The Buy Now Pay Later pioneer reported solid growth in revenue and merchandise volume. But questions remain about the struggling American economy.

May 23, 2022

Affirm Holdings (Nasdaq: AFRM) is looking to build a more honest financial lending system. By disclosing all of its simple interest fees upfront and by allowing borrowers to pay over time, it’s a more transparent and convenient alternative to late-fee and often hidden-fee laden credit cards. It also gives merchants an intriguing new way to appeal to its 11 million active users. This two-sided network is a win for both parties and is rapidly gaining adoption.

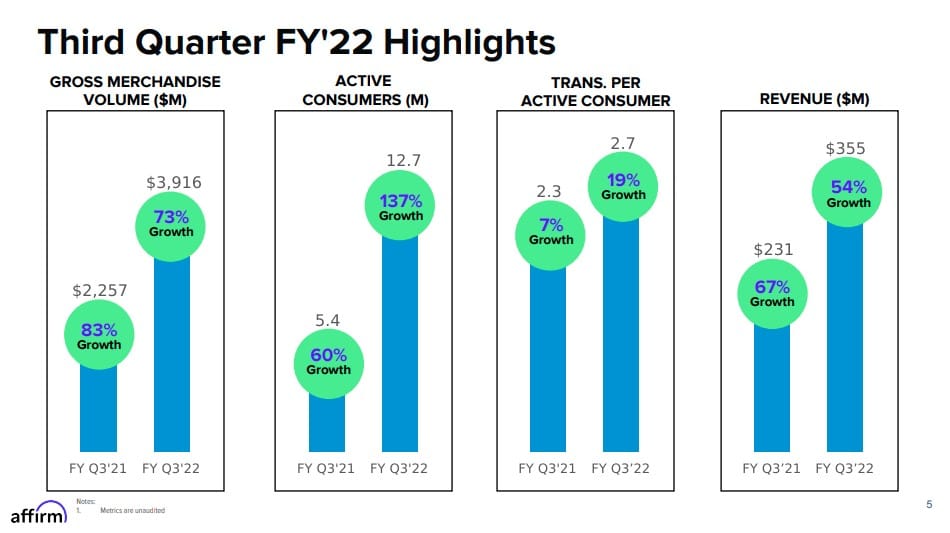

The company’s third quarter results re-affirmed that. Revenue grew 54% to $355 million and gross merchandise volume (GMV) was up 73% to $3,916. If we exclude Peloton (Nasdaq: PTON), who’s one of Affirm’s largest customers yet has had some struggles this past year, GMV was actually up 97% year-over-year.

One of the big wins in the quarter was an expansion of Affirm’s partnership with Shopify. Shopify’s (NYSE: SHOP) “Shop Pay” option (a variation of Affirm’s previously-launched “Split Pay) initially allowed consumers buying from Shopify’s vendors to pay a zero-percent interest loan in four equal installments over a six-week period. While the shoppers were paying zero interest, Shopify’s vendors still pay a 5-6% fee to Affirm, which they recognize upfront as revenue.

As is often the case, more data wins. And Affirm is getting really good at harnessing the power of more data.

This very expansion of Shop Pay is the result of Affirm learning more about Shopify’s hundreds of thousands of vendors and millions of consumers and then becoming more comfortable with expanding its financing terms. Shop Pay will now allow zero-interest biweekly or monthly payments for purchases of up to $17,500. Payment terms are no longer bound to six weeks; they can now go as long as 12 months for the most eligible consumers.

