Long-Term Investing Ideas in a Volatile Market

Simon recently spoke with a $35 billion global asset manager about how they're navigating the market volatility. The key takeaways are to think long term, tune out the noise...

7investing lead advisor Matt Cochrane interviews Acquirers Funds founder Tobias Carlisle about value investing.

June 25, 2020 – By Simon Erickson

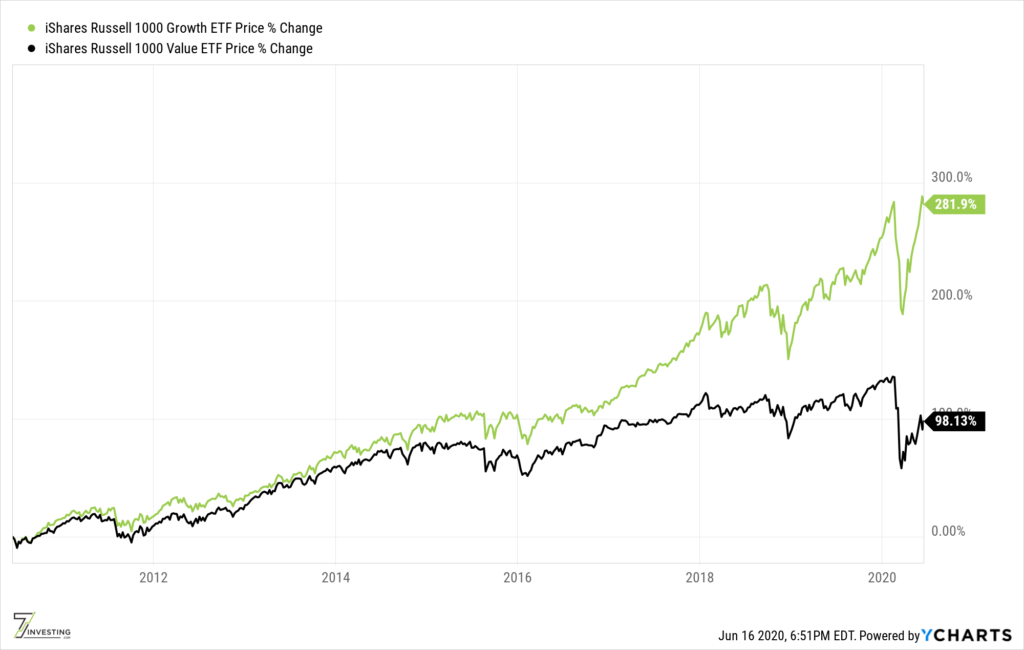

Is value investing dead? New investors could be forgiven for thinking so. Over the past decade, the Russell 100 Growth ETF has appreciated 282%, nearly triple the returns of its counterpart, the Russell 1000 Value ETF. Whether this is due to perpetually low interest rates or the ongoing digital transformation in the both the consumer and corporate worlds or some combination of the two, investors seem to almost assume that growth will continue to outperform value going forward.

But has this always been the case? When looking at larger data sets than just the last ten years, investors see that trend reverse. Indeed, for the majority of times when data is available, value actually outperforms growth. Are we in a new paradigm where growth stocks will continue to dominate value stocks or will this trend reverse towards the mean?

In our fourteenth official podcast, 7investing lead advisor Matt Cochrane chats with Acquirers Funds founder and managing director Tobias Carlisle about the current state of value investing. The two discuss Toby’s investment philosophy, the stocks his fund is holding, a well-known company it’s shorting, and when to know it’s time to sell.

0:10 – Introduction: From Australia to LA, from law school to investing, Toby describes the journey that brought him to deep value investing.

8:25 – What is “net-net” and Benjamin Graham’s formula for value investing?

12:00 – Why has value investing underperformed growth over the last ten years? Why might this trend reverse?

17:10 – Thoughts on Warren Buffett’s famous quote: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

20:25 – Do Facebook (NASDAQ:FB) and Alphabet (NASDDAQ:GOOG)(NASDAQ:GOOGL) have durable economic moats?

24:10 – When do you sell a quality company?

29:55 – How Acquirers Funds seeks a margin of safety in three ways: 1) a discount to a conservative valuation; 2) a strong, liquid balance sheet; and 3) a robust business capable of generating free cash flows.

34:40 – What makes Best Buy an attractive investment?

37:30 – Workday, a human capital SaaS platform, is growing revenue by more than 20%, most of which is recurring, and has $2.6 billion of cash on its balance sheet. Why is Acquirers Funds short this company?

41:10 – Has Warren Buffett lost his touch? Is Berkshire Hathaway too large to realize market-beating returns? Is Berkshire still an attractive investment today?

46:20 – As a father, what advice does Toby have for other parents for teaching their kids about personal finance and investing?

We hope you enjoy our 7investing podcast! Please send your ideas and questions to info@7investing.com or submit them here!

Companies mentioned in this podcast include Alphabet, Amazon, Berkshire Hathaway, Best Buy, Facebook, Microsoft, Shopify, Walmart, and Workday. The 7investing team may have active positions in one of more of these companies.

This podcast was originally recorded on June 12, 2020 and was first published on June 22, 2020.

[00:00] Matt Cochrane: Greetings, fellow investors. I’m Matthew Cochrane, a lead advisor at 7investing, where it is our mission to empower you to invest in your future. We do that by providing monthly stock recommendations to our premium members and educational content that is freely available to everyone.

Listeners, today you’re in for a special treat. If you’re interested in what it means to be a deep value investor, how to weigh stock valuations with the quality of the company you’re investing in, and how deeply undervalued out of favor stocks can offer asymmetric returns, possibly with limited downside and a greater upside, you will want to pay special attention today.

