there’s this company that has a streaming app. We don’t want the streaming app, but we want this one little bit of technology that’s going to be valuable to us. That’s tends to be their strategy, and they’ve been steadily up up up. They call it waves that build on each other. So what it is, is a signature, that’s going to get you in the door, then you’re going to go to the agreement cloud, which that makes automation bigger, it covers end to end agreement, then you’re gonna go to the smart agreement cloud, that’s what they’re working on now. That’s where AI helps you and sort of figure this thing out. Sometimes that could be actually making relationships. So you get to a point where you don’t have someone to send it to for legal review. Well, that’s a service they might be able to market to you. And they can identify that using AI. Yhey’re in the early steps of this. Look at their customer base, it’s a who’s who. T-Mobile, Netflix Intuit. You know, Office Depot, that’s a weird one to pick. Samsung. The NASDAQ. There’s just a ton of people here, because why wouldn’t you use them? But you know, let me ask anybody, can you name another e-signature company? I don’t think you can. I’m sure there is one. But this is by far the default. And you know, we’ve done this like, so we use zoom for meetings, and every now and then you have to go to a meeting on Microsoft Teams. But like that one meeting where you’re on like Ring, and someone has to send you special instructions, and you don’t know how to do it, and it doesn’t recognize your camera. Why would you use another document signing company? Their customer base has been growing, as has the amount of process that’s gone through. 822,000 customers, that’s tip of the iceberg when you look at the document business. I can argue that there is no business that couldn’t benefit from using DocuSign. Even if DocuSign is done in person, how much easier is it to pull up a screen and someone can flip through the document and just put in their signature automatically than it is and nobody’s reading boilerplate. So if it’s a document you have to read, you can do that electronically as easily as you could do it in person. And of course, you could print it out. So I see it as an unlimited customer base. They’re growing internationally as well. Still a relatively small part of their revenue, but that just shows the opportunity to look at all the parts of the world they’re not in. Pretty significant. And obviously there might be some local defaults or some banks offering these services in some markets. But there’s an awful lot of opportunity, especially where if you’re an international company, you know, you’re Apple or Google and you’re using these services. Why wouldn’t you just roll it out across your entire operation?

Dan Kline 15:00

Okay, so this is a company that you think of as a signature company. But they have dozens of applications that go through the entire process. They have over 1000 customer built API’s, that’s where it’s integrated into what you’re actually already doing. There’s 350 company built integrations – that’s when you’re using Microsoft Teams, you pull up your DocuSign, or your real estate platform, and all your documents are right there. This is a company that has been innovating. They’re always aggressively improving their product, and they’re pushing at the boundaries of what their product means. So they don’t have to sell their own product. When you’re using Salesforce, the opportunity to integrate DocuSign is there. That’s true with Microsoft, Google, all these other companies here. They also have reseller partners that when they’re coming up with a solution for a company, they’re saying, “okay, why don’t we add DocuSign on here.” So when some of your sales are happening organically from partners, and you don’t have to do it, that is really a strong business driver. When you’re integrating with these major, major platforms, nobody who uses Salesforce wants to print out and mail a contract, I think that’s pretty fair to say. Okay, we’re moving to the end. And Dan Springer is not quite this skinny, I had to make the document fit the page, so I’ve made him much, much more lean than he is. So here’s a negative here. He’s not the founder of the company. This is not a founder led company, but this is one of those cases where the founders took it kind of as far as they could go, and then brought in the right management. So nobody has major skin in the game in terms of having, you know, 10% 20% of the company. But this is a seasoned executive that’s been all around the industry that grew into this position, and he’s done a really good job. So not every founder, just because you think of an idea, doesn’t mean you can take it and lead it to multibillion dollar status. So sometimes getting out of the way, is actually a positive.

