For the very first time, 7investing is revealing one of our previous recommendation reports! Dicerna Pharmaceuticals was recently acquired by Novo Nordisk in a $3.3 billion deal. We're taking this opportunity to showcase some of our previous research of what we liked about the pre-commercial drug developer using RNAi to control gene expression.

Companies: Dicerna Pharmaceuticals

(December 28, 2021) 7investing doesn’t publicly reveal recommendations. Our members subscribe to our service for our research, after all. But a unique opportunity has presented itself for the team to publicly share our research for the first time. On December 28, 2021, Novo Nordisk announced that it had successfully acquired RNAi pioneer Dicerna Pharmaceuticals, which was recommended in November 2020, April 2021, and October 2021. In fact, it was the first three-time recommendation of 7investing.

We’ve decided to make the October 2021 recommendation report and Deep Dive video pitch (with team Q&A) publicly available to showcase our research. As this now-public research demonstrates, each team member wields a deep understanding of their respective domains — we’re not just handing members a list of tickers. We thoroughly and objectively evaluate opportunities and challenges to encourage members to adopt a long-term mindset. The team at 7investing comprises experts in biotechnology, health care, synthetic biology, artificial intelligence, fintech, disruptive innovation, space technologies, and more. If you’re interested in gaining access to seven of these recommendations each month, then subscribe today!

The real October 2021 recommendation report follows. You can download a PDF copy using the button above. References to other 7investing recommendations have been removed.

If you’re concerned about an expensive stock market or priced-for-perfection biotech and genomics stocks, then Dicerna Pharmaceuticals (NASDAQ: DRNA) is difficult to ignore. This is a no-brainer recommendation. This is also the first time at 7investing that a company has been recommended three times following the first rec in November 2020 and first re-rec in April 2021.

The company has more cash ($710 million as of the end of June 2021), collaborations (six), clinical programs (six), preclinical programs (nine), and discovery programs (over 20) than Editas Medicine, Caribou Biosciences, Beam Therapeutics, Verve Therapeutics, Kymera Therapeutics, Monte Rosa Therapeutics, Rubius Therapeutics, and many other trendy names. Each of these early-stage drug developers holds promise for different reasons, but investors would be hard-pressed to justify a market valuation of only $1.7 billion for the RNA interference (RNAi) leader. The company’s market cap was lower than each of the trendy names above at different points in September 2021.

Relative valuation with respect to drug developer fundamentals (cash, pipeline, and collaborations) is hardly the only metric that stands out. Investors rightfully celebrate the day an early-stage drug developer announces a collaboration with a respected partner because it de-risks development and provides financial stability. Dicerna Pharmaceuticals has formed six collaborations originating from its pipeline or technology platform. To put that number into perspective, the other eight drug developers on the 7investing scorecard have announced eight such collaborations combined.

Most importantly, the company’s pipeline has significant commercial potential, which is the entire point of investing in drug developers. There are no style points when it comes to building wealth. It doesn’t matter if you invested in the therapeutic modality with a Netflix documentary or the stocks in popular thematic ETFs. All that matters in the long run are the returns. Dicerna Pharmaceuticals presents one of the most favorable risk-to-reward profiles in drug development right now.

This October 2021 recommendation report is substantially different from the previous two reports and presents a detailed roadmap for what’s ahead, so please give it a thorough read.

Dicerna Pharmaceuticals is a drug developer using the therapeutic modality of RNA interference (RNAi). The discovery of the natural biological process of RNAi won the Nobel Prize in Physiology or Medicine in 2006, although the first drug product utilizing the technique didn’t earn U.S. Food and Drug Administration (FDA) approval until 2018. As of this writing, four RNAi drugs have earned FDA approval and two more are widely expected to join the list in 2022, including a drug candidate developed by Dicerna Pharmaceuticals.

RNAi is used to control gene expression by temporarily inactivating or “silencing” a gene. In biology, scientists say that “DNA makes RNA makes proteins.” RNAi is used to chop up mRNA molecules before they can be translated into proteins, which are the molecules that drive health and disease. If a disease has a well-defined genetic target — a gene or mRNA that plays a central role in the disease — then scientists can design a highly-selective RNAi drug candidate for it.

