Free Preview

Is the stock of this digital advertising innovator significantly overpriced? We dug deep and let the numbers do the talking.

See my previous Discounted Cash Flows last month for Coupang and Rocket Lab.

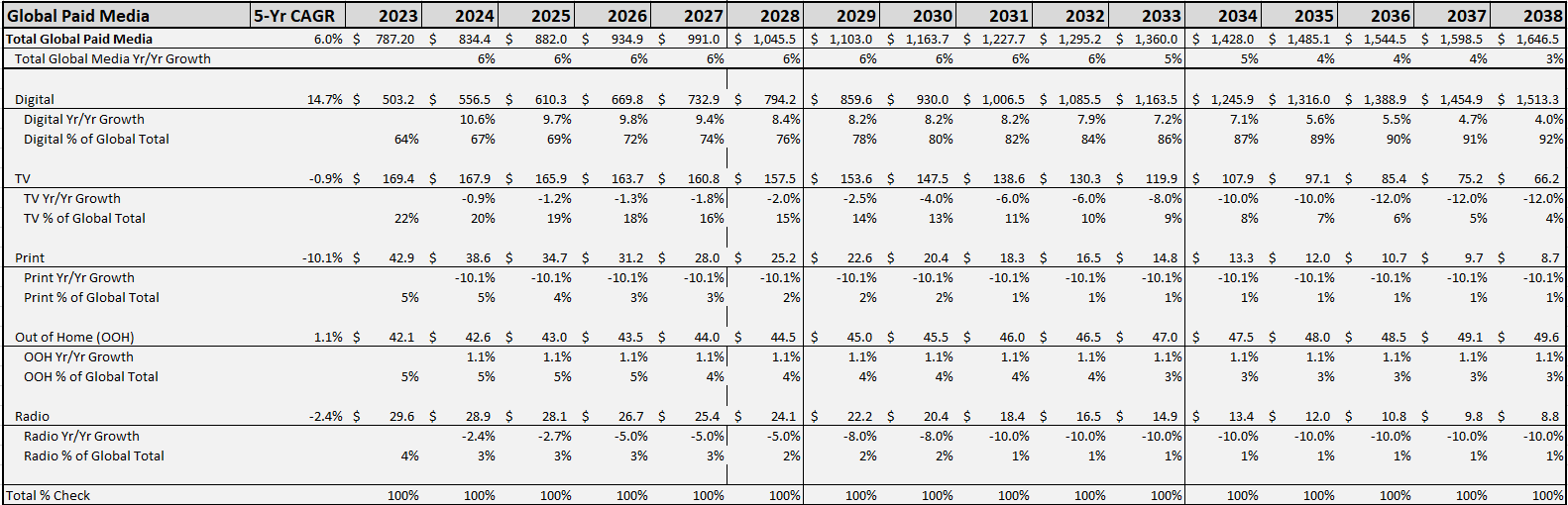

Digital advertising is an industry that moves at the speed of money.

Ad budgets that used to go to print newspapers, radio, and linear television are transitioning to internet display ads, podcasts, and streaming channels.

Consumers preferences and technology changes quite have a say as well. Privacy concerns about Big Tech hoarding user data have led to regulations and lawsuits, while the deprecation of the third-party cookie has large tech companies searching for a more user-friendly identifier to help place personalized advertisements.

One innovative company who’s made a name for itself in the digital world is The Trade Desk (Nasdaq: TTD).