Joining us for what I believe will be an enlightening conversation is Tobias Carlisle. Mr. Carlisle is the Founder and Managing Director of Acquirers Funds, where he serves as Portfolio Manager of the firm’s deep value strategy. He is author of several books, including The Acquirers Multiple, which after was released hit number one in Amazon’s business and finance category. And last but certainly not least, Tobias is the host of one of the best investment podcasts in the podcast universe: The Acquires Podcast. And I don’t say that lightly. I’m personally a fan and I think I’ve listened to every single episode. If you listen to just one investing podcast, make it 7investing. But if you listen to two, give Acquires Podcast a listen, especially the Value After Hours discussions, which Toby holds with Bill Brewster and Jake Taylor every week, which I enjoy immensely. You can follow him on twitter @greenbackd: that’s “at greenbackd”. Toby, welcome to the show!

Tobias Carlisle: Thanks for a very kind introduction. Matthew. Looking forward to chatting.

Matt Cochrane: Yes, great. So Toby, maybe you could just start out by telling us a little about yourself. You know, listeners might be able to detect a hint of an accent. Why don’t you tell us where you’re from and how you got started in investing.

Tobias Carlisle: So I’m Australian originally. Started working as a lawyer in April 2000, which was right at the very top of the “.com 1.0” peak. And thought that I was going into venture capital was super sexy, any kind of.com type stuff was really sexy at the time. And basically, shortly after I showed up, it became kind of clear that that was probably not going to be happening. There wasn’t gonna be a lot of VC. There was still like dot coms in Australia. These are mostly Australian companies that I’m talking about there. But they’re all the same idea as the ones that are in the States. They didn’t make any money. They didn’t even make any gross margin on the stuff they sold. They lost money on every single thing they were doing. Mostly because they’re trying to encourage people to use the internet to buy stuff. So we had this thing called d store.com, like department store. And it was trying to be an Amazon. And the way that they they used to send out these vouchers to my dad, because I’d been at school. So dad would give me these things, and basically what they let you do is to buy a book for free through this website. And so I used to go in and find the most expensive book from America that I possibly could on investing, like the obscurest thing I could find. And then use this voucher to buy these things

So that we’re losing, you know, 50 bucks on these things.

Matt Cochrane: [Matt laughs] Sounds like a great business model.

Tobias Carlisle: Yeah, it’s a great business [laughs]. So I started working, expected to do that stuff, which I personally thought was super sexy. I wanted to be involved in that stuff too. And the market collapsed. And it turned into rather than sort of being a capital raising environment, it turned into a mergers and acquisitions environment. So I started doing m&a as a lawyer. And these little .com’s – there are quite a few that are listed and raised a lot of cash – were burning cash. Started getting approaches from these guys who’d been corporate raiders in the 80s. They’re all sort of famous in Australia. And when they got approached, that you’re trying to get control, and I could never work out why do these guys want these businesses. Like, they’re losing money.

And of course, it’s because they’ve raised $20 million, they’re burning like five or 10 a year. But if you stop the cash burn and you’ve got this cash pile, you can then go and use that to buy other businesses. Liquidate it if you want, get the cash back, and get get a quick return. So I thought, that’s a really interesting strategy. By that time, I had read Security Analysis, read the original version of Security Analysis, because I had this friend that said “you’ve got to go and get the original.”

As I’ve discovered, it’s like this statement of your philosophy: which one of the versions of Security Analysis you prefer. And it’s kind of like this, the original one is written just after the Great Depression. And so there’s a lot of deep value net net liquidation at early activism kind of discussed in it, even though a lot of it’s about railway bonds and valuing bonds. Very, very hard going.

So I read the chapters in there on liquidation value. Found the old net net ratio, and went and did a few valuations on these things. I wasn’t allowed to buy anything because I was a lawyer and you can’t have a conflict. But I thought, if this ever happens again, that the market crashes and these things come out again, I’m going to go and try and buy these things.

And it’s took until 2000 and sort of late 2008. By that stage, I’d worked in the States for a while in San Francisco. I was doing tech m&a in San Francisco for some big companies. Just bolting on little acquisitions. And had gone back to Australia to work in a telecommunications company as their general counsel with the telecommunications company. That had dark fiber and data centers and appearing exchange and built a subsea cable. So it was like genuine telecommunications infrastructure with some wires on top of that. But we were much, much closer to the infrastructure and then the managed service end. We sold to the guys who have the managed services.

And so that business got a bid. Got sold. I made a little bit of money and kind of had an opportunity to work out what I wanted to do. I thought I want to be an investor. I want to be this kind of more deep value kind of investor.

So as the market collapsed, I started working with this guy who was an activist. He’s sort of a reluctant activist in the sense that he looked for “undervalued assets, situations with a catalyst” is how he described it. And so he tried to find something trading for much less than it was worth where there was a pretty certain return and then in the not too distant future. And then if the return, for whatever reason, management kind of bungled that or didn’t deliver the return, then he’d go activist and kind of compel them. And it included like sending letters, taking them to court, standing up in general meetings Like it was real activism. So it’s real nuts and bolts, stuff, and it was fascinating to learn that. Then my girlfriend at the time who I’d met in San Francisco, was American, we wanted to get married. More than likely to have kids so she wanted to come back and be closer to her mom and dad in Los Angeles.

I really like LA, so we moved back. And that’s sort of how I got back to the States. And since then, I’ve started a firm. Launched a fund called the Acquirers Fund, which is long/short. Basically worked out I don’t have the personality for activism. I don’t really want to harass people or stand up at meetings or take them to court. Too much mental energy expended on that stuff.

