Payroll processing might be boring but for Paycom shareholders returns have been anything but boring. What does the future look like for Paycom?

August 17, 2022

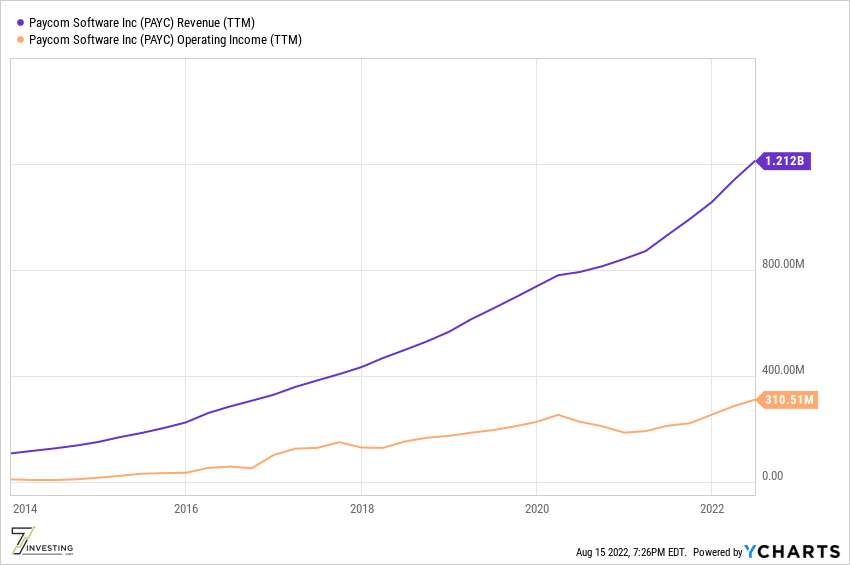

Payroll processing might sound boring, but it is a service every business needs. And Paycom (NYSE: PAYC), founded in 1998 by CEO Chad Richison, has made hay by diligently serving the needs of small to medium-sized firms in the US. Over the past decade, Paycom’s revenues have increased 10-fold, while operating income has jumped 30-fold.

Source: YCharts.

One might think the company’s best days are behind it (considering the manifold increase in revenue for instance), but that might be far from the truth. Its latest quarterly revenue grew 31% year-over-year to $316.9 million, and adjusted earnings before interest tax depreciation and amortization (EBITDA) came in at $119.6 million, up from $87 million a year earlier. Although the business is now on a $1 Billion-plus annual run rate, management estimates their share of the addressable market, defined as clients in the US with 50 to 10,000 employees, at about 5%.

Paycom is more than a payroll provider. The company describes itself as a cloud-based human capital management (HCM) software as a service business. In their filings, Paycom says its software provides “functionality and data analytics that businesses need to manage the complete employment lifecycle, from recruitment to retirement.” In straightforward terms, in addition to core payroll processing capabilities, businesses can also choose to use one or more of Paycom’s 28 other modules focused on areas such as time/roster management, talent acquisition, talent management, and typical human resources (HR) functions.

Paycom charges its clients based on the number of seats and modules used. Generally, there are no long-term contracts but subscriptions/fees account for about 98% of the company’s revenues. None of its customers account for more than one-half of one percent of the company’s revenues, so there is no revenue concentration risk.

Furthermore, as a payroll business, the company holds funds on behalf of its customers, with an average daily balance of around $2 billion. These client funds are held in “safe” and “stable” investments such as overnight sweeps, CDs, commercial papers, and 2-year treasury, enabling the company to earn a yield on these holdings. Paycom’s CFO, Craig Boelte, noted that every 25 basis points increase in the Federal Funds rate adds roughly $5 million annually to their revenue.

One of the great things about payroll processing is its stickiness. Businesses don’t like messing with payroll and other critical HR functionalities because of the disruption risk posed by changes. In fiscal 2021, Paycom reported client retention of 94%, which translates to a customer lifetime of 16.7 years!

Of course, stickiness is excellent, but it also implies winning market share from majors like Automatic Data Processing (NASDAQ: ADP) and Paychex (NASDAQ: PAYX) is challenging. One salient point working in Paycom’s favor is its ability to consolidate many HCM functions into one scalable, easy-to-use cloud platform. Several of Paycom’s competitors primarily provide payroll processing services and then integrate with other solutions to facilitate other operations. As founder and CEO Richison says, “Paycom is a single solution, while many others integrate multiple solutions.“

But displacing the majors doesn’t have to be a significant focus. Paycom’s growth doesn’t have to come from the rip-and-replace realm. In-house systems and do-it-yourself options such as a spreadsheet, paper-and-pen, or perhaps something like Intuit’s QuickBooks represent 60% of the small business market; this market is ripe for disruption by Paycom.

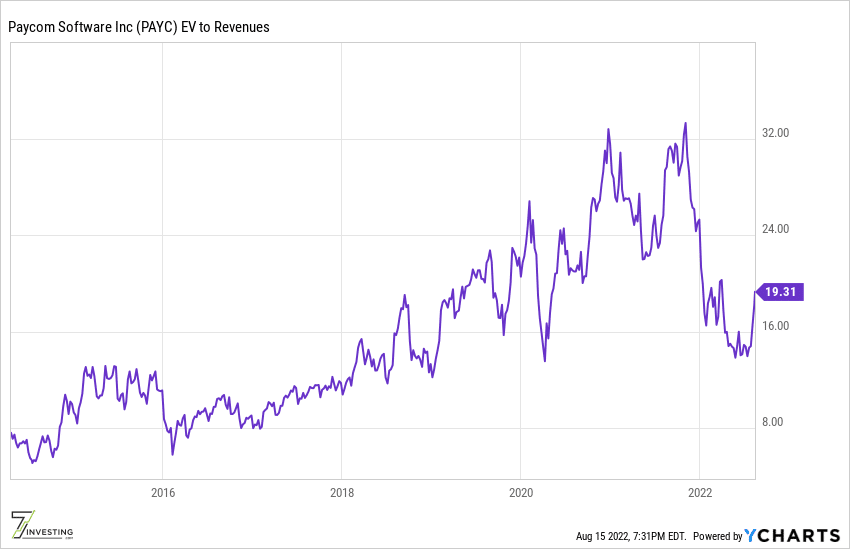

Source: YCharts.

Paycom is a solid growth business with switching costs as its primary moat. In fiscal 2022, Paycom expects to deliver an adjusted EBITDA of $547 million. That puts the company on an enterprise value to EBITDA of just over 40. That’s not in value territory, but this company has generally traded at a premium, and one can say deservingly so, given its steady execution over the past decade. As you can see from the price to sales chart below, the stock has pulled back some, but it still is relatively pricey at 18x sales.

I have been a long-time holder and fan of Paycom. It has done fabulously well over the past 8-years for me, and I’m been looking to add to my position opportunistically. Investors interested in stable growth with profitability, increasing operating leverage, a founder-CEO at the helm navigating a large addressable market should consider putting Paycom on their watchlist.

Already a 7investing member? Log in here.