The temperature's rising as I've gone from bullish to bearish about Celsius this summer. The experience highlights several behavioral biases we constantly face as investors.

September 13, 2024

I’ve had an interesting investing relationship with Celsius Holdings (Nasdaq: CELH) this summer.

For those who have followed my saga, I’ve gone from being uber-bullish on the energy drink company to being really bearish in a 90 day period. I recommended Celsius and eagerly endorsed it, only to withdraw my conviction and to remove it from our investing scorecard entirely.

This is a very rare occurrence for me. Whenever I buy a stock, I like to commit to it for at least three years.

I’ll describe what specifically led to my change of heart here in a minute. But Celsius also served as a great reminder of the behavioral biases we constantly face as investors.

Whenever we buy or recommend a stock, we instinctively focus on the positives. We convince ourselves it’s going to be a good investment and congratulate ourselves for buying such a great company.

Yet sometimes those behavioral biases can hide lurking issues, which are dangerous traps to fall into as an investor.

We benefit ourselves any time we recognize those biases. Especially when we respect that they’re impacting our decisions.

Celsius helped me realize that it’s possible to escape those traps. Here’s my story, which I hope will prove valuable in helping you to navigate your own investing journey.

As a disclaimer, I don’t often talk publicly about our 7investing recommendations. We reserve those as a premium benefit for our paying subscribers, who get access to our reports and then continually discuss our stock picks in our Community Forum.

But I’m a bit more open to discussing sold positions. These stocks are no longer active recs or impacting our scorecard’s returns, and yet we sold them for specific reasons. Those reasons are often great learning opportunities for us to collectively improve as individual investors.

With Celsius, I was enamored by the company’s sales momentum. Thanks to its distribution partnership with Pepsi, it was growing revenues at triple-digit rates and gaining important shelf space in America’s grocery stores, convenience stores, and fast-casual restaurants.

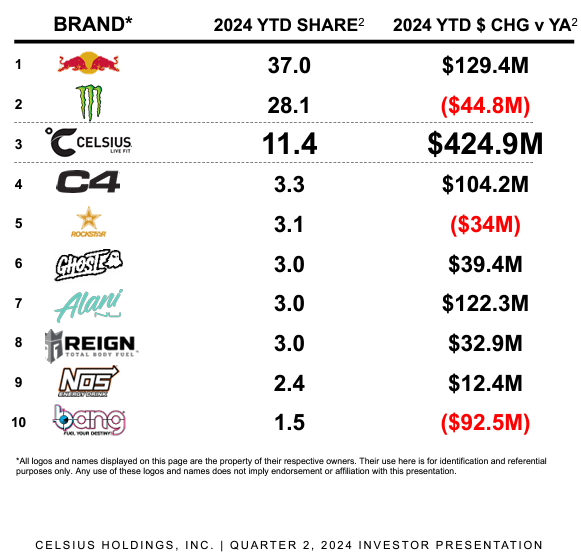

This was a company who was facing bankruptcy less than a decade ago. But with great execution, it now held the third-largest market share in its segment and was closing the gap on Red Bull and Monster.

I went on to recommend Celsius Holdings as my top stock idea in September.

Its energy drinks were growing 7x faster than the overall category. Margins were improving and cash flows were surging. Pepsi seemed eager to introduce them into new markets like Canada, France, and Australia.

And the cherry on top was that its stock had been selling off all year. I love to buy great companies when they go on sale for the wrong reasons. It felt like the concerns about its slowing growth rates and the recent inventory destocking at Pepsi were just distractions. After all, Monster was the stock market’s very-best-performing company of the past three decades. Celsius felt primed to be its next great success story.

So I jumped head-first into the echo chamber. I found myself only hearing the good news that would support my thesis. It was easy to quickly dismiss the risks and the concerns, which seemed superficial and easily correctable.

I began building out my Deep Dive for Celsius. I always give a formal presentation in front of a live audience, to share the investing thesis behind my most recent stock pick and why I’m recommending the company.

It was easy to pull together the bull case. The growth rates were there, the fundamentals were improving, and the valuation was attractive.

But then I started digging deeper into one of the most important sections that I include in every one of my recommendation reports: The Key Risks.

Here’s a snippet of the Key Risks that I wrote about Celsius in my initial report on September 1:

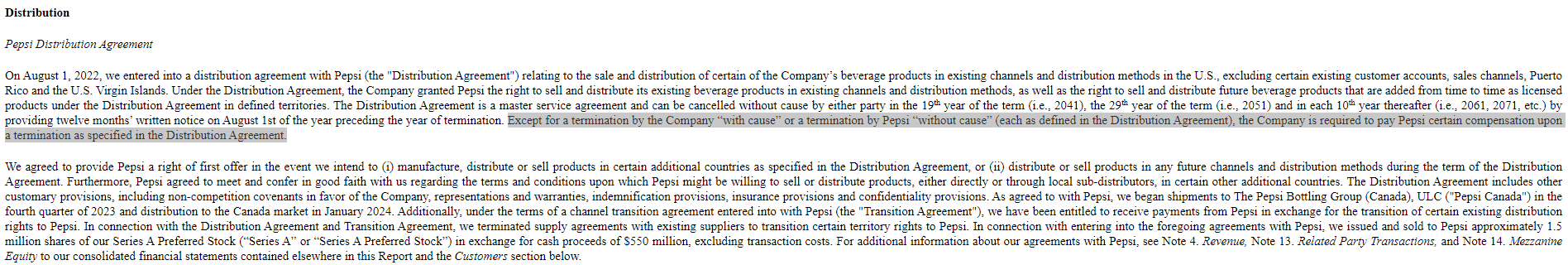

And lastly, there’s a lot riding on the Pepsi partnership – which is pretty much what single-handedly drove Celsius to profitability in late 2022. If for any reason Pepsi loses interest or pulls the plug on the deal, Celsius would immediately lose the vital distribution network that’s necessary to supply its products.

I stared at those two sentences again for quite awhile. This was a much bigger deal than I might have initially appreciated.

Pepsi’s distribution network and the relationships it has in place to get shelf space at retailers has been crucial to Celsius’ success. Before the agreement with Pepsi — which it most likely did in order to mimic Coca Cola’s recent deal with Monster — Celsius was reporting heavy losses and didn’t have national distribution.

Only after digging deeper did I realize that Pepsi was holding all the cards here. They were benefitting from the stock price going up and from collecting a dividend on their preferred shares. But they could also terminate the agreement at any time and for any reason, without any form of financial penalty.

Four days after my recommendation, Celsius announced at the Barclays’ Global Consumer Staples Conference that Pepsi would be “inventory destocking” and placing $100 million to $120 million fewer orders during the upcoming third quarter. That was a really big deal; it meant Pepsi would be cutting its orders in half. The stock sold off more than 10% on the news.

That led me to ask more questions. Why was Pepsi cutting back on its orders so significantly? Why didn’t Celsius have any transparency into this beforehand? Why was Pepsi so interested in Celsius in the first place?

As I began to emerge from the echo chamber, it opened my eyes to see some even more troubling key risks.

I found seven of them, to be exact. They also included risks related to ownership concentration, heavy insider selling, leadership credibility concerns, and a lack of many long-term tangible assets.

These were things that I hadn’t discovered or considered before. They weren’t financial in nature, and they weren’t obvious to find in the quarterly reports, the conference call transcripts, or the investor presentations.

Yet these were the risks that anyone who was planning to buy and hold the stock for several years should be considering.

It was then that I realized that I’d made a mistake in recommending Celsius. These could be really big problems. And they could permanently capsize an investment.

At this point, it would be difficult to change my mind. After all, I’d just published my recommendation less than a week ago! Wasn’t I bullish about Celsius, and I should be continuing to promote them? Was I being too wishy-washy and non-committal to even consider selling the stock so soon?

Yet an inner voice kept telling me that things just weren’t quite right. As I later phrased it, it was like the feeling of being unable to look away from a terrible car crash, coupled with realizing you’d just eaten expired lunch meat. It was an upset feeling in the pit of my stomach that I simply couldn’t shake off.

So I went with my gut and I pulled the trigger. I recommended selling Celsius less than eleven days after I recommended buying it. This was the first time 7investing had ever sold a new recommendation so quickly.

As you might expect, there were mixed reactions to this decision.

Some responses were frustration and confusion. Why hadn’t I caught these red flags in my initial diligence? Simon, you are crazy and this product is just getting started. Why did you pull out the rug from under us and pull a complete 180?

I could have easily jumped back into the echo chamber at this point. Part of me even wanted to not publish the sell recommendation at all. It would have easier to just stick to my guns and to not rattle the cage or shake the boat.

But I felt I would only be acting with integrity if I allowed myself to address both the yin and the yang of my inner investing conscience and to ultimately do what I genuinely believed was right.

This was well-taken and brought out some positive feedback as well. I respect you for changing your mind as the facts change. Thank you for acting with integrity and I value your honest research and opinions. I admire your ability to even make such a drastic pivot.

So to say the least, it’s been an interesting two weeks for me here in September.

There’s an important takeaway in all of this that I feel compelled to share publicly. Allow yourself to change your mind as an investor.

We’re too often trapped in these echo chambers. Social media feeds us what it thinks we want to hear. It’s easier to agree with like-minded peers than to hear critical opposing viewpoints. As humans we seek consensus, dopamine rushes, and being popular.

But investing isn’t about those things; it’s about performance. We should be finding the best risk-versus-reward opportunities and then having a decision-making process that gives us the courage to act on them.

It’s impossible to know what will happen with Celsius in the coming months or years. If in three years the stock has doubled, I wouldn’t be surprised. If in three years it’s fallen another 50%, I also wouldn’t be surprised.

I’ll conclude by reiterating that investing is personal. There are two sides to every trade. Think critically about them both, before making any important decisions.

Already a 7investing member? Log in here.