Anirban's quarterly cloud computing checkin looks at how Amazon Web Services, Microsoft Azure, and Google Cloud Computing are growing ... and what we can learn about the broader Cloud Computing space from the results of these hyperscalers.

February 10, 2023

I (Anirban here) am back once again with my quarterly cloud computing check-in. After all, today’s enterprises use hundreds of cloud-based applications, and ultimately every company is on its path to embracing the Cloud. But how far are we into this cloud transformation? Is growth slowing because we are hitting the upper bounds of this sector’s potential?

My favorite barometer for answering the above questions is to look at the cloud segment of the three hyperscalers, namely Alphabet (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), and Amazon (NASDAQ: AMZN).

For those interested in looking at my earlier reports, I include links below:

Let’s dive in.

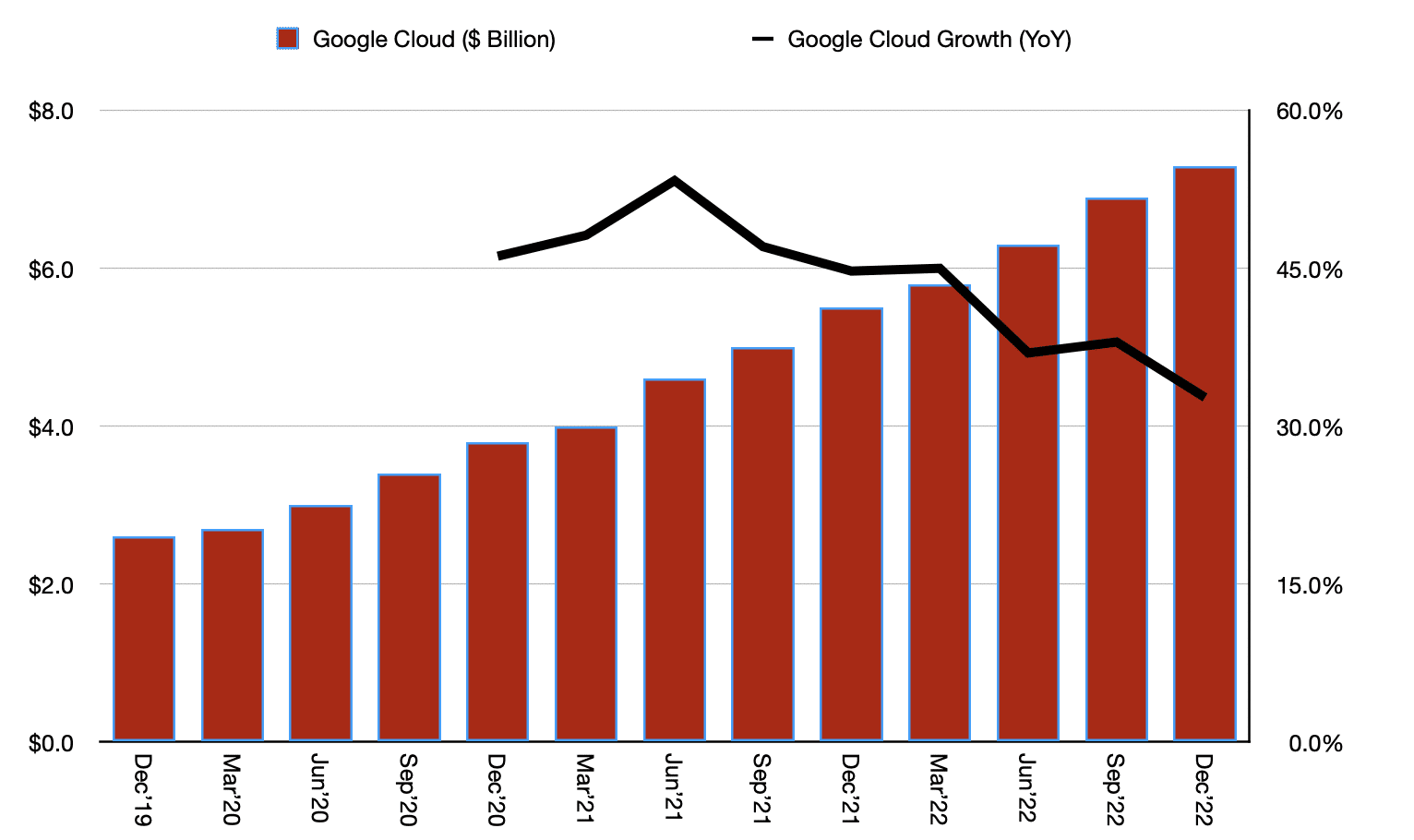

Google doesn’t break out GCP’s revenue. However, Google Cloud’s fourth-quarter (Q4) 2022 revenue grew 32% year-over-year to $7.3 Billion. Alphabet’s CFO Ruth Porat again used her stock lines to describe cloud performance noting the following:

“Turning to the Google Cloud segment. Revenues were $7.3 billion for the quarter, up 32%. Revenue growth in GCP was again greater than Google Cloud, reflecting strength in both infrastructure and platform services. Google Workspace’s strong results were driven by increases in both seats and average revenue per seat.”

This quarter’s operating loss was $480million, a solid improvement over the $890 million loss from a year ago.

Given Alphabet doesn’t break out GCP sales, we are left making an estimate. I peg GCP’s contribution to be 70% to 80% of Alphabet’s overall Cloud revenue. That puts GCP in the $20 to $23 Billion annual run rate neighborhood, growing around 30%. That’s strong, and Pichai et al. believe we are still in the very early stages of this journey. We can also appreciate the renewed focus on GCP’s path to profitability.

One way to track potential future growth is to look at the company’s remaining performance obligations (RPO). In Alphabet’s case, RPO is primarily related to Google Cloud and represents customer future spending commitments.

Alphabet reports RPO in its 10Q/10K filings, and it usually isn’t featured in the earnings release. As of December 31, 2022, RPO was $64.3 Billion, an increase of 26% year-over-year.

