Enterprise software stocks have experienced quite the battering. And it appears there is no end to this shellacking with many earnings reports driving the stocks further down. Is enterprise software fundamentally broken? Or is now the time to be greedy and hunt for the best-in-class enterprise software businesses?

December 2, 2022

Cybersecurity company CrowdStrike‘s (NASDAQ: CRWD) fiscal third quarter 2023 report was met with disdain by the market. On a day when the indices enjoyed a solid bounce, thanks to some dovish commentary from Federal Reserve Chairman Powell, CrowdStrike saw its stock price down 15% on the back of 53% revenue growth to $581 million.

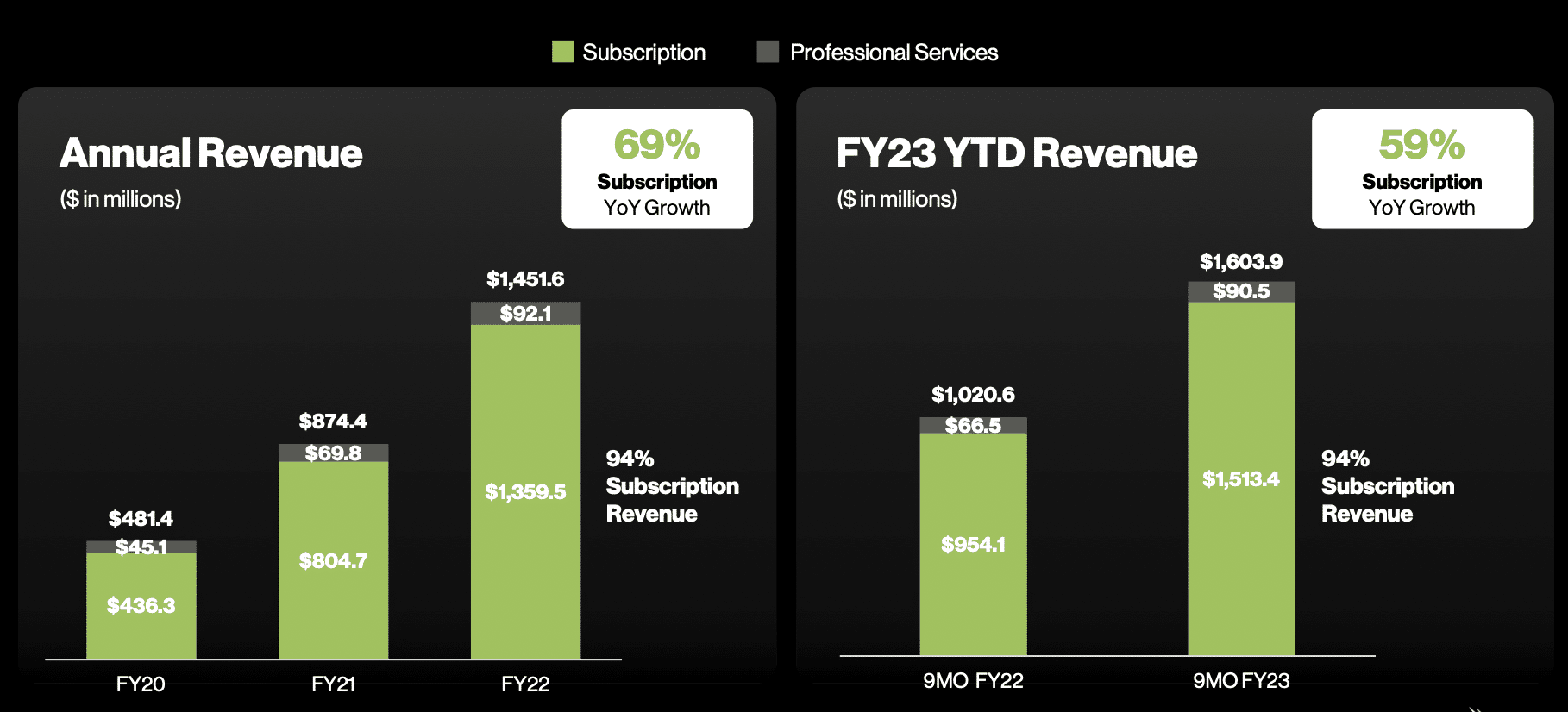

Source: Company’s fiscal Q3 2023 presentation.