Simon Erickson 17:06

Yeah, fantastic job, Dan. And thanks for the presentation. Like we showed, you know, this is kind of exactly how it goes throughout the call, when we have team calls that we present for our 7investing subscribers, right down to the PowerPoint presentation format itself there. Dan, thank you for that. We kind of talked about the market opportunity, the business opportunity, and then also the management team. We typically also, and Dan, if we could bring you back to stop screen sharing so we can have this more of a group conversation at this point. There we go. We typically now at this point, have a group conversation about each one of our picks, where the person presenting the company, that is bullish on the company, is counterbalanced by some questions, maybe even some critical questions about that. Rather than having the entire team chime in at this point, I’ve actually selected one person to be the devil’s advocate for DocuSign specifically, and that is Steve Symington who is going to take the bear case on this. Again, for our team calls, we typically open up to everybody, but for this one specifically, just one person in particular. Go ahead, Dan.

Dan Kline 18:05

Yeah, I just want to jump in with one thing to sort of color the audience. So this is not a pick. This is you know, stocks that you sent to us that you wanted us to look at. And I’ll say DocuSign has been on my radar, but I probably spent about a day a day and a half diving into this. Whereas when I make an actual pick, I’ve been following it for months, if not years, and I will probably do a week and a half of added research on that pick. So as much as this is a deep dive, it’s kind of a deep dive for a television show, compared to when we make an actual pick. Our level of conviction, our level of research is dramatically higher. I mean, you know, not everybody, maybe.. no everyone is doing that. And Steve, now it is your time to make me look stupid.

Steve Symington 18:51

Yeah, well, that’s a pretty solid bull case, but it’s time to rip it apart. So no, just kidding. I can truthfully say I have the displeasure of arguing the bull case for DocuSign because in the interest of full disclosure, it has been in my top three a couple times since we launched 7investing last March.

Simon Erickson 19:14

Steve, this is not a very convincing bear case.

Steve Symington 19:17

I gotta say I love DocuSign. But there are risks and we can’t ignore them. And I guess, you know, to be clear, I like them from a perspective that you know, views its core e-signature market as a stepping stone toward capturing the broader digital transaction management market, that DTM market you’ll see. So the systems of agreement platform that it’s built is really compelling, and it’s a massively scalable business. I like its network effects. But you know, one of the things we have to consider is that DocuSign is market cap right now. $50 billion, somewhere around there. 46.7 something

Dan Kline 20:01

Like 48 billion or so.

Steve Symington 20:03

We’re talking about a business that’s run up really hard. As of last month, the company is still suggesting, or you mentioned, Dan in your presentation, of suggesting its total addressable market sits around $50 billion. Yeah, that’s a squishy figure. Yeah, that could expand. DocuSign is delivering some some pretty solid growth, it’s been accelerated by the pandemic, but it’s trading around what 35 times trailing 12 months sales, I think, like 26 times enterprise value to this year’s revenue. Pretty steeply valued. And I can’t help but wonder, with shares almost quadrupling over the last year alone, whether any signs of a slowdown, we’re gonna see the stock pullback pretty hard, and some of those multiples contract. And so really more of a near term concern, maybe? Has it gotten ahead of itself in the near term? You mentioned earlier that it’s hard to name another e-signature company, but there’s a little one named Adobe, actually, that some people might have heard of. Adobe Sign is a pretty significant competitive risk, and actually, a little cursory googling, you’ll find some some documents where Adobe’s trying to knock them pretty hard. I think one’s titled “Why Adobe?” Why DocuSign customers choose Adobe Sign. So it’s talking about basically scalable network effects. And, you know, the Adobe document cloud which has massive momentum. There’s kind of little upstarts that that can threaten it as well. One called Hellosign. It’s becoming a pretty crowded market. So for talking about a market, a total addressable market that is worth about 50 billion, at least right now, and a lot of companies vying for that money. Some companies will look at this and say, well, how difficult is it to replicate? And sure, DocuSign can take advantage of its network effects, but that’s something we really need to keep in mind. Another thing I think over the longer term that DocuSign customers, investors rather need to keep in mind is disruptive threats from emerging technologies that could potentially do this. One of those is blockchain. That’s sort of one of those things they don’t talk about as much. You know, the immutability of blockchain technology could potentially translate well to the digital contracts world. So, and to DocuSign’s credit, that’s something that they’ve actually thought about pretty extensively. They’re sort of on top of it. I think they have a partnership with Visa. A couple of years ago, they entered the Enterprise Ethereum Alliance. They’re focused on up and coming blockchain solutions that could potentially because they recognize you know, and said before going to be it would be a huge strategic mistake said Springer himself, to ignore the threat of blockchain. So they are kind of on top of it. And right now, the the economics of, and the scalability of blockchain as far as it goes on a widely available enterprise scale edge, it’s not attractive enough to really translate there. So the costs are still high enough to where it’s not really that much of a threat. But that’s something to keep in mind, kind of down the road. But really, you know, those are, those are big concerns, you know, we’ve got a crowded market, a lot of people vying for big companies like Adobe, which is what a $230 billion monster with really, really impressive cash flow. I mean, the scalability of their business, and the the kind of end to end solutions that Adobe provides could be a huge threat. So, you know, I’ve seen some, some bearish arguments that are saying “is DocuSign more of a Dropbox? Or is it more of an Amazon?” It could go either way. So there is a threat that DocuSign could be rendered somewhat irrelevant over the longer term. I see that threat dissipating with scale and with the the positive impact of its network effect effects, but it’s something that we really need to keep in mind. So I think that’s that’s kind of the bear case in a nutshell. I personally would would rather bet for it than against it. But there’s there’s some risks with as far as its run up, and the potential for this sort of stay at home stock that’s been significantly accelerated by the COVID pandemic to get smacked pretty hard if we see any semblance of a slowdown in growth.