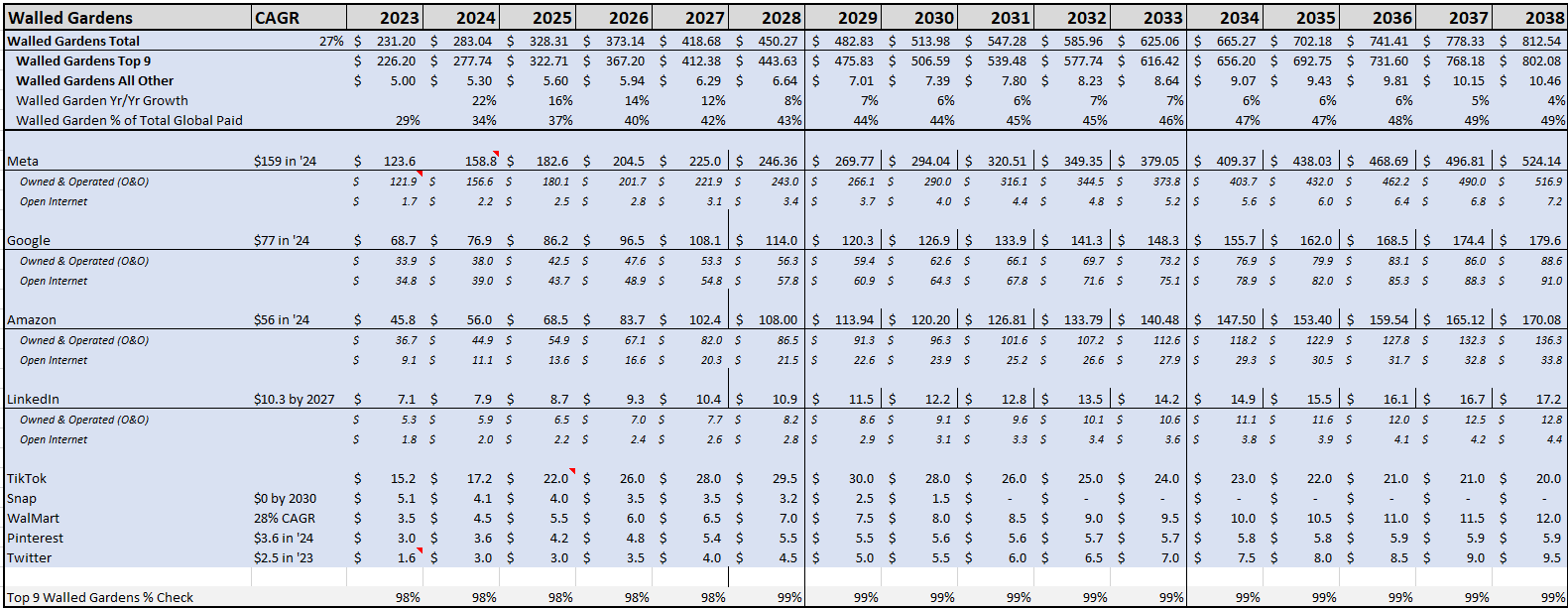

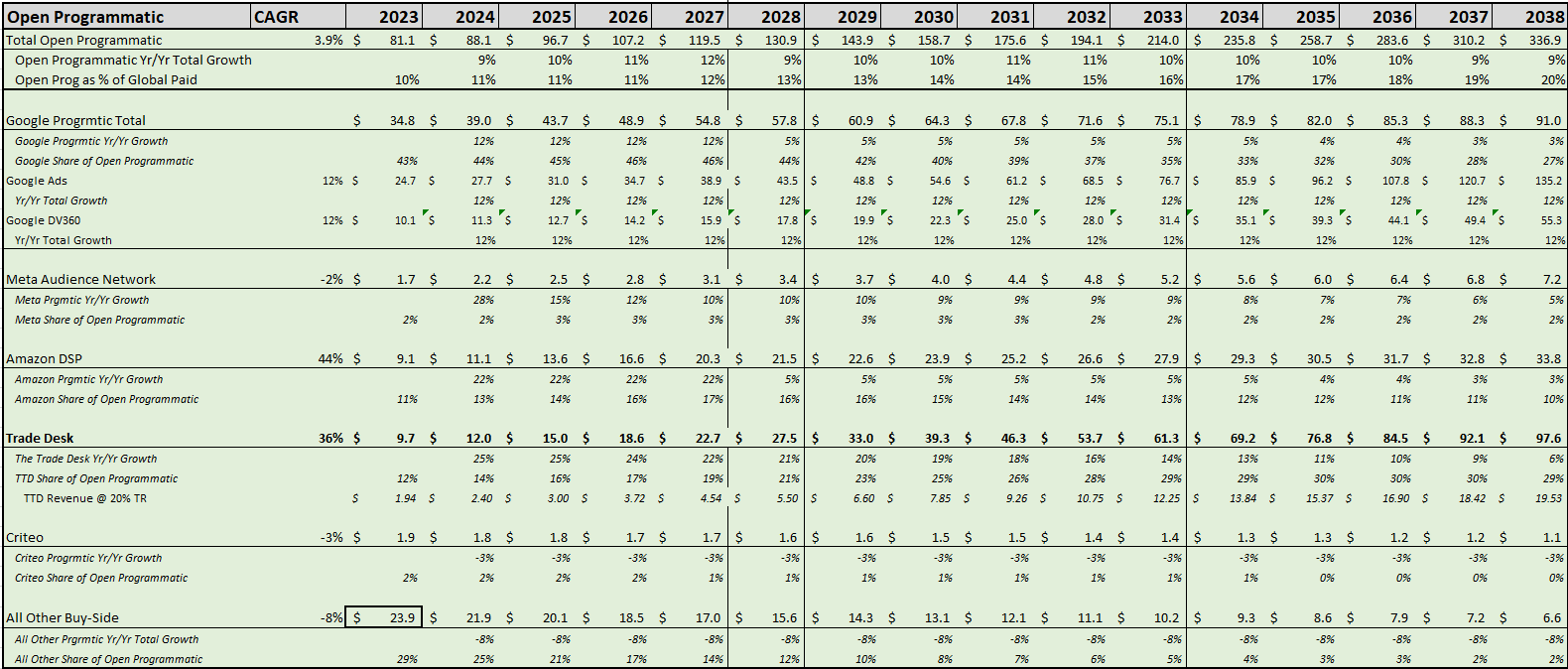

As a demand-side programmatic platform, it helps large advertisers place the right ads in front of the right people on the right devices. “Programmatic” means that there are fine-tuned AI algorithms winning bids and placing ads in less than half a second, without requiring any human oversight.

Many investors are already quite familiar with The Trade Desk, whose stock has increased 26-fold since its 2016 initial public offering. Even in this fast-moving industry, it has been a perpetual winner — always finding ways to stay ahead of the competition and outperform even lofty expectations.

Yet there’s also another word that often get thrown into the discussion whenever we’re talking about The Trade Desk. And that word is “overpriced”.

Critics and bears are quick to point out that even though this is a fantastic company, its stock now sells at a Price/Sales multiple of more than 20x and a Price/Earnings multiple of more than 200x.

Those are rich multiples to pay, even for the best-in-breed. Even incredible companies can turn out to be lousy investments if we vastly overpay for their shares.

So is all of the good news already fully priced in to The Trade Desk’s stock? What’s a reasonable price for us to pay for TTD shares?

Introducing the Discounted Cash Flow Valuation

To answer those questions, we need to bring in a useful new tool.

Doing so involves a discounted cash flow analysis. A DCF estimates future free cash flows — i.e. the cash that a company generates after paying all of its operational and capital costs — and then discounts them to the present day. The end result is a fair value, representing what that shares are worth for investors to pay to be the owners of those future free cash flows.