But I thought you can probably identify, these are the targets that I would hold. So I started out that way. As I’ve gone along, I’ve become increasingly a sort of “quality at an unreasonable price” investor. Kind of the way that I describe it. I don’t really like necessarily growth. And we can talk about why I sort of tend to not pay for it. But what I’m looking for is very cash rich balance sheets, very solid operating earnings and cash flows. I want management that’s alive to the fact that the company’s undervalued and doing something about it. Which typically means buying back stock, which I think is a very strong signal.

So those are the kind of things to look. Free cash flow. Cash in the balance sheet. Because those businesses that can weather whatever crisis they’re coming from. And then on the other side, I tend to short stuff that has their junky balance sheets, negative free cash flow, so they’re burning cash and issuing stock to stay alive. And all of those signals over time, I think should help outperform the market. And that’s kind of what I do now.

[08:13] Matt Cochrane: Gotcha. So I want to get into your your fund strategy more. But first, I’d like to just start off with a bit of a higher level discussion.

You used a term there, and I’ve heard you the plenty of times. But for people who don’t know, when you say “net net”, explain what that means.

Tobias Carlisle: So this is the old Graham formulation.

So the the idea that Graham’s sort of the proof that value has some meaning to stock market investing. Because it can feel like you’re trading pieces of paper back and forth. What’s the tether to the intrinsic value? Why does intrinsic value matter at all?

And Seth Klarman dealt with this in his book. And he said, at a liquidation level, it becomes very material. It’s a real number. Because often you can buy these things at $1 in the market and they might have $2 or $3 in liquidating value. And if they’re liquidated, you can be paid out. And you can double or triple your money over a period of time. And often that’s the challenge. That you’ve got 12/24/36 months of sitting in there. But it’s a very certain return, it’s just a matter of how long it takes to get the money back out.

So “net net” was Graham’s sort of rough proxy for calculating the liquidating value. And he said, what you look for is the net current asset value. And that’s cash on the balance sheet, the inventory, payables, and receivables. So netting out all of the liabilities of the business. And then that residue, you compare that to the market capitalization. If the market capitalization is two thirds or less of that residue, then you can put the transaction on. The reason it’s two thirds or less is if your calculation is correct, you make a 50% gain by buying at that price.

There have been lots of tests done over the years. That was one done in 1983 by Henry Oppenheimer. Professor Oppenheimer. He looked at and he said it had worked for the 25 years from whatever to 1983. And then I looked at it on the 25th anniversary, and it worked from the 20th. And basically on the same scale. You make about 30% a year on these positions. There’s only a handful of them around. You can’t put very much money into them. You can literally, like I don’t think…you couldn’t run a fund on that basis. You couldn’t get a million dollars into them. You might be able to get a few hundred thousand into the whole portfolio of these things. Because they just don’t trade. But they’re very certain returns and the downside is capped.

The problem with them is that they don’t come around very often. You don’t get them unless there’s real pressure, selling pressure in the stock market. So you don’t see them in 2019. But you might see them in March 2020. And if there’s another stock market crash, you might see them closer to the low. And so when you see them, you buy them. Not a great strategy for running a fund, because there’s nothing to do in the interim.

So I wanted to find a strategy that was sort of the same philosophy. Look at some balance sheet value, look at an operating business, come up with a valuation for the operating business, and then buy that. And the catalyst in those instances is activists or private equity firms coming in. Like financial acquirers. Because I think if you’re paying at a discount to what an informed financial acquirer will pay for a business, then that’s sort of your hard dig for what you can return. That’s a pretty hard, intrinsic value that should be able to be taken out of the business at some stage. Assuming that you don’t get the mean reversion. Which I’m usually relying on. So that’s basically the strategy.

[11:53] Matt Cochrane: Gotcha. So now, why would you say like for people… Value investing has now underperformed for, let’s call it 10 years. Why do you think it’s underperformed? And why do you think that trend will reverse?

Tobias Carlisle: We should define our terms a little bit. Because value investing, as any “Buffet watcher” will tell you, value is a discounted cash flow analysis. Or something that’s more akin to what Buffett does. Where he looks at the core of this business’ returns. Whatever some number on invested capital. We can take that internal engine of returns. So say that can return 15% on on invested capital.

And then we can look at our own investment possibilities. And we can see that basically cash yielding virtually nothing. The 10 year, the 30 year. And so then we can come up with a valuation for that engine. And then we can try and buy at a discount to that valuation. That’s basically how Buffett’s doing it.

There’s a return on invested capital element or growth element, if you’re doing it through a discounted cash flow or something like that.

That’s sort of the more “growthier” end of value. At the other end of value is the stuff that I’m trying to do, which is sort of closer to the Financial Acquirer end. This is where you get the private equity firms and activists and so on. And that’s looking at…let’s assume that there’s no growth. Let’s look at something that’s going through a crisis. Assume that we can see it at the other side of the crisis.

And so you get earnings mean reverting up. There should be a discount to the to the intrinsic value, which should narrow as well. And so that end I called “Deep value”. It’s just a more conservative end, trying to not pay too much for growth.

So that is the end that has really underperformed for the last 10 years. It’s not the growthier. Growthier value investors have done fine. And value investors who invest within industries have done fine.

The issue has been that when you use these cheaper metrics, it pushes you down towards things that are heavier industry businesses: finance and banking, energy. And those sectors and those industries have tended to underperform. You’ve tended to cluster into those sectors.

But if you apply the same approach on an industry, distributed, sector — equal weighted sector approach, you’ve done pretty well. And even deep value investors inside industries have done well. They’re just, across the entire market, have lacked exposure to typically information technology, which has been very good.