It was more than just juicy topline growth. Non-GAAP operating income jumped 77% year-over-year to a record $89.7 million. Free cash flow was a solid $174 million, albeit aided and abetted by stock-based compensation of around $140 million.

We can only speculate without asking all market participants why they sold off CrowdStrike shares. But if I had to bet money, it would be on the company’s softish guidance. In his prepared remarks, CEO and co-founder George Kurtz talked about elongating sales cycles, especially at the smaller end of their customer spectrum. Furthermore, the tepid guidance offered by CFO Burt Podbere, with revenue growth projected to be in the low to mid-30s during fiscal 2024, didn’t help the stock.

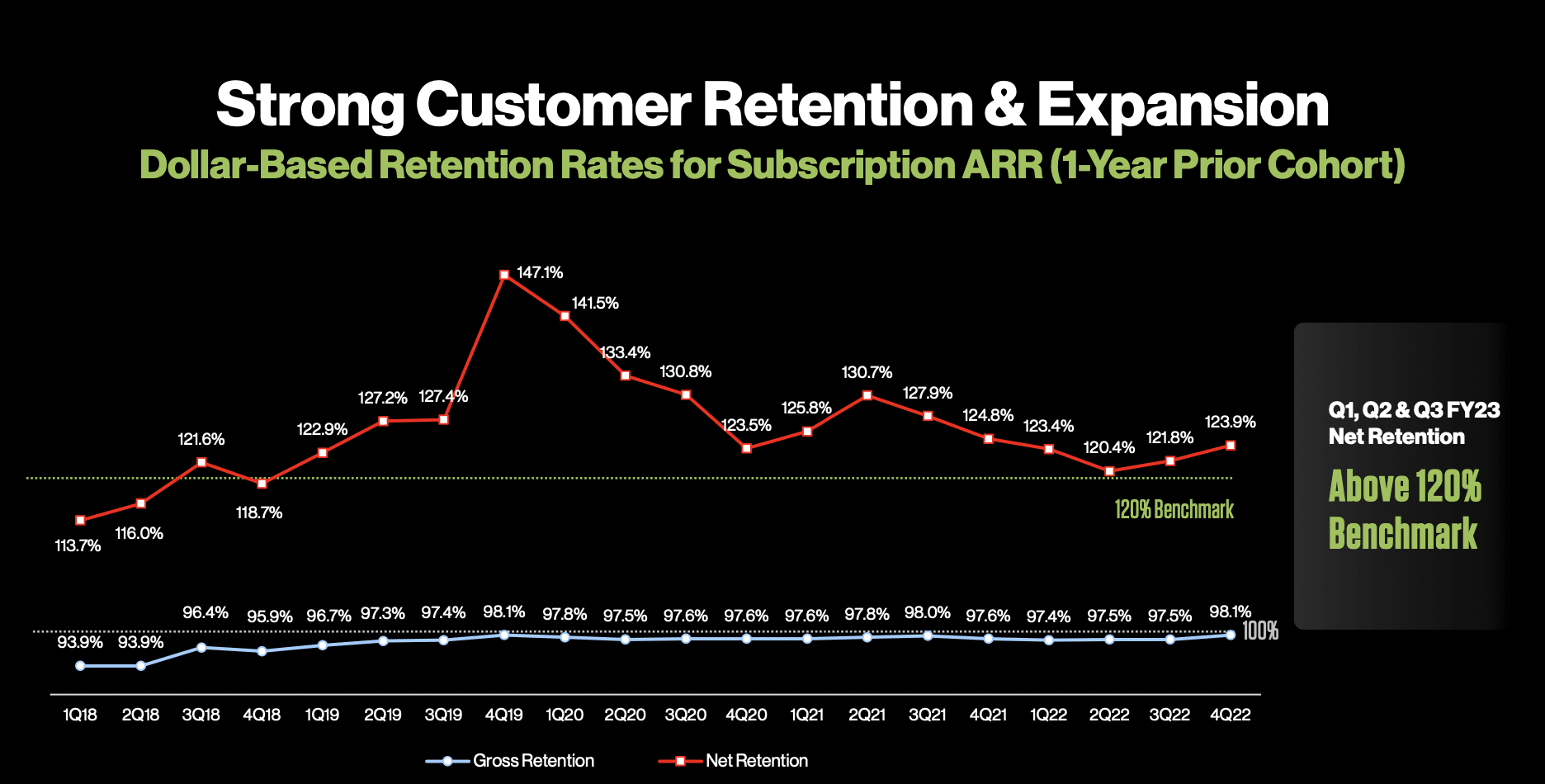

Is CrowdStrike justified to continue spending on sales and marketing, as well as research and development, while macroeconomic conditions create significant headwinds? If one looks at CrowdStrike’s $76 billion total addressable market and then considers the chart of its retention rate, shown below, the answer should be an emphatic yes.

