America is moving aggressively to bring solar manufacturing back to its own shores. The future looks bright for investors.

October 23, 2023

“The energy market is $8 trillion and solar is 1% of it today. There will be solar companies with $100 billion market capitalizations in the near future.”

– Frank van Mierlo, CEO of CubicPV

Innovation alert: Solar PV manufacturing is coming back to America

Harnessing solar rays for power generation has the potential to be one of the world’s most important breakthroughs. The sun hits Earth’s atmosphere at 1,366 Watts per square meter, which provides more than enough to power the entire world’s energy needs.

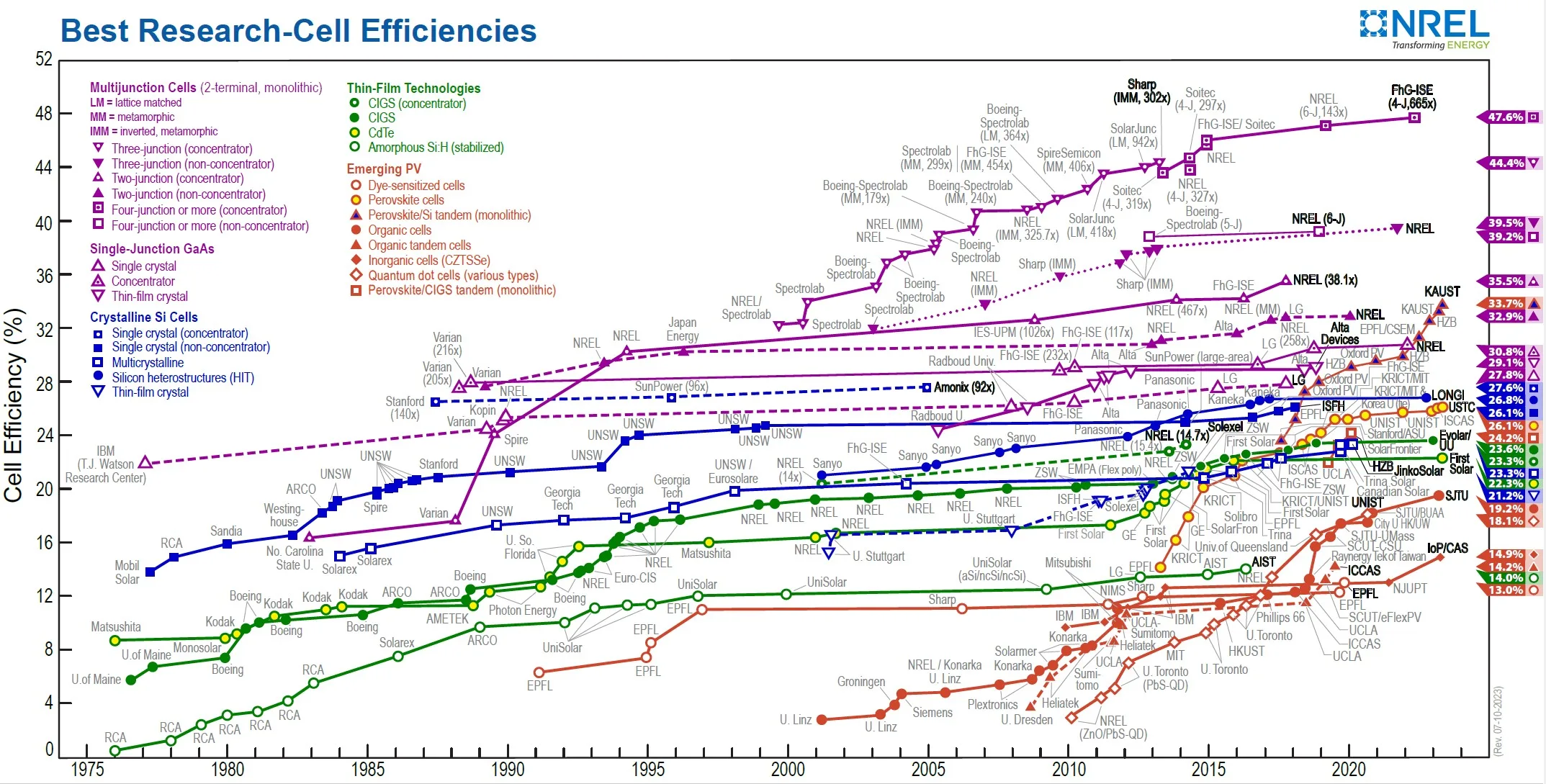

70 years ago, scientists at Bell Labs figured out how to convert that energy from the sun into electricity through the invention of the solar photovoltaic cell (“PV”). Their silicon-based solar cell inventions initially had a 4% efficiency, meaning only 4% of the total energy from the sunlight exposed to the cell was converted into useful electricity.