Austin Lieberman 24:49

Steve, you cut out. Could you say that again? Please. You cut you cut out at the beginning.

Simon Erickson 24:56

I do think it’s funny Steve’s the bear case having bear in his front yard most of the time up in Montana. Great points, I really liked the points about the market opportunity. Dan brought up $50 billion potential market out there, it’s still only 4% penetrated on the signature side of it. But Steve’s also got some great points too about is that market just moving paper to the cloud when there’s some other technologies like blockchains, which could displace that entirely? And then Adobe Sign and Hello Kitty sign and every other sign side that you said in the group they’re competing against it there.

Steve Symington 25:30

I agree that it’s one of those things that, you know, it’s easier to say “oh, that’s DocuSign.” You know, everybody knows DocuSign. But I think Adobe is making an effort for everybody to know Adobe Sign too.

Dan Kline 25:43

They’ve got a clever, clever name.

Simon Erickson 25:45

Yes. Let’s keep moving. The show must go on. So we’re gonna pitch. Sea Limited next. If you have thoughts if you’re watching this, and you have thoughts about DocuSign, send them to us at info@7investing.com. Or @7investing on Twitter. We’d love to hear what you think about DocuSign as well. But in the interest of time for this podcast, Austin, I’m going to hand the floor to you to talk about Sea Limited. Seems like this is a company doing digital everything in Southeast Asia right now.

Austin Lieberman 26:20

Yes, Simon. Thanks for the opportunity here. I think after this bull case, you will see that this is a great investment opportunity. So let’s get started. And again, this is a mock recommendation, right? Not a real recommendation. I’m putting it in the e-commerce industry, because I think everything ties back to e-commerce with what this company does. Over time, I believe that will probably be their largest source of income, medium risk, it’s definitely growth investment, and it has now become a large cap company.

