Is home bias eating into your returns? Are you fishing where the fish are? Anirban answers these questions in this article and explains why a global outlook can benefit your portfolio.

August 12, 2021

According to an Australian Securities Exchange (ASX) investor study, only 15% of Australian shareholders have investments in equities listed overseas. That’s a shockingly low number for exposure to international shares and shows significant home bias.

There are many reasons behind this.

Historically, brokerage accounts were offered by banks. These accounts only supported domestic share trading. Trading internationally required much paperwork. It was cumbersome, and one would have to wake up at odd hours (late night or early morning for US stocks) to buy or sell stocks listed overseas.

While the market opening hours haven’t changed, I think modern broker platforms make it easy to buy or sell stock in international markets, especially in the US.

I am a big fan of Stake, where we have our family’s Self Managed Superannuation Fund (retirement account). I also have accounts with Charles Schwab and Saxo Bank. Many others like CMC Markets now provide seamless access to international stocks. I am probably missing some others. So it is easier to now buy or sell foreign, mainly US equities.

But why bother?

First, let’s consider the relative size. The National Stock Exchange of India, for instance, comes in at number 10 and is 16-times smaller than NYSE and NASDAQ combined. The ASX is even smaller! The US equity exchanges, namely NYSE and NASDAQ, together account for about 55% of the global stock markets. They are the largest in the world by a country mile.

In simple terms, sticking with one’s relatively small exchange is the equivalent of fishing in a small pond. Or, if you like candy, it is the equivalent of buying candy at the corner store.

The other argument I hear from investors is this. There are 1,800 odd companies listed on the ASX. Numbers are similar for other smaller exchanges. And if a portfolio only needs 30 to 40 good ideas, why bother?

I agree that one could find 30 odd investable ideas on a local exchange.

But are those good ideas as good or the ones on offer at a global marketplace like NYSE or NASDAQ?

Do the smaller exchanges host companies you and I interact with every day?

So, think about it. Like many people in the world, I have an iPhone. I am writing this on the latest MacBook Pro with the M1 chip.

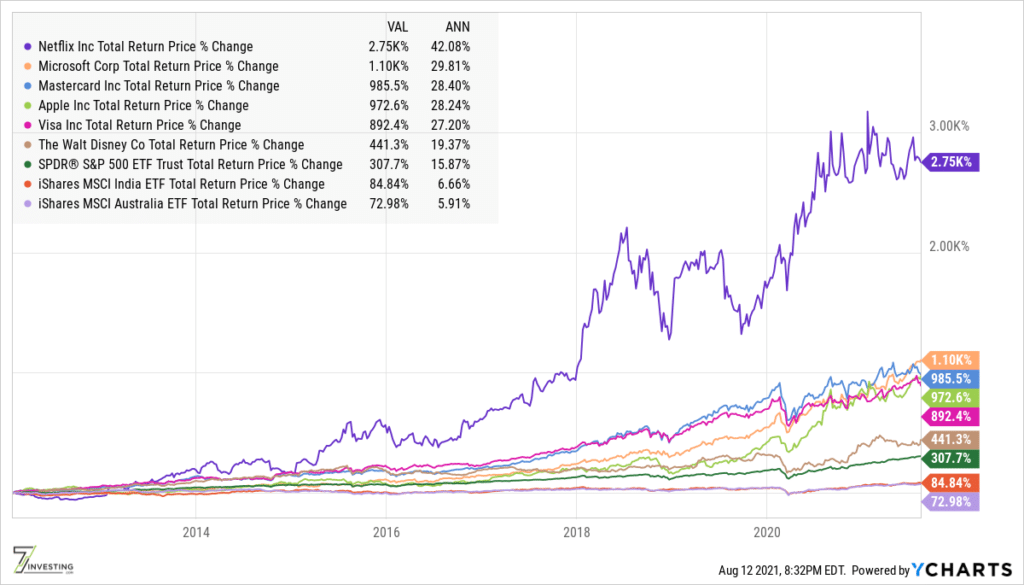

But it is not just Apple (NASDAQ: AAPL). Whether you live in Australia, Canada, India, or Europe, you might have a Netflix (NASDAQ: NFLX) subscription. Maybe a Disney+ (NYSE: DIS) subscription. You might be wearing Nike shoes. A Mastercard (NYSE: MA) or Visa (NYSE: V) might be in your wallet. And perhaps you use Microsoft (NASDAQ: MSFT) Office.

Well those well-known names, those companies whose products or services so many of us use, aren’t available on smaller exchanges. Missing them is a big miss in my book.

There’s an implicit advantage of investing in companies with a global footprint. We get diversification. We get exposure to different economies. Companies on smaller local exchanges often are niche businesses with a domestic focus. Devoting a portion of one’s portfolio to global equities counterbalances the risks of owning domestically focused businesses.

Perhaps the biggest reason why I invest almost exclusively internationally is business quality. I like to invest in companies growing at scale. That means finding businesses that continue to grow at 30%, 40%, or higher at the scale of hundreds of millions in revenue, or perhaps even billions in revenue. Typically, these sorts of businesses generate gobs of free cash flow. These are businesses that can weather many storms and still be okay. I love the combo of high growth and stability blended with brand power.

I don’t mean to say investors should abandon local exchanges, far from it. But restricting oneself to a small local stock exchange because of artificial constraints doesn’t seem wise. As investors, we should fish with a global outlook and fill our portfolios with companies that represent our definition of the very best.

I will leave you with a chart of returns for some of these well-known names, alongside index returns for Australia, India, and the US. Quality companies have delivered outstanding returns.

As I like to say, invest in the best. Invest like the best.

Already a 7investing member? Log in here.