The current-generation RNAi treatments approved to date have relatively few side effects aside from temporary injection site reactions, which is more than acceptable considering patients only require monthly or quarterly dosing. Future treatments may only require a single dose once every six or 12 months. That’s not a permanent solution, but it’s a pretty darn convenient one.

Although RNAi doesn’t permanently alter genes, that can be an advantage for specific diseases or disorders that only require temporary treatment. In 2021, we don’t have the ability to precisely correct mutated genes, which could make temporary treatments such as RNAi or the emerging tools of RNA editing attractive solutions until the science catches up. As we’ll see below, RNAi also can be used to temporarily silence healthy genes to provide therapeutic benefits — something DNA editing cannot accomplish. That suggests the therapeutic modality will be relevant for many years to come.

Dicerna Pharmaceuticals has a rare combination of exceptional financial flexibility, one of the deepest pipelines in the industry, and an ambitious development strategy that creates an asymmetrical risk-to-reward profile. Before we discuss those attributes, we must discuss the lead drug candidate, which delivered mixed results in the company’s first-ever phase 3 clinical trial in August 2021.

Nedosiran: Nedosiran was being developed to treat all three subtypes of a rare genetic disease called primary hyperoxaluria (PH). Although each subtype — PH1, PH2, and PH3 — is caused by a different genetic mutation, the metabolic process involved in all three diseases is thought to run through the LDHA gene a few steps downstream. Dicerna Pharmaceuticals ambitiously attempted to treat all three subtypes with a single RNAi drug by silencing that shared downstream gene. There is one approved treatment for PH1 (an RNAi drug from Alnylam Pharmaceuticals) and no approved treatments for PH2 or PH3, so a single treatment option would have significant commercial potential.

The phase 3 clinical trial successfully met the primary endpoint and key secondary endpoint, but it failed to deliver the best-case scenario. The study included one group of patients with PH1 and another group of patients with PH2. Individuals with the first subtype saw a clear benefit from treatment with nedosiran. Individuals with the second subtype had more variable responses. A smaller phase 2 study with a nearly identical design delivered positive results in patients with both subtypes, so the mixed phase 3 results were somewhat surprising.

This is a good time for investors to remember that genetic medicines must be developed for well-defined genetic targets. The role of the LDHA gene in primary hyperoxaluria was not a slam dunk. Additionally, there are only about 170 individuals diagnosed with PH2 in the United States. These are not very well understood diseases with reams of genetic data to pore over.

The phase 3 clinical results suggest there are more complex genetics at play. To be clear, the drug candidate is likely to earn FDA approval in 2022 as a treatment for PH1. The company isn’t including PH2 in the new drug application (NDA), while a separate study in PH3 is expected to have results in October 2021. A larger, longer clinical trial in PH3 would be required for approval.

Although treating PH2 represented the smallest economic opportunity of the three subtypes, nedosiran’s reduced commercial potential wouldn’t justify the investments in building commercial infrastructure — sales, marketing, and other support teams — for the first time. As a result, the company has made the strategic decision to outlicense international rights to nedosiran. The move will preserve cash and focus limited bandwidth on better opportunities. If the drug candidate earns approval and a license agreement is finalized, then the company should receive a large upfront payment of at least $100 million and/or significant royalties on sales. That could extend the company’s cash runway into 2026 and/or allow it to accelerate development efforts.

Losing out on the best-case scenario for nedosiran stings, but investors can turn their attention to 14 other programs in preclinical or later development and over 20 discovery programs. This is exactly why I focus on companies with technology platforms — a failure or three doesn’t necessarily impact the investment thesis.

Development strategy (partnered programs): Dicerna Pharmaceuticals has a framework for deciding whether a program should be partnered or wholly-owned.

The company seeks partners when diseases have large patient populations and commercial success relies on scale and execution. For example, many cardiometabolic diseases (high cholesterol, obesity, and so on) affect millions of individuals globally. Clinical trials for these indications will require hundreds or thousands of patients to be enrolled, while selling the drug will require robust and potentially global infrastructure. These are not strengths of Dicerna Pharmaceuticals.

