It's been rough year for previously richly-valued small-caps and growth stocks. But it might be time for them to shine again.

January 22, 2022

Given the fear, doubt, and angst I see in the markets right now, it might seem crazy to sprinkle in a dose of optimism for the future of the worst-performing corners of the market. But when our CEO Simon Erickson asked us to make “one wildly speculative, investing-related prediction” for 2022 this month, that’s exactly where my mind went.

So, here’s my “wild” prediction: I’m going out on a limb to say that tech stocks, small- and mid-caps, and beaten-down growth names will narrow their undeperformance gap with the rest of the market in the coming year.

Some perspective is in order: As of Friday’s close (January 21, 2022) the Nasdaq Composite Index is down more than 15% from its all-time high set two months ago. The S&P 500 is nearing official correction territory as well, down almost 9% from its peak. Virtually all of these losses have materialized for the widely followed indexes over the past three weeks alone.

But however painful the indexes’ recent pullbacks have been, they’ve also largely masked even greater turmoil over the last several months for shareholders in many of their underlying components — particularly as we look closer at the tech-heavy Nasdaq. In fact, around 40% of all stocks listed on the Nasdaq exchange are currently down at least 50% from their highs. A full 1,037 Nasdaq companies (out of just under 5,000 total listed) set new 52-week lows yesterday. Only 10 Nasdaq stocks hit fresh 52-week highs yesterday.

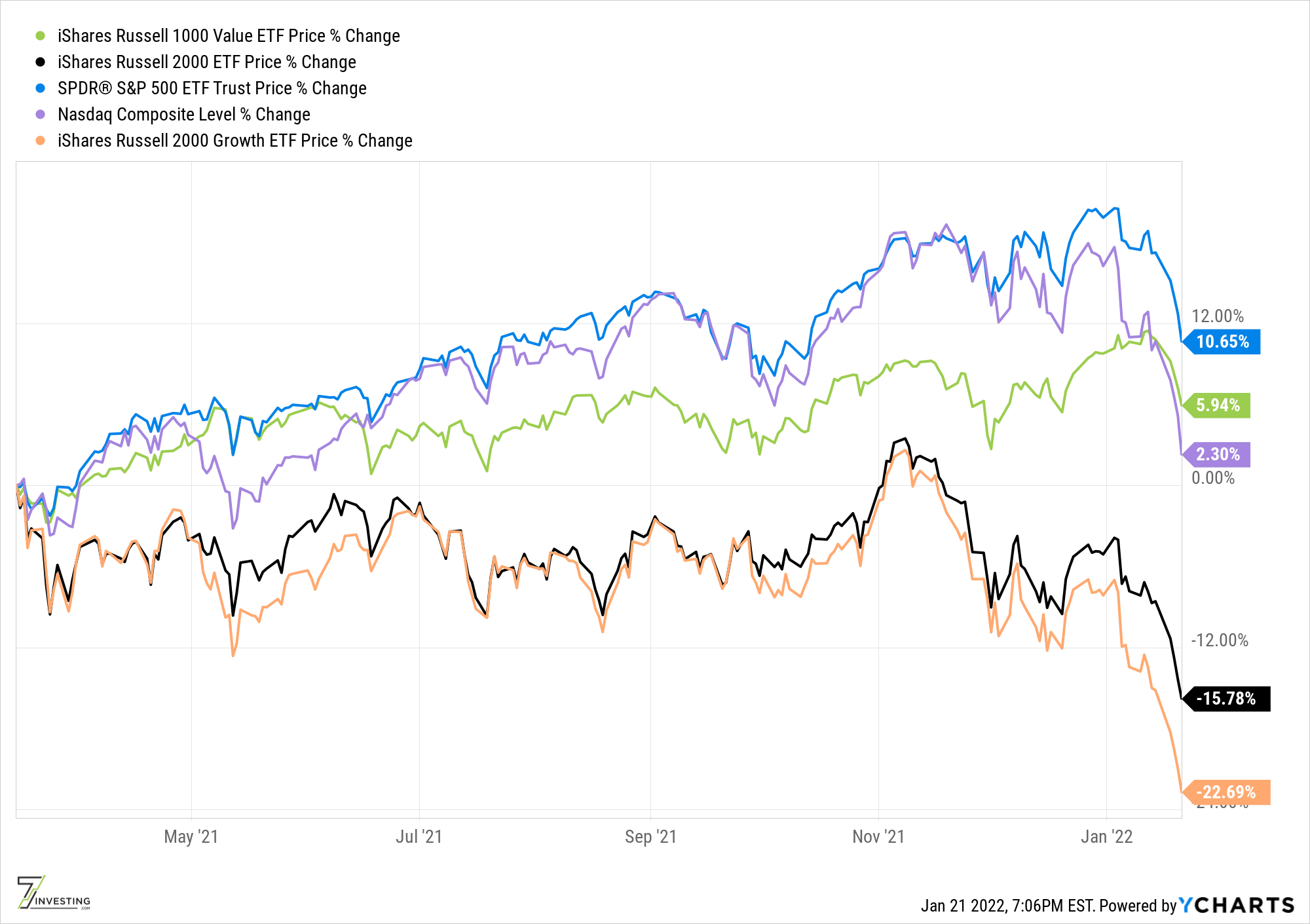

Indeed, a relatively small number of mega-cap businesses, so-called value stocks, and few sectors (energy, financials, and real estate in particular) drove much of the indexes’ outperformance leading up to this month’s drop. Zooming further in, we can see that small-cap stocks and previous richly-valued growth names — as illustrated by the performance of the two small-cap heavy Russell 2000 ETFs shown below — have endured more than their fair share of pain for the better part of the last year, badly underperforming the rest of the market in the process.

Of course, that doesn’t mean small-cap growth stocks and beaten-down tech names can’t go even lower — especially if the previously outperforming sectors and mega-caps driving the indexes continue to unwind in the near term, potential dragging the rest of the market down with them. In the face of ongoing pandemic uncertainty, rising interest rates, geopolitical strife, and arguments from certain “permabears” that the world is in the thick of a multi-asset “everything bubble” that’s already popping, it can be tempting to flee to the sidelines in favor of trying to time the bottom of whatever segment of the stock market might suit your fancy.

But I also won’t be the least bit surprised if — perhaps following some additional near-term declines — we see a reversion to the mean for yesteryear’s laggards before the end of 2022. To that end, I’ll be doing what I’ve always done while investing through thick and thin: That is, keeping my head down and looking for what I believe to be the best opportunities our market has to offer every single month. So, if you’re not already an active 7investing subscriber, you should be equally unsurprised over the next several months if my individual side of the 7investing scorecard grows to include even more high-growth small- and mid-cap tech stocks that that have not only endured staggering valuation multiple compressions in recent months, but — in contrast to their stock-price declines — which have also continued to drive exceptional growth over the past year resulting in drastically improved financial profiles.

If these kinds of stocks indeed close their underperformance gap with the rest of the market in 2022, I think fellow long-term shareholders who invest accordingly will be more than pleased with the end result.

Already a 7investing member? Log in here.