PV research has come a long way during the last seven decades. Best-in-class, commercial-grade PV cells today have around a 23% efficiency. Different architectures developed in the lab, such as thin-films or high-bandgap semiconductors, could theoretically increase efficiencies to up to 35%. However, these are still just research projects and haven’t yet been commercially-proven.

Source: National Renewable Energy Laboratory

Even though all of the solar research has originated in the United States, it was other countries who truly benefited from scaling up PV manufacturing.

Japanese companies like Sanyo and Panasonic were the first to invest heavily in solar manufacturing in the early 1970s, largely as a hedge against the OPEC embargos that quadrupled the price of oil in a single year. Germany then followed suit in the mid 1980s, largely due to the Chernobyl disaster in 1986 prompting its move away from nuclear and into solar for renewable energy.

But it was China who really pushed in the most chips for solar. China has included renewable energy goals in its 5-Year Plans since the 1980s, and its Best and Road infrastructure initiative in 2013 aggressively accelerated its role in the world’s renewable supply chain. Today, China is spending more than half a trillion dollars every year on clean energy initiatives; which is 4x the investment of the United States. Due to the massive investment, lower-cost labor, and economies of scale, nearly 100% of the world’s solar PV wafers are now being manufactured in China.

Even though China has a convincing lead in the solar race, America has ambitions of bringing the manufacturing of its PV technology back to its own shores.

Its Inflation Reduction Act in 2022 established generous incentives including the Advanced Manufacturing Production Tax Credit (45X MPTC) that will directly apply to any companies who make the components required for clean power generation. Components include the manufacture of photovoltaic cells, PV wafers, PV inverters, and battery storage modules. It would also apply to critical mineral suppliers.

In addition to the tax credit, the Department of Energy also has loan authorization of up to $400 billion; to get up-and-coming solar companies off the ground and operational.

That means now is the time for solar entrepreneurs to shine.

Several innovative companies are still privately-held. The government grants and loans are helpful, but manufacturing facilities are also quite expensive. These companies would eventually love to tap the public markets through IPOs, to give them a new funding source for much-needed capital.

One worth monitoring is CubicPV, who is committed to designing and manufacturing Solar PV wafers in the United States rather than China. The company manufactures the wafers directly using molten silicon, which is a vastly different and more efficient process than creating and then sawing the silicon ingots that are used by most manufacturers today. The molten silicon approach is faster and produces less waste.

CubicPV has announced it will build a 10 GW molten solar manufacturing facility in the United States that will begin construction next year (the location hasn’t yet been disclosed; though there’s speculation it will be in Texas). The plant will cost more than one billion dollars in total, with 2/3 of the funding coming from the DOE loan. The other 1/3 of the capital will come from equity funding, and $103 million has already been committed through clean energy funds led by SCG Cleanergy, Hunt Energy Enterprises, and Breakthrough Energy Ventures.

Source: MIT ClimateTech Conference

Cubic PV CEO Frank van Mierlo said at the recent MIT ClimateTech conference that “the IRA ensures America will have a strong industrial presence.” He believes state-sponsorship, coupled with private innovation in manufacturing automation and AI, will be necessary for America to regain its lead in solar manufacturing.

The learning curve will be another necessary factor, where it requires a first factory being built and operated before the necessary efficiency improvements can be identified and implemented later on. “A second factory will be 30% cheaper than the first, and the third factory will be 30% cheaper than that. American is still the most innovative country on the planet. It’s the best hope to come up with the solutions we need.”

Renewable energy programs are massive, requiring billions of dollars and up to a decade to properly implement. Yet the importance of low-cost, domestically-sourced energy is extremely important, to power America’s growing demand for electric vehicles, computing data centers, and semiconductor manufacturing.

The solar PV market has a bright future. Now’s a good time to find the well-funded innovators who have raised capital and are rapidly scaling up their operations. You’ll be hearing about their upcoming IPOs very soon.

This 7investing article is supported by our affiliate partner Koyfin. Koyfin’s financial dashboards are empowering individual investors to make better-informed decisions.

Through our partner program with Koyfin, they have prepared a special pricing offer exclusively for 7investing’s audience. Click on the Koyfin image below to learn more about this offer:

Already a 7investing member? Log in here.