Apple generated over $110 billion in free cash flow during its fiscal 2022, up 20% year-over-year. Anirban reviews the company's recently reported Q4 2022 earnings and discusses the road ahead...

November 4, 2022

This earnings season has been brutal for big technology companies. Microsoft (NASDAQ: MSFT), Alphabet (NASDAQ: GOOG), and Amazon (NASDAQ: AMZN) saw their shares shellacked following their earnings releases.

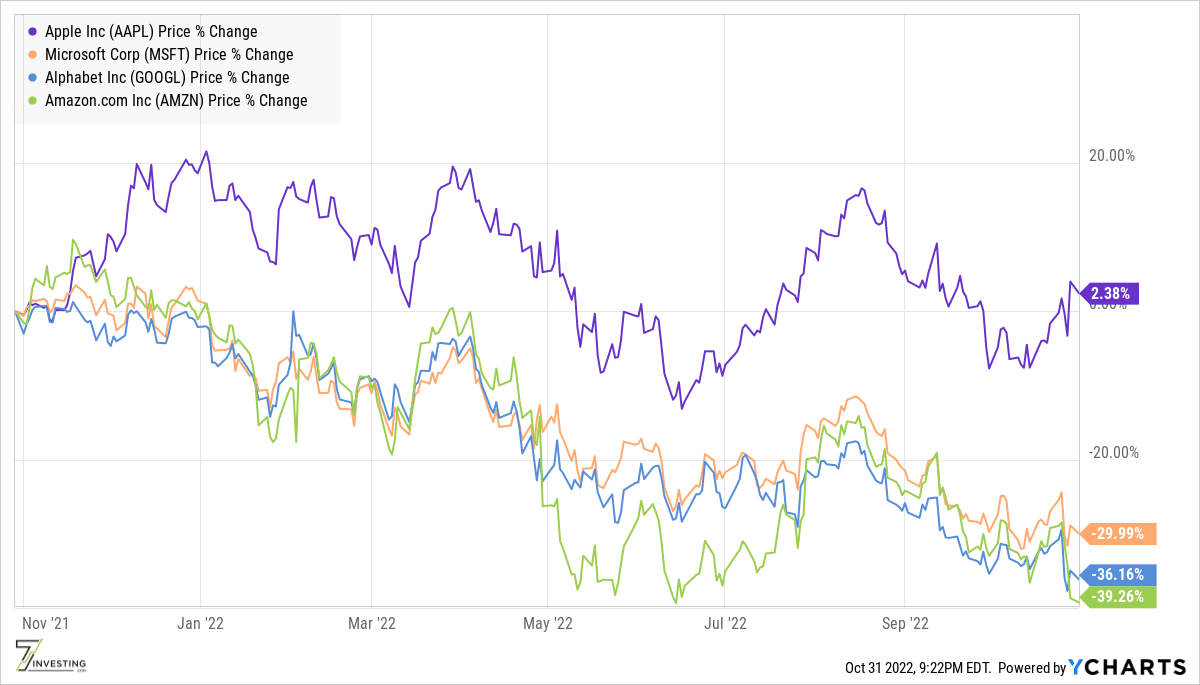

However, Apple (NASDAQ: AAPL) has escaped unscathed, with the stock price rising more than 5% upon reporting. Widen the horizon to the past year, Apple has been like the Rock of Gibraltar, while the others have seen their valuations walloped.

Performance of Apple, Microsoft, Amazon, and Alphabet over the past 1-year.

For a long time, and perhaps even today, Apple has been considered a highly cyclical business that ebbs and flows with the broader economic cycle. It has also been thought of as a smartphone-only business that has saturated its core.

On the other hand, Microsoft is thought of as more resilient because of its enterprise roots. Then there’s Alphabet’s Google search, which is considered resilient and perhaps has a much longer runway for growth.

But over time, Apple’s management team has shown us the value of careful cost management and the incredible value of thinking long-term.

And thus, we have Apple finishing fiscal 2022 in style, reporting Q4 2022 revenue of $90.1 billion, a new record, up 8% year over year. Those results may not appear impressive at first glance, but they come on the back of a 29% year-over-year increase in Q4 2021, with a foreign exchange headwind of 6%. In other words, Apple would have grown double digits sans those currency headwinds.

Impressively, free cash flow for fiscal 2022 was $112 billion, up 20% year-over-year. That growth at scale is impressive. And you can contrast that with Meta‘s (NASDAQ: META) apocalyptic quarter, where free cash flow production imploded!

Apple is meticulous with its capital expenditures and returns excess cash to shareholders at a furious pace. This quarter, shareholders were paid $3.7 billion in dividends, and $25.2 billion was devoted to repurchasing 160 million shares. Since the start of Apple’s share buyback program, the company has spent over $550 billion repurchasing shares at an average price of $47.

But share buybacks and fiscal 2022 free cash flow generation are now in the rearview mirror. So what did management say that makes the market optimistic about the company’s future?

First, iPhone demand appears to be solid, contrary to various scuttlebutts suggesting a weakening of demand. As I have previously noted, what matters is the aggregate iPhone sales rather than whether one model has lower demand than expectations. In the September quarter, iPhone sales grew 10% year-over-year to $42.6 billion, a record, despite significant foreign exchange headwinds. Demand continues to be robust in most geographies, and “performance was particularly impressive in several large emerging markets,” including a new all-time record in India. Tim Cook, in response to an analyst’s question, said:

Customer demand was strong and better than we anticipated that it would be. And keep in mind that this is on top of a fiscal year of ’21 that had iPhone revenue grow by 39%, and so it’s a tough comparison as well. And so we were happy with it.

Cook went on to add:

…since the beginning, we’ve been constrained on the 14 Pro and the 14 Pro Max and we continue to be constrained today.

In other words, iPhone demand remains robust. Add an all-time record for the Mac and solid growth for Wearables, Home, and Accessories, and we have an all-round reliable performance. It means Apple’s ecosystem continues to strengthen, which augurs well for the company’s future. CFO Luca Maestri amplified this point when he talked about Apple’s subscription business:

We now have more than 900 million paid subscriptions across the Services on our platform, up more than 155 million during the last 12 months alone and double what we had just 3 years ago.

The Apple engine is moving full steam ahead. The company’s qualitative guidance for Q1 2023 calls for growth slowing relative to Q4 2022’s 8%. Maestri expects foreign exchange headwinds to have a 10% negative year-over-year impact. So, if Apple delivers 5% growth, in currency-neutral terms, it translates into mid-teens. That means plenty more cash generation, a nice dollop of dividends, and ample buybacks.

Apple’s disciplined cost management shows us how a company can innovate without spending like a drunken sailor. The company’s Services business generates revenue like a Fortune 50 company. Competitors would kill to have a business like the Apple Watch, iPad, or Mac. They might be giddy with performance that’s half of Apple’s.

With an ever-expanding installed base of loyal customers, Apple remains best positioned to usher in the next computing platform, whether augmented or virtual reality or something completely different.

Already a 7investing member? Log in here.