What's the true cost of car ownership? My nerdy habit has provided some interesting answers.

August 18, 2021

It’s certainly not a great time to be in the market for a new ride. Supply disruptions from the coronavirus pandemic and global chip shortage have driven a historic surge in new and used car prices. But even in more normal times, a vehicle is one of the single-largest purchases most individuals make in their lifetimes.

There’s the actual purchase price of the vehicle, but also fuel, maintenance, insurance, registration, parking, and other recurring expenses. The true cost of car ownership quickly adds up to thousands of dollars per year. That reality leads to several familiar questions and debates.

Is it better to buy new or used?

Could you ditch your car and rely on public transportation or ride sharing?

How does the math change if you start working from home post-pandemic?

The questions and answers change for each household. Luckily for you, I’m a nerd. I’ve tracked every car-related expense since I purchased my first vehicle eight years ago. The data may not perfectly match every driver’s situation, but they shed light on the true cost of car ownership.

First, it’s important to frame the following data with my situation and driving habits:

New car: I purchased a brand new Mazda 3 for $25,300 in 2013. Zoom zoom.

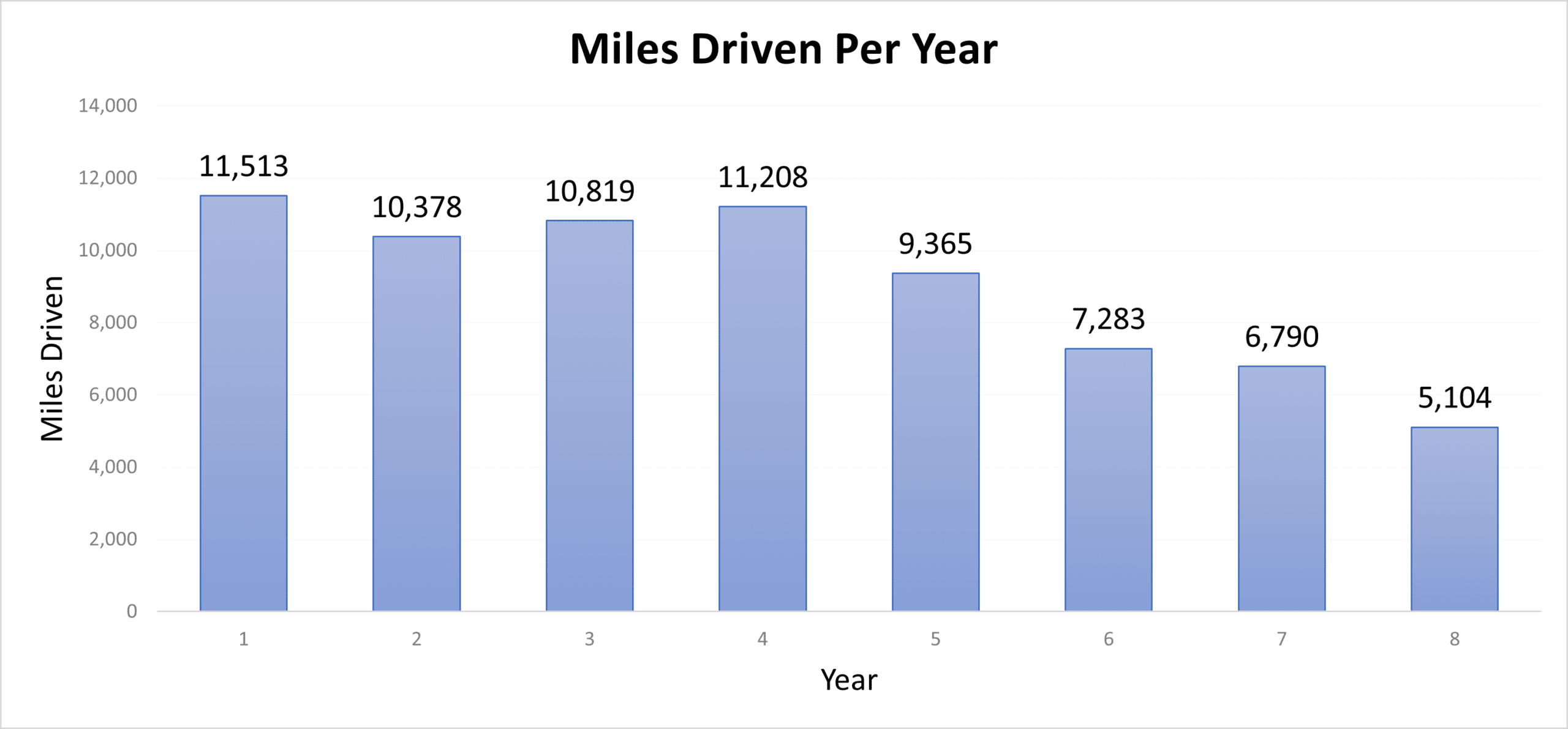

No daily commute: I’ve only ever worked from home (you’re not special), but roughly 40% of my miles driven have been racked up on road trips.