Similarly, the company views diseases with undifferentiated genetic targets as less attractive for internal development. If multiple drug developers are using RNAi to silence an identical or overlapping part of an mRNA sequence to treat the same disease, then it will be difficult to stand out and generate intellectual property. Many cardiometabolic diseases also fall into this category.

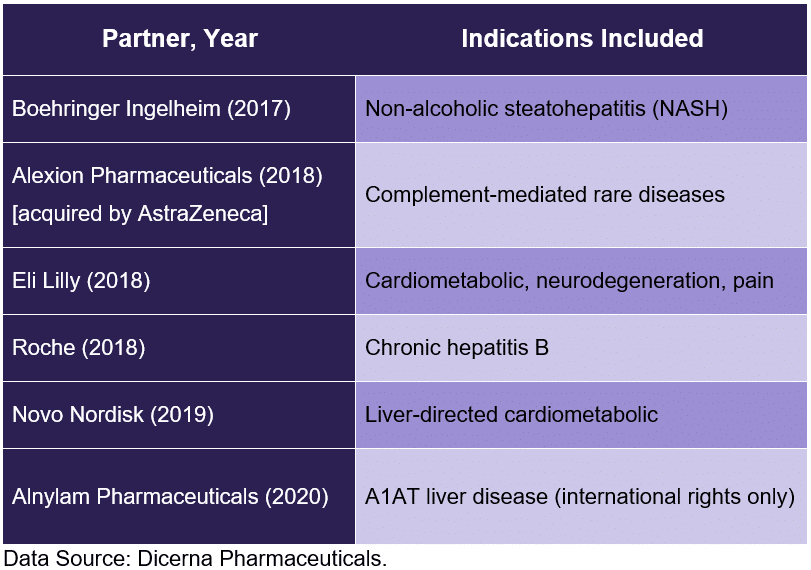

Each of the company’s six collaborations fit within this framework:

Dicerna Pharmaceuticals anticipates announcing the initiation of one new phase 1 program per quarter for at least the next eight quarters. Put another way, investors might expect eight new clinical entries and a total of 12 clinical programs to be underway by mid-2023. A look at the most-advanced preclinical programs suggests that partnered assets will comprise six or seven of these programs.

In the eyes of Wall Street, the reliance on partners limits the near-term opportunity for the company. That’s almost certainly the wrong interpretation.

Dicerna Pharmaceuticals stands to earn a steady stream of milestone payments from collaborations as programs advance (which will fund operations) and can share in significant economic opportunities through both co-commercialization and royalties. These arrangements also provide the freedom to take an ambitious approach with the wholly-owned pipeline.

Development strategy (wholly-owned programs): The company seeks to develop programs internally for diseases with limited competition from other therapeutic modalities, differentiated genetic targets available, and/or genetic targets ideally suited for RNAi. These are meant to be more ambitious programs and, soon, programs that only Dicerna Pharmaceuticals can develop.

Alcohol use disorder (whitespace program): The most important wholly-owned asset after nedosiran is DCR-AUD, which is being developed to treat alcohol use disorder (“alcoholism”). There are an estimated 14 million individuals affected by the disease in the United States alone, although only 1% receive a pharmaceutical treatment because existing options are inconvenient, ineffective, and potentially unsafe. For comparison, there are less than an estimated 10,000 individuals with PH in the United States and most are undiagnosed. A 2010 study by the Centers for Disease Control (CDC) estimated that excessive alcohol use costs the United States $249 billion per year, primarily from lost productivity (72%), health care expenses (11%), and law enforcement expenses (10%).

Dicerna Pharmaceuticals expects to initiate a phase 1 clinical trial for DCR-AUD in the final week of September 2021 (not announced as of this writing). The treatment goal is to change a patient’s behavior by providing real-time physiological feedback to discourage excessive drinking. More simply, the drug candidate will make individuals feel sick when consuming alcohol. It might not be as crazy as it sounds.

