The market plunged -- and rallied -- after another hotter-than-expected CPI reading this week. Here's what investors need to know.

October 14, 2022

After a relatively calm start to the week, major stock market indexes capped it off by swinging wildly following the Thursday morning release of the latest Consumer Price Index (CPI) summary — a widely followed inflation gauge that measures the change in prices paid by consumers for various goods and services.

To be fair, this wasn’t entirely surprising; 7investing CEO Simon Erickson and I even went on record Wednesday afternoon (link to the recording in the Tweet below) to discuss the likely possibility we’d see significant moves one way or the other depending how changes in the CPI lined up with consensus estimates for a roughly 8.1% year-over-year increase in prices.

Add to your calendar for market close:

We’ll be talking with @7Innovator and @7investingSteve about the #marketcrash , how to handle the volatility around the Fed, $rklb, and what we see as our strongest #StockMarket buys in the current environment. https://t.co/IgxbT2IBWu

— 7investing (@7investing) October 12, 2022

Anything above 8.1% would likely spur a selloff, I argued, as stubbornly high inflation would decrease the chances of U.S. Federal Reserve officials abandoning their hawkish policy stance anytime soon. Anything below could mean a broad-based rally.

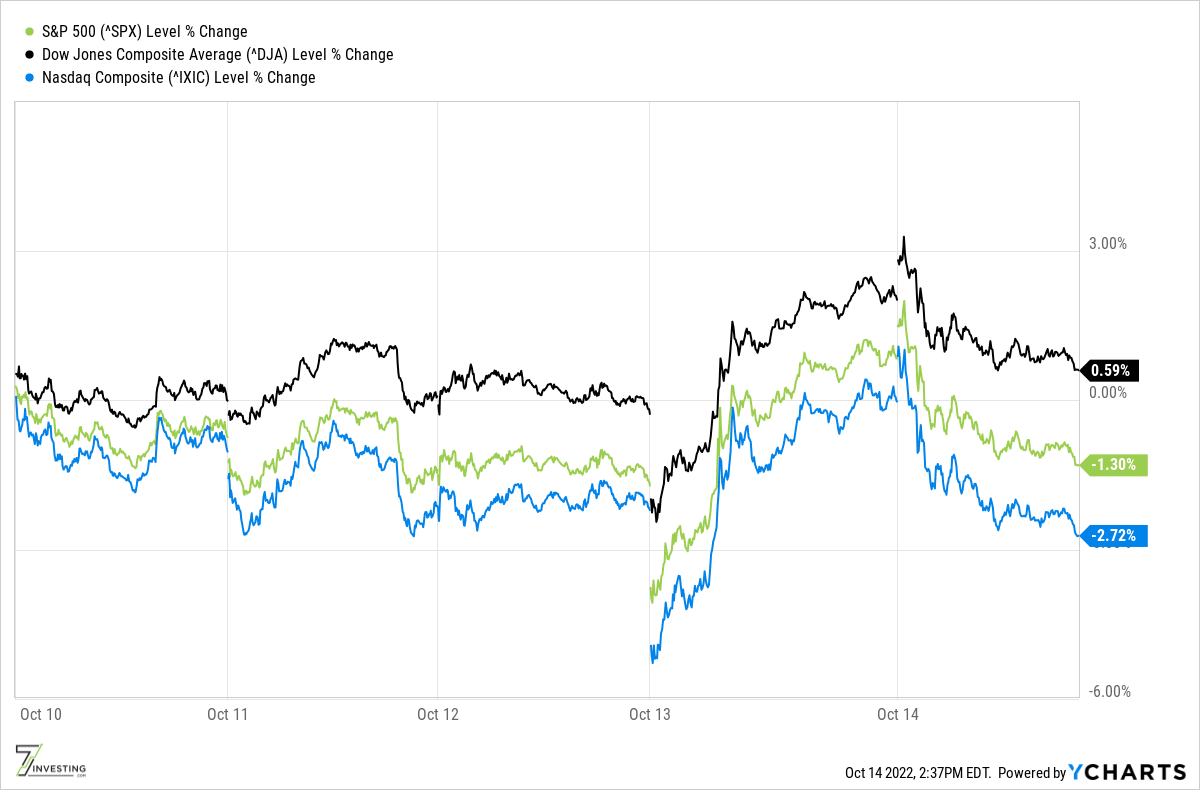

What I didn’t expect was to see both a massive plunge and an enormous rally in the same day. Sure enough, when the 8.2% CPI result hit the wires, the S&P 500, Nasdaq Composite, and Dow Jones indexes promptly plummeted to start the morning. But then they posted a stunning, near-record intraday swing from deep in the red to solidly green:

Then again, Thursday’s rally proved temporary as stocks largely gave up those shocking gains on Friday. But that raises the question: Why in the world did stocks swing so wildly from red to green on the heels of seemingly discouraging CPI data in the first place?

There are two primary reasons I can think of:

The first is near-term in nature — a combination of technical and psychological. Zooming out on the chart above shows there was no significant run-up leading into this report like we saw the past few months. And after watching the S&P 500 endure meaningful declines the day following seven of the past eight monthly CPI releases — including a sharp 4.3% drop after last month’s slightly hotter-than-expected report — it seems few traders truly anticipated a low CPI number that would cause the Fed to seriously rethink its hawkish inflation-taming stance. That ho-hum sentiment was only reinforced on Wednesday after the release of the Fed’s latest (September) meeting minutes signaled that Fed officials expect higher interest rates to remain in place for as long as “inflation was declining more slowly than they had previously been anticipating.”

The second represents a potential longer-term catalyst — namely, that our forward-looking market might finally be seeing a light at the end of this dark, inflationary tunnel. I’ve said many times our market is a forward-looking machine, and even argued recently that growth stocks will emerge a particularly bright spot once “the market begins to view subsequent reports as capable of delivering [positive inflation] surprises.” I think that’s only just beginning to happen now.

Indeed, Charles Schwab Chief Investment Strategist Liz Ann Sonders — who often shares her invaluable insights on CPI data via Twitter each month, by the way — echoed that view on Thursday morning, musing of the hot CPI report that “We get this last gasp higher in inflation and from here we start to decelerate.”

That’s not to say stocks won’t have further to fall from here, however. Let it suffice to say, though, that the next few months’ reports could be quite interesting, and I remain excited as a long-term investor for what’s to come.

Already a 7investing member? Log in here.