Austin Lieberman 26:51

Sea’s mission is to better the lives of consumers and small businesses with technology. They have three core businesses that go across: digital entertainment, e commerce, and digital payments/financial services. Those are called I might get these wrong the way I pronounce them but Guarana, which is a leading global online games developer and publisher. Their big game there is Free Fire. Shopee, which is the largest pan regional e-commerce platform in Southeast Asia, in Taiwan, and then Sea Money, which is the leading digital payments provider in Southeast Asia. A quick overview of their third quarter 2020 business results. So on the left side, we’re looking at total revenue growth for the group, which is all of their business segments combined. 99% year over year growth, and total GAP revenue, which is pretty good. And then on the right side of the chart, you see 110% year over year growth in D bookings. D stands for digital entertainment. So that’s the Guarana, or Free Fire side of their business, the gaming side of the business. Just below that, 173% growth in the e-commerce GAP revenue. So that’s Shopee. So strong growth in two of their biggest segments, and breaking this down a little bit more per segment. So digital entertainment, we’re seeing continued growth of the user base. Quarterly active users from third quarter 2019 to third quarter 2020 were up 78%, which is great because more current users spend more as they monetize the platform better. But if they’re also able to grow users upwards of 70%, year over year. That’s additional revenue, and then additional growth for that new cohort of users every year. So very important to monitor the quarterly active user growth for this company. And then quarterly paying users, you know, what are users worth if the only way to monetize them is through, you know, potentially advertisements or something like that? Well, not as much as if they are paying users. So one of the recent developments, and I believe one of the reasons that this platform and Guarana’s market or shops – getting all mixed up here – Sea’s market cap has expanded so much is because they have really shown that they can monetize their user base. So quarterly paying users was up 124% year over year. And then the digital entertainment growth 572.4 million quarterly active users, which again was up 78%. 65 million quarterly paying users, that’s just putting that 123% growth into a number. And again, that’s for Free Fire, which it continued to be the highest grossing mobile game in Latin America and Southeast Asia, and that’s according to App Annie. Now let’s dig into Shopee. They’re extending their leading position across the region. According to management, and gross orders were up 131% year over year as of their last quarter, and gross merchandise value is up 103%. So what we’re seeing here is just a strong growth across the most important aspects of their digital gaming, digital entertainment and e commerce businesses what is which is what drives most of Sea’s revenue. So a quick infographic on their e-commerce growth, they had 741 million gross orders 9.3 trillion billion in gross merchandise value. Tt was number one, their app was number one by downloads, average monthly active users, and total time spent in the app on Android in the shopping category in both Southeast Asia and Taiwan. And that was the number two most downloaded app worldwide in the shopping category in the third quarter 2020. Again, according to App Annie. So strong figures, we’re seeing the apps really popular, people are spending time in there, and they’re spending money. And Sea Money is their digital finance, financial services segment. This is their newest segment, and it represents the smallest portion of their revenue, but they’ve got a ton of room for growth. If we think about what Shopify has done with financial services and digital payments, and Shop Pay, as well as Square, we’ve seen the opportunity there and companies in the United States, you know, Sea Group is kind of following a similar path as companies like Shopify and Square and even Amazon in a way.

