7investing CEO Simon Erickson shares a primer on how renewable projects tend to be evaluated by larger energy companies.

December 28, 2023

There’s a lot of wheels turning when it comes to America’s renewable energy policy.

Our country is putting a ton of money into an energy transition. The US has committed more than $1.2 trillion through a bipartisan infrastructure law and another $369 billion through its Inflation Reduction Act — intended to unleash hundreds of new programs for electric vehicles, carbon removal, home electrification, renewable energy, and more.

On top of those, the Department of Energy also has another $400 billion in loan authority — to help finance the projects and to get them up-and-running.

How should investors play this trend? Are there specific companies or technologies that are well-poised to capitalize on America’s Clean Energy Future?

To help frame that question, here’s a primer to describe how renewable energy projects are evaluated. While isn’t an official list of companies to invest in, it’s a great lay of the land to better understand the renewable arena.

(Note: Before committing to a career in publicly-traded equities, I previously evaluated different technologies and invested in companies for a major American energy company).

If all other things were equal, the lowest cost of reliable production would win as the preferred form of electricity generation. Economics matters. Scalability matters.

Yet the “lowest cost” is difficult to define, because it is based upon a large number of factors. This includes capital costs and depreciation (nuclear plants are expensive to build), input fuel costs (natural gas and oil have significant price volatility), and maintenance & operations (coal plans are expensive to maintain).

Financing of the projects is also important. High upfront cost/low operating cost projects can be more attractive when debt capital is cheaper or heavily-subsidized.

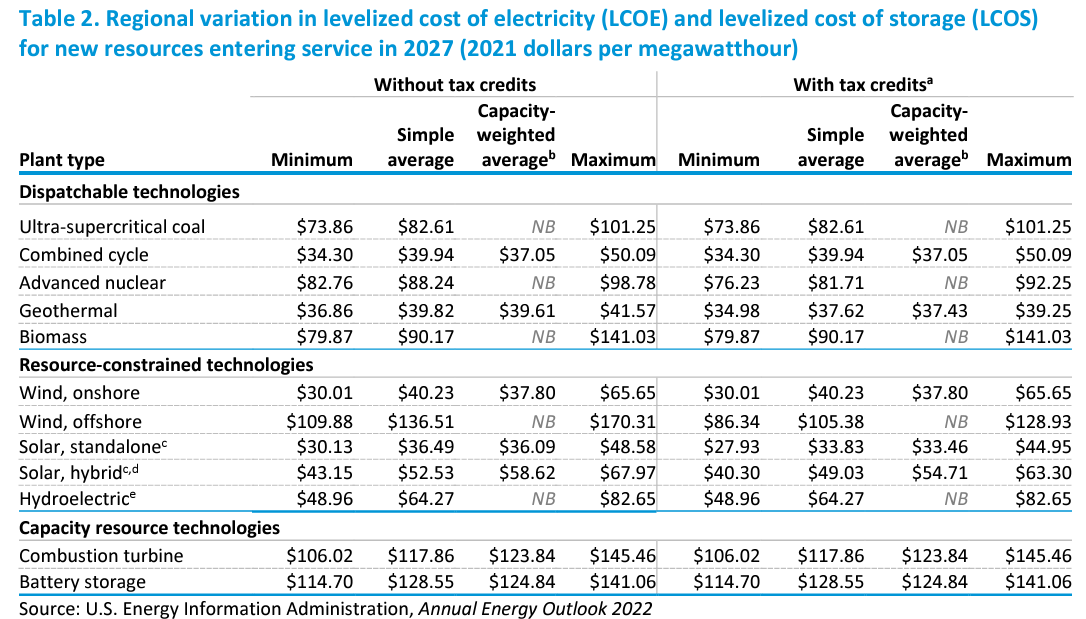

The LCOE is tracked every year by the Energy Information Administration (EIA) as a way to keep score between different technologies.

It reports the present-value cost of all factors per fixed amount of electricity produced (typically expressed in terms of dollar per megawatt-hour: $/MW-hr).

The LCOE is very important and serves as a primary decision-making tool for power producers to quantify the minimum power price they would need to receive in order to justify building a new plant.

Here’s a look at America’s most recent LCOE, as reported by the EIA.

Source: EIA’s Annual Energy Outlook

Even within any single technology (the difference between “min” and “max in the table), there is a wide variance in the potential costs. This is largely due to where the plant would be operating and what kind of governmental support it would receive.

The US is heavily incentivizing renewable energy right now. It recognizes that the technologies are improving, which could make them cost-competitive with traditional sources even without subsidies (and in many places, it already is).

One example is increasing solar cell efficiency, where panels of the same size and same cost are producing more electricity as the technology improves. Renewables also offer several other advantages over fossil fuels too, such as zero carbon emissions, limited maintenance, and no fuel costs. They politically reduce our reliance on importing hydrocarbons from other countries.

However, things do not happen in a vacuum. There are also technological advances happening in fossil fuels — such as hydraulic fracturing unlocking huge natural gas reserves within America’s own borders. Due to this huge supply of natural gas coming online, conservatives often dislike paying higher taxes in order to subsidize renewable development.

America’s incentives take a variety of forms. The Federal Investment Tax Credit offers a 30% upfront rebate for the capital cost of renewable projects. Feed-in tariffs guarantee certain prices will be paid for renewable energy that is supplied to the grid. FITs are big in Europe, but only a handful of states have implemented them in the US.

There are also ‘hidden’ penalties to discourage carbon-emitting producers. California implemented a cap-and-trade program in 2013, which caps the allowed amount of carbon emissions for power plants and manufacturers but then allows them to trade for credits from lower-emitting entities. Several states are also considering policy that would implement direct carbon taxes.

Energy policy is still largely state-based. Some states are more progressive in pushing for renewable energy than others.

Renewable Energy Standards are state-based mandates that would require large power producers to have a certain percentage of their production come from renewables by a certain date. California, New Jersey, and Hawaii have all been leaders in the adoption of solar, while Texas and Iowa have been leaders in wind.

While renewables are cleaner and require less maintenance, they also have several disadvantages.

The biggest disadvantage is intermittency. Solar isn’t producing when the sun’s not shining and wind isn’t producing when the wind’s not blowing. To solve for the intermittency issues, renewable advocates are pushing for large-scale energy storage or a new SmartGrid distribution (‘smart’ power lines) that immediately match supply to consumer demand. But these projects are expensive and it’s been hard to raise funding or gain traction. Especially with the rising cost of capital, as the Fed has driven up interest rates in recent years.

Another disadvantage is there’s a limit to how large renewables projects can become. Solar panels are reaching peak efficiency, large windmills have maintenance problems related to the turbines, and geothermal is only available in certain locations.

There’s no shortage of publicly-traded companies with exposure to the energy industry.

From energy producers like ExxonMobil (NYSE: XOM) and Chevron (NYSE: CVX), to massive utilities like Duke Energy (NYSE: DUK) and NextEra Energy (NYSE: NEE), to niche-specific technology companies like NuScale Power (NYSE: SMR) or EOS Energy (Nasdaq: EOSE), there are plenty of options for investors to choose from.

The decisions for new power products are generally based upon technology-specific economics, which is influenced by location and state-based policies. We should consider these factors — as well as how they change over time — to help guide our investment decisions.

Already a 7investing member? Log in here.