Geography: I live in Pittsburgh, which has many steep hills. I actually lived in the neighborhood with the steepest paved road in the United States for a few years. #RIPmpg

Second, consider several high-level statistics after eight years of car ownership:

Distance travelled: 72,460 miles driven (116,613 kilometers)

Lifetime fuel economy: 27.3 miles per gallon (mpg)

Lifetime fuel consumption: 2,692 gallons of gasoline

Lifetime refuelings: 240 trips to the gas station

Lifetime fuel cost: $2.70 per gallon

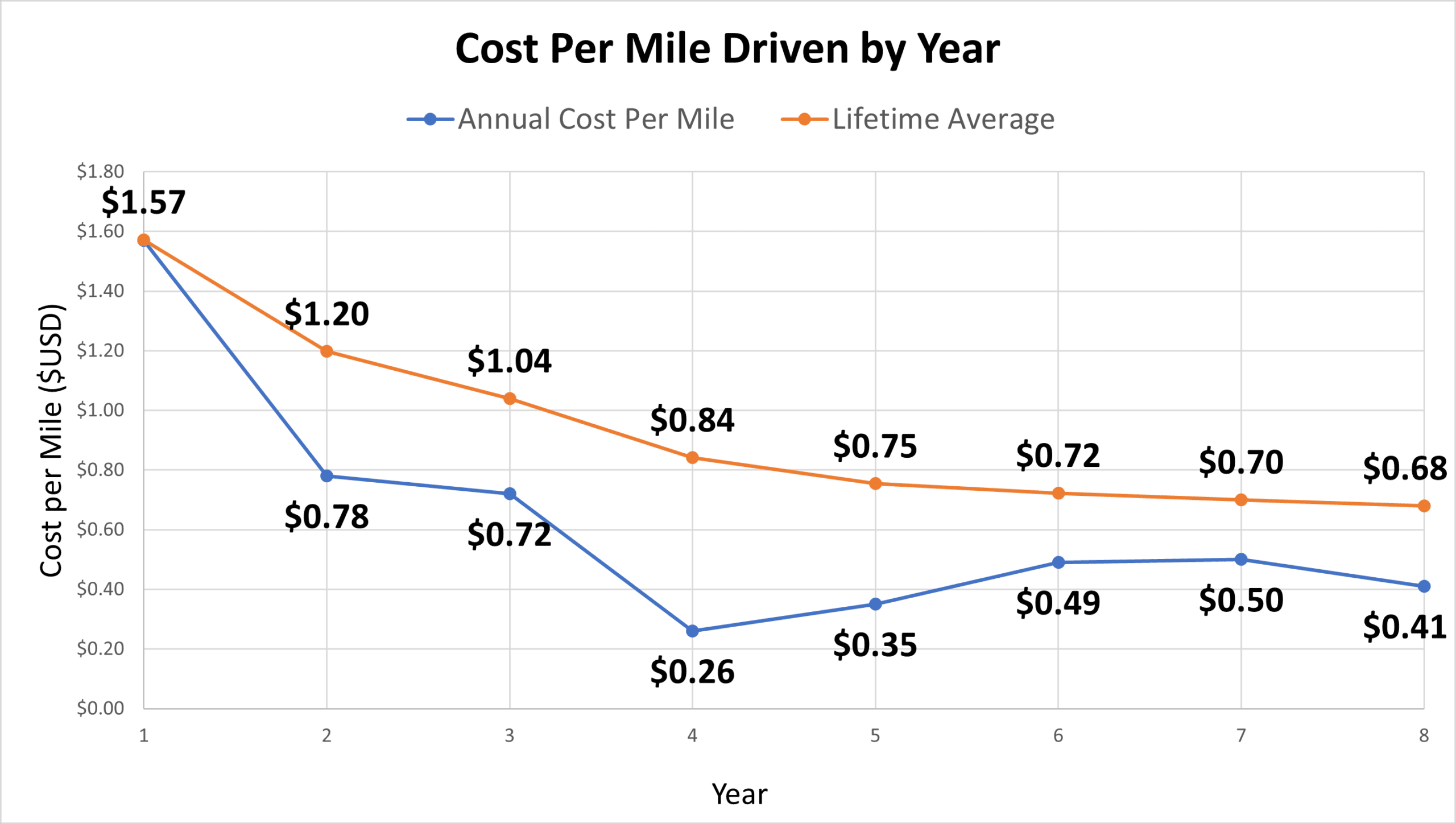

Lifetime cost per mile, total expenses: $0.68 per mile

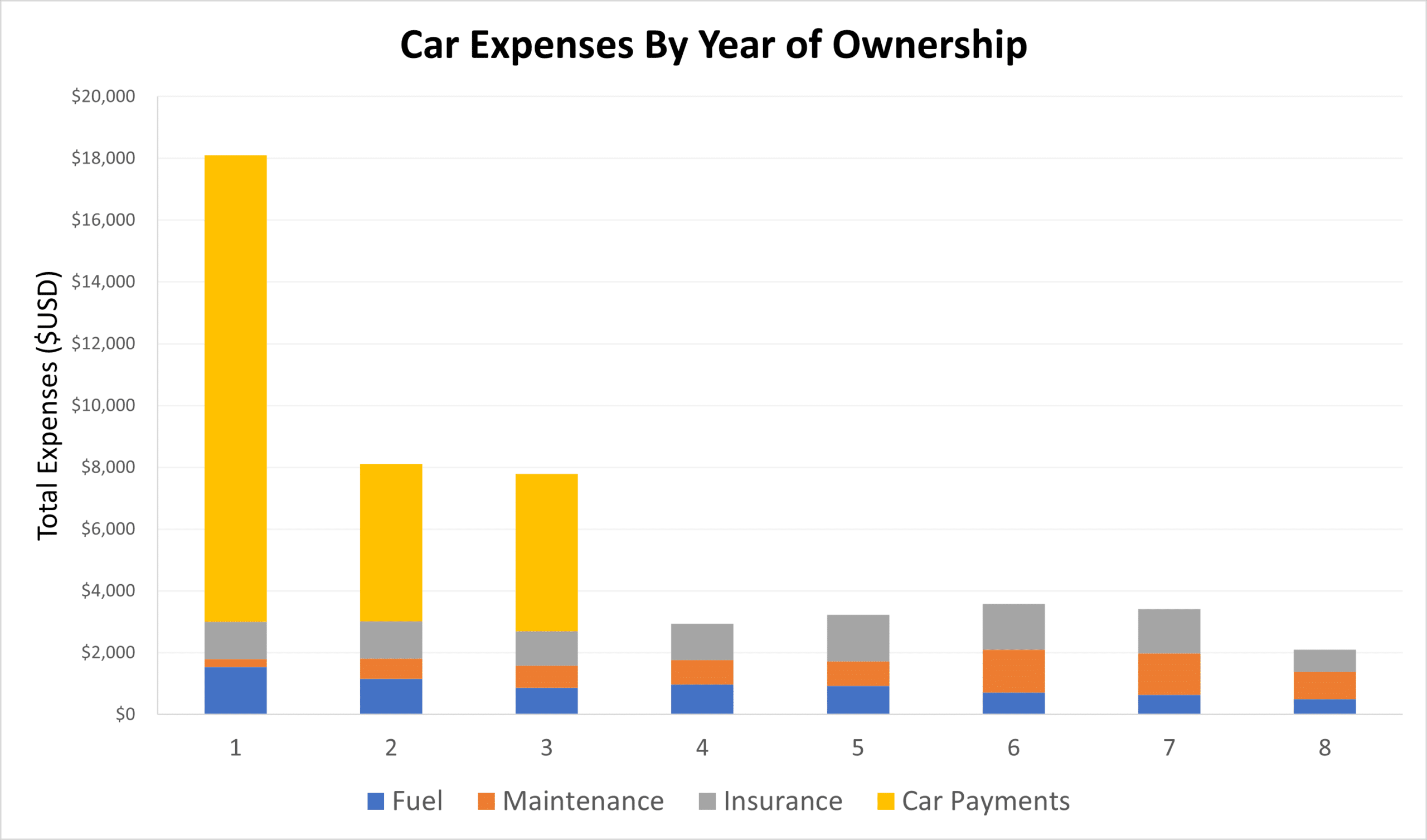

Third, consider how various expenses compare at the eight-year mark, or after 96 months of car ownership:

Car Expense | Lifetime Expense | Monthly Average | % of Total Expenses |

Purchase price | $25,300 | $264 | 51% |

Insurance | $9,846 | $103 | 20% |

Fuel | $7,281 | $76 | 15% |

Maintenance | $6,843 | $71 | 14% |

Total | $49,270 | $514 | 100% |

Data Source: Author.

It’s important to consider how these total and relative expenses change over time. Although the purchase price of my vehicle is fixed, it’s share of my total expenses gets diluted over time — one of the more important factors to consider. Older vehicles tend to be more expensive to maintain, which suggests my maintenance costs will begin to creep up from here. Fuel expenses are largely out of my control, but can be impacted by driving habits. Therefore, understanding the true cost of car ownership requires a longitudinal analysis.