Austin Lieberman 31:28

But doing that mostly internationally, which there’s a ton of room for growth. So they had 2.1 billion total in mobile wallet, total payment volume for third quarter, over 17.8 million quarterly paying users. And then over 30% of Shopee’s gross orders were paid using their mobile wallet. So again, very similar to what we’ve seen with evolution of Shop Pay for Shopify is platform. A few more details on their financial services growth, talked about the 2.1 billion. And this is just what I just covered in an infographic. So to gross profit, again, this is for the overall business. But gross profit was up 101% year over year, which is great, from 203 million to 407 million. But the business is not profitable. So net loss in the third quarter grew from 206 million in 2019, to 425 million in 2020. Now I’m okay with that, because clearly, Sea Group is investing for growth. And we’re seeing that growth in revenue across all of their services. So they’re taking this opportunity to reinvest in the business, and they’re accepting more net losses, but it’s a smaller percentage of revenue than previously. So that’s exactly what we want to see is we want to see net loss become a smaller percentage of revenue over time. If it doesn’t, and they can’t eventually show that they’re making their way towards profitability, then the total growth potential of this business is eliminated, but limited, but we saw it with Amazon. Amazon has become one of the best investments of our generation, and they were unprofitable for most of their history. Then just a little bit about staying power. So basically, what these text blurbs show is that they’re introducing more social and community features into the game. We’ve seen things like this in the – escaping me right now -Fortnight. So you know that we’ve seen Fortnight in the US and worldwide do concerts and try to create a real community feature. What that’s done is it’s brought more people to platform, they spend more time on the platform, and they’re able to be monetized better through in game purchases. And then, you know, in Sea’s case, they’re building a huge network that they can potentially then get these people into shopping and buying things in e-commerce on their platform. And so a big network effect here. But that’s what this is saying, is that they’re trying to create a community aspect, much like we’ve seen with games like Fortnight to help sustain that user base. And that’s why Free Fire has been such a popular game for such a long period of time. People are worried about it losing it’s staying power, but they’re trying to do things to keep it there. Quick blurb on Shopee growth potential. What we see here is that they’re announcing partnerships. They have a partnership with Google that they announced last quarter, they launched a new strategic partnership with five leading global media agencies, and that program is designed to equip those agencies with in depth e-commerce knowledge, tools and skills so they can help more brands and retail merchants scale and succeed on Shopee. So what they’re trying to do through partnerships is not have to go out there and appeal to every shop owner or person that’s going to start a business. They’re trying to partner with these agencies that have really wide networks and audiences and get the agency’s to help bring people on to the platform and Sea Money. The biggest thing was Sea Money is it’s an additive feature to their shopping platform. The more that they can get people using Sea Money, they capture more revenue from those people. But it also makes Shopee more of a sticky service. If you can open a business online, and we can think Etsy and Shopify in the US, and through that platform, you’re able to get these additional services, like Sea money and payments and process payments, then you’re much more likely to stick to that online platform, then, leave and go somewhere else. And so ultimately, I believe that’s what they’re trying to do with Sea Money right now, and then eventually, it can grow into a much bigger part of their revenue as total payment volumes increase, and the network effects go into play. And they’re able to attract additional payment volume from merchants, even outside of Shopee. Potentially the red flag or the yellow flag, I guess, you can say for Sea Group, in my opinion, is valuation and total market cap size compared because every time we make an investment, we have to think about the opportunity costs and other things that we can invest in. So right now we’re looking at a chart, it is ordered from highest to lowest price to sales ratio. On the right side, we see Shopify has the highest price to sales ratio at 58. Shopify at the very top has a market cap of $146 billion, and their revenue growth was 96% with 2.4 billion and trailing 12 month revenue. In my opinion, compared to Shopify, it looks like Sea Group is is a better opportunity right now, because they’re growing at 98%. On a larger revenue base, they’ve got a little bit lower of a gross profit margin. There again, we talked about profitability, their operating margin is much lower than Shopify. They’ve got a slightly smaller market cap, and then almost half the PS ratio. Now the thing to think about, though, is what is the total e-commerce opportunity for a company like Sea Group versus a company like Shopify? And that’s probably why right now Shopify has a much higher price to sales ratio. So I would say Shopify and Sea Group are probably about on the same level, in my opinion, as potential investments. But where this gets interesting to me, and I think that potentially better opportunities are in companies like Etsy, where Etsy grew their revenue 128%, it’s on a smaller base, so 1.37 billion, but they have a higher gross margin. So it’s more than double the gross margin of Sea Group at 70%. Etsy is profitable, so they had an operating margin of 20%, and the business overall is profitable. What I really like about Etsy is that the market cap is much lower at 27 billion, and their price to sales ratio is only at about 20. Now the argument can be made that Etsy’s total potential market cap and total addressable market is lower than Sea Group and Shopify. But you know, that management team is going to try to expand too. So this is a yellow flag to me. I think Sea Group is a great business with a lot of growth potential ahead, but there are other options out there. Ultimately, in normal years, these types of companies kind of are expected to trade at similar valuations. So there’s a chance for price to sales, multiple contraction, or that could just limit growth potential in the future. But I don’t think the business is going anywhere. It’s not at risk of going bankrupt, in my opinion, unless something comes out of fraudulent which we’ve seen nothing, no signs of that. And the last thing is that it is a founder led business. And I love to see that in businesses that I I own and recommend. So let’s open it up to questions.

Simon Erickson 38:59

Yeah, fantastic job. Austin, like you said, kind of a regional leader, right. It’s tough to compete against those businesses that are so established in the areas where they compete. I’m going to fall on the sword on this one and take the bear case for Sea. It’s hard to argue against so many of those those points you made. I guess there’s just two things that I really want to point out for investors from the bear case on this, and that is the valuation today versus the market’s potential size, and then also some things that we dig in deeper the ownership bothers me a little bit. But first, let’s talk about the valuation. You did a great job of pointing out that chart at the end, Austin of how large and how quickly, Sea has grown in just the past couple of years. There’s no doubt about it. That revenue and customer size is growing incredibly quickly, but it’s not like the market has just ignored that. This is a company that just two years ago was selling at eight times sales. That’s the multiple when you consider the market cap of the company versus the sales that it has for the trailing 12 months. It was just eight times sales two years ago. Today, it’s selling at between 30 and 31 times sales. So the valuation multiple the market has rewarded Shopify, or I said Shopify, Sea Limited.

