October 9, 2022

At 7investing, transparency is important.

We’re not running a TV show where we scream “Buy!” and hit sound effect buttons. We’re not pumping the next crypto scheme, nor the next stock that’ll make you a millionaire in 20 minutes.

We take this much more seriously. We know there’s real money at stake and that the stock market will impact your financial future.

As such, we’re doing something that many others are not: we’re tracking our real-time returns transparently.

Everyone can see the real-time performance of our recommendations scorecard at any time. And our members can take that a step further, and see how every one of our past recommendations has performed. Right down to the minute.

Sometimes our picks do phenomenally well.

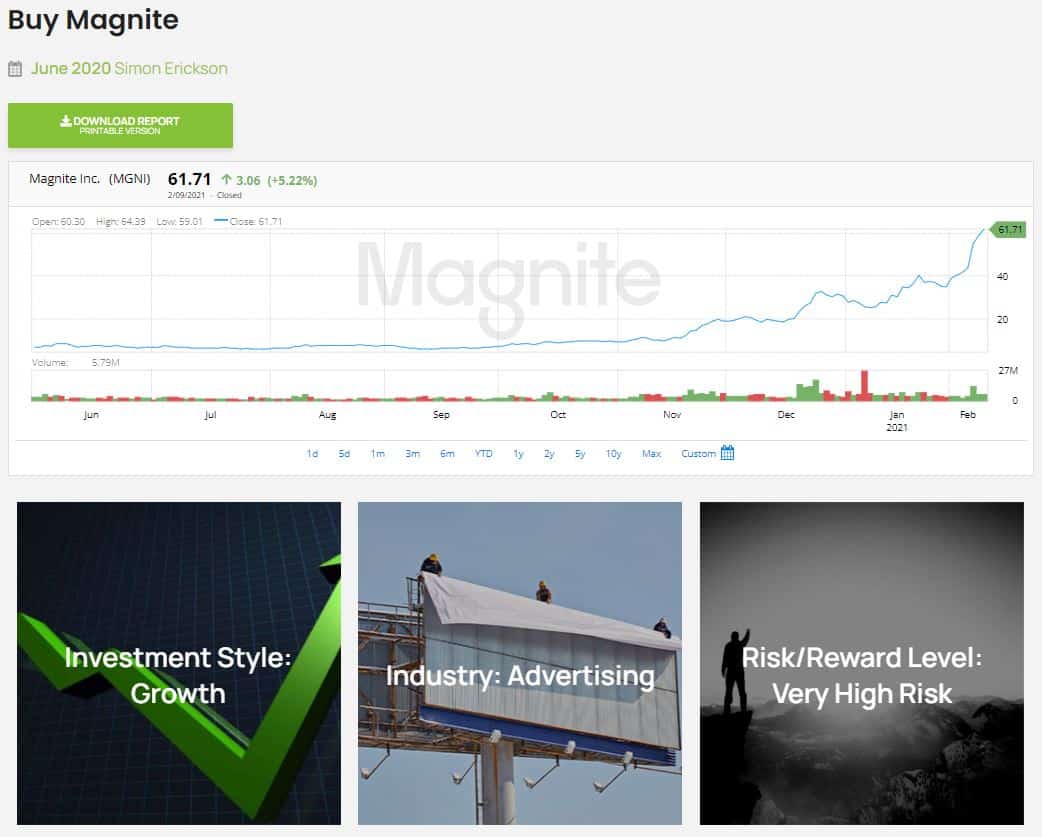

Magnite (Nasdaq: MGNI) — which was technically ‘The Rubicon Project’ at the time — became a huge short-term winner for us two years ago.

We saw the opportunity for an independent, supply-side platform in Connected Television. And we originally recommended Magnite on June 1, 2020, when its stock price was only $6.59 per share.

Things went incredibly well. and the stock shot though the roof. By February 2021, Magnite rose to a high of $64.39 a share. That means any 7investing members who bought alongside our Magnite rec had banked a 900% gain on their money within just nine months!

However, sometimes the stock market has a short-term memory. Short-term bragging right aren’t the same as long-term wealth creation. And unless you’re a close descendent of Nostradamus, it’s tough to know exactly when to sell a stock at its very top.