The ALDH2 gene plays a crucial role in alcohol metabolism. Naturally-occurring variants within the human population result in individuals having one or two inactivated copies of the gene. These individuals develop flushing (a red face or skin), feel the effects of alcohol after fewer drinks, and experience worse hangovers. Importantly, these individuals are significantly less likely to develop alcoholism.

This is where it gets interesting. Humans have two copies of each gene — one inherited from each parent. Harboring one inactivated copy of the ALDH2 gene (half of the total) has a protective effect against developing alcoholism. Although the liver is important for alcohol metabolism, only about half of the body’s ALDH2 gene expression occurs in the liver. It’s a complete coincidence that the numbers match, but it creates a unique opportunity for a liver-directed RNAi drug that can selectively silence the ALDH2 gene. Essentially, DCR-AUD will attempt to recreate this naturally-occurring protective genotype by silencing only half of the body’s ALDH2 activity to help individuals overcome their addiction to alcohol.

The company believes DCR-AUD will allow individuals to consume moderate, but not excessive, levels of alcohol. By contrast, all four drugs approved for alcohol use disorder require abstinence prior to beginning treatment. What’s more, the FDA and World Health Organization have recently adopted more favorable positions on allowing harm reduction outcomes in clinical trials instead of abstinence outcomes. The company plans to evaluate both — just in case.

An RNAi treatment for alcohol use disorder would have another important advantage: compliance. Addiction treatments almost universally suffer from poor compliance. Typically, less than 20% of individuals remain on treatment after only a few weeks — and that makes complete sense from a patient’s perspective. Abstinence is required just to be eligible for treatment, consuming alcohol while on treatment can be dangerous, and three of the four treatments require taking a pill at least once per day. That puts a heavy burden on the individual struggling with addiction. By contrast, an RNAi treatment could be dosed once per month or once every three months. That would only require one compliance decision every 30 days or 90 days, compared to 30 decisions in 30 days or 90 decisions in 90 days with daily dosing.

DCR-AUD is an exciting program. In a best-case scenario, this could easily have over $1 billion in annual revenue. Heck, it could have $10 billion in annual revenue. But let’s temper expectations a bit for an asset that has yet to generate any clinical data. There are many reasons this ambitious approach could fail (see “What are the Key Risks?” section below). Luckily, the phase 1 clinical trial is relatively straightforward and should quickly generate results. Investors can expect a data readout in the first half of 2022.

Oligo-lipid conjugates (whitespace opportunity): Everything discussed in the report to this point refers to RNAi drug candidates delivered to the liver, but affecting gene expression in other tissues in the body will require new tools. Dicerna Pharmaceuticals is taking a slightly different approach from peers.

Let’s review three important terms.

These three terms are important because delivery outside of the liver is the next battleground in genetic medicines. How can a drug candidate based on RNAi, gene editing, base editing, peptide nucleic acids, or mRNA be delivered to the lungs? Muscles? Heart? It all comes down to optimizing the ligand for the cell receptors of the target tissue. What key fits the lock?

Dicerna Pharmaceuticals is developing various ligands beyond GalNAc, but the initial focus is on lipids. Not to be confused with lipid nanoparticles (used for encapsulation), lipid ligands can be varied in length or chemical composition to target multiple tissues at the same time. Alnylam Pharmaceuticals and Arrowhead Pharmaceuticals are going all-in on peptide ligands, which are better for selective delivery to a single tissue. The zig to lipids when others are zagging to peptides could create some wide-open opportunities for Dicerna Pharmaceuticals.

It appears that the company’s first siRNA-lipid conjugates are being designed to simultaneously silence gene expression in the liver and adipose (“fat”) tissues to treat cardiometabolic diseases. These might have advantages over liver-directed RNAi drug candidates or enable treatment of complex cardiometabolic diseases, such as obesity. The company owns full rights to siRNA-lipid conjugates for cardiometabolic indications, although it may make sense to expand existing partnerships with Eli Lilly or Novo Nordisk — the world’s two leading cardiometabolic drug developers — for development and commercial de-risking.

siRNA-lipid conjugates can also be used to target specific cells and tissues within the central nervous system. These tools could allow for broad penetration of brain tissues and more effective gene silencing than antisense oligonucleotides. Eli Lilly owns full rights to siRNA-lipid conjugates for neuro and pain indications, although Dicerna Pharmaceuticals has rights to two orphan neuro indications.