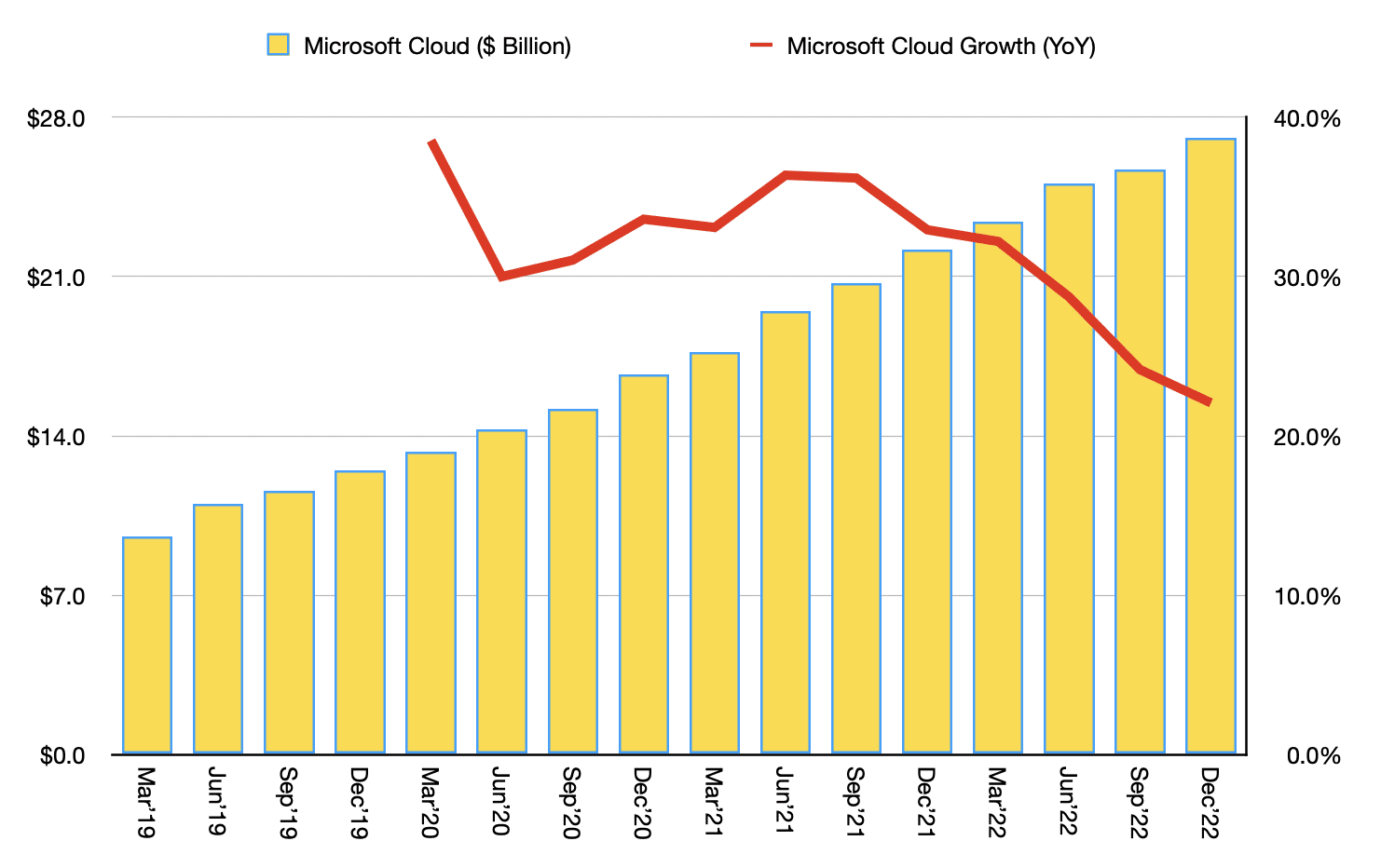

Like Alphabet, Microsoft too bundles Azure within its broader Cloud segment. Microsoft Cloud revenue in Q2 2023 was $27.1 Billion, up 22% year-over-year. Currency was a significant headwind as, on a constant currency basis, the growth was 29%.

Concerning Azure, CFO Amy Hood noted the following:

“Azure and other cloud services revenue grew 31% and 38% in constant currency”

Similar to Google Cloud, Microsoft Azure is facing the twin headwinds of a strong US dollar and a harsh macro environment. As noted by Hood, customers are optimizing their usage, resulting in a moderation of the segment’s growth. Hood provided additional color stating “growth continued to moderate, particularly in December, and we exited the quarter with Azure constant currency growth in the mid-30s.”

Given that Microsoft’s Cloud segment includes some mature but well-ingrained offerings like Office 365 Commercial, it might be reasonable to estimate Azure’s contribution to be roughly 60% to 70%. That puts Azure on approximately a $65 to $75 Billion annual run rate, growing around 35%.

