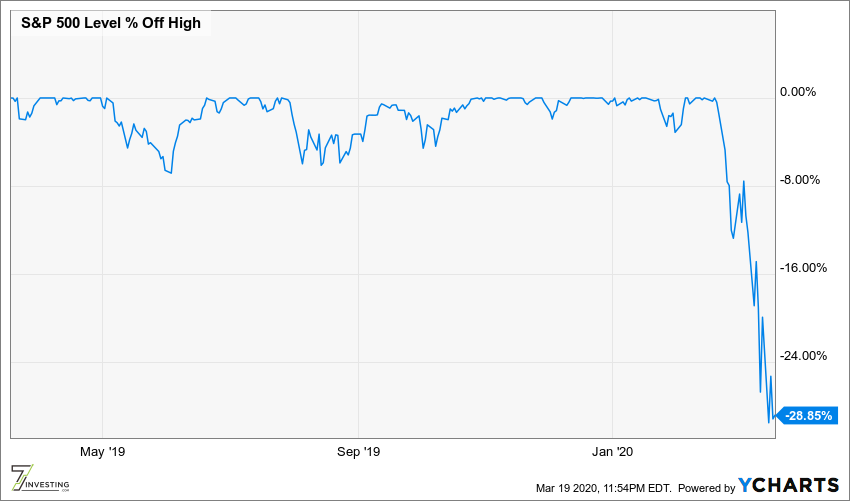

Watching the market quickly drop by more than 28% isn’t fun. With a 24/7 reel of negative headlines in the news, it’s easy to feel like now is the time to fold our cards and give up on investing. It’s during these times that investors should do their best to tune out the noise and let history be our guide. If we look at historical data, investors should be focused on buying rather than selling.

March 27, 2020

As of last week, the S&P 500 had dropped 29% and all 7 of our first investments were in negative territory.

Things have improved a bit since then, but it still looks pretty bleak out there.

Every day there are countless negative headlines in the news. I don’t know how long or how severe the impact of COVID-19 will be to global health or the global economy, but it’s clear that a lot of negativity is baked into U.S. stock prices.

I don’t know when the market will hit a bottom. But I do know that historically, selling after a 29% drop in the S&P 500 has not been a good idea. Additionally, based off data we’ve seen from China, Italy, and others after two or three weeks of quarantine, cases should level off. And after another two or three weeks, the economy should start to pick up again. Once that happens, there’s a possibility for a fast recovery.

I’m optimistic that this terrible event will unify parts of the world and spark innovation in many different industries that will save lives and improve peoples’ quality of life. I believe companies that had strong balance sheets and were already leading the way in the digital economy will actually come out of this event stronger.

Already a 7investing member? Log in here.