On the second-quarter 2021 earnings conference call, CEO Dr. Douglas Fambrough summarized the vision for wholly-owned programs:

I would like to see Dicerna in more of a whitespace, open-field running room. When we reveal the programs, I think you’ll see that we are probably attacking in a slightly different direction than some of other early RNAi companies going outside the liver, drawing on the strength of GalXC-Plus to get to other tissue types.

There are reasons oligo-lipids may not work, but the technology was first proposed by the RNA Therapeutics Institute (RTI) at the University of Massachusetts Medical School. Dr. Craig Mello, who shared the 2006 Nobel Prize for discovering RNAi, is a professor at the university and helped to start RTI.

If the next battleground in genetic medicines is delivering therapeutic payloads to tissues other than the liver, then let’s briefly review emerging ideas in the field.

Dicerna Pharmaceuticals is initially focusing on oligo-lipid conjugates. On the one hand, these aren’t very selective. The therapeutic payload will end up in many different tissues in varying amounts and that does create the potential for safety risks. On the other hand, gene expression is tissue specific. If the company selects genetic targets that are primarily expressed in the liver and adipose tissue, then the therapeutic payload is likely to be inert when it arrives in muscles or the kidney. Additionally, the company can tune the lipid ligand used to ensure the therapeutic payload is delivered most efficiently to the desired tissues. Oligo-lipid conjugates certainly won’t work for all diseases, but they hold potential in carefully-selected diseases.

Fellow RNAi peers Alnylam Pharmaceuticals and Arrowhead Pharmaceuticals are focusing on peptide ligands. Peptides are short fragments of proteins that can be tuned to very specific cell receptors in very specific cell types. What GalNAc did for delivery to the liver, peptides could do for delivery to many other tissues. If you’ve never heard of peptides as ligands before, then brace yourself — that’s all investors will be hearing about in the next few years for genetic medicines from RNAi to gene editing to mRNA.

In recent months, Ionis Pharmaceuticals (antisense oligonucleotides) partnered with Bicycle Therapeutics (peptides) to create ASO-peptide conjugates and Alnylam Pharmaceuticals (RNAi) partnered with PeptiDream (peptides) to create siRNA-peptide conjugates. On the second-quarter 2021 conference call, RBC Capital analyst Luca Issi asked if Dicerna Pharmaceuticals would follow suit. CEO Dr. Douglas Fambrough replied:

That is something that we are considering and we’ve had conversations with players in the field. Having said that, we are very pleased with the delivery we’re getting with our in-house technology, which as I mentioned is getting us to a pretty broad array of tissues. So we’re not feeling a particular need at this point to form a collaboration with someone who can help us get to other tissues. We are already in a situation where the number of opportunities we’re considering far outstrips the number of programs that we can plausibly prosecute.

If oligo-lipid conjugates work, then the company might not need to explore oligo-peptide conjugates. Scientific bandwidth is a limited resource.

That said, lipid ligands do appear to have significant advantages in central nervous system applications (the brain). Preclinical data suggest oligo-lipid conjugates will outperform oligo-cholesterol conjugates, which are currently being developed as the next-generation delivery tool in neuro indications by Ionis Pharmaceuticals. Poor Ionis Pharmaceuticals can’t seem to catch a break.

A next-generation RNAi start-up called Atalanta Therapeutics is solely focused on neuro indications. The company has an impressive technology platform that simply joins two siRNA molecules to create a siRNA-siRNA conjugate. These tools leverage the same principles as siRNA-lipid conjugates, in which the length of the ligand increases uptake in brain tissues. Atalanta Therapeutics was founded at the University of Massachusetts, counts Dr. Craig Mello as a co-founder, and is partnered with Biogen and Genentech (Roche).

The same management team remains in place from the previous two recommendations. Founder and CEO Dr. Douglas Fambrough, one of the “OGs” of RNAi therapeutics, continues to lead the company. There have been no departures among the main C-suite executives, but there have been changes.