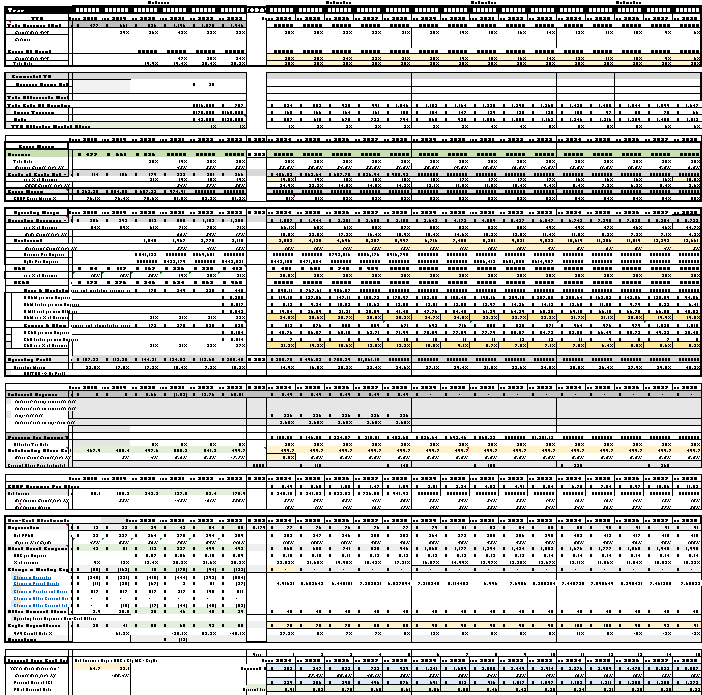

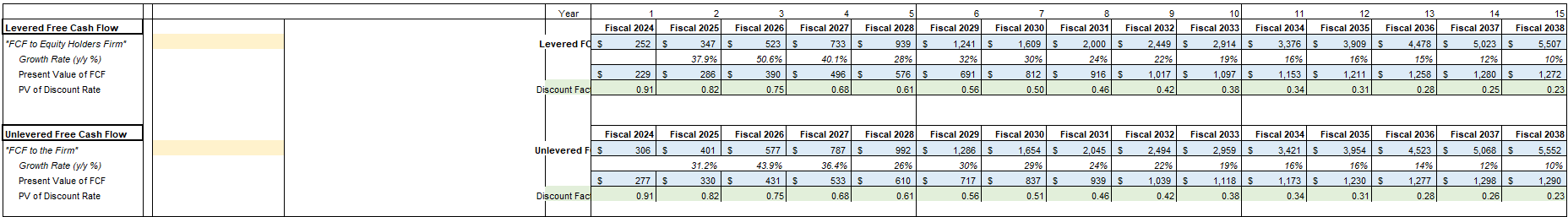

DCF models are the primary way that Wall Street firms set price targets for stocks. They’re not simple and are a huge time commitment to do properly. Here’s a quick look at the financial magic and voodoo that’s being run in the models.

This past month, I’ve published DCFs on small-satellite launch provider Rocket Lab (Nasdaq: RKLB) and on South Korean e-commerce leader Coupang (NYSE: CPNG). I came to the conclusion that Coupang is worth $19.25 and appears fairly valued. Yet I also concluded that Rocket Lab was worth $22 per share and appears to be significantly undervalued.

Just as before, I build my DCF models from scratch. I don’t look at other reports or price target estimates because I want to avoid any bias. My inputs are purposely conservative, to result in a price target that investors should be very comfortable in paying. Using conservative assumptions will ultimately result in a lower price target, though certain drivers could provide significant additional upside if they come to fruition.

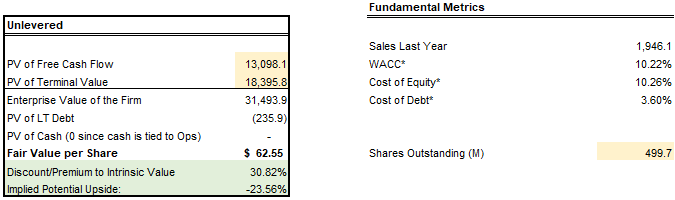

So all of that said, let’s jump right to the punchline. I believe The Trade Desk’s stock is worth $62.55 per share.

The stock is trading hands at $82 this morning, which suggests that shares are quite a bit overvalued. But as I’ll discuss in the following sections, The Trade Desk innovates quickly and tends to find ways to outperform expectations.

And before we get into the trenches of my entire model, I’d like to quickly promote our 7investing service.