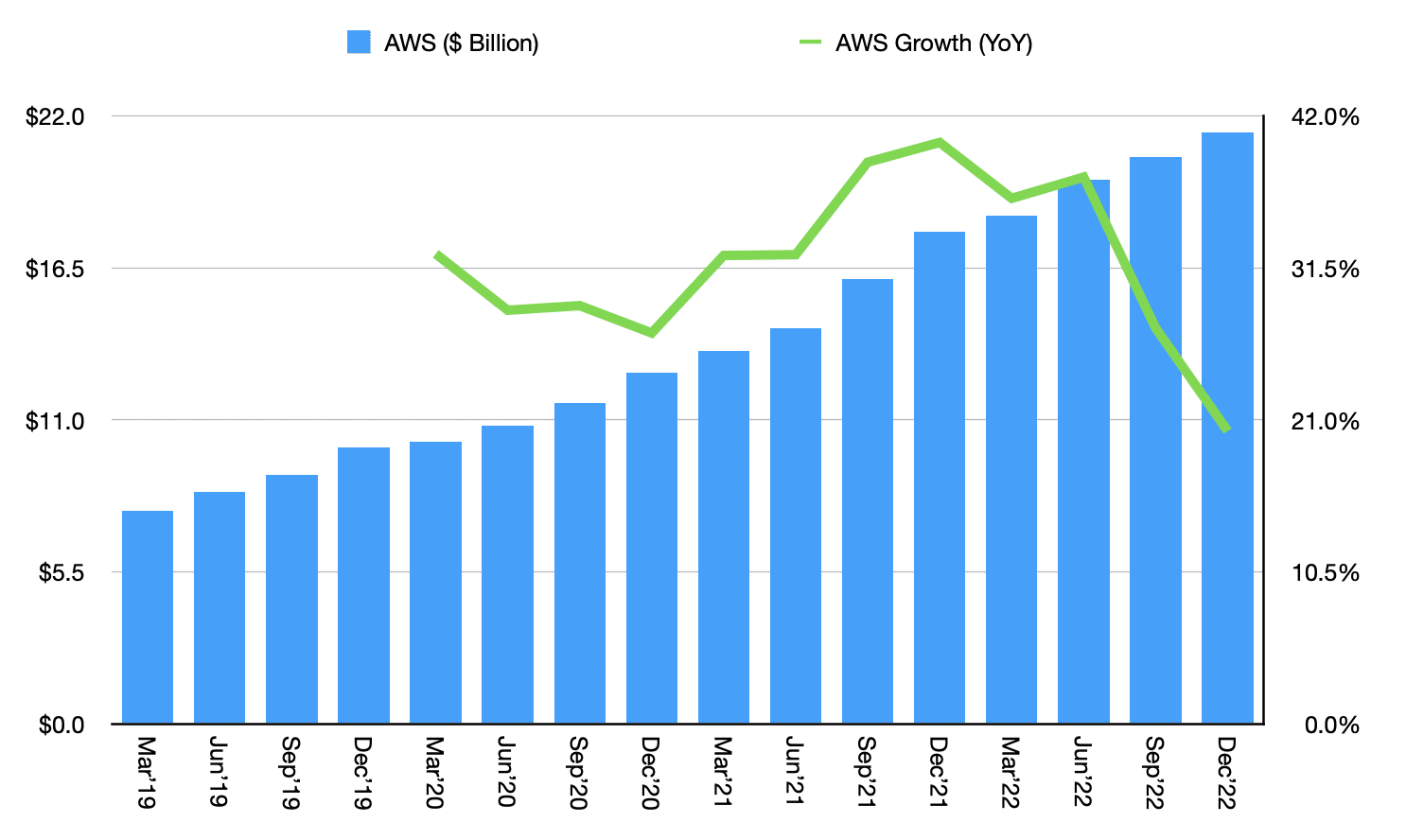

Lucky for us, Amazon actually breaks out AWS results. In the latest quarter (Q4 2022), AWS reported revenue of $21.4 Billion, up 20% year-over-year. That’s a deceleration from the 27% year-over-year growth in Q3 2022, 33% year-over-year growth in Q2 2022, and 37% year-over-year growth in Q1 2022. Nonetheless, the 85 Billion annual run rate is nothing to sneeze at.

AWS is nicely profitable, but this quarter we saw operating profit drop by 2%, coming in at $5.2 Billion. CFO Brian Olsavsky discussed the impact of the challenging macroeconomic conditions noting:

“Starting back in the middle of the third quarter of 2022, we saw our year-over-year growth rates slow as enterprises of all sizes evaluated ways to optimize their cloud spending in response to the tough macroeconomic conditions. As expected, these optimization efforts continued into the fourth quarter.”

AWS’ backlog stood at $110 Billion at the end of Q4 2022.

The hyperscalers are today approximately on a $180 Billion per year run rate, growing around 25%-plus per year. That says something about the scale of cloud computing. These hyperscale providers are pouring a lot of money to keep growing their infrastructures, which says something about the scope of future opportunities. Growth rates have moderated with macroeconomic headwinds but could easily bump up to the mid-30% ‘s given the size of committed contracts locked up by the big three.

Already a 7investing member? Log in here.