Matt explains why you should keep looking for great companies regardless of who occupies the White House.

October 22, 2020

When investing in individual companies, investors should always be aware of the country’s level of economic freedom where the company is domiciled. Economic freedoms include fundamental things such as property rights, judicial effectiveness, and government integrity, and to a lesser degree, things like corporate tax burdens and onerous regulations.

Fortunately, for U.S. investors these are fundamental rights that will almost assuredly persist no matter which political party wins control of the White House and Congress after this year’s elections. While we all know that our political party is better than the other one, the U.S. stock market has largely excelled no matter which was in control of the political seats of power in Washington. This is because American investors enjoy Constitutional rights and a relatively stable rule of law regarding individual and business freedoms that extends beyond any single president. While it is certainly not without its faults, it truly is a remarkable system that has benefited this country and, by extension, the American stock market.

Of course, while fundamental laws and freedoms will not be affected by November’s outcome, shorter-term catalysts such as tax rates, stimulus bills, and other regulations are certainly at stake. Depending on which party wins, these things will certainly help or hurt the political winners’ favored and disfavored industries.

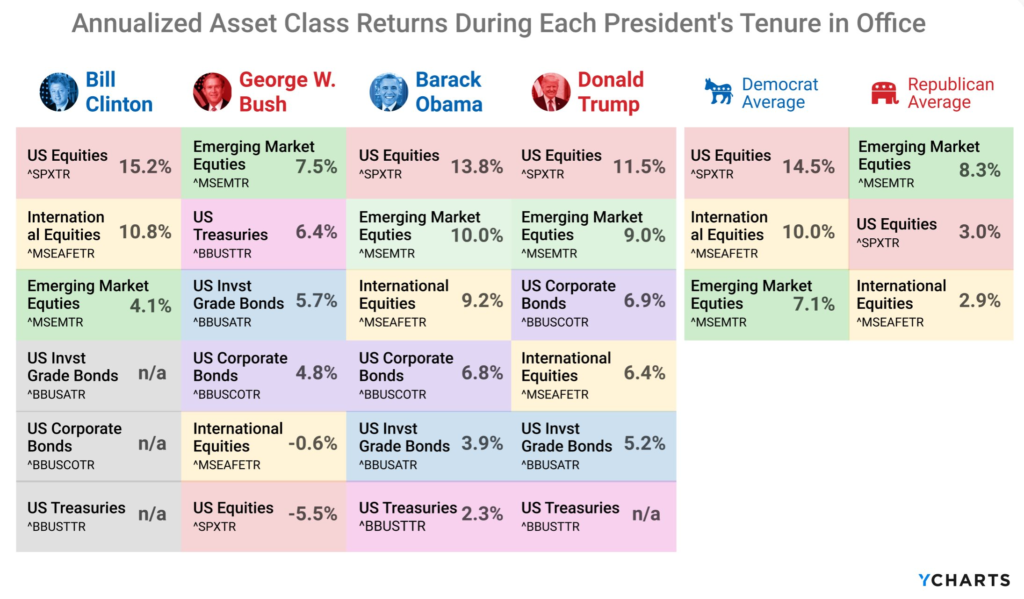

While I believe it is fascinating to look at asset classes and how they have fared during different presidential administrations, like this table does from our friends at YCharts, be careful about extrapolating these trends out into future presidencies from either political party. So many variables go into how the economy and markets fare in any given year, of which the political party that is sitting in power in Washington is only one. Events such as wars, terrorist attacks, and natural disasters can send the stock market diving. Other things, such as an explosion of technological innovation in Silicon Valley, can drive stock market returns for decades. In many of these cases, the sitting president only plays an indirect role at best.

Depending on the winner or loser of this election, I believe the financial sector, specifically big banks, have more at stake than most other sectors. The Trump administration has lowered taxes and eased regulations and still many large banks, such as Wells Fargo (NYSE:WFC), have struggled. If Biden wins, corporate taxes will probably be raised, and regulations could tighten. With interest rates almost certain to remain low no matter who wins, this would create a difficult environment in which big banks can thrive. If you’re inclined to bet on a Trump victory, you might want to consider two of the best big banks, Bank of America (NYSE:BAC) or JPMorgan Chase (NYSE:JPM).

But no matter who wins or loses this year’s political contest, don’t stop investing in great companies with durable moats at fair valuations. That formula will produce winners no matter who’s in office.

Already a 7investing member? Log in here.