While 18 companies have crossed that valuation milestone, only one has consistently outperformed the S&P 500 after.

September 23, 2021

One of the most important lessons I’ve learned as an investor is also one of the most counterintuitive: The most important industries, companies, and technologies don’t always make the best investments.

There may be no better illustration of this than the lousy performance of the world’s largest drug developers. Although 18 pharmaceutical or biopharma companies have achieved a market valuation of at least $100 billion, only one has consistently outperformed the S&P 500 from the day it reached that milestone — and half of that company’s revenue is generated outside of drug products.

How can this be? Surely, the industry is more innovative than ever. Patients have safer and more effective treatments today than 10 years ago. Even better treatments are on the way. Drug discovery today increasingly leans on artificial intelligence algorithms to scan petabytes of chemical space. In a world where multiple tech companies have grown to $1 trillion market valuations, how could a mere $100 billion market cap create a gravitational pull on drug developers?

There are several reasons for the relative underperformance of large drug developers, but the primary factor is the ability of these world-renowned businesses to grow revenue in never-ending replacement cycles.

My historical database counts 18 drug developers that have ever reached a $100 billion market valuation. To my knowledge, this is the first time these data have ever been compiled.

Merck became the first to reach this mark in 1997. The next four companies to join the exclusive club — Pfizer, GlaxoSmithKline, Bristol Myers Squibb, and Johnson & Johnson — did so during a 62-day period in 1998. Including Eli Lilly (1999), a total of six companies reached a $100 billion market valuation during the Dot Com boom more frequently associated with tech stocks.

The last company to eclipse a $100 billion market valuation was BioNTech in August 2021, less than one month after Moderna emphatically stamped its name in the history books. Prior to these mRNA innovators, the last company to cross the coveted threshold was AbbVie on Halloween 2014. That might be a fitting data point for this spooky dataset.

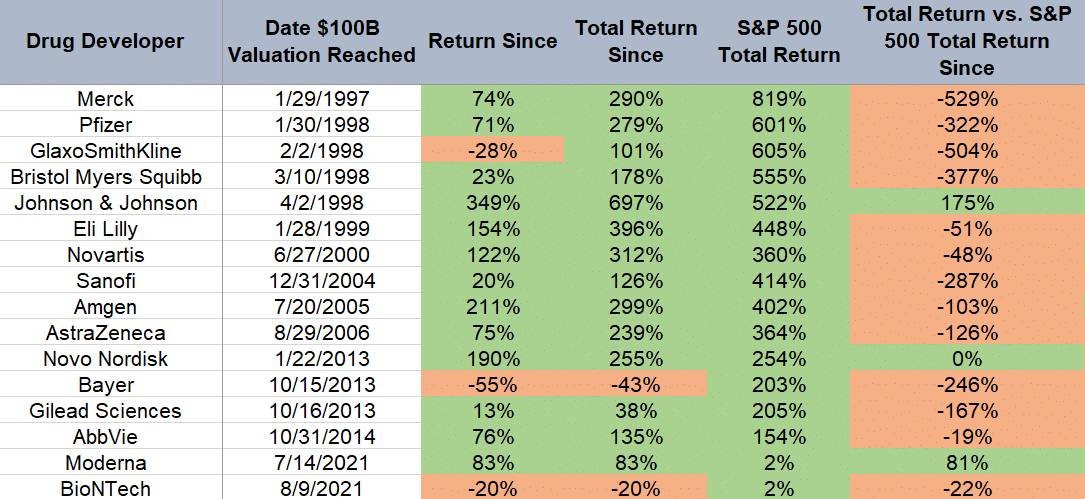

Reliable historical data don’t exist for Genentech and Roche. Of the 16 remaining drug developers, only Johnson & Johnson has consistently outperformed the S&P 500 when dividends are included since surpassing a $100 billion market valuation — and only half of its revenue is generated from drug products. Most of the remaining pharmaceutical titans aren’t even close to outperforming the index. Consider how historical total return data compare for the world’s largest drug developers vs. the benchmark with closing prices as of September 17, 2021:

Data Source: Compiled by author. Total returns = price performance plus dividends. Data exclude Genentech and Roche, see note at the bottom of the article.