This article contains institutional-grade research and is only possible to be published for free because of our generous paying subscribers. If you find value in this article, please consider sharing it on social media to help our brand awareness or joining 7investing for just $1 to get similar research reports on all of our official stock recommendations.

Your 7investing membership also includes complete access to our Community Forum, where our advisors and other investors are discussing stocks on a 24/7 basis.

Now, let’s get into the details of my Trade Desk DCF.

Inputs and Assumptions

Revenues

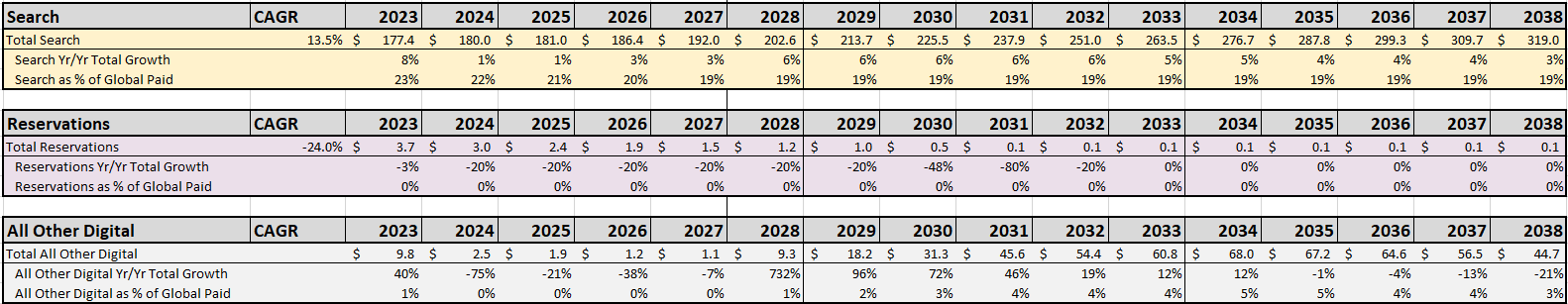

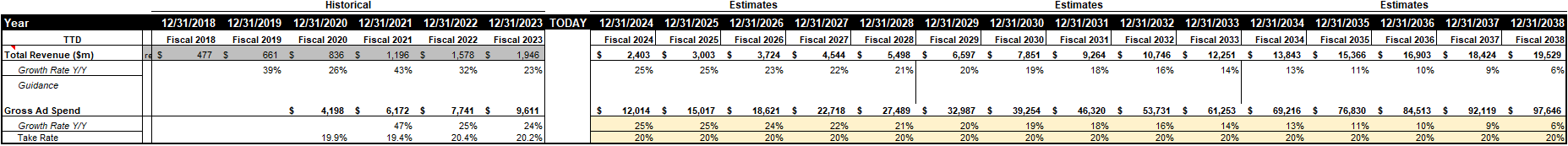

As a demand-side platform (DSP), The Trade Desk provides a way for advertisers to place their ads within others’ websites, podcasts, and connected TV streaming channels. The company takes a portion of the gross ad spend — knows as the “take rate” — in exchange for placing the ads and providing the analytics.

Costs of Goods Sold

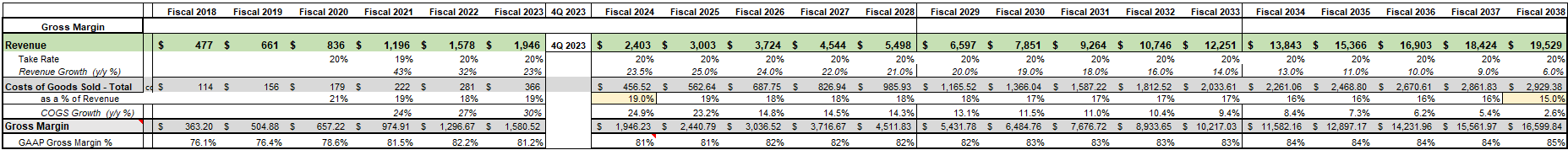

The Trade Desk’s costs of goods sold are primarily the computing infrastructure and support required for the massive amount of impressions they’re serving and data they’re processing. This is something that can moderately scale over time, where revenues outpace the necessary costs.