There are periods of time over the full data set. So we’ve got data going back to 1920 for price to book data. Price to cash flow and price to earnings start in early 50s. Throughout the entire period, there are lots of times when this style of value investment underperforms. And the times when it tends to underperform are closer to the peak of famous bull markets. So the last really famous one was 1999. And it did really well through the early 2000s. And it did did pretty well up until sort of mid 2010.

Since 2010, it’s roughly tracked in line with the rest of the market until about 2015. Just using ratios. And it’s underperformed since then. If you’re using like the full suite of things, where you check on balance sheet health, quality of the earnings, make sure there’s no fraud in there, make sure there’s no earnings manipulation, look for financial distress. All the things that you would call quality measures of a company that kind of kept you up until about with the market until about 2018.

Since the beginning of 2018, it’s been pretty miserable for my style of investment. It’s sort of down over that period of time and it’s massively underperformed the market, which has sort of run up.

So the spread now between the performance of the market and this strategy is as wide as it has ever been in the data. I can’t find a wider underperformance. Even though there are six other periods of underperformance, it’s never been this wide. Much wider now than it was in 2000. And it’s much, much longer than any other period of time.

Naturally, that leads people to ask, “has it stopped working?” Is it just because it’s so easy to find these things? I just think it’s one of those things that when the market gets the bit between its teeth, it kind of tends to run. This one’s run a lot further than I probably would have expected. If you’d asked me a few years ago, I thought we were getting a little bit closer to the end of it. But it’s persisted. I sort of think that we’re now into the…we’ve seen the crash, we’ve seen a bounce, we might see another crash. So I think we’re kind of getting to the end of that period now.

[16:45] Matt Cochrane: Gotcha. So one of the problems I have with — I guess, not a problem — but one of the questions I have with deep value investing, is a lot of times, it does feel like when — and even using shortcuts like ratios and things like that. But I feel like when you get when you’re looking at deeper value stuff, you get pushed into inferior quality companies. And I was going to ask you about this Warren Buffett quote, where he goes, “it’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

How do you take that quote? Do you disagree or agree with it?

Tobias Carlisle: Yeah, so the full quote is, “it’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” And so, Joel Greenblatt, in his book, “The little book that beats the market,” writes about what he actually means by that in a quantitative sense. So fair company. A wonderful business is something that has a very high return on invested capital, sustainably so. So it can earn sort of an above market, it can earn supernormal profits. And the reason it’s able to do that is because it has some sort of protection. It has some sort of moat. Because if you just test on the basis of high returns on invested capital, you find that that underperforms the market. Because at any time those appear, it either means it’s a business at the top of its business cycle, or it’s a business that has a big target on its back. Because if you’re in another industry, you’re not making as much money, and it’s adjacent to that one, and you can take your skills across, you’ll do that.

Matt Cochrane: Going to start attracting competition.

Tobias Carlisle: 100%. So that’s pretty well established that microeconomics says that we’re going to come in and compete for those profits. And that drives profits down. So you see that repeatedly over different periods of time in the market.

So he says “wonderful company, high returns on invested capital, fair price.” He uses operating income on enterprise value to make that assessment. Buffett talks about that too. It’s how he assesses the companies internally

Taken together, that is the “magic formula.” And so Joel Greenblatt tested that. Just mechanically buying and selling every 12 months over a period of time. Finds it does outperform the market.

We tested that in Quantitative Value, which came out in 2012. We threw everything we could think of to make it underperform. And it didn’t do that. We used the academic gold standard of back testing. It definitely does outperform the market over the long term.

When you devolve it, to see what the return drivers are, what you find is that return on invested capital actually leads you to underperform the market. And all of the return plus some actually comes from the value ratio — EBIT/EV — which I call the Acquirers Multiple.

So I think that what Buffett is saying is that if you can find the moat, rather than a high return on invested capital, the moat is more important. And so when you think in those terms, and you go back and read his letters, you’ll notice he spent a lot of time talking about how you identify them.

The problem is that anytime it’s been tested scientifically by guys like Michael Mauboussin, in particular. Mauboussin says, “what are the predictors of a moat?” “How do you keep this competitive advantage?”

It’s really hard to predict over a decade of time; which companies will be able to persist with that high return on invested capital. So if you can’t predict it, I think you’re better off kind of ignoring that particular measure of quality and looking at just the value ratios and the business health ratios and the balance sheet health ratios. So that’s basically what I do. I ignore the things that I think are highly mean reverting or the things that I don’t think provide information and I focus on the things that I have that I think are more predictive. And that’s sort of the the essence of the investment strategy.

[20:36] Matt Cochrane: Yeah, that’s interesting. I don’t know if you’re familiar with Polen Capital. But they talk a lot about that. They look for companies with economic moats, too. And one of the things they look for most is something that’s withstood a, what they call a “moat attack.” When a company has, like a legitimate company has made a full out effort. Like when Google+ attacked and wanted to make a social network like Facebook had. And Facebook’s network effect withstood it. That would be like an example they gave of, once they see that like historical evidence of competitors trying to enter into that market. Or competitors trying to take out that moat. Then they see that as like another historical evidence. They want the historical evidence of a moat withstanding attacks. And things like that.

Tobias Carlisle: Well I think that’s a very interesting approach. But I think Facebook’s a really good example too. Because if you look at what Facebook has done, I think a lot of the attention has gone away from facebook.com to Instagram. And they sensibly bought Instagram and they keep a lot of that.

But even now, I think that the attention is going away from Instagram to TikTok. And I think that there’ll be another generation beyond that. And part of that is that kids just don’t want to be on the same network as their parents are. They want to get away from where the parents are.

So I do think there’s going to be a little bit of those platforms are a little bit more faddish. Facebook may have avoid that by becoming sort of the white pages of the internet. That’s where, if you want to know where the guy you went to high school with is now, he’s probably got a white pages entry equivalent on Facebook.

