We look into Fastly's Q2 2022 report and try to decipher whether or not now is the time to invest for a rebound.

September 14, 2022

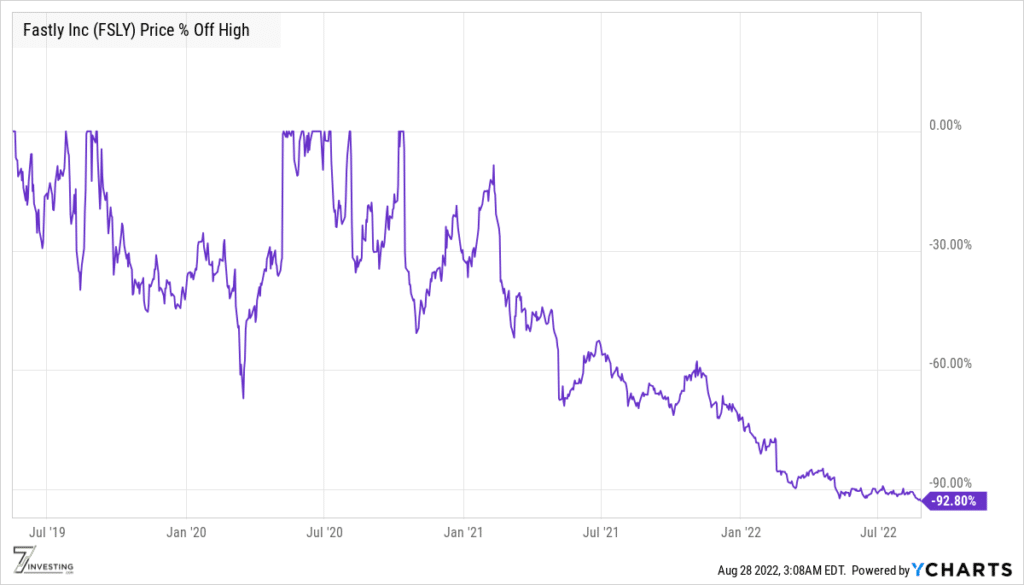

Content Distribution Networking business Fastly (NYSE: FSLY) was once a market darling. At the peak of euphoria, the stock was trading above $120, up 5-fold from its IPO in May 2019. Today the stock is trading around $10, down more than 90% from that peak valuation. The business has seen changes at the C-suite level, with Todd Nightingale recently named as a replacement for outgoing CEO Joshua Bixby.

Will Nightingale be able to restore Fastly to its glory day? Is the business primed for a rebound? The recently reported second-quarter 2022 report sheds some light on the potential for a favorable outcome. I think the odds for a strong rebound in the business remain low. I will caveat by noting that the recent earnings call was helmed by Bixby, and we are yet to hear from the Cisco executive Nightingale about changes to company strategy and direction.

In any case, reviewing the company’s earnings reports provides insight into the strengths and weaknesses of the underlying business, so let’s look under the hood.