Gross margin was 81% last year and I expect that will gradually improve to 85% over the next 15 years.

Operating Expenses

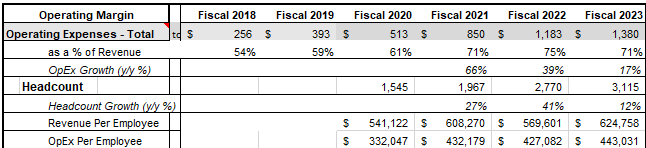

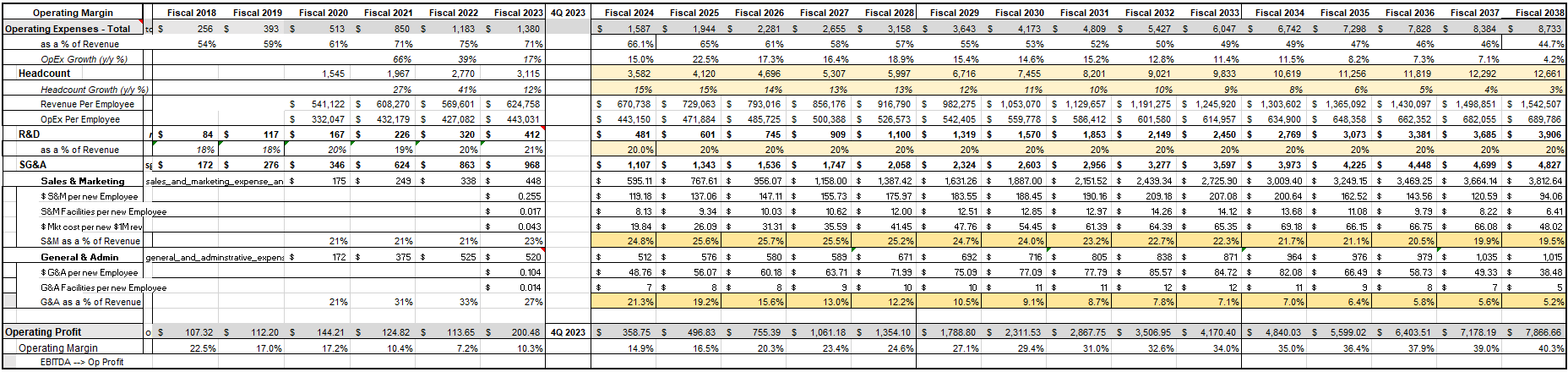

With as much as The Trade Desk talks about international expansion, I don’t expect the hiring to slow down any time soon. I’m modeling for headcount to expand another 15% in 2024 and then taper down slowly over time. I am estimating the company will have 12,661 employees by 2038.

This is an extremely scalable platform; i.e. there’s not as much hand-holding required for customers to spend more money on advertising. I expect Revenue per Employee will increase to $1.5 million by 2038 and Operating Expenses per Employee will increase to $689,000 (including all stock-based compensation).

As I’ll show in the next section, that’s $689,000 per employee isn’t exactly evenly distributed. It’s highly-skewed by the massive stock incentive plan of Jeff Green and the company’s top-brass executives.

Regarding how the operating expenses are categorized:

- The Trade Desk has historically kept R&D constant at 20% of total revenue. I believe that’s a specific managerial target, so I’ve kept it constant throughout the forecast.

- Sales, General, and Administrative includes stock-based comp, facilities costs, and marketing budgets. I took the increase in each of these during 2023 and divided it by the new employees hired, to estimate the Opex burden per new employee.

SG&A as a percentage of revenue declines from 50% in 2023 to just 25% in 2038, while GAAP operating margin increases from 10% in 2023 to 40% in 2038.