Maybe Facebook avoids that. And it does seem to be. It does seem to have withstood that. So maybe Facebook is one that can withstand it.

I 100% agree that there are quality businesses out there. I’d spend a lot of time, not so much on the podcast, but I talked to Jake Taylor about this a lot (he’s my co host on Value After Hours for folks who don’t know). I think that Google is a phenomenal business. Google is an unbelievably durable business wholly embedded in most people’s lives. If you’ve got a Gmail account, if you look at YouTube. I think that if you use search, basically you’re using Google’s products. And you couldn’t take those out without a material lack of quality to your life, right? Because you have to start paying for things.

And I think that Google makes so much money from those things that it kind of has to disguise how much money it makes by hiring a lot of people and taking these moonshots. Because if people saw how profitable it actually was, they might show up to the campus with pitchforks and things like that.

It seems to avoid a lot of the “ick factor” that Facebook has. Because Facebook, I think people over shared initially. And now they kind of don’t feel good when they go in there because they’ve shared too much. But Google knows a lot more about you than Facebook. Or they probably know the same amount. But nobody’s got that “ick” factor.

Matt Cochrane: Definitely different for sure.

Tobias Carlisle: So I would love to own Google. I would love to own those kind of businesses. It’s just that I don’t want to pay up too much for them. And you know, Google has come into my screen over the years. Microsoft has come in. Facebook has not. But Apple has come in. They do get cheap on occasion. And those are the times when I plan to buy them. In the interim. I just don’t have an opinion.

[24:00] Matt Cochrane: So a slight hypothetical here. But let’s say in March, one of those companies got cheap. Whatever you want to pick: Google, Apple, Microsoft. And they enter your screen and you bought it for your fund.

And as it recovers in price, where do you make that decision. Like “Well, now it’s at fair value.” Do you sell it then? Do you let it run a little bit? Like where do you make that decision to sell?

Tobias Carlisle: I think that the problem for a lot of value investors and particularly deep value investors is they tend to truncate returns. And this is partly Graham’s fault. Because Graham said the rules for selling were “if you’ve held it for two years or it’s gone up by 50%, you should sell.” So I’ve tested that, naturally. Because that’s the kind of investor that I am.

The 50% rule is a terrible rule. That’s, you know, the old stock markets saw that you shouldn’t pull your flowers and let the weeds grow. Because everybody…if something’s down, they feel like they don’t want to crystallize the loss. But if it’s up, they want to take the profits. Which is exactly the inverse of what you should be doing. If something’s down, and it looks like it’s not working, then you should pluck that thing out. If it’s up and it’s growing, you should let it keep on going.

So I find it extremely hard. Nobody is very good at selling, I don’t think. And I find it extremely hard to be a seller too.

Matt Cochrane: Everybody has struggles with selling,

Tobias Carlisle: Everybody thinks about buying. Nobody thinks about selling.

And I think part of the reason is that you buy for fundamental reasons, if you’re a fundamental investor. Whether you’re the growthier end of the spectrum or the deeper value end of the spectrum.

And then, the fundamental story becomes less relevant once the press starts running. And often these things turn into momentum type trades. And you you’re trying to sell into momentum. I think that you’re kind of truncating your winners.

So I think that the best approach is to just sell on a time basis. And you either say I’m not going to sell for less than a year, I’m not going to sell for less than two years. I’m just going to let it go and see where it gets to. I think that’s the best way of having the biggest winners.

When I have tested over the full data set that I have. I think that most things that are undervalued on average — so you know, any given stock can do any thing — but on average, it takes about five years for the from the time that you buy it for the excess return to dissipate. The bulk of the excess return comes in the first year. There’s a very material amount in the second year, and then it sort of gets asymptotically less as you go along until you get beyond five years, there’s no excess return. So I think for value guys, you could hold for five years pretty easily. But the bulk of it is in the first two years. So I sort of use one to two years as my sell rule.

Matt Cochrane: That’s interesting. You know, it’s different for managing a fund and doing your own personal retail investing.

But what I’ll do, I’ve had Shopify for a long time. And when he hit 300, I remember thinking “wow, it’s really expensive.” And I said, “you know what, I’m good. I just want to hold it because I really like this company.” And I expected it to come down a lot.

By that time, at $300 I was doing very well in it. And when it hit $400, I trimmed significantly. Where I captured more than my cost basis back. But I wanted to keep a small part. Because at some point, it’s gonna fall and I want this company. If I sell it, I’m going to lose track of it. There’s companies where I’m just kicking myself, because in March, now I’m realizing how low they got in March. I just missed that.

So I didn’t want to do that with Shopify. Because I really like the company. And now it’s just like, I don’t know if I should fully recognize how overvalued it is. And I’m still holding on though. I just feel like I recognize that it will come down. And I don’t know if it’s smart or not. But it’s like, I guess like the coffee can methodology. Where I want to hold this part of it. I haven’t trimmed it since $400. But I trimmed it down to where it was like a smaller position again. But it’s obviously growing. For retail investing, I really like the “This is a great company and I’m just going to hold on. I understand trimming valuations. But I like holding on to a core element of it.”

Tobias Carlisle: I think when you look at where the very best companies come from, they tend to come from the more expensive side of the market. Because everybody knows that they’re good businesses. So Zoom might be a good example of that. Walmart is sort of a classic example. Microsoft is also a classic example.

Matt Cochrane: Amazon.

Tobias Carlisle: Yeah, Amazon. Exactly. They never got cheap at any stage. They’re always expensive. But they’re growing so rapidly that they’ll always — if you bought, you sort of over a period of time, the valuation kind of caught up to you and then went beyond you.