The S&P 500 has been on a historic run since The Federal Reserve began assisting financial markets during the coronavirus pandemic. If we track the same data through the last day of 2019 to exclude the effects of monetary policy and the early impacts of the pandemic, then Novartis (outperforming by 108%) and Amgen (outperforming by 62%) join Johnson & Johnson in the list of outperformers. However, Novo Nordisk (underperforming by 56%) falls from grace in the adjusted timeframe. That means only three of 16 companies with these criteria (at the time) were outperforming the benchmark — still pretty lousy.

Moderna has also outperformed the S&P 500 by a considerable margin since eclipsing a $100 billion market valuation. What might investors expect going forward? It’s a bit complicated, but history certainly isn’t kind.

The pandemic star has been included in the dataset for 67 days. All other companies in the list above (excluding BioNTech) have data for at least 2,515 days and for as long as 8,571 days. Many companies rode momentum after reaching a $100 billion market valuation to outperform the index in similarly short periods of time but fell behind in the long run. For example, Gilead Sciences reached its peak total return on June 13, 2015 — almost two years after reaching the valuation milestone — and was hammering the S&P 500 by 63% on that date. Since the peak, shares are underperforming the benchmark by 165%.

It all comes down to revenue.

Climbing to a $100 billion market valuation is the exciting part. In most cases, a drug developer stamps its entry into the club by owning one of the best-selling drug products in the world. However, all good things must end — and they tend to end much more quickly in this industry. From Lipitor (Pfizer) to Humira (AbbVie), drug products eventually lose exclusivity and face a horde of generic or biosimilar competition. At that point, revenue from new drug products is only replacing revenue from drug products in decline.

These replacement cycles are difficult to endure, but what drives lackluster returns for investors is the duration of the cycle. Achieving moderate revenue growth over a decade is generally no longer enough to overtake the tech-driven returns of the S&P 500.

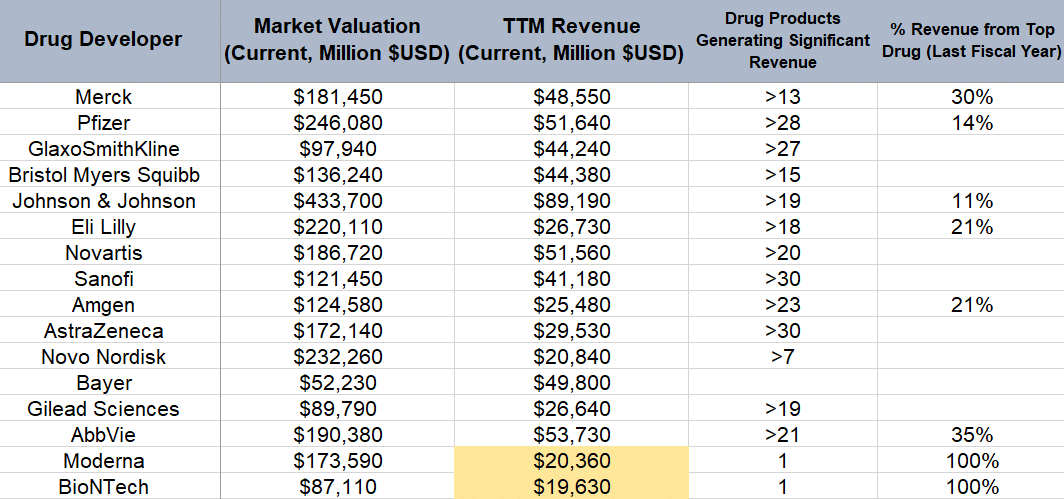

Almost every drug developer valued at $100 billion or greater has over one dozen products generating significant amounts of revenue. This definition varies from company to company, but it generally includes products generating hundreds of millions in annual revenue and blockbuster products generating over $1 billion in annual revenue. Only two companies currently rely on a single product for more than 30% of revenue: Merck (Keytruda, which is on the way up) and AbbVie (Humira, which will be on the way down in 2023).

