We check in on the pulse of consumer spending via the earnings reports from Starbucks, Apple, and Netflix...

August 6, 2022

Depending on who you ask, the United States may or may not be in a recession. But there’s no denying that the country’s GDP has shrunk two quarters in a row. Couple that with record-breaking inflation, which makes one wonder about the fragility of the US consumer.

So, this earnings season gave us some hints on the strength of the US consumer confidence.

Consider coffee king Starbucks (NASDAQ: SBUX). That company reported comparable store sales grew by 9% in the US, primarily driven by an 8% increase in average ticket. That’s pretty amazing for a company selling high-priced cappuccinos and frappuccinos. Management sounded pumped on the earnings calls, and rightfully so, noting that they were pleased given they were lapping a record-breaking quarter from a year ago.

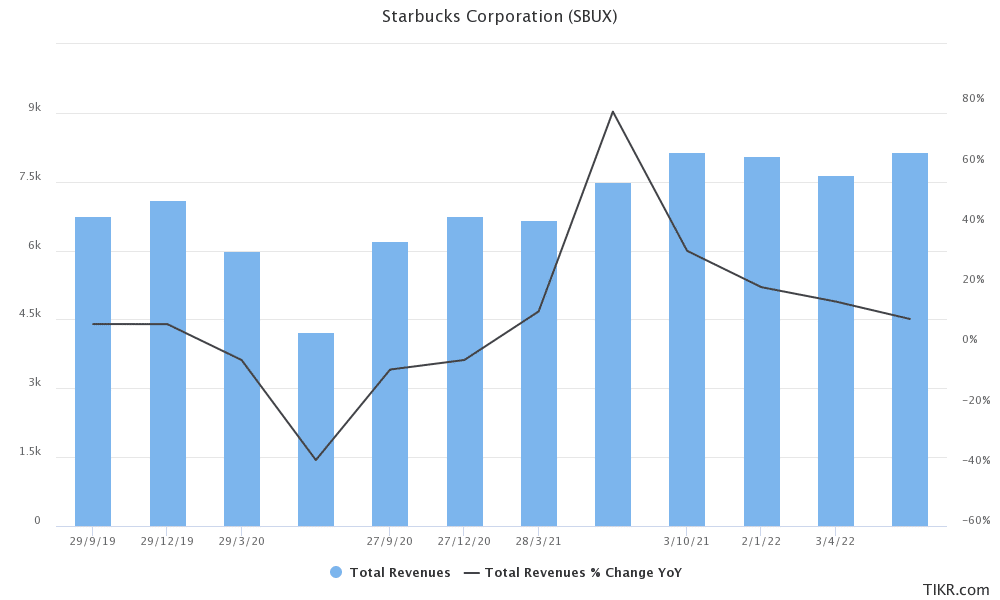

Source: Data and chart from Tikr.com

In Starbucks’ case, the 13-week fiscal third quarter ended July 3, 2022, benefited from pricing increases and strong “food attachments.” In other words, Starbucks consumers were willing to pay more for their drinks and happy to add food items such as a frosted coconut bar or a Grilled Cheese Sandwich.

Of course, while the consumer is happy to come in and even spend more, that isn’t covering all the cost increases. Starbucks’ North America revenue hit an all-time record for the third quarter to reach $6.1 Billion, up 13% year-over-year. Yet North America’s operating margin contracted by 250 basis points year-over-year due to “ongoing inflationary headwinds, labor investments including enhanced store partner wages and new partner training support costs.“

Providing an outlook for the next quarter, Starbucks’ management noted that they aren’t seeing any impact on their consumers’ spending behavior. Management’s comments, quoted below, say it all:

While we are sensitive to the impact inflation and economic uncertainty are having on consumers, it’s critically important that you all understand we are not currently seeing any measurable reduction in customer spending or any evidence of customers trading down, reflecting the strength of the Starbucks brand, deep customer engagement and loyalty, pricing power and the premium nature of our beverage and food offerings.

It’s interesting to note that the digital advertising market has seen the pressure of inflation with a wide array of businesses – Alphabet (NASDAQ: GOOG), Meta (NASDAQ: META), Snapchat (NYSE: SNAP) – experiencing pullbacks in advertising revenue. On the other hand, consumer discretionary companies like Apple (NASDAQ: AAPL) and Starbucks seem to be doing just fine. Even Apple’s uber-expensive iPhone set a new sales record for the recently reported quarter. Even a company like Netflix (NASDAQ: NFLX) which is experiencing stiff competition and tough comparisons because of the Covid-19 boost in the comparable quarters, reported significantly better-than-expected subscription growth.

It’s perplexing. Gross Domestic Product is shrinking. Businesses are tightening their belt when it comes to spending. But the consumer appears to be rock steady when spending their dollars with their favorite brands.

Already a 7investing member? Log in here.