Anirban's quarterly cloud computing checkin looks at how Amazon Web Services, Microsoft Azure, and Google Cloud Computing are growing ... and what we can learn about the broader Cloud Computing space from the results of these hyperscalers.

August 8, 2022

Every quarter I like to take stock of the status of cloud computing. After all, we know that today’s enterprises use hundreds of cloud-based applications, and ultimately every company is on its path to embracing the Cloud. But how far are we into this cloud transformation? Is growth slowing because we are hitting the upper bounds of this sector’s potential?

My favorite barometer for answering the above questions is to look at the cloud segment of the three hyperscalers, namely Alphabet (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), and Amazon (NASDAQ: AMZN).

For those interested in looking at my earlier reports, I am including links below:

And now, without further ado, let’s dive in.

As always, we start with the baby among the trio, Alphabet’s Google Cloud Computing (GCP) platform.

Google doesn’t break out GCP’s revenue. However, Google Cloud’s second-quarter (Q2) 2022 revenue grew 36% year-over-year to $6.3 Billion. Alphabet’s CFO Ruth Porat again used her stock lines for describing cloud performance noting the following (emphasis mine):

Turning to the Google Cloud segment, revenues were $6.3 billion for the second quarter, up 36%. GCP’s revenue growth was again greater than Cloud’s, reflecting significant growth in both infrastructure and platform services.

In Q1 2022, Google Cloud reported $5.8 billion in revenue, up 44% year-over-year. Of course, the base is becoming larger, and the comparison is more challenging if the corresponding prior period had great results (which happens to be the case here). Nonetheless, this is a noticeable slowdown.

In the earnings call, management was asked about the slowdown. CEO Sundar Pichai noted that while there wasn’t any specific pattern, they did see some pockets of customers with spending impacted and some customers taking longer to finalize deals. In my view, that’s undoubtedly a macroeconomic hit.

Given Alphabet doesn’t break out GCP sales, we are left making an estimate. I peg GCP’s contribution to be roughly 70% to 80% of Alphabet’s overall Cloud revenue. That puts GCP in the $17 to $20 Billion annual run rate neighborhood, growing north of 35%. That’s strong, and Pichai et al. believe we are still in the very early stages of the cloud transformation.

Next, let’s look at Azure.

Like Alphabet, Microsoft too bundles Azure within its broader Cloud segment. Microsoft Cloud surpassed $25 billion in quarterly revenue for the first time in the recently reported Q4 2022 results, up 28% year-over-year. Currency was a significant headwind as on a constant currency basis, the growth was 33%. Nonetheless, this report too showed a slowdown versus Q2 2022, when Microsoft Cloud revenue was up 32% year-over-year.

For Azure, management noted that Azure grew by 40% year-over-year, representing a step down from the 46% delivered in Q3 2022. Based on the digestion of the conference call, my best guess is that there are pockets where cloud resource consumption has decreased, and the strong US dollar has become a significant headwind.

Given that Microsoft’s Cloud segment includes some mature but well-ingrained offerings like Office 365 Commercial, it might be reasonable to estimate Azure’s contribution to be roughly 60% to 70%. That puts Azure on approximately a $60 to $70 Billion annual run rate, growing around 40%. We can have some confidence on these estimates by circling back to commentary from management regarding the scale of Azure. For instance, this time, Microsoft alluded to the growing backlog and its expansion plans by noting:

We are seeing larger and longer-term commitments and won a record number of $100 million-plus and $1 billion-plus deals this quarter. We have more data center regions than any other provider, and we will launch 10 regions over the next year.

Azure makes GCP’s numbers look small, and GCP is closing in on $20 Billion annually! Now that says something about the scale of the Cloud. It sure is massive.

What about the big daddy of cloud computing, AWS?

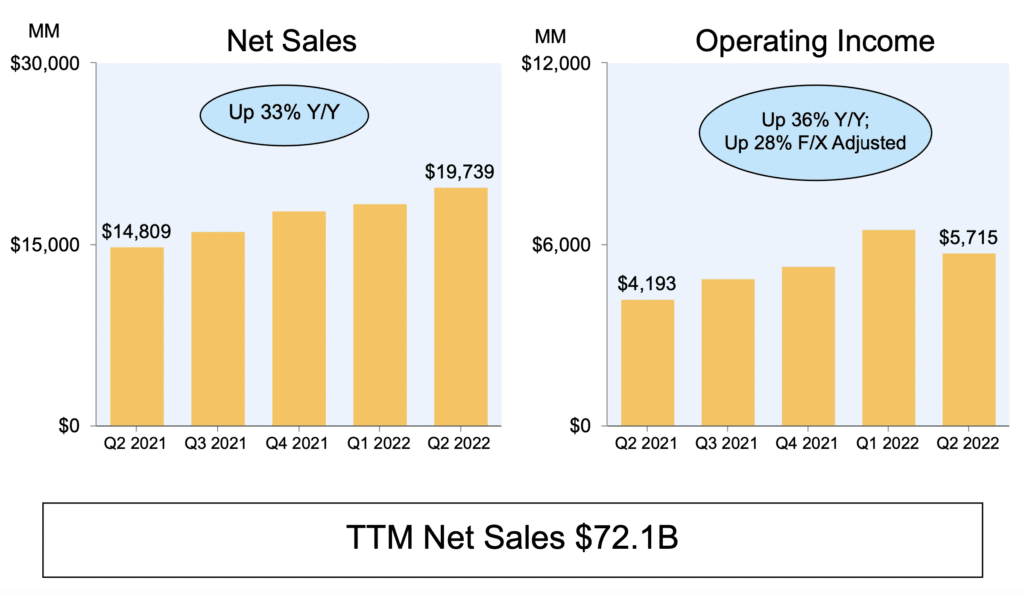

Lucky for us, Amazon actually breaks out AWS results. In the latest quarter (Q2 2022), AWS reported revenue of $19.7 Billion, up 33% year-over-year. That’s almost an 80 Billion annual run rate. Impressively, AWS is not just growth at scale but high-margin profitability at scale.

Like its peers, the growth rate has come down from the 37% year-over-year increase delivered in Q1 2022.

In the hyperscalers arena, everyone is investing in maintaining their competitive positions and serving the demand. During fiscal 2021, Amazon spent about $24 Billion on “technology infrastructure,” primarily AWS. This year they expect to spend more, growing the AWS footprint. I bet some of this is a response to the expanding Azure footprint.

The hyperscalers are today approximately on a $160 Billion per year run rate, growing at a 30% per year cadence. That says something about the scale of cloud computing. These hyper-scale providers also are pouring a lot of money to keep growing their infrastructures, which says something about the scope of future opportunities.

I like to look at committed backlog indicators, which tell us how much money customers have committed to spend in future years. Conveniently for us, Amazon discloses this number in their 10Q filing. In AWS’ case, the backlog stood at a cool $100 Billion; impressively, this number was up 65% year-over-year and 13% sequentially. That’s mind-boggling and just shows how fast cloud computing is scaling.

Already a 7investing member? Log in here.