And so I do think that that if I was to invest that way, and I may come up with something that balances. I think that at the moment, deep value is an incredibly fat opportunity. But I think that in the fullness of time, value in 2007 was very, very expensive. And by 2014, that value strategy — and it sounds really weird — paradoxically, value was more expensive than growth, if you’re looking at that other side of the market on a forward P/E basis. So the value stocks had run so well. Everybody had piled into value. It had got very expensive.

Jake Taylor wrote this article at the time, where he said this is the worst opportunity set for value in 25 years. And he was absolutely right. And since then, it’s sort of materially underperformed.

I just didn’t think “what is the next step beyond that? What’s the implication of that?” And I should have thought, I should go and look at the growth stocks, which are now unusually cheap, and put a position in on them. So I do plan to do that next time, if that opportunity presents itself.

And the way that I would do that is to work backwards from the way that I do it as a value investor. First of all you identify, these are all the best, fastest growing companies in the market. Now let’s try and find them on, let’s find the better opportunities inside that cohort. Rather than these are the cheapest companies in the market, let’s find that higher quality opportunities in that cohort.

So I think that there’s a lot of merit to it. I just think that the easier way for investors is at the value end of the spectrum. Even though under performs periodically, as it’s doing now.

Matt Cochrane: Right. I want to move on. I wish I could talk to you longer.

But let’s talk about your fund’s strategy a little bit. On your fund’s homepage, you say “we seek a margin of safety in three ways: a wide discount to a conservative valuation, downside protection and a strong, liquid balance sheet, and a robust business capable of generating free cash flows.”

Can you just walk us through that a little bit? Each of those steps.

Tobias Carlisle: So the balance sheet is pretty straightforward. I just want more cash than debt. Or if there’s debt, I want it to be not great in relation to the size of the business or in relation to the size of the operating income that the business is generating. So it’s got some wiggle room, if the business continues to deteriorate. It can at least finance itself for a period of time.

The discount to intrinsic valuation just means very fat yields. I look at the enterprise value to operating income as a proxy for sort of cash flow. I also check and value on that basis, and I go and confirm that the cash flows match the operating income over time. Because that’s a trap. Enron is a good example of that. Where basically they had very good accounting earnings, but they had no cash flow. And that’s because the accounting earnings were sort of a figment of the imagination of the management team there. And that’s something that you find occasionally in the market, where the accounting earnings outstrip the cash flow earnings. So I just like to make sure that the cash flow roughly matches the accounting earnings and that we’re not paying too much for it.

And then we use some statistical measures as well. So I look at is there financial distress in this business? Is there earnings manipulation? Is there some statistical indication of earnings manipulation in this business? Is the some statistical indication of fraud in this business?

And so one of the funny things is that all three are often found together. If you’re doing really well, you don’t need to manipulate your earnings and you won’t be in financial distress. If you find yourself in financial distress, you might want to make yourself look better than you are. Which might mean manipulating earnings as a gateway drug to fraud too often. I use this suite of different measures, which are like bennish (?), Mscore, Altman Z score. All of these sort of statistical measures as a group. And then I just kick out the worst 5% because I think that they are the ones that I want to short. They’re the ones that if you’ve got one of those indicators, like that’s one cockroach in the kitchen. There’s often more cockroaches in the kitchen. So I’m just trying to catch anything that kind of passes through there.

So have I have I missed anything?

Matt Cochrane: Why discounting conservative valuation. Downside protection and the strong liquid balance sheet. And a robust business capable of generating free cash flows.

Tobias Carlisle: Yeah, so the business capable of generating free cash flows is, you know, metal benders and mines in particular. They don’t generate a lot of free cash flow. So they tend to be things that fail to get through my screen. Even though that’s something that more traditionally deep value guys quite like. I’ve just learned over the years, what I really like is I like industrial operating businesses that genuinely do make money over time. And I love free cash flow. Everybody loves free cash flow, so that’s not a great surprise. But those things together, I think if you’re buying stuff like that, the chance that you lose that the business is just fundamentally broken is pretty low. And I think that they’re real businesses. I just don’t like mining businesses. I don’t like minerals type businesses. But there is a time and a place for them. If they get cheap enough, I’ll buy them.

[34:28] Matt Cochrane: Great. So now, if we can, I would just like to go through a few of your funds’ holdings. And just walk us through how they meet your criteria?

And first, when I was looking at your long holdings, I wanted to start with a more vanilla company. One that consumers are familiar with and that is probably relatively easy to understand. And I spotted Best Buy. Now, I have a special place in my heart for Best Buy because of its Geek Squad. Like I’ve already admitted to you, or confessed to you, my technical ineptitude. And so I have a subscription to Geek Squad support that I have used several times.

But what makes this such an attractive investment?

Tobias Carlisle: Well it’s very cheap. That was the first thing. So you’re not paying a great deal for the operating income that Best Buy’s generating. Retail has been a treacherous environment because Amazon is so strong and Buffett himself has said over the years that anytime a new concept in retail comes along it sort of displaces the old concept. Which makes retail very difficult to invest in. At one stage it was, you know, you needed to have your suit; the first department store sort of blew away anything else that was smaller, that you could walk inside and sort of go through this. And then the department store needed to be close to a tram stop. If you’re further down the street, you kind of missed out on those dollars.

And so as the way that we have shopped has evolved, the marketplace has had to evolve too. Now we do a lot of shopping online and Amazon’s a huge beneficiary of that. I think that in the process of that move, everybody sold off all retail really hard. Everything has been thrown out. And for good reason, a lot of those have turned out to be not able to compete with Amazon. For whatever reason.