Austin Lieberman 40:07

It’s tough to talk about these companies. Similar names, they do similar things. Yeah.

Simon Erickson 40:12

More coffee required by me on this. My point is that the market valuation multiple has quadrupled in two years. The market has very clearly rewarded this business, and it’s returned 395% as a stock in 2020. That’s gone parabolic. There’s a clearly an awakening that this is a great company. I don’t think it’s the hidden gem that it was a couple of years ago. And I don’t think we can expect at least I don’t expect to see that kind of performance continuing. And the other thing that I want to point out on this valuation point is that this is a company that doesn’t have unlimited growth potential. We’ve seen them do very well in regions like in Indonesia, and Thailand, Vietnam, and Southeast Asia, but I would be very shocked if Sea limited expands into China. We’ve talked about Sea limited expanding into South America. That’s going to be very difficult for them, because there’s another company called Mercado Libre that’s already kind of got the digital wallet, and it’s got the e-commerce presence in different regions. I think that companies like this, they are winner take most in the regions where they compete in. I’m not so convinced yet that Sea is able to breach into a lot of those larger markets, and my reasoning for that actually ties into my second point here, which is the ownership and the dependence that Sea has on Tencent and on its CEO/founder. When you dig into the proxy statement, it’s a little different for international companies, but here in the United States, it’s the the definitive proxy. The 14A and the SEC government regulatory filings, it shows the voting power of a company’s owners. So when companies own a business, they have say over what the company is going to do. There’s multiple class structures. But when you look at overall voting power, what say does certain owners have in this, we see that Sea Limited founder and CEO, and Chairman Forrest Li has got 39% ownership power in his hands, and then another 18% voting power through a separate entity. And on top of that, 25% voting power is directly in Tencent’s hands. So add those three components together, which is just the founder and just Tencent, that’s 82% voting power of this company structure. We are minority shareholders as individual investors in this. I think that that is something that kind of is a little challenging. We consider foreign ownership requirements in Vietnam and Thailand, a lot of Southeast Asia, we are really along for the ride and putting our faith in this founders hands, and then also in Tencent’s hands. The Tencent thing, just one last final comment that I think something investors should be aware of, in addition to having voting power, they also licensed the games over to Sea. Sea paid $122 billion last year for royalties to license the games actually developed by Tencent. They’re also dependent on Tencent for their cloud computing infrastructure. This is something that Sea is going to expand in the region where it is, but I think that Tencent is going to keep it where it wants it to be. It’s not just going to open up it’s much larger market in China. So I think it might be a little constraint on the growth potential for this. But that’s just what I had to say, again, I’m the self appointed bear for Sea. A fantastic company. Both of these, I’m going to open it up to the group now, are fantastic businesses. Just within the last three years, the S&P 500 index has increased 43% in value. DocuSign has increased 533%, and Sea Limited has increased over 2,000%. So we’ve clearly got some fantastic businesses here. I think at this point, maybe we’ve got a couple minutes left. Does anyone have any thoughts about either one of these business before we go in and actually vote on which of the two we think is a better company? Maxx, Manisha? Any any comments from either of you on the companies that we’ve talked about here this morning?

Maxx Chatsko 44:04

So when you’re talking about DocuSign,

Dan, you mentioned that they use non GAAP operating margin. I know a lot of tech companies use non GAAP metrics. For me, that’s something I hate. Do you have any idea what thay are they adjusting there or…

Dan Kline 44:21

So I apologize for the vagueness of this because I put my notes away. It was the answer is that when I looked into why it made sense to me, it was a it was an accounting thing. It was a way money was moved around. It usually that is something I find troubling and I apologize for forgetting the specific answer. But I had the same question. I looked it up and went okay, it’s because of this method of recording revenue that that the numbers look a little bit different. And again, from a cash flow basis, they are they are making money and they have been steadily growing that I didn’t get really hung up because the actual gap numbers, which showed a slight loss, again steady improvement, and it was only a slight loss. The big thing I sort of, you know, count down, I’ll go back to sort of the bear case that Steve presented, they only have 822,000 customers. Every transaction, in theory, could bring them more customers. I don’t think it’s crazy to think that they could have 2.4 million customers. And Adobe Sign can also have 2.4 million customers who will all be spending their days trying to figure out how to install the Adobe software and deciding if they have the paid version or the free version, or whether they can edit it or not edit it. So I think there’s actually a track record of simplicity for DocuSign that Adobe has not generally lived up to.