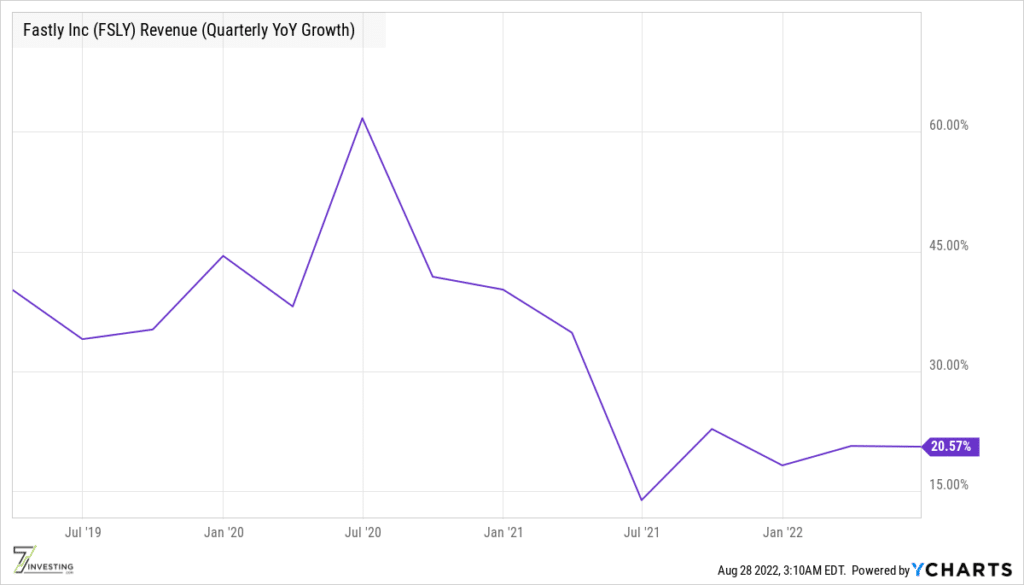

At the headline level, Q2 2022 revenue came in at $102.5 million, up 21% year-over-year. Signal Sciences, the Web application security company Fastly acquired in October 2020, contributed 13% to the revenue and was up 56% over the prior corresponding quarter. If I back out Signal Sciences, the growth of the core business was approximately 17%. While Signal Sciences seems to be going strong and increasing its share of the revenue pie (up from around 10% in Q2 2021), the core content distribution unit appears to be experiencing growth headwinds.

The core business seems to be also experiencing gross margin pain. Gross profit for the quarter was $46 million, roughly flat compared to a year ago’s $44.7 million. In other words, while revenue has grown, the same can’t be said for gross profit dollars, implying increasing pressure on the costs of goods sold.

Here’s another way to think about the situation. On a non-GAAP basis, the pre-Covid-19 gross margin was around 58% (e.g., in Q1 2020). Signal Sciences, one would guess, is a high-margin software business, so margins are possibly in the high 70% to low 80% range. Therefore, it seems fair to conclude that the core content delivery business has seen gross margins decline substantially, perhaps around 1000 basis points. That is undoubtedly a scary proposition. Note that this has been confirmed by company executives and is a ballpark estimate. Still, it nonetheless doesn’t paint a pretty picture.

I guess the company has plenty of spare capacity in its network. That will be pressuring margins. At the same time, content delivery being such an intensely competitive arena, one would imagine Fastly having to spend to keep up with competitors. Fastly’s customer base is relatively small at 2,894, of which the company classifies 471 as enterprise-grade. What the company needs at this point is rapid growth in the enterprise customer base. However, the business only added 14 customers last quarter, a dramatic decrease from the 76 added in the first quarter!

Now it is not all dark and gloomy. Customers seem to stick around with Fastly for a long time. The dollar-based net retention rate was a healthy 120%. And customer churn is extremely low at 1%, which implies a very long lifetime.

The job of the new CEO, I would guess, would be to turbocharge enterprise customer sales. That seems to be crucial to the company’s margin pain point. Can it be done? Is there enough juice in the Fastly balance sheet to allow a potential turnaround?

The company ended the quarter with cash and equivalents of $767 million. It has debt in the form of convertible notes of $703 million. That convertible note debt is down after the company repurchased $235 million in aggregate convertible debt at a 25% discount to the principal outstanding.

That convertible debt deal is another beast of its own type. It is natural to ask why debt holders are willing to take a 25% haircut on the amount owed. It is partly because the convertible note had a 0% coupon attached to it, which means debt holders didn’t get paid until the notes matured. At maturity, debt holders would make a killing if the stock was well and indeed outperforming the market. However, as of now, the notes have no chance of hitting the conversion price. Maybe the debt holders think there’s a fair chance Fastly won’t be able to pay them back in 2026, so they are willing to take whatever cash they can get. Note that all outstanding convertible notes are far from converting to stock unless something changes dramatically and thus will need to be paid back in cash.

In the meantime, Fastly is bleeding money. If the company can’t fix its growth engine, it might not have the money to pay back its convertible note holders! Free cash flow was a negative $66 million in Q2 2022.

With a market capitalization of $1.1 Billion, the company is trading on roughly 6-times annualized gross profit. That valuation isn’t onerous, but with so many question marks on strategy and future prospects, I am not yet inclined to bite the bullet, yet.

Already a 7investing member? Log in here.