Whether you buy a new or used vehicle, optimizing car ownership essentially comes down to driving the most distance for the lowest cost possible. The three variable costs with the most impact are the purchase price, fuel expenses, and maintenance expenses.

The purchase price is the single-largest cost of car ownership for the majority of your vehicle’s lifetime. I purchased my vehicle brand new in 2013, but the $25,300 spent to gain control of the title still represents 51% of my lifetime vehicle expenses eight years later. If I had purchased a higher end vehicle or a luxury vehicle, then the relative share would be significantly higher.

This is important to consider in the “new vs. used” debate. A new car can be a better investment if the price is right, the vehicle is properly maintained, and you keep it in your stable for many years. You’re basically trying to dilute the purchase price over time. If you buy a new car too frequently, then you’re almost certainly not optimizing the cost of car ownership. Consider the following visual from my first eight years of car ownership.

A handful of other expenses are a distant second to the purchase price — for the first decade or so, anyway. Fuel expenses vary based on selling prices (outside of your control), driving habits, and distance travelled. I work from home and live in the hills of Pittsburgh, but 40% of my miles travelled have been logged on road trips. That odd mix of circumstances results in a lifetime average fuel economy of 27.3 mpg — basically the rated efficiency of my vehicle. As the chart above shows, fuel expenses are not a major concern for me, especially as I’ve driven less in the last three years. Year 7 included the initial lockdown from the pandemic and Year 8 included the second wave during winter 2020-2021. I expect to drive more as in-person work commitments pick up again in 2022.

Maintenance expenses have actually become the second-largest cost of car ownership for me in recent years, although there’s a healthy dose of nuance to consider.

In Year 6, I had to purchase new brakes, new rotors, and a new battery. In Year 7, I had to purchase a new exhaust and replace part of my catalytic converter as a side effect of not driving frequently. Believe it or not, I had to purchase a new battery again after the dealer “lost” proof of the previous year’s purchase. It was during the height of the pandemic, which wasn’t a fun time to be haggling with car dealerships, so I ponied up the money and got on with my day (I stopped going to that dealer). I also had street parking and had both of my side mirrors knocked off in the same month. Both! Savages! (I moved somewhere with a driveway.)

Insurance is essentially a fixed cost. In the graph above, you’ll notice that this expense fell drastically in Year 8. What was the reason? I had pay-per-mile insurance from Metromile (NASDAQ: MILE) for the first seven years of car ownership. However, as the company neared its initial public offering, it raised prices considerably and stopped offering safe driving perks for each term. In Year 7, I drove 6,790 miles, had an excellent credit score, and had never had an accident — and my monthly insurance payments were at an all-time high. I switched to Progressive, maxed out my insurance coverage, and ended up paying half of what Metromile was charging me.

Remember, optimizing the cost of car ownership means you’re trying to maximize miles driven and minimize expenses (within reason). You’re trying to dilute the purchase price over time. Here’s how my cost per mile compares by year of ownership, including the average over time:

The rate at which you dilute the cost of the purchase price slows over the years. Nonetheless, if I drive 7,500 miles per year, spend moderately more in maintenance over the years, and see expected increases in insurance over time, then I estimate my cost of car ownership will decline as follows:

Year 10: $0.62 per mile with 87,500 miles driven (lifetime expenses of $54,000)

Year 15: $0.53 per mile with 125,000 miles driven (lifetime expenses of $67,000)

Year 20: $0.49 per mile with 162,500 miles driven (lifetime expenses of $80,000)

Importantly, the purchase price of my vehicle remains the single-largest expense even at Year 20, weighing in at an estimated 32% of lifetime expenses. Will I actually keep my vehicle for 20 years? Who knows! Despite relatively low mileage, it could be more difficult to find parts for my vehicle at the two-decade mark, which might impact maintenance expenses. My current goal is to make it 15 years and go from there. At some point it would be nice to have the latest and greatest safety features and technology upgrades — and an electric vehicle.

My driving habits won’t be a perfect match for you, but eight years of tracking every car-related expense provide some universal insights:

Optimizing the cost of car ownership is about maximizing mileage and minimizing costs. The purchase price of your car is the single-largest expense for the life of your vehicle, but that doesn’t necessarily mean a used car is the best choice for your situation.

Buying a new car too frequently isn’t the optimal financial strategy for most people. If you’re a gearhead, then your joy of driving could be more important.

Don’t be afraid to shop around for insurance. I thought a pay-per-mile insurance provider was perfect for my work-from-home lifestyle, but it ended up being double the cost of traditional insurance.

Working from home — a new reality for more people — really does extend the lifetime of your vehicle, assuming it remains properly maintained. For example, you need to change your oil every six months or so regardless of how many miles you’ve driven.

Already a 7investing member? Log in here.