Simon Erickson 45:40

Manisha any thoughts before we jump into the vote? Are we ready to start voting which one of these companies we pick as a better investment opportunity?

Manisha Samy 45:48

To be honest, I will say both of these companies are out of my wheelhouse. I use DocuSign, I really did not know much about Sea invest before. I guess with DocuSign, my one question is, and just if you can imagine an average investor, I just think, hey, like I can sign documents. But that’s it. So how are they actually making revenue again?

Dan Kline 46:22

So the revenue comes from all the customers paying to use the service. And, you know, that’s a small transaction, but then when you get into things like managing document flow. So even a small realtor – my realtor is a small brokerage with you know, you know, a handful of people. The amount of documents they generate are pretty massive. So paying whether it’s $19.99 a month, and then it goes to $39, or $69, or whatever it is, that might replace a person who used to have to manage all that flow and physical file cabinets, or digital file cabinets in this day and age. But imagine getting a physical document and having to make it electronic. Yeah, some places have the copiers and you put it through and it’s kind of quick and it scans, then you have to go get the file and rename it, there’s just a lot of pain to the process. And this makes it easier, it also makes it dramatically less likely you’re gonna lose those documents. So the costs are relatively minimal when you look at how much is being done here. And the great thing is, it gets you in the door. It’s a lot. It’s a lot like, you know, some of the Microsoft products. Oh, yeah, first you use Word, and now use PowerPoint, and then you sign on and get Team. So that’s going to be the test. Can they grow beyond just being a signature company, to really being a process management company. Everything I’ve seen is pretty encouraging. Imagine using it for a, you know, in fact, I did use it. I tried to get into a COVID vaccine test. And I didn’t for a variety of reasons, and they were using DocuSign for some of the documents and managing their process. And you know, that’s a really complicated legal process to make sure everybody’s indemnified and that people fully understand what’s going on. So there’s no end of users, and apologies for the very long answer there.

Simon Erickson 48:08

On the spot! Very nicely done, Dan. We’re gonna go to the vote here. Just a reminder, for everyone watching, we don’t actually vote in the actual team calls we do every month. We have conviction, we know what pick we’re going to make for the upcoming month. We only do this to go back and forth and chat with the rest of the team so that they can share their opinions as well. But just for the fun of it for this call, since this is public facing, we wanted to add an element of a vote at the end on which of these two companies we think is the better investment opportunity. So here we go, raise your hand, if you think of these two companies, Sea Limited is the better investment opportunity right now. One for Austin Lieberman, and one for Simon, one for Steve, and one for, Manisha. Raise your hand if you think DocuSign is the better of these two opportunities. And there is Maxx and Dan, with a thumbs down from Austin. Maybe a negative 0.5 for the thumbs down. So one and a half for DocuSign. Just kidding, of course. So just to have some fun, this is kind of – so I guess our winner is Sea Limited for for this call. But thanks for tuning in. The whole point of this call was to kind of show you our research process, and we do this every month. We love to hear opinions from the rest of the team. We love to interact with subscribers about our picks themselves. We don’t think that investing is just writing a report and publishing the report and then disappearing. We want to have the back and forth conversation. That’s the whole purpose of us publishing this. So thanks for tuning in to this month’s call. We looked at Sea Limited and DocuSign. Those were the two companies that you said you wanted us to chat about. We’re going to have another public facing team call upcoming in February, and we look forward to chatting with you then. Until that time, we are here to empower you to invest in your future. We are 7investing

Simon recently spoke with a $35 billion global asset manager about how they're navigating the market volatility. The key takeaways are to think long term, tune out the noise...

Anirban and Matthew were joined by Alex Morris, creator of the TSOH Investment Research Service, to look at seven former market darlings that have taken severe dives from...

On episode 5 of No Limit, Krzysztof won’t let politics stand in the way of a good discussion - among many other topics!