Green’s Incentive Plan and Stock-Based Compensation

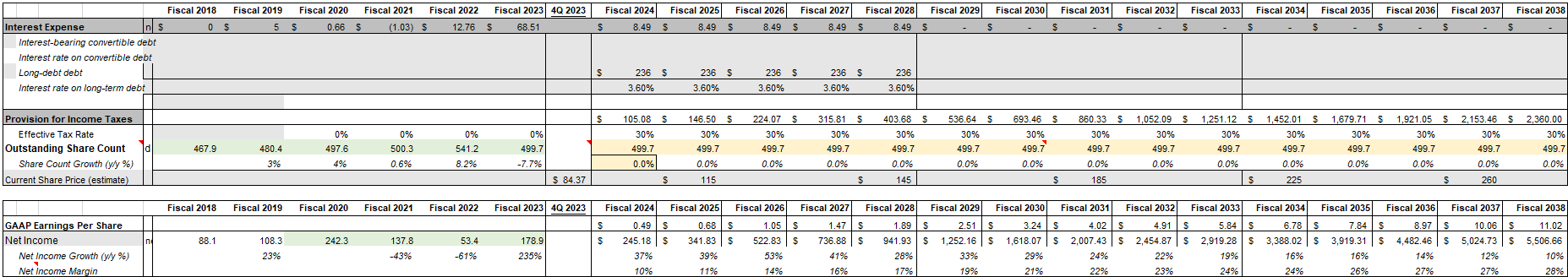

Another important consideration is that The Trade Desk is offsetting any dilution by immediately repurchasing shares issued as stock-based compensation.

Its share count has remained at around 500 million for the past three years. They’ve done that, even after issues stock-based comp, by authorizing repurchases of those new shares that are issued. They have a $700 million buyback authorized and ready to deploy, to offset any shares that might be issued this year.

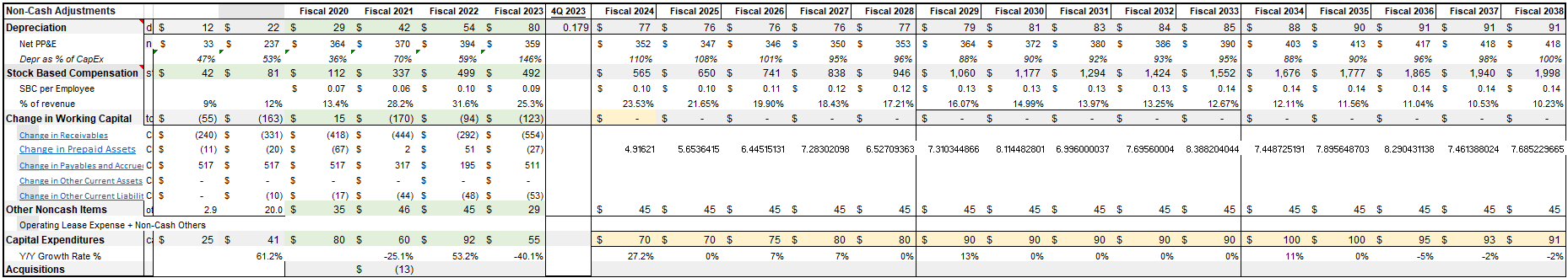

Typically when companies pay stock-based comp, we just treat it as a non-cash expense. It’s added back to the cash flows, but we also increase the overall share count accordingly.

But because The Trade Desk is buying back all of its newly-issued shares, that means SBC is really more of a cash expense. It’s essentially the company paying cash to the employees/executives, in an equivalent value of what the shares are worth.

So this cash expense will reduce free cash flow in future years. I’m holding the outstanding share count constant at 499.7 million and am not adding back the SBC amounts when making the free cash flow calculations.

Non-Cash Adjustments and Other Assumptions

A few more odds-and-ends:

- TTD has a capital lease agreement that I’m treating as long-term debt. It’s estimated at 3.6% cost of debt and a five-year term; fully repaid by 2029.

- I believe the share price will hits the Green comp plan triggers every third year. $115 per share by 2025, $145 by 2028, etc.

- CapEx is tied to international expansion and infrastructure, increasing from $60 million in 2021 to $92 million in 2022, but then falling to $55 million in 2023. I’ve estimated $70 million in CapEx for 2024, rising to $100 million by 2034 and then settling back to maintenance-only CapEx by 2038.

- No acquisitions and no long-term debt borrowing. I believe the company’s expansion will be organically funded.

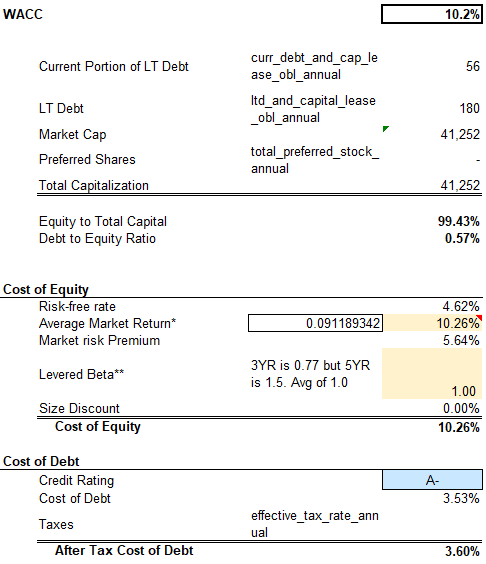

I used a discount rate of 10.2%. The Trade Desk has no long-term debt and is almost fully-funded by equity. I calculated the WACC using an average market return of 10.3% and a Beta of 1.0 (The Trade Desk’s 3-year Beta is 0.77 and its 5-year Beta is 1.5).

I used a 15 year growth window and assumed a terminal growth rate of 3% for the cash flows beyond 2038. I then discounted all of those future cash flow back to the present.

So What’s The Trade Desk Worth?

So now that we’ve gone through all of the inputs, let’s circle back to that punchline. I estimate The Trade Desk’s present equity value is worth $62.55 per share. This represents the fair value of what The Trade Desk’s shares are worth today.

The Trade Desk’s current stock price of around $82 suggests that shares are a bit overvalued. That’s pretty much been par for the course though, as this company always feels expensive and yet always tends to outperform expectations.

One Ace it has up its sleeve could be its OpenPath initiative, which allows large advertisers to directly place ads into open inventory offered by large publishers like Disney. This would bypass the traditional real-time bidding auctions entirely, saving advertisers from inefficient/wasted spending and rewarding The Trade Desk with a larger take rate of their overall budget.

Another upside to this $62 price target could come from faster than expected revenue growth. The Trade Desk could more aggressively take share from other buy-side platforms, or charge higher than 20% take rates due to placing premium ad formats like videos into streaming channels. Lastly, it could require fewer employees and operating costs in order to achieve the growth projections of the model.

All of this is just the beginning. DCFs evolve over time and I’ll be updating my model accordingly to keep up with the digital ad industry’s ongoing changes.

I’ll be sharing all of those updates on our 7investing Community Forum. And I’d love to invite you to join in on the conversation.

Want to discuss Simon’s assumptions on The Trade Desk directly with him and with other investors?

“Thanks a lot, Simon, for all the work. It would have surprised me if the stock was fairly valued or undervalued given it’s P/S ratio above 20 and “relatively modest” growth for that multiple. The discussion on SBC and the headcount that you provided were quite interesting. I don’t have a full position yet but am not building up at these prices.”

“Thanks for doing this. So much work goes into these models, that this kind of financial calculus on individual stocks is worth the price of admission by itself.”

“Thanks a lot for working through this publicly, really an excellent exercise.”

This is a great company but an average stock at this moment in time. If you build out a position at these prices it will likely take great execution and time to outperform the market. It is a tremendous company so when the stock experiences significant corrections I add trade positions. But I trim them back away upon recovery.

“Thanks for the modeling!”

“Thanks for the hard-work, 7innovator! Would be interesting to see if this impacts the conviction rating..”

These are actual posts from actual members in our Community Forum. Click here to join 7investing’s Community Forum today!