Source: Company’s fiscal Q3 2023 presentation.

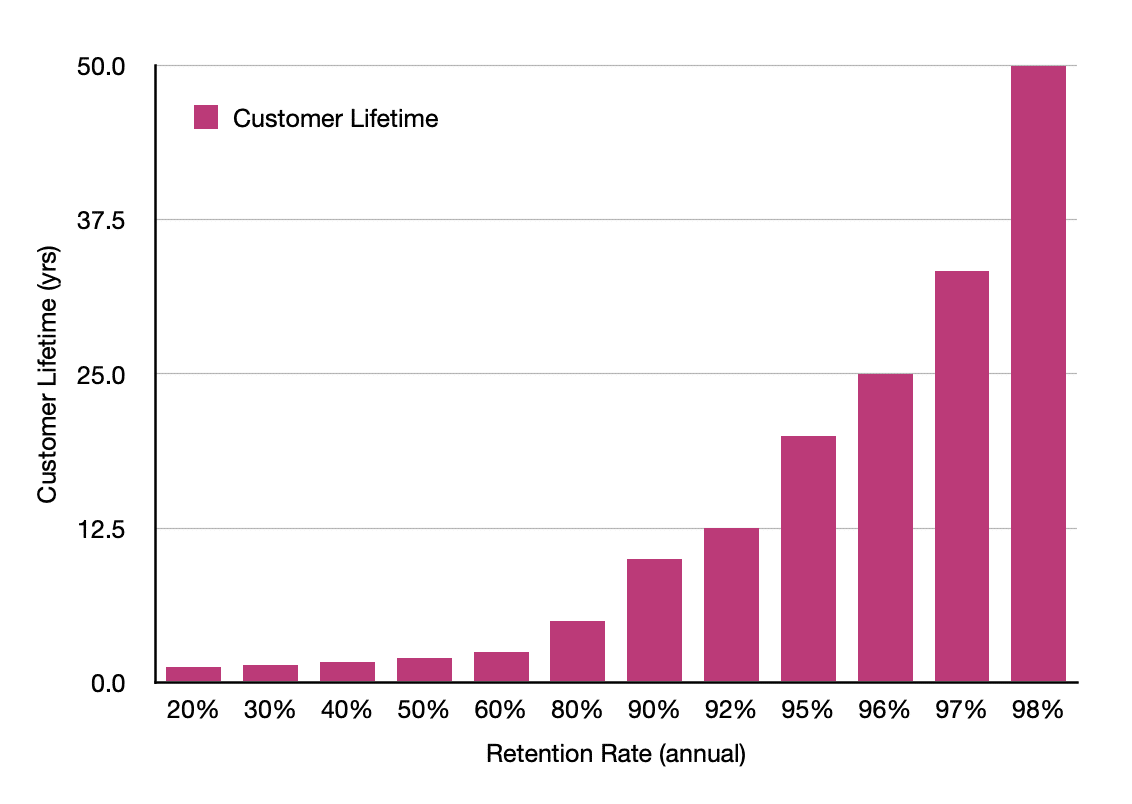

CrowdStrike’s customer retention rate is 98%. That’s world-class for software businesses. To understand why, we need to think about customer lifetimes, which is mathematically equal to 1/(1 – retention rate). Thus, as churn decreases, customer lifetimes exponentially increase, as shown in my chart below. Now tell me, if I have a business with such low churn rates that I am effectively locking customers for life, won’t I be mad not to go after as much of the market as possible? The caveat is that the lifetime value is substantially greater than the acquisition cost. But at retention rates as high as they are for CrowdStrike, it is almost a given that each customer delivers substantial dollars to the bottom line over time.