So rather than jumping in and out, we instead prefer to find and buy great companies and to hold them for long periods of time. Magnite has slumped in recent months due to a pullback in digital advertising spending. Yet we’re keeping it — as well as others in the programmatic advertising world — on the scorecard. We have the intention of holding each of our recommendations for at least three years.

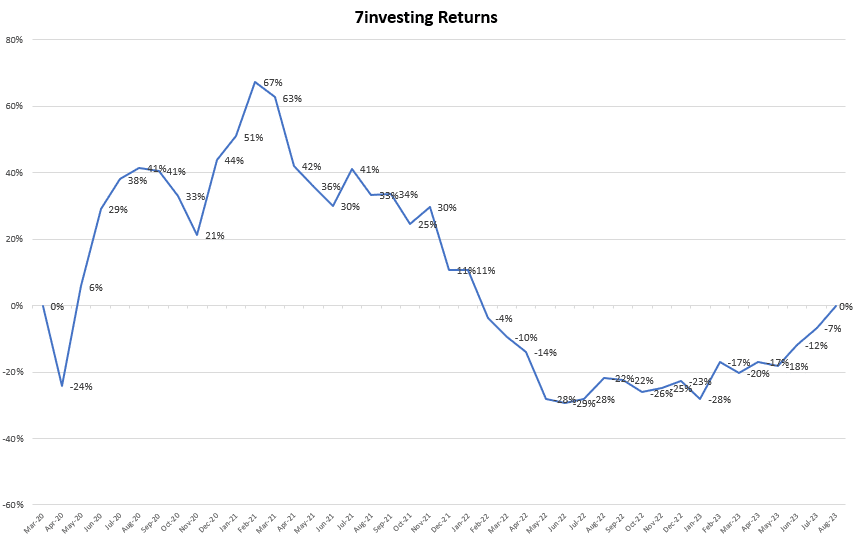

Our long-term mindset sometimes works for us and sometimes works against us. In other words, our overall 7investing scorecard return sometimes looks fantastic. And yet in other times…less than fantastic.

In February 2021, several of our other recommendations were also skyrocketing. In fact, that month our average return across all of our recommendations was 66% — meaning they were 66% higher than our starting prices.

But the stock market’s honeymoon didn’t last forever. Fears of inflation led the Fed to drastically increase interest rates, and stocks took the brunt of its new, hawkish stance. Many American equities fell in value by 50% or more in a broad-based selloff. During calendar 2022, the S&P 500 — which represents the stocks of the 500 most-valuable American companies — fell 20%. That was it’s fourth-worst performance of the past fifty years.

Yet while the doom-and-gloom often seems to dominate the headlines, it will not shake our resolve or to cause us to change our process. Alongside many other investors, our performance suffered during 2022. But we believe this is all part of the larger economic cycle, and that stocks will once again shine.

So far, 2023 is looking to be much better. The first month of the new year was the best January for the tech-heavy Nasdaq since 2001!

And we continue to report our returns — transparently and in real-time — in the good times and the bad. Here’s an aggregate look at all of our active 7investing recommendations since our launch in March 2020:

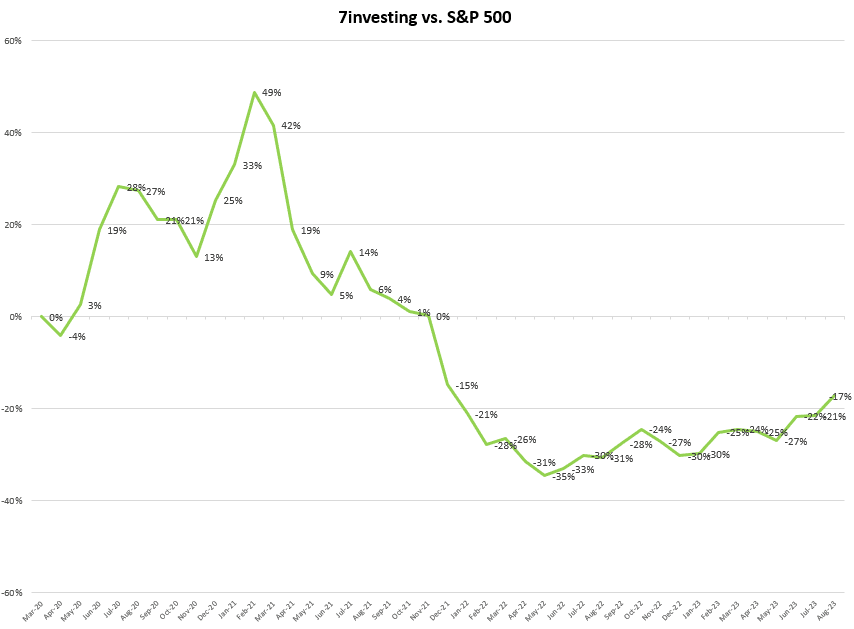

And here is a look at how we’ve performance versus the broader S&P 500 market:

We’ve found the best way to tune out the short-term market volatility is to continually and relentlessly be talking about what’s going on in the stock market. For us, that includes discussing our favorite stock ideas as a team (“Deep Dives”), discussing them with our subscribers (“Subscriber Calls”), and discussing them with other investors (“Community Forum”)

We believe 7investing isn’t selling our short-term performance. We’re selling our aggregate returns; the area “under the curve” that normalizes out the best and worst of times.

The great investor Ben Graham said that in the short-term, the stock market is a voting machine. But in the long-term, it’s a weighing machine. To find those important stocks that really tip the scales in your favor requires a dedicated practice and a methodical process.

Please refer to this third-party research from Inveduco to see how our 7investing returns stack up against other popular investing newsletters and growth-style ETFs.

Our team does this by following a process every month. And it begins with each advisor selecting his/her favorite stock and presenting it to the rest of the group. (All parts of our 7investing process are recorded and published for subscribers.)

Our Deep Dive videos are the “stock pitches” from each advisor. They include a 30-40 minute presentation and 10-20 minutes of Q&A from the other advisors. It’s a great way to learn about our investing framework and how we each think about finding our favorite companies. Our team has PhD, post-docs, MBAs, and more than 100 years’ worth of combined domain expertise — in everything from biotechnology to banking to artificial intelligence.

Rather than just being cheerleaders, we also aren’t afraid to size up the risks. In our Deep Dives, we objectively ask each advisor to lay out the risks of the investment and to explain what could possibly go wrong.

One step further is our monthly Subscriber Calls and Discord Community Forum, where you can actually interact with 7investing’s advisors and directly ask questions about their recommendations.

Our Subscriber Calls are semi-structured and typically run around 75 minutes. Each advisor spends the first part of the call discussing their most recent pick, and we have some fun running a crowd-based poll for the entire audience to vote on their favorite recommendation each month. We also provide updates on important developments relate to our previous picks. Other fun topics tend to rise up as well, such as bears wandering in Steve’s backyard, Luke’s motorcycle vacations across Europe, or Krzysztof’s marathon running or poker tournaments in Austin.

We also answer all of the questions that are asked by our audience. Some are about broader-based market trends like how the falling costs of genomic sequencing or the semiconductor chip shortage. Others are with reference to competition in the market, like Netflix (Nasdaq: NFLX) now allowing ads within its content. And some are related to specific decisions make by management, like like a recent buyback announcement for one of our consumer lending AI companies or the risks of geopolitical tensions between China and Taiwan.

Our Community Forum continues this conversation throughout the month. Our Forum is free for everyone; though the vast majority of the discussion here takes place in our members-only recommendations channels. Our 7investing Community Forum now has more than 1,200 investors interacting on a daily-basis.

At the end of the day, investing is personal. When it comes to stocks, you know your own risk tolerance and your own comfort zone.

We are your investing coaches, here to bring you seven new ideas every month and to lay out our case for why we like them. From there, you can build a battle plan around our thoroughly-researched ideas, and begin to put together a long-term strategy.

We consider that to be empowering, and we’d love to invite you to join us on this long-term investing journey. The stock market offers the greatest (legal) way to compound wealth over time — and we want that to unlock new opportunities for you and your future!

Already a 7investing member? Log in here.