Consider how the group compares on current market valuation, trailing 12-month revenue as of June 30, 2021, and the number of significant drug products in the portfolio. The revenue data for Moderna and BioNTech include the average analyst estimates for full-year 2021 revenue.

Data Source: Compiled by author. Data exclude Genentech and Roche, see note at the bottom of the article.

The amount of revenue expected to be generated from coronavirus vaccines in 2021, 2022, and perhaps 2023 can be used to justify the market valuations of Moderna and BioNTech. The surge in revenue brings a surge in profits and cash flows, which can be reinvested in the rest of the pipeline for many years to come. Nonetheless, investors must acknowledge the challenges ahead.

Many traditional vaccine developers such as Merck, Sanofi, and AstraZeneca are investing in mRNA tools, suggesting that future products will face more market competition. The therapeutic modality is a no-brainer for infectious disease vaccines, but the best-selling seasonal influenza treatments and vaccines generate a few billion in annual revenue. That alone wouldn’t be enough when Moderna and BioNTech face their first replacement cycle in the next few years — and mRNA influenza vaccines will likely still be in development by then.

mRNA tools will also need to compete with different therapeutic modalities, especially when being developed for cancer indications or genetic diseases. The first clinical trial results for an mRNA vaccine in melanoma were underwhelming compared to other treatments in development. Meanwhile, genetic medicines from gene therapy to base editors represent stiff competition.

As long as the stock market exists there will be a “this time is different” argument to be made. It may actually make sense in this discussion — to an extent. The largest drug developers today built empires by cobbling together one-off successes and acquisitions, which injects more uncertainty when replacement cycles begin. Pfizer owned both Lipitor and Viagra, but the two blockbusters had nothing to do with one another. Although replacement cycles will remain an inevitable part of drug development, technology platforms have the potential to disrupt the underperformance trend for $100 billion companies. These opportunities tend to be concentrated in genetic medicines and technology-enabled drug discovery.

A technology platform powered by mRNA, gene editing, base editing, another emerging genetic medicine tool, or artificial intelligence-powered drug discovery could potentially be deployed across a much broader number of therapeutic areas. Such companies would have larger and more modular pipelines than anything that came before. There are many nuances and technical hurdles to consider.

For example, the approach and technical details that allow mRNA tools to work well in infectious diseases don’t necessarily translate to oncology (different parts of the immune system must be activated) or genetic diseases (delivery to specific tissues is important). Additionally, genetic medicine tools and AI algorithms can be replicated. There will be many companies developing drug candidates based on mRNA or gene-editing tools, while supercomputer-assisted drug discovery could become the default.

But at a high level, investors might expect tomorrow’s largest drug developers to continue expanding well past a $100 billion valuation. There still might be a ceiling — a level at which revenue replacement becomes difficult — but that ceiling could be significantly higher.

For now, investors should acknowledge the historical data demonstrating the lousy performance of the world’s largest drug developers and the importance of replacement cycles. Investors can also entertain the possibility that the newest and next members to the exclusive club could raise the ceiling later this decade, but even that might not be enough to outperform the tech-driven S&P 500 after eclipsing the $100 billion mark.

[* Author Note: The tables above exclude Genentech (acquired by Roche) and Roche (reliable historical data are difficult to find). Roche might be outperforming the S&P 500 since it reached a $100 billion market valuation, but investors would need to include share gains accumulated in Switzerland. The company debuted on an American exchange in October 2008 at a market valuation of $122 billion. Shares are underperforming the S&P 500 by 232% on a total return basis since their debut.]

Already a 7investing member? Log in here.