Long-Term Investing Ideas in a Volatile Market

Simon recently spoke with a $35 billion global asset manager about how they're navigating the market volatility. The key takeaways are to think long term, tune out the noise...

7investing CEO Simon Erickson interview's Flyover Stocks' Todd Wenning about how to find overlooked, high-quality investment opportunities.

August 31, 2023 – By Simon Erickson

There are thousands of publicly-traded companies for investors to choose from on any given day. What’s the best way to evaluate them — and to separate the cream from the crop?

7investing CEO Simon Erickson recently interviewed Flyover Stocks’ founder Todd Wenning. Todd has spent two decades in the investing industry — representing the buy-side with Ensemble Capital, the sell-side with Morningstar, and the retail side with The Motley Fool. He’s now launched his own Flyover Stocks newsletter to help investors find overlooked, quality companies.

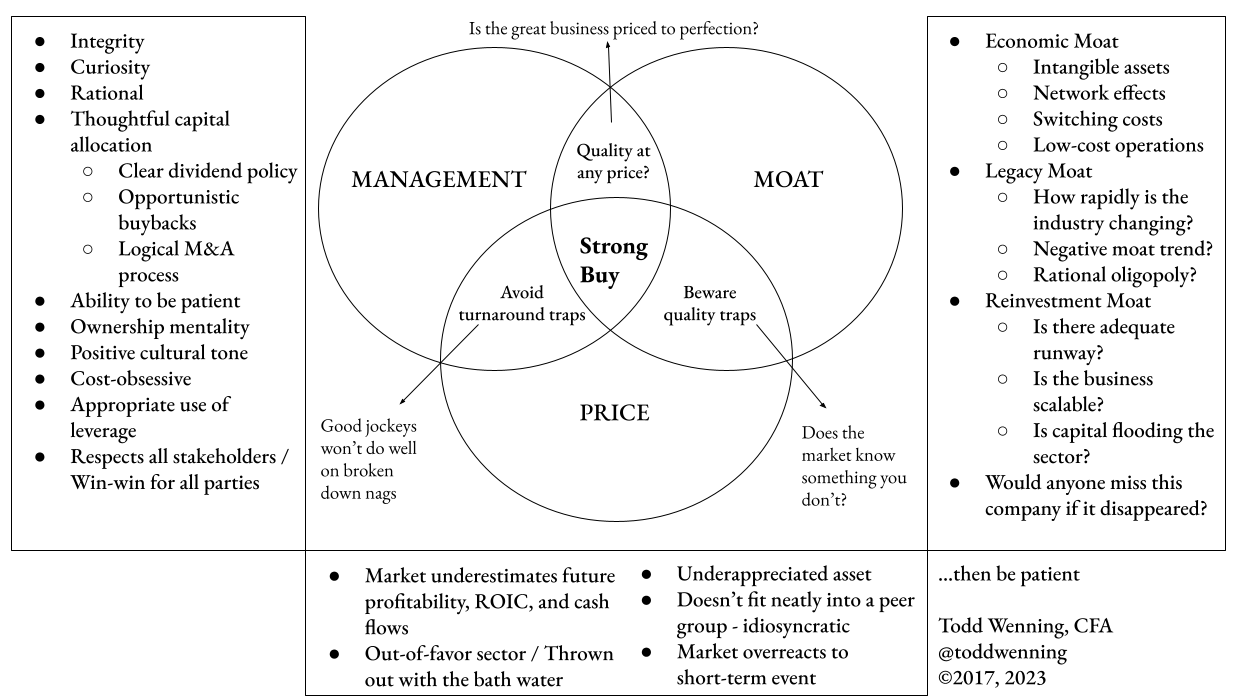

In the first part of the conversation, Simon asks Todd about his investing methodology. Todd describes that “Strong Buy” opportunities are often found at the collision of Moats, Management, and Price.

Source: Flyover Stocks

A moat refers to a company’s competitive advantage. Easy to comprehend but more challenging to quantify, moats represent an “unfair advantage that makes a business sustainable.” Todd explains that there are different types of moats — such as legacy or reinvestment moats — which should be considered as management plans out their capital allocation strategy.

The two then discussed management, which they framed as capital allocation decisions. Dividends are still a popular allocation strategy, as they show a discipline and commitment to returning cash directly to investors. Management teams can also pursue acquisitions or execute strategic buybacks with their company’s profit stream.

Lastly, Simon asks Todd to explain when the price is right for an opportunity. He further describes the differences between how institutions and retail investors tend to think about valuations. Specifically, most funds create detailed discounted cash flow models to pinpoint target valuations, and multiples such as the P/E multiple are a representation of the expectations of those models. Importantly, Todd notes that selloffs due to earnings results are never just knee-jerk reactions; they almost always involve institutions lowering their expectations of a company’s long-term earnings potential.

In the final part of the conversation, Simon and Todd discuss why Costco (Nasdaq: COST), Old