There are some though that have managed to compete. So I think Walmart competes really well with Amazon in their own niches. Target competes quite well with Amazon. And I think Best Buy competes well with Amazon for the things that it does. And so basically, it’s really not much more complicated than that. I think that it’s got the balance sheet to get through. I think that it is effectively competing with Amazon. And I just think it’s cheap. It’s cheap where it is when I bought. So that’s a fairly new acquisition in the fund. I think that might be one that we picked up…we’ve either picked it up this quarter or the preceding quarter.

Matt Cochrane: And they, I know this goes back a few years, but they did such a magnificent job. I mean, it looked like they were about to be left for dead like five years ago. And shifting to e-commerce in and managing that. I mean, it’s almost like the textbook case for any other brick and mortar retailers: how to make that shift.

Tobias Carlisle: Right.

[37:22] Matt Cochrane: They did a fantastic job there. One of your shorts now is Workday. And this is probably a company that maybe even on some of our listeners own. We have not recommended it. But, you look at this, and at first glance, it’s a SaaS stock. So it’s growing revenue by over 20%. SaaS, Software as a Service, human capital management software, mostly. It’s growing revenue by over 20%. It’s a sticky platform, so it keeps its customers around it. If you just looked at the balance sheet real quick, it has $2.6 billion cash and cash equivalents on it.

So why did you short this company?

Tobias Carlisle: The problem for Workday, I think, is the share based compensation. I think they have an enormous issuance of share based compensation.

So there are lots of sort of statistical measures built into the way that I look at these things. And one of them is share issuance. So, historically what has happened is that companies that buy back stock tend to generate returns in excess over the market return of about four and a half percent a year. Companies that issue a lot of stock tend to underperform the market by about two and a half percent a year.

So that margin is about 7% between the best issuers or the biggest issuers and the best buyers back; the best repurchasers.

That is built into my model. And so what that does is it pushes companies that issue a lot of stock and that then possess other criteria that I don’t necessarily want to have in a portfolio. Now it’s entirely possible, because the shorts tend to be much shorter term. So it’s entirely possible that something like Workday… The short book, I don’t really know what the short book’s going to look like from quarter to quarter. Because it’s very dependent on what is going on over the preceding 12 months for that portfolio. The short portfolio has not done well since the bounce in the market. It’s done better than the market, so it’s been a painful short period of time.

I think that for many of these companies, they’re being valued on a basis that they’re more mature than they actually are. And I think that some of them are going to take a long time to grow into their valuations.

I think that Workday is one that has outstripped its intrinsic value. Plus, the share issuance means that if you’re a holder you’re being diluted all the time. And so you actually own even less of that intrinsic value then. And certainly in five or 10 years time. Having said that, I’m going to get about half of the shorts wrong in any period of time. Any given quarter, it can be the whole book. And it just depends. The reason I have the shorts in the book is as the spread closes, which it typically does, you can make a little bit of money in any given quarter or over time. And then, in times like the first quarter, where the market falls over very substantially, the shorts provide some ballast to the long book because they tend to go down more than the market.

So that’s basically the strategy. So the shorts sort of, I don’t have anything necessarily against any given name that’s in there. I think I have had Tesla in the past. And Tesla can feel a little bit personal because I think Tesla’s just a plain old metal bender.

Matt Cochrane: Right, right.

Tobias Carlisle: Yeah. Valued like it’s software as a service.

[40:53] Matt Cochrane: I wasn’t even gonna ask you about Tesla. But I do have you on, and I do want to ask you about Berkshire. You do have a long position in it. I know you obviously listen to Buffett recently. What do you think? Has he lost his touch? Or, is it a case of Berkshire just being too large? But you have a long position. So I guess, why do you have a long position at Berkshire?

Tobias Carlisle: Well, I think the thing that I’m always thinking about — the first thought that I always have — is how am I going to lose in this position? What’s the downside scenario here? And I think that for Berkshire, the downside scenario is higher than where it’s trading right now. This is one of the strange things about Berkshire.

It definitely suffers by the fact that it’s a $400 and something billion dollar company. It suffers because it’s an insurer. And it suffers because it’s a conglomerate. And all of those things make it difficult to value or it’s hard to see how much upside it’s got from that point.

On the plus side, it’s got probably the best balance sheet of any company listed on the stock market. It’s probably run by the greatest investor of this or several other generations maybe ever. And the businesses inside it earn enormous returns on invested capital. It throws off enormous cash flow back to head office, which is then redeployed by this legendary investor. I don’t think you necessarily need for him to be there. He’s 90 years old. I hope he’s around for a lot longer, but that’s a consideration one must consider. And he’s got other guys in there, I think, who are also very good investors to take over the reins if, God forbid, anything should happen to him. But I think it’s mispriced. It’s asymmetric. There’s almost no downside. There’s pretty solid upside. I think it can compound from here, from my purchase price, between 13 to 15% a year for like five to 10 years. So I think it’s incredibly undervalued and incredibly safe. And I’m more than happy to hold it.

Matt Cochrane: Were you surprised they didn’t buy back more stock when they reported?

Tobias Carlisle: Yeah, I was. And hearing Buffett’s explanation for it made my blood absolutely run cold. Not because I think that it’s passed him by. But because I think that the underlying damage to the economy is probably a lot worse than most people realize.

And certainly Buffett has a good overview because he’s got the railway. He’s insuring all of these businesses, he sells to a lot of businesses. So he’s got this very good overview of what’s happening. And it’s certainly anytime I’ve spoken to anybody who’s in private equity or who works with small and medium enterprise businesses, works with small business, or who’s trying to acquire the small businesses like Brent Beshore or any of those sort of gentlemen. You know, they are quite somber to negative on what we’ve gone through. And so I suspect that we haven’t seen the end of this thing. We haven’t seen all of the dead bodies float to the surface yet. I kind of think we’re like big wave riding over a coral reef. And we’re not kind of out through the breakers yet. Need to see where we get to. And I think I’m sort of gathering that from Buffett and talking to these guys. I don’t have any personal knowledge of this stuff. I’m just reporting what I think.

