Guest contributor Anand Khatri from StocksCurrent describes how investors should approach the cloud computing industry.

January 22, 2024

This article appears from guest contributor Anand Khatri. Anand is the founder of Stockscurrent and is a long-time friend of 7investing.

As we wrapped up 2023, the S&P 500 posted 24.23% returns and (26.29% with dividends). Some stocks were down more than 60%, 70% in some cases more than 90% in 2022. Some of the cloud and SaaS stocks faced a similar downturn in 2022. Investors were anxious and worried; some got the scar of owning cloud stocks higher percentage allocations in their portfolios.

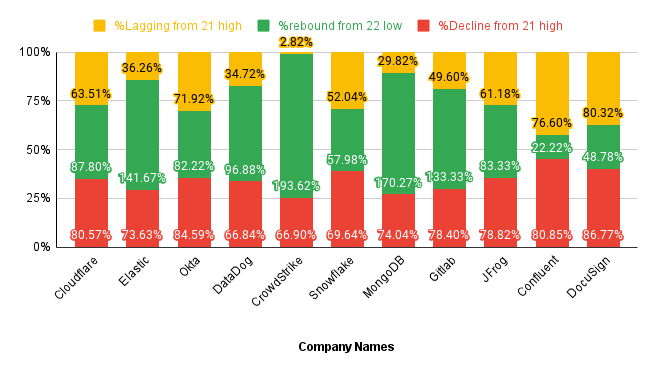

Here are a few company examples:

| 2021 High | 2022 Low | % Decline | Current Price | % Rebound from 2022 Low | % Lagging from 2021 High | |

| Cloudflare (NET) | $211 | $41 | 81% | $77 | 88% | 64% |

| Elastic (ESTC) | $182 | $48 | 74% | $116 | 142% | 36% |

| Okta (OKTA) | $292 | $45 | 85% | $82 | 82% | 72% |

| DataDog (DDOG) | $193 | $64 | 67% | $126 | 97% | 35% |

| CrowdStrike (CRWD) | $284 | $94 | 67% | $276 | 194% | 3% |

| Snowflake (SNOW) | $392 | $119 | 70% | $188 | 58% | 52% |

| MongoDB (MDB) | $570 | $148 | 74% | $400 | 170% | 30% |

| Gitlab (GTLB) | $125 | $27 | 78% | $63 | 133% | 50% |

| JFrog (FROG) | $85 | $18 | 79% | $33 | 83% | 61% |

| Confluent (CFLT) | $94 | $18 | 81% | $22 | 22% | 77% |

| DocuSign (DOCU) | $310 | $41 | 87% | $61 | 49% | 80% |

In the table below, you can observe a decline in stock prices of some cloud companies. The red color on the graph represents the percentage decrease from their record-high stock price in 2021. The green color on the graph represents the percentage increase from their lowest stock price in 2022. The yellow color represents the percentage lag from their record-high stock price in 2021 or the gap that needs to be filled to reach the record-high stock price in 2021. Some of the high-quality companies’ stocks had sharp reversals and touched 52-week highs, and some crossed all-time highs in 2023 – Jan 2024.

Some are still down more than 50%, 60%, and 70% from their recent high stock price in 2021.

This opens up the question of which companies are worth investing in, particularly in the relatively new and emerging cloud or SaaS market? And it requires careful vetting.

Valuation is crucial, but more is needed to evaluate a good cloud company. Valuation matters dearly for all the companies and in general in investing thesis.

Investors must also consider the company’s business model, product or service, growth prospects, and how well the management team executes its strategy. Therefore, investors need to spend significant time understanding the business or the company they own.

It’s important to remember that not all cloud companies are equal – some are good, some are not. In this article, I will discuss what to look for when evaluating emerging cloud companies.

Specifically, I will cover three key factors: the company’s mission-critical status, the “land and expand” model that most companies use, and how sustainable the company’s growth is. I will provide examples to help illustrate these points.

From the list above, let’s analyze the performance of a mission-critical company, Okta (Nasdaq: OKTA).

Product and Services:

In the ever-growing digital world, identity and access management are not optional but mandatory. Security works on multiple networking layers in the digital world, and every incoming and outgoing connection must be validated and verified with the correct identity and access level. Okta is one of the companies leading the way in identity and access management. As the leading independent Identity partner, Okta provides a safe means of using any technology, anywhere, on any device or app.

