Google's ad business faced a rare year-over-year decline. Timing couldn't be worse given the hype around language models like OpenAI's ChatGPT and the thought that these new tools could disrupt Google Search. But don't count Google out, as Alphabet dominates Search and AI. We examine the recent and past quarters to understand the current situation and speculate on when Google advertising might recover.

February 8, 2023

What a difference 3-months make.

Sundar Pichai started his Q4 2022 prepared remarks by calling out macroeconomic headwinds.

Thank you, Jim, and good afternoon, everyone. It’s clear that after a period of significant acceleration in digital spending during the pandemic, the macroeconomic climate has become more challenging. We continue to have an extraordinary business and provide immensely valuable services for people and our partners.

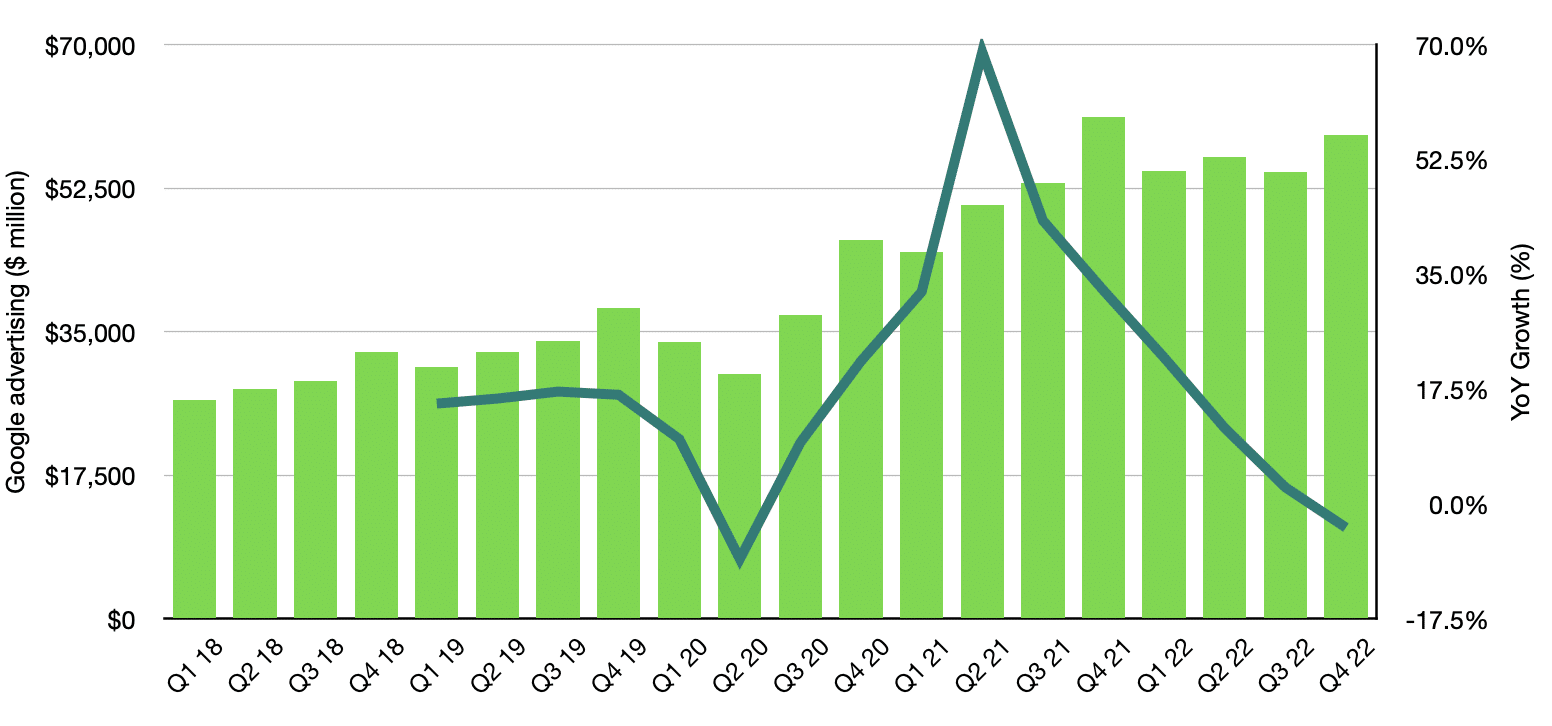

Source: Company earnings, author’s calculations.

Last quarter, Pincai started the earnings call by highlighting “healthy fundamental growth in Search.” That was when Google advertising delivered under 3% year-over-year growth; management pointed to a strong comparison and foreign exchange headwinds for the low single-digit number.

But Q4 2022 saw advertising revenue dip by almost 4%. Aside from the one-quarter during Covid, when almost everything had come to a standstill, Google’s advertising business last saw a down year a long time ago.

