The granddaddy of software as a service -- Salesforce.com -- is on sale. Anirban explains why you should consider putting it on your watch list ...

June 22, 2022

Salesforce.com (NYSE: CRM) is the granddaddy of the cloud-based software as a service industry. The company’s software solutions, including Sales Cloud, Marketing Cloud, and Commerce Cloud, are used to power enterprises’ sales and marketing functions. Over the years, Salesforce has used acquisitions to enter adjacent areas. For instance, Salesforce acquired MuleSoft and Tableau to grow into data integration and visualization and snapped Slack to add a new-age communications platform to its stable. When the company launched its initial public offering (IPO) in 2004, Salesforce was clocking around $100 million in annual sales. Today, the business is throwing off $28 billion in annual revenue, which is still growing at about 20% per annum.

Salesforce is a well-known name. It is a behemoth with a strong balance sheet and a consistent free cash flow generation history.

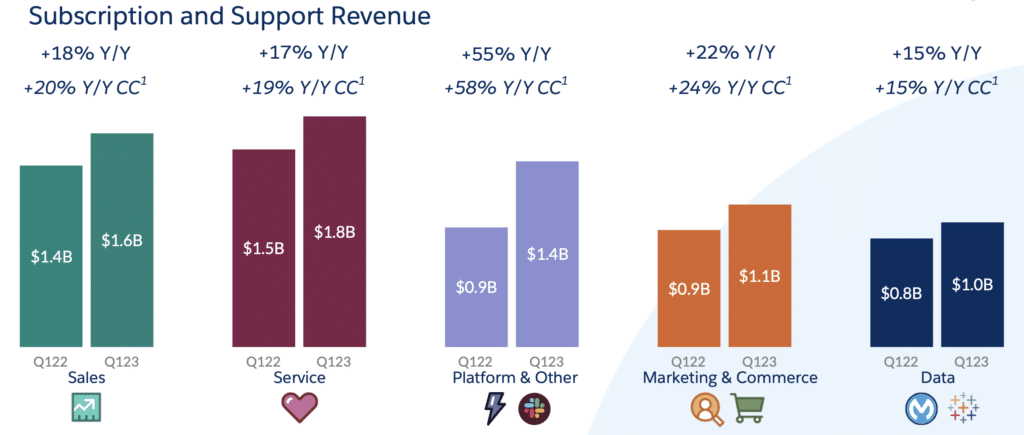

Source: Salesforce Q1’23 Investor Presentation.

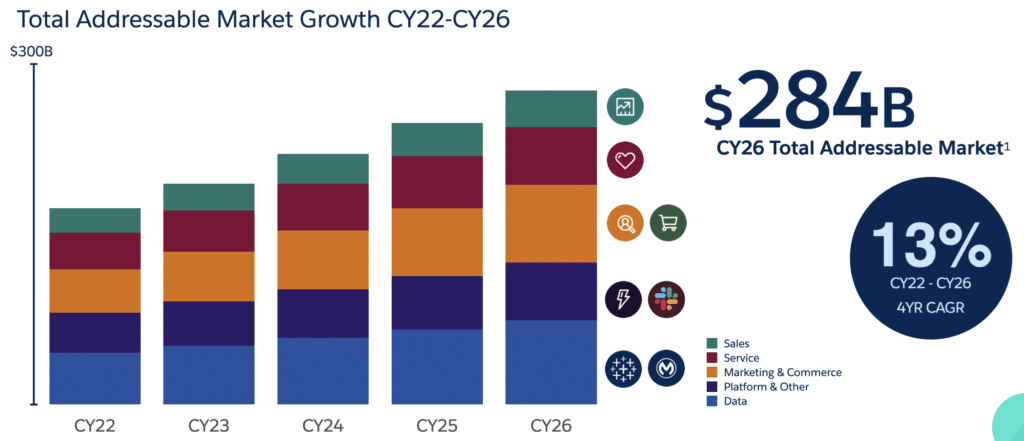

Salesforce is also a steady performer. Recently reported first-quarter 2023 earnings showed revenue growing 24% year-over-year to $7.4 billion. The company’s entire product portfolio continues to witness strong demand, and the $42 billion of committed contracts (Remaining Performance Obligations) tells us how vital their solutions are for their customers. And growth at scale can continue for years to come thanks to the company’s sizable addressable market, which management estimates to be worth $280 billion annually by the calendar year 2026.

Source: Salesforce Q1’23 Investor Presentation.

But why is Salesforce worth adding to our watchlist now?

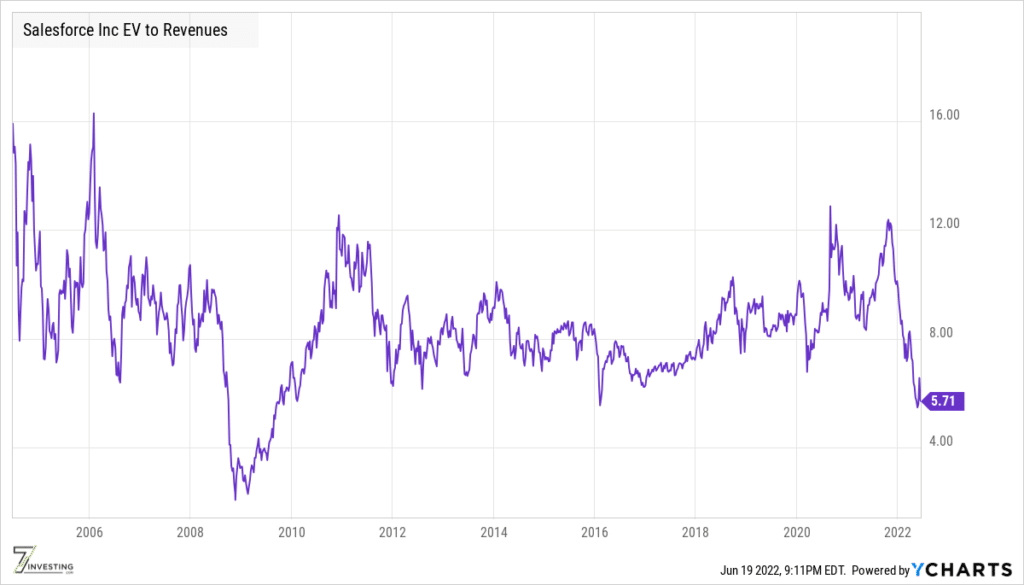

Currently, Salesforce has an enterprise value of $163 billion. It generated $27.9 billion in sales over the last twelve months and produced free cash flow of $5.7 billion. That puts the company at around 28-times FCF and less than 6-time sales. Both appear to be undemanding for a company of Salesforce’s stature!

Source: YCharts.

On an enterprise value to sales basis, a 6-multiple is close to the lowest the stock has traded, except for the GFC when it went down to around 2! But it is worth noting that Salesforce today is different from what it was back in 2008 or 2009. Today Salesforce’s solutions are a must-have for many enterprises. The company has $13.5 billion in cash and equivalents. And it has committed contracts of $40-plus billion!

I am not calling the bottom for Salesforce. But Salesforce appears to be sale and I think it is ripe for consideration from long-term business-focussed investors.

Already a 7investing member? Log in here.