In mid-September 2021, Dicerna Pharmaceuticals announced a reorganization of responsibilities that better position the company to execute its strategy and balance priorities between collaborations and wholly-owned programs. This is especially important given the emerging wholly-owned pipeline, which is the first time the company has focused on its own programs in over five years.

Created the position of Chief Strategy Officer: This new role is responsible for overseeing the company’s multi-tissue product creation efforts, general pipeline expansion, and support of collaborative relationships. Rob Ciappenelli, formerly the company’s Chief Commercial Officer, will move into this new role. Considering certain wholly-owned programs have overlap with existing collaborations, it makes sense to consolidate strategic decision-making within the same executive position. What programs should the company pursue by itself or add to existing collaborations? When should those decisions be made?

Created the position of Senior Vice President, Discovery Research: Previously, the company only had an SVP, Program Development. This new role distinguishes earlier R&D activities and strategic decisions. Dr. Marc Abrams, previously Senior Director, Preclinical Development, is moving up the hierarchy chart with a promotion to SVP in this new role. It’s interesting that the former head of preclinical development is now overseeing discovery research (one step before preclinical development), which suggests the company could now have stricter criteria for advancing discovery programs into preclinical development — a boon for the commercial potential of pipeline programs.

Created the position of Senior Vice President, Investor Relations and Corporate Communications: This new role could help the company better communicate the advantages of its development strategy and technology platform to investors — a point Simon Erickson asked about on the October 2021 Deep Dive / Team Call pitch. Ms. Kristen Sheppard, formerly in the same position at Akebia Therapeutics, joins the company for this newly created position.

These new positions are signs of a maturing company and should augment decision-making as Dicerna Pharmaceuticals begins to devote more bandwidth to wholly-owned programs.

Perhaps the simplest way to discuss this topic is through the lens of strategic risk.

Dicerna Pharmaceuticals has adopted a pragmatic development strategy that seeks partners for undifferentiated programs and prefers to retain larger stakes in differentiated programs. As nedosiran demonstrates, the ambitious pursuit of differentiated programs creates an asymmetrical risk-to-reward profile, but investors certainly cannot only focus on the “reward” part.

The ambitious DCR-AUD program falls into this category. A best-case scenario might involve revolutionizing alcohol use disorder by significantly improving harm reduction outcomes and generating billions of dollars in annual revenue. A worst-case scenario might be flaming out of phase 1 clinical results and getting jettisoned from the pipeline by mid-2022.

Then again, failing in phase 1 might not be that bad considering the program isn’t factored into the company’s market valuation (nor should it be). Failing in phase 2 or phase 3 — when expectations are higher — could be worse. The FDA might decide against using harm reduction outcomes (which can be more subjective — another development risk) and instead lean on abstinence outcomes, which would significantly limit the drug candidate’s market potential.

There are also potential safety risks to silencing the ALDH2 gene, which protects individuals from kidney injury after consuming alcohol, cancers of the esophagus, and certain viral infections of the liver. DCR-AUD is only expected to silence about half of the body’s ALDH2 expression and would be a temporary treatment, but scientists and investors cannot be certain of the experimental compound’s effectiveness or safety until the hypothesis is tested in a large number of human patients in clinical trials.

The company’s chronic hepatitis B program, now called RG6346 and under the control of Roche, is also ambitious. The viral genome contains two conserved regions: S and X. Arrowhead Pharmaceuticals and Alnylam Pharmaceuticals have chosen to silence both regions, but Dicerna Pharmaceuticals decided to only target the S region. Counterintuitively, the company discovered that silencing the X region leads to greater expression of the S region over time, even if the latter is also silenced by a therapeutic payload. Preclinical and initial clinical results suggest that sparing the X region leads to genomic instability in the virus and deeper, more durable responses. If the ambitious approach works, then the asset could differentiate itself in the market. If it doesn’t, then that could threaten one of the pipeline’s largest economic opportunities.

Aside from the risks of any specific program, there are development risks to the oligo-lipid conjugate approach. First, these therapeutic payloads will end up in a broad array of tissues. That could lead to greater safety risks compared to oligo-peptide conjugates that end up in specific tissues. Second, if the oligo-lipid approach fails, then the company might be far behind in the footrace to develop effective peptide ligands. That would be bad. Third, peptide nucleic acids can cross the blood-brain barrier. If NeuBase Therapeutics or newer entrants optimize the therapeutic modality for neuro indications, then it could limit the opportunities for RNAi in those indications.

Finally, there’s always a risk that collaborations dissolve. This is less worrisome for Dicerna Pharmaceuticals because it has six collaborations. Nonetheless, losing two or more major collaborators would sting, especially if they run off to a competing therapeutic modality. The optics might be difficult to overcome.

As summarized in the introduction, Dicerna Pharmaceuticals is one of the most undervalued drug developers on the entire stock market. I said the same thing in the November 2020 and April 2021 recommendation reports, although the market valuation is now lower after mixed results for nedosiran were announced.

Pre-commercial drug developers aren’t valued based on traditional financial fundamentals such as revenue, earnings, and cash flow. Instead, investors must pay close attention to drug developer fundamentals such as cash, pipeline programs, and collaborations. To recap a few important metrics with respect to drug developer fundamentals:

Cash: Dicerna Pharmaceuticals ended June 2021 with roughly $710 million in cash, which is enough to fund development activities into 2025. The cash balance is likely to increase after the business finalizes commercial rights to nedosiran, which could fetch a significant upfront payment. Given the strong cash balance, the business could forgo a large upfront payment and instead request larger royalties on sales. Either way, it’s difficult to understate the importance of a strong balance sheet for a pre-commercial drug developer. The company won’t have to dilute shareholders for at least the next four years, can comfortably support collaborations and invest in wholly-owned programs, and could even consider an acquisition if the opportunity arose.

Pipeline: Dicerna Pharmaceuticals counts six clinical programs, nine preclinical programs, and over 20 discovery programs. The strategic decision to sell commercial rights to nedosiran reduces the near-term opportunity, but investors shouldn’t mistake that for a lack of opportunity. The company owns full U.S. rights to belcesiran (phase 2), DCR-AUD (phase 1), and two multi-tissue programs (preclinical). It can opt-in to three programs with Roche and Novo Nordisk and expand existing cardiometabolic collaborations with Eli Lilly, Novo Nordisk, or Boehringer Ingelheim should it need help developing siRNA-lipid conjugates.

Collaborations: Dicerna Pharmaceuticals has formed collaborations with Boehringer Ingelheim, Alexion Pharmaceuticals (AstraZeneca), Roche, Eli Lilly, Novo Nordisk, and Alnylam Pharmaceuticals. That spreads development and financial risks across a broad number of partners. It also spreads opportunities. The company can earn up to $350 million per program in the Eli Lilly collaboration, which will explore over 10 programs. The company can earn up to $357.5 million per program in the Novo Nordisk collaboration, which includes over 30 potential programs (not a typo). Neither sum includes royalties on any drug candidates that reach market.

Will every partnered or wholly-owned program reach market? Of course not. As nedosiran demonstrates, even those that do may not deliver a best-case scenario for shareholders. Nonetheless, it’s impossible to argue that Dicerna Pharmaceuticals is fairly valued based on drug developer fundamentals. At a market valuation of only $1.7 billion, one of the three main collaborators (Eli Lilly, Roche, or Novo Nordisk) could walk away and the company would still be undervalued. Full stop. There’s absolutely no valuation risk baked into shares at the current price.

I’m keeping the focus of 7investing members on two of the three same key developments as outlined in the April 2021 recommendation report. Developments regarding nedosiran are no longer as important for investors with a long-term mindset.

Interested in learning even more about Dicerna Pharmaceuticals? For more information about the company’s development strategy in DCR-AUD, read through the presentation unveiling the program and outlining the regulatory plan. The latest investor presentation for September 2021 can be found here.

Disclosure: As of October 1, 2021, 7investing Lead Advisors Maxx Chatsko, Simon Erickson, and Dan Kline own shares of Dicerna Pharmaceuticals.