Matt Cochrane: Do you think it’s more he sees like long term lasting or longer term lasting economic damage? You think he’s worried at all about insurance liabilities they might have, with all their insurance companies? Or do you really think it’s, like he’s a little bearish on the economic outlook?

Tobias Carlisle: I don’t think that it’s because he’s worried necessarily about business that they’ve written. You know, business interruption type insurance. I don’t think he’s worried about that. I think that — and this is not my idea; this is just I’ve seen this idea discussed — because they do the supercat writings. So, you know, what happens if a hurricane comes up through New York, while New York suffering from Coronavirus. That would be, at the time, that could have been incredibly damaging to New York and probably that would have cost a lot of money for Berkshire. I don’t think that’s happened. I think New York’s come out the other side of that. The threat has probably gone away.

I just think he runs it so that, it’s sort of a thesis that I have too. I always try to take the zero off the table. I don’t want to hold anything that could be zero. So that sort of means that sometimes you take away some of the things that have more upside too. Because anytime you invest, you’ve got multiple potential paths that we can take. And you only live through one path. But there are others that you could take and you want to make sure that in the worst case scenario, you still survive to invest another day at the other side. I think that’s what he’s doing. And I like that.

[46:02] Matt Cochrane: Right. Sure. Toby, just one last question before we wrap this conversation up. You know, one thing our 7investing advisors have been talking a lot about lately on Twitter and our podcast is teaching our kids about personal finance and investing. I know you’re a parent. What tips would you give fellow parents about educating their children on financial matters?

Tobias Carlisle: Yeah, that’s a good question.

Matt Cochrane: Is your kid gonna know what a “net net” is by the time they graduate middle school? [laughs] Or like, I’m sorry I interrupted, but what wisdom can you impart?

Tobias Carlisle: No, no, you’re fine. I was just thinking whether I’d teach them about a net net or not. I might not give them that pain. [laughs]

It’s something I think about a lot. I’d really don’t have a great answer for it, just because my kids are so young at the moment. They’re six, five, and two. First of all, you need to learn to save. Once you save, then you learn to invest. And when you learn to invest, I think think that it would be good to be taught about investment as “This is a business. Businesses generate returns over time. Your idea is to try and buy it at a discount to that and learn over time.”

So I think even just owning a little bit of stock and watching how it wiggles around is really helpful. I would love my kids to come and do what I do. Because I love doing what I do. It’s fun. I’m fully engaged when I do it. But I’m wary that anytime any parent tries to push their kid to do something, they rebel from that. So I’m trying to find a really light touch way of doing it. So if anybody’s got any good suggestions, then by all means, let me know.

Matt Cochrane: Right, right. Well, that’s great. Thank you so much for sharing. Let’s wrap up our conversation there. Toby, where can people find you if they’re interested in learning more about Acquirer’s Funds and your other work?

Tobias Carlisle: So I have a website called Acquirers Multiple which has the screens for the stocks that we’re talking about. And we put up posts, we put up blog posts, all the podcasts, anything that we find that’s interesting goes up there. Acquires Funds is my firm. And I have a really simple post on the front page just describing the kind of investing that we do. And then acquirersfund.com is the fund website.

And the ticker for the fund is “ZIG”. It’s long short, deep value US equities. Only 30 positions long to about 100 or 130% of the portfolio. 30 positions short to about 30% of the portfolio, if we can find all 30 positions. Over time, I hope that it works. It’s only been live for about a year. So we’ve only got a short trading history. We’ve underperformed so far. It’s a little bit disappointing, but it’s sort of been the trend for value. I think the opportunity for value, deep value in particular, is very good at the moment. And so at some stage that turns around. And I hope we start outperforming

Matt Cochrane: Oh, that’s great. And you’re on Twitter too. “@Greenbackd”via Twitter.

Tobias Carlisle: Yes, I spend all day long on Twitter. I’ve got a terrible Twitter addiction. @greenbackd.

Matt Cochrane: Is it more entertainment for you? Or is it more like investing assistance?

Tobias Carlisle: I think it’s a phenomenal tool. I think it’s the best news feed you can possibly get. And then mixed into the news feed are some of the smartest guys. And I follow you on Twitter among other people. Some of the smartest investors around that give you that almost immediate take on something that’s happening. So this is what this smart investor who I respect thinks about this thing that I just saw happen. And then four hours later it turns up on CNN or MSNBC or CNBC or something like that. But I already saw the event, saw what all the smartest guys think about it. And it’s a great way to promote. And you can engage with just about anybody. I’ve talked to very well known investors all the time on that thing, that I would just have had no way of getting in contact with because they’re there and they’re happy to chat.

Matt Cochrane: It’s phenomenal and I share your your Twitter addiction.

Tobias Carlisle: You’re a good Twitterer! I enjoy yours.

Matt Cochrane: I enjoy yours too. Tobias Carlisle, ladies and gentlemen. Thank you so much for coming on today and discussing investing with us. Again. I’m Matthew Cochrane, lead advisor with 7investing and we’re here to empower you to invest in your future. Have a great day, everyone!

Simon recently spoke with a $35 billion global asset manager about how they're navigating the market volatility. The key takeaways are to think long term, tune out the noise...

Anirban and Matthew were joined by Alex Morris, creator of the TSOH Investment Research Service, to look at seven former market darlings that have taken severe dives from...

On episode 5 of No Limit, Krzysztof won’t let politics stand in the way of a good discussion - among many other topics!