Source: Author’s calculations

It is this crazy dynamic of stickiness that makes best-in-class enterprise software companies excellent long-term investments. It is why frontloading of costs (a term my colleague Simon Erickson often uses) makes sense. As these companies mature into their opportunity, their sales and marketing or innovation expenditure growth will slow. And they will continue to reap the benefits of the customers acquired along the way for years to come resulting in copious amounts of free cash flow.

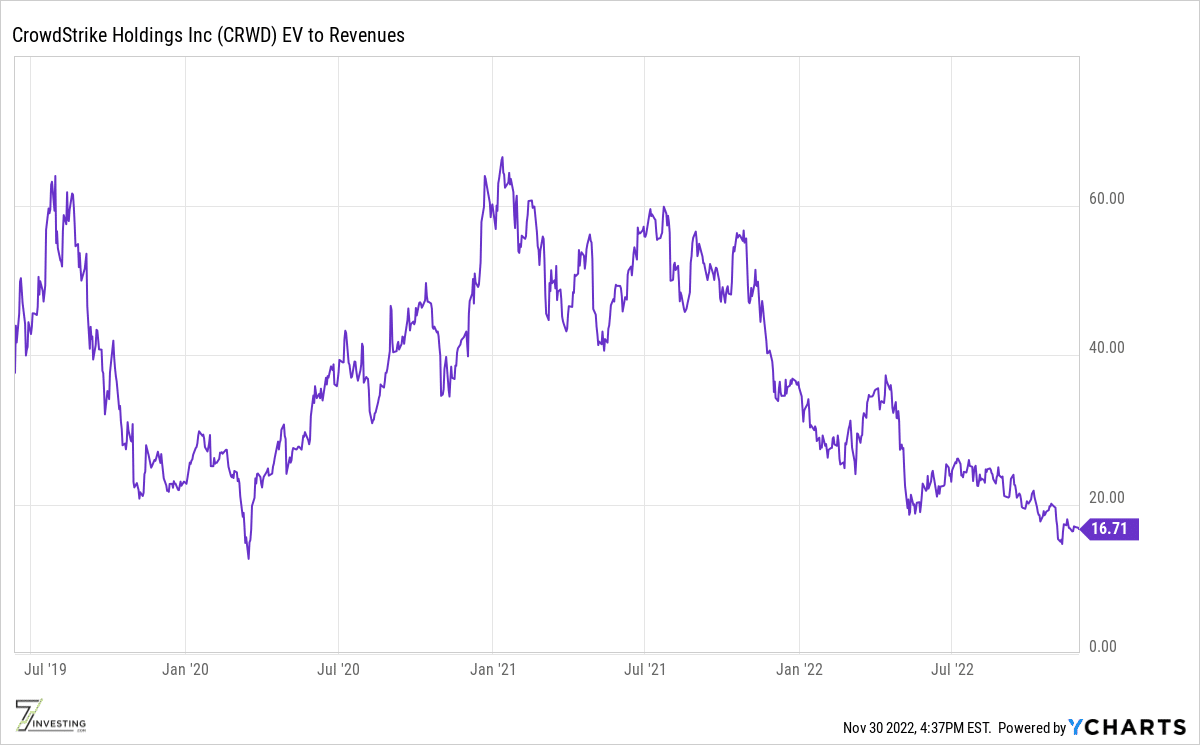

Source: Ycharts.com

As the chart of enterprise valuation to trailing sales shows, CrowdStrike has seen quite the valuation pullback. Investors today are skittish and ignoring the long-term potential of CrowdStrike.

And CrowdStrike isn’t alone in the left high and dry corner. Many top-flight enterprise software companies are now selling for much less than their intrinsic value. The market fears enterprise software, and now might be the time for patient volatility-tolerant investors to be greedy in this group of companies.

Already a 7investing member? Log in here.