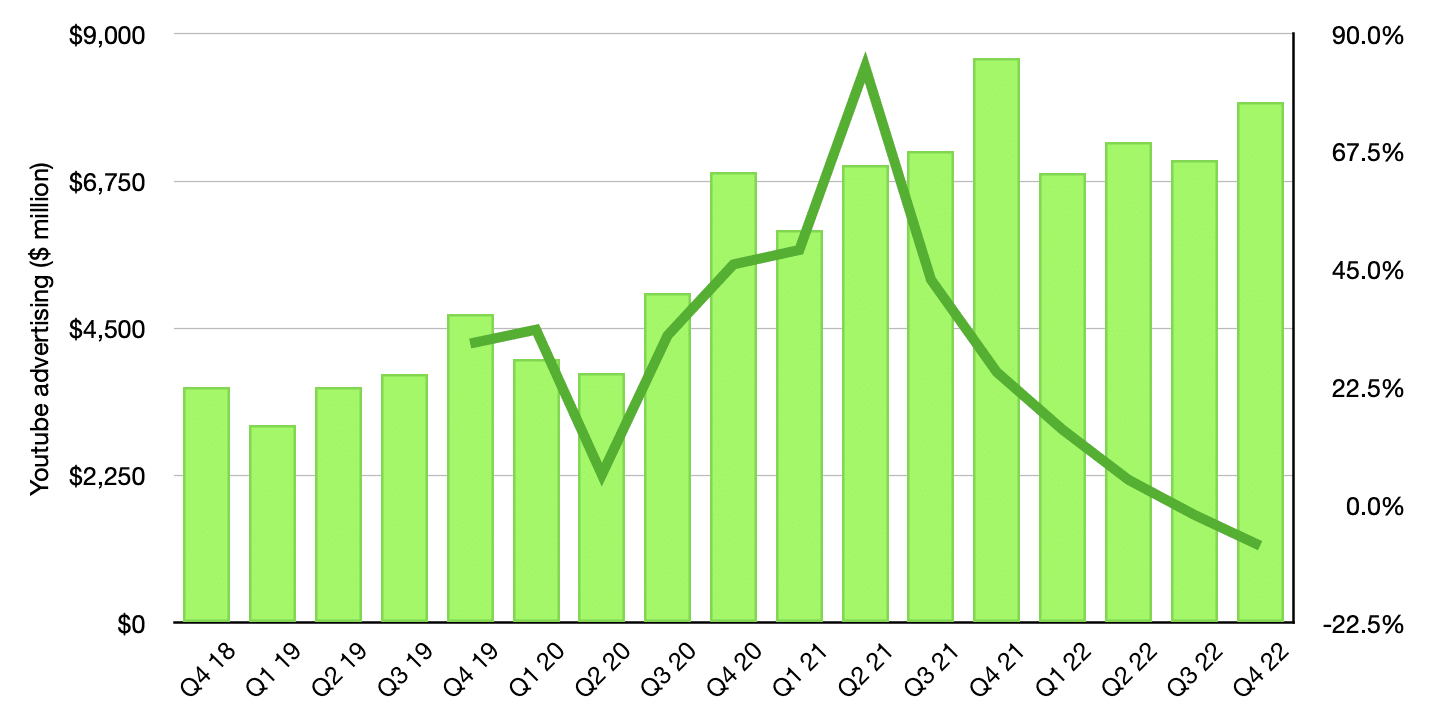

Source: Company earnings, author’s calculations.

Let us disaggregate Youtube’s contribution to Google advertising. Youtube’s advertising revenue started declining in Q3. In that case, we notice that the former pulled back much more than Search and Other sales. Ruth Porat, Alphabet‘s (NASDAQ: GOOG) CFO, noted that they saw a “further pullback in spend by some advertisers in Search in Q4 versus Q3.” The further acceleration in year-over-year decline was explained as “a broadening of pullbacks in advertiser spend in the fourth quarter.“

We have seen this movie before. Advertising budgets have declined as we have seen similar commentary from other companies such as Meta (NASDAQ: META) and Snap (NYSE: SNAP).

Broadly, there are three intertwined themes at play. First, the increased focus on privacy, most notably Apple‘s (NASDAQ: AAPL) App Tracking Transparency, is likely playing a significant role in moderating advertising budgets. With Apple kneecapping tracking, advertisers may not get the return on the investment required to up their spending.

Second, Youtube was a tailwind before the pandemic because its growth outpaced Search and Others. Youtube got a massive boost during the pandemic.

Youtube is now a headwind on the other side of the pandemic. The reasons for headwinds are many-faceted, but it is a combination of how much videos (and increasing short-form content) can be monetized. There’s a ceiling to ad load. With users out and about doing things in a reopened world, increasing the advertising load might mean commensurately worsening the viewing experience. My personal experience is that there are too many ads; I only use the service when I need to.

Third, it is easy to forget that the pandemic saw a surge in digital spending and habits. Before the pandemic, in 2019, Google advertising was growing at around 16%, a slowdown from the low 20%s in 2018. While advertising revenue growth slowed to 9% in 2020, it roared back to life in 2021 with a phenomenal 43% year-over-year surge. As such, between 2017 and 2022, Google’s advertising business has grown at an 18.5% annual rate, which is simply astounding considering the scale of its operation. We should naturally expect lower growth at higher revenue run rates. No company is immune to the law of large numbers.

The first half of 2023 might be rough because of the tough comparison with the prior period. As we move into the second half of the fiscal year, the year-over-year comparisons become more manageable, and we are likely to start seeing growth.

Over the long-term, it is reasonable to expect the advertising business to grow at high single-digits to low double-digit rates, on average, now that it is a mammoth-sized business. And my guesstimate does incorporate the potential impact Large Language Model (LLM) based chat bots such as Open AI’s ChatGPT might have on the current digital advertising landscape, but that’s a conversation for another day.

Already a 7investing member? Log in here.