The EV innovator is facing some near-term headwinds, but is still full-speed ahead when it comes to global expansion.

May 7, 2024

I’ve just completed Day 1 of building out my Tesla (Nasdaq: TSLA) discounted cash flow model. This is a Herculean task, as Tesla is a massively complex company who is selling globally and is innovating quickly.

But as I said yesterday, now’s the right time to put a stake in the ground and to have an opinion about its current valuation. My Keurig machine enjoyed all of my love and attention yesterday.

I’m sharing all of my insights, input assumptions, and outputs in our 7investing Community Forum. This is a resource that’s free for anyone to join; though we reserve our stock-specific commentary and conviction ratings with current subscribers. Here’s a link to join our Forum and to immediately get in on all of the action.

As a Cliff’s Notes version, here are five key takeaways from Day 1 of my Tesla DCF research.

Tesla’s first quarter earnings report didn’t make any friends with investors. Total vehicles deliveries of around 386,000 were a pretty-significant whiff when compared to estimates of 449,000, and they represented the first year-over-year decline in deliveries since COVID.

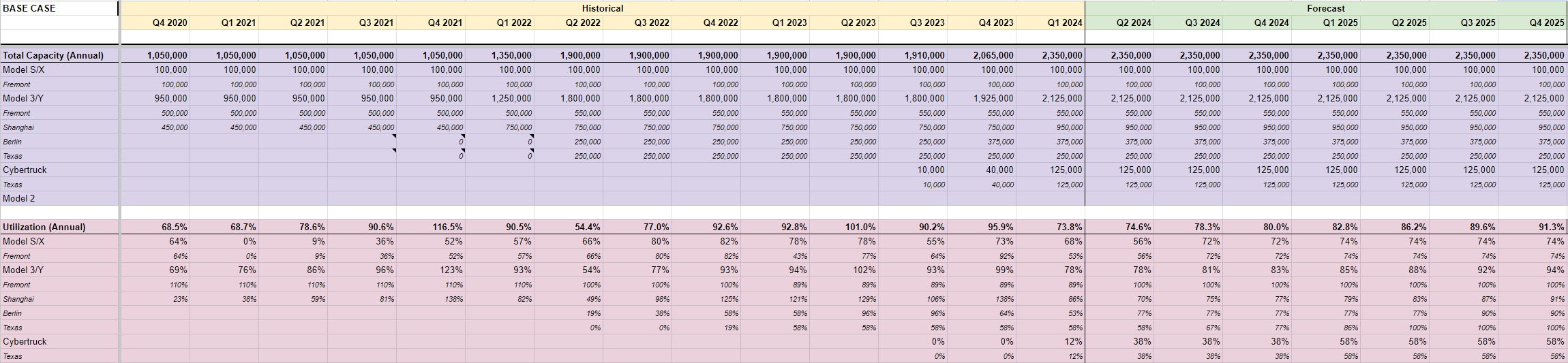

Tesla been running its Gigafactories at between 80-90% of capacity for the past two years. I stick they’re going to turn down the EV spigot for a bit, in response to the slowing demand. I’m modeling for closer to 70-80% of production capacity in 2024-2025.

One of Tesla’s key market is China, where its Shanghai Gigafactory is capable of manufacturing nearly 1 million Model 3 vehicles per year.

But Tesla’s not selling anywhere near those volumes yet. In fact, it actually delivered less than 200,000 vehicles in China during its first quarter and is currently stockpiling unsold inventory.

Competition in the Middle Kingdom is cutthroat. At one end of the market, BYD is offering plug-in hybrids that are receiving government subsidies and cost the consumer only around one-third of the price of a Tesla EV. On the other end, NIO (NYSE: NIO) offers a full-suite of luxury EV sedans and SUVs. Even Smartphone-maker Xiaomi just introduced its own electric vehicle, and it completely sold out on the first day it was available.

Tesla has thus far obtained excellent margins from China. But it’s responding to the competitive threats by cutting price. It reduced the price of its Model 3 by 6% to 245,900 yuan (around $34,000 USD) and the Model Y SUV by 3% to 258,900 yuan ($36,000) in January, and is also offering a boatload of other incentives like insurance discounts and preferential financing to move its unsold inventory as quickly as possible.

The Cybertruck is an intriguing new model. Tesla is taking a shot across the bow, offering a zero-emission truck with superior horsepower to one of the most loyal and demanding customer groups of the auto market (and after living in Houston for most of my life, I’m very confidently able to say that).

Tesla has already received more than 2 million reservations for the Cybertruck. That’s more than the total vehicles it sold globally of all of its models last year.

But it will also need to get its costs down significantly, if it wants to translate those reservations into actual sales. Elon initially projected the Cybertruck would have a price tag of $39,900 and Tesla posted this directly on its website in its early promotion. Right now, the first Cybertruck off the Gigafactory line are selling for double that — with an average price of $81,895 for deliveries in the first quarter.

Just like the S, the Y, and the X, the Cybertruck will be a price-versus-volume game. The Austin Gigafactory is getting production up-to-speed, but Tesla still has a long way to go.

I’m building my DCF model independently and from the ground up, estimating the delivery volumes and the average price of each of Tesla’s models in order come up with an overall revenue estimate.

When I did that, the revenue expectations I calculated for 2024 and 2025 were each within 5% of consensus estimates. It appears Wall Street has similarly done its homework and has reasonably baked Tesla’s stated production guidance into its own near-term price targets.

But as I’m sure you already knew before reading this article, Tesla is a long-term investment with a long-term vision. Things will really start to get interesting in the longer-term, as Elon continues to innovate and to execute on his Master Plan for a sustainable future.

Elon is already envisioning a self-driving fleet of up to 100 million Teslas that would provide autonomous rides in developed markets.

If that were to come to fruition — where customers are purchasing Teslas as profit-generating opportunities and then paying a monthly FSD subscription fee — it could increase Tesla’s current revenues by an order of magnitude.

Tesla still has quite a bit in store for investors. Stay tuned.

Already a 7investing member? Log in here.