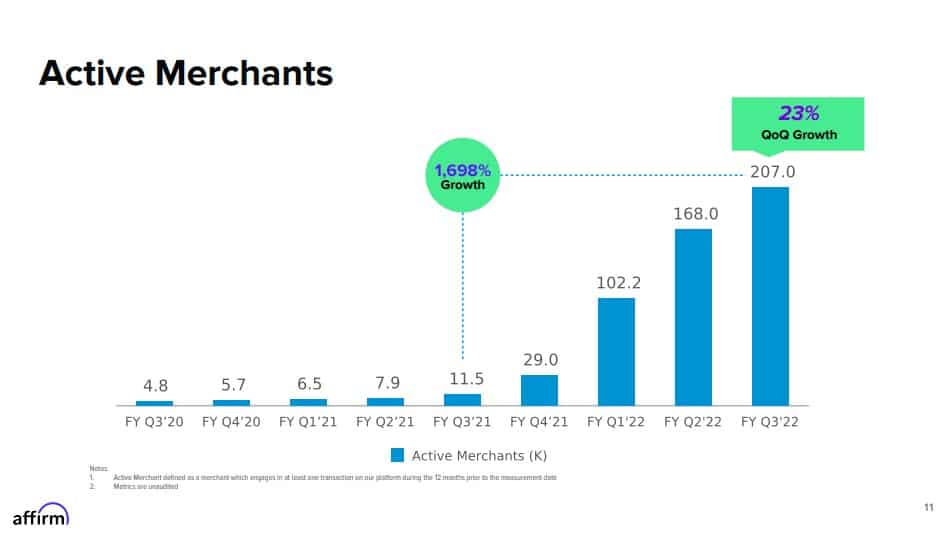

This is a great sign that things are working. Shop Pay already accounted for around a quarter of Affirm’s overall GMV. Expanding the deal with your largest partner is a great way to drive GMV even higher. But more importantly, it will further boost the merchant count, customer count, and data for Affirm to make future decisions off of.

However, things aren’t all rainbows and butterflies right now. As you’ve likely noticed, the American economy is going through some challenges and it isn’t really a great environment for consumer lending.

Inflation is spiking and interest rates are rapidly increasing. America’s economic contraction is making it much harder for Affirm to loan to consumers.

We’ve gotten used to Affirm’s stock price being volatile and becoming somewhat of a sign of the times. Affirm went public in January 2021, where optimism and enthusiasm for its Buy-Now-Pay-Later solution caused shares to triple during just the next 10 months. But things sobered up quickly in late 2021. After hitting a peak of $176.65 in November 2021, Affirm’s shares have now fallen 87% during the past six months to $23. Today, its market cap is $6.5 billion.

Furthermore, more than 10% of Affirm’s publicly-tradable shares now being sold short, who are investors that are betting for the stock price to continue to fall.

The market is going to do what it’s going to do when it comes to valuation multiples in the short term. But one of the most important questions that faces long-term investors is whether Affirm can continue to profitably made loans to creditworthy borrowers, even in a challenging macro environment. The rising revenues and GMV mean nothing if consumers default on their loans in mass quantities.

Affirm proactively expected the uncertain American economy would be an issue for consumers. It raised its 2022 allowance for credit losses to 6.4% of the loans it holds on its balance sheet (it sells other loans to external investors). That 6.4% allowance is up from 5.2% a year ago — meaning it’s expecting a greater percentage of its loans will go bad.

That seems, so far, to be a rather conversative assumption. Affirm uses a proprietary scoring system to determine creditworthiness (separate from FICO), and 92% of its loans fall within what it has determined to be the top-decile of its ITACS scores.

There’s a bit of an eyebrow-raiser in that chart. The value of the loans that scored less than 90 doubled over the same period last year. Is Affirm making lower quality loans for the sake of growing revenue? Will those loans go bad and end up needing to be written off?

Thus far, Affirm has written off $50 million of the $2.1 billion in BNPL loans it originated in 2022. That’s around a 2% delinquency rate, which is well within its expectations and its allowance for bad loans.

Yet this will be a key factor in how we evaluate Affirm’s performance going forward. We don’t want to see the company pushing itself too hard in an economically-contracting environment, which might cause it to make more bad loans in 2022 and get stuck holding the bag.

Yet the choppy macro is also exactly what’s causing many potentially-interested investors to sit on the sidelines. Now is a pivotal time for Affirm — to show that its scoring algorithms work and that it’s worthy of trust even in the middle of a challenging environment.

If it does that, it will gain favor with large financial institutions who are impressed by its performance. And it could send today’s depressed stock price soaring, in response to the cash flow machine Affirm is building.

I have a lot of faith in Affirm’s CEO Max Levchin and I believe he is one of Silicon Valley’s very greatest algorithm-builders of our time. He has a knack for solving challenging problems (which previously fixing PayPal’s fraudulent accounts) and in finding needles in haystacks (isolating outliers in data sets). If you are investing in Affirm, a good portion of your thesis should be in Levchin & Co building a better BNPL mousetrap than their competitors.

The company raised its full-year guidance and shares have recovered this month on the news. I personally believe the selloff is overdone and that shares are a great bargain right now. Yet there are important questions that will need to be answered in 2022, and the risks of permanent impairment to capital remain.

Already a 7investing member? Log in here.