Okta began its journey as an identity platform with two key features: Multi-Factor Authentication (MFA) and Single Sign-On (SSO). These features were crucial for enterprise companies to manage workforce identity, and Okta delivered on that front. However, they soon realized the importance of the entire identity and access life cycle, adding many more features and functionalities. Currently, Okta offers two main products: the Workforce Identity Cloud and the Customer Identity Cloud.

Land and expand strategy:

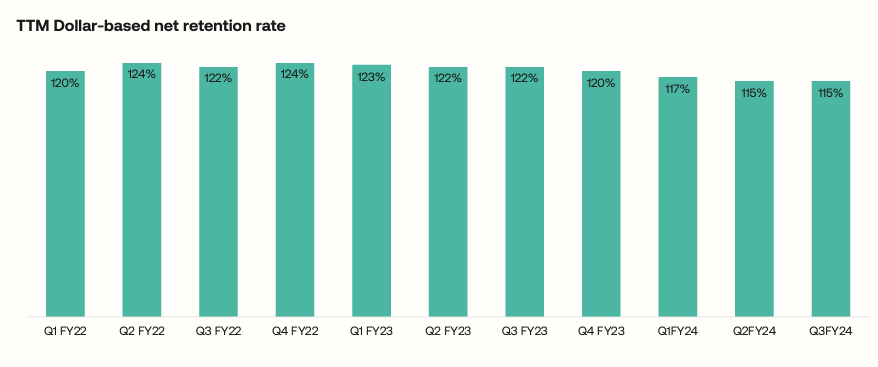

Okta’s Remaining Performance Obligation, known as RPO, seems to flatten a bit, and so the revenue also has a similar pattern; that’s not a bad sign since the dollar amount of the revenue is more than $2 billion per year, but definitely, the growth comes at a plateau. The company needs a catalyst to propel the growth. Their Dollar based net retention rate is going down and stabilizing at 115%.

Okta’s large customers >100k ACV, known as Annual Contract Value growth, is also slowing down, which shows that they can only expand a little in their existing customers.

| FY2022 | FY2023 | FY2024 (9months) | |

| Customers >100k ACV (y/y growth rate) | 59% | 27% | 11% |

Sustainable Financials:

The company has worked on improving its efficiency by reducing its costs, and the management team highlighted this through its adjusted operating profit and cash-flow progress. Although Okta is profitable on a non-GAAP basis, it has yet to achieve profitability on a GAAP basis. Nonetheless, the company has prioritized this goal. The difference between the GAAP and non-GAAP numbers mostly comes from stock-based compensation.

The company had $687 million in stock-based compensation over the last 12 months. With $2.168 billion in revenue, this means almost 32% of revenue, which is very high. In the most recent quarter, Okta had $172 million in SBC. Unfortunately, this means the company would still be free cash flow-negative without the SBC, as it only generated $150 million in free cash flow.

One example of a SaaS company mastering the land and expand strategy is Datadog (Nasdaq: DDOG).

Product and Services:

Datadog is a cloud-based monitoring and analytics platform for developers. The company offers a platform that monitors its customers’ cloud infrastructure and applications and alerts them to critical downtime. Their SaaS or Software as a Service platform integrates and automates infrastructure monitoring, application performance monitoring, and log management to provide unified, real-time observability of their customers’ technology stack. The company enables digital transformation and cloud migration, drives collaboration among development, operations, and business teams, and tries to break the silos. Their platform helps reduce time to problem resolution and create actionable insights across the whole organization.

The observability solution is crucial for enterprise companies as it allows them to monitor their production systems. However, it doesn’t mean that it is mission-critical. It is relatively easy to replace the observability solution with a better and more cost-effective alternative. This is due to the fierce competition in the observability space.

Land and expand:

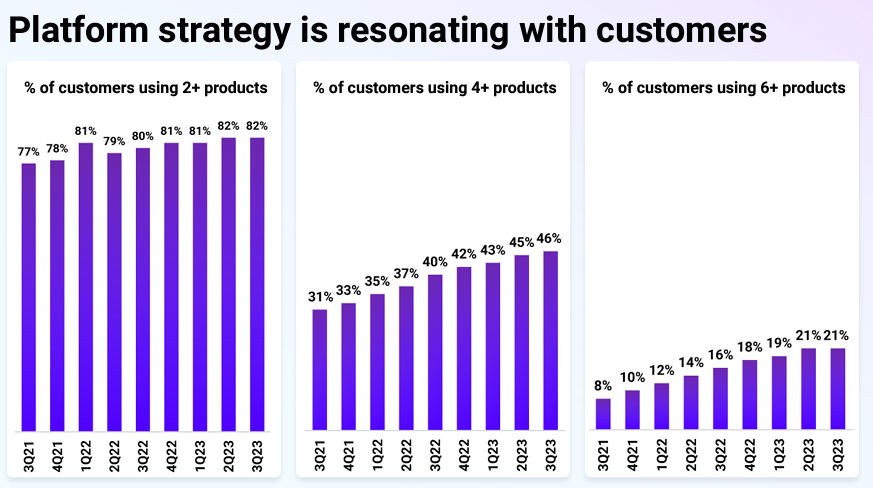

Datadog offers a comprehensive observability platform with 19 feature-rich products, all in one place. Adding additional products to its platform is one way a company can proliferate. The ‘Land and Expand’ strategy involves initially acquiring new customers with a small purchase and then encouraging them to increase their usage over time by expanding their product range. In their recent quarter, They reported product adoption rates were,

That means their land and expand model works; each additional product is a higher gross margin business for the company and directly contributes to their gross profit.

Sustainable Financials:

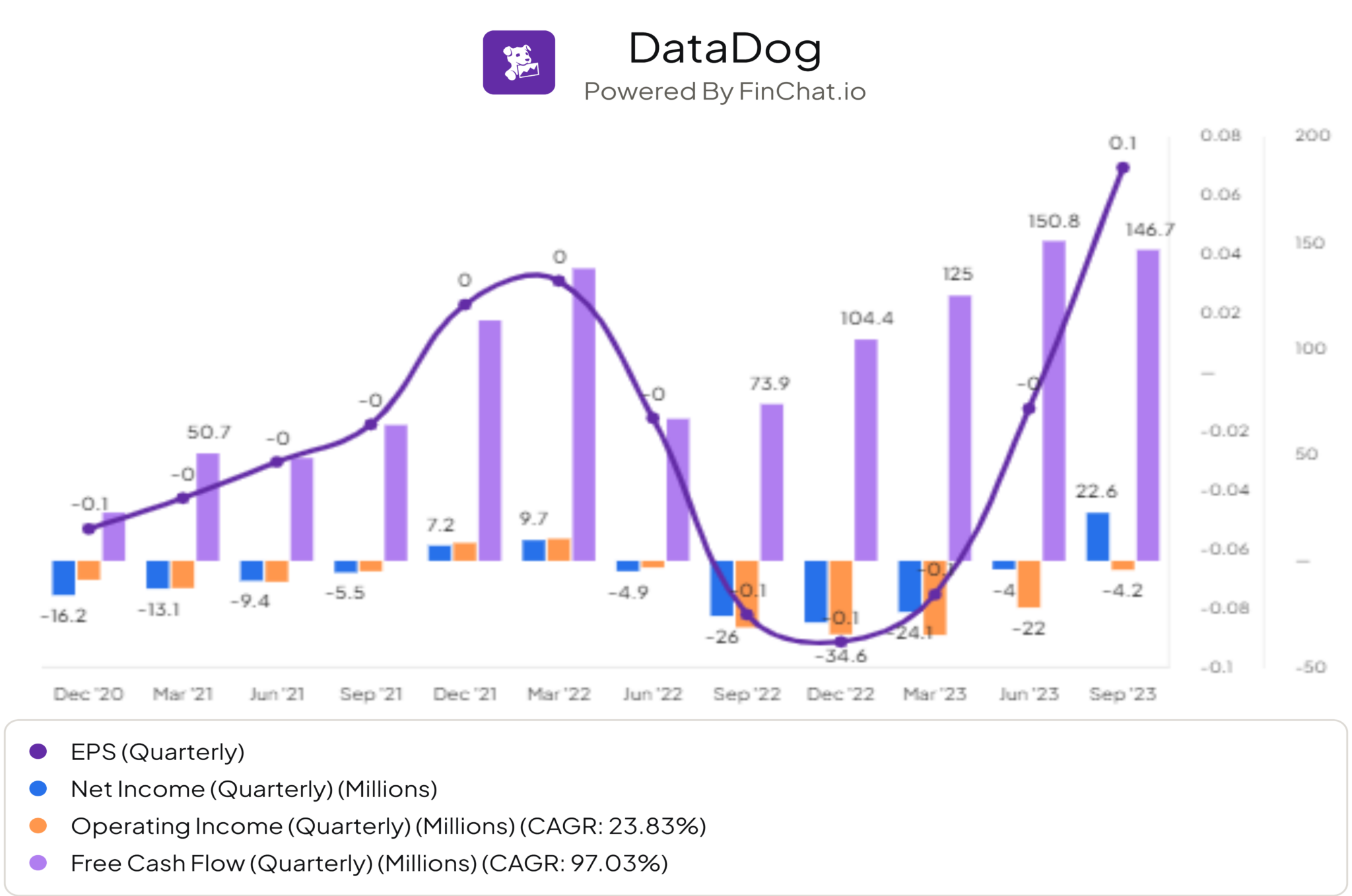

In the recent Q3 2023 result, Datadog reported a GAAP operating loss of $4.2 million and a -1% operating margin, which was better than expected. Chief Financial Officer David Obstler mentioned during the call that the company is continuing to increase efficiency in its internal cloud costs and cost of goods sold, and its engineering teams are working on cost savings and efficiency projects.

As a result, Datadog was able to generate a GAAP (Generally Accepted Accounting Principles) net income of $22.6 million or $0.06 per share on a fully diluted basis. On a non-GAAP basis, EPS came in at $0.45, beating the estimates by $0.11. Furthermore, the company reported a free cash flow generation of $138.2 million and a free cash flow margin of 25% this quarter, and it has more than $2.3 billion in cash on hand.

One company that executes successful land expansion strategies, focuses on sustainable, profitable growth, and is mission-critical is CrowdStrike (Nasdaq: CRWD).

Product and Services:

CrowdStrike is a leading cybersecurity company that aims to protect its customers from all cyber threats using its Security Cloud. The company’s mission statement is to stop breaches. With its Falcon platform, the company has created a new category of cybersecurity called the Security Cloud. CrowdStrike’s single data model and cloud-neutral architecture enable it and third-party partners to quickly innovate, build, and deploy new cloud modules to provide customers with additional functionalities across many use cases. The platform is designed to be easy to use, rapidly deployable, and extensible. The Falcon platform changes how organizations handle threats from slow, manual, and reactive to fast, automated, and predictive.

Land and expand:

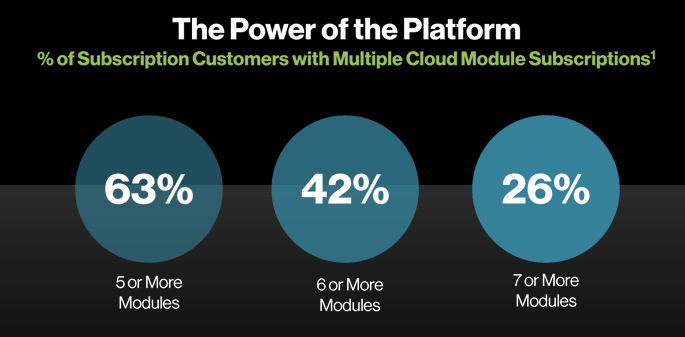

I remain impressed with CrowdStrike’s ability to keep cross-selling clients on additional software modules. In the recent Q3 2023 result, They reported module adoption rates were:

That means their land and expand model works; each additional module is a higher gross margin business for the company and directly contributes to their gross profit. Combined with gross client retention figures that have consistently been around 98% in the past five quarters, CrowdStrike’s dollar-based retention rates have stayed above the company’s 120% target threshold for more than five years.

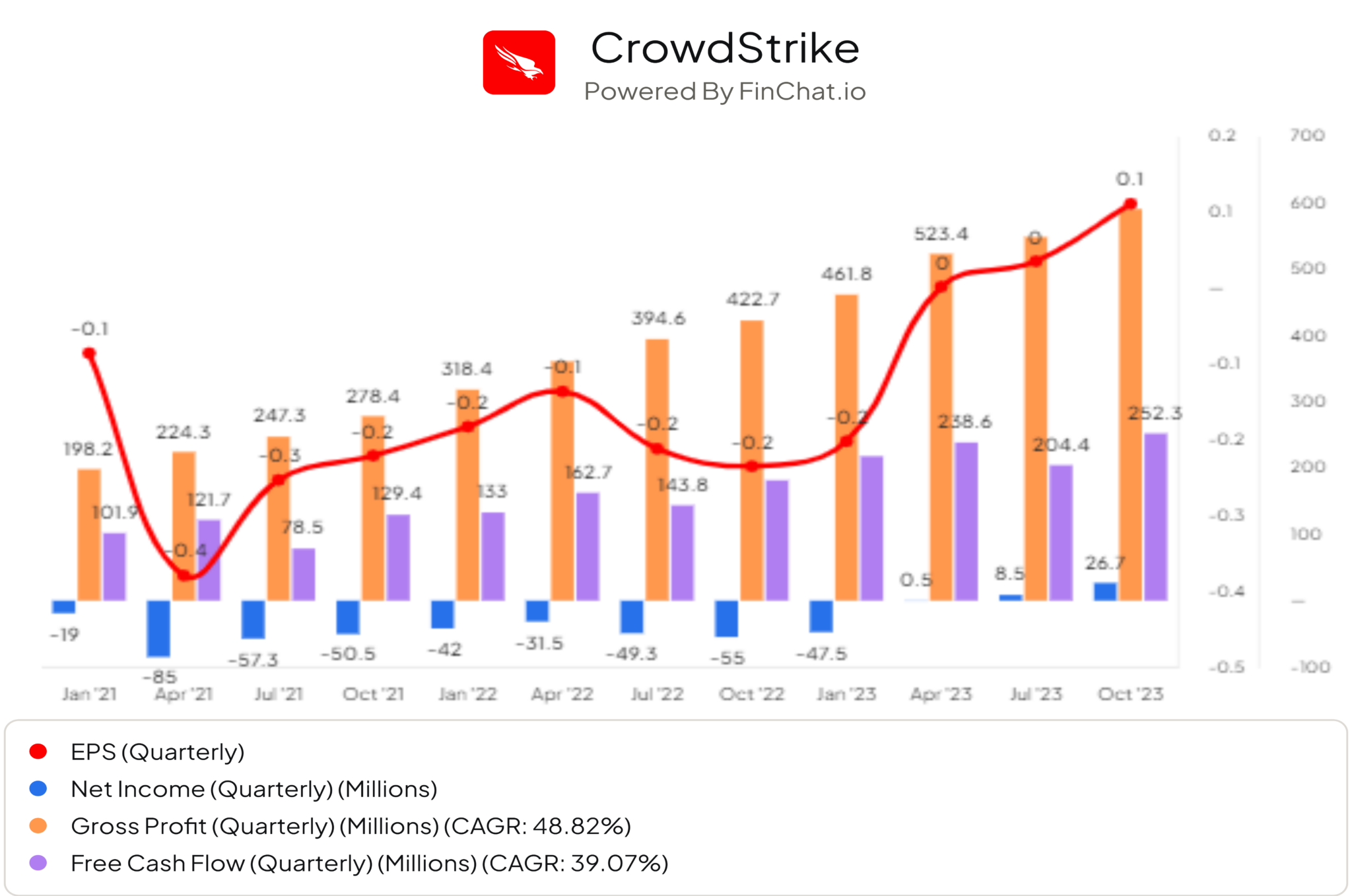

Sustainable Financials:

In the recent Q3 2023 result, CrowdStrike reported $591 million of gross profit, increasing 40% year-over-year. The company reported that non-GAAP net income was $199.2 million, compared to $96.1 million, up 107% a year ago. GAAP net income was $26.7 million, compared to a loss of $55.0 million in the third quarter of fiscal 2023.

The diluted non-GAAP net income per share was $0.82, compared to $0.40, and the GAAP net income per share diluted was $0.11, compared to a loss of $0.24 a year ago.

If you look at FCF (free cash flow), you see $239.0 million, compared to $174.1 million in the comparable quarter last year, so it’s up 30.40%.

| Mission-Critical | Land and Expand | Sustainable Financials | |

| Okta (OKTA) | Yes | No | No |

| Datadog (DDOG) | No | Yes | Yes |

| CrowdStrike (CRWD) | Yes | Yes | Yes |

Not all cloud and SaaS companies are built equally. Some companies may be struggling financially, lacking sufficient cash flow to fuel growth, while others may be thriving. It’s important to be discerning when choosing stocks and not sacrifice quality for the sake of investing. If you manage your own portfolio, the percentage allocation can significantly affect risk and returns. Choose wisely and pick the winners that will give your portfolio a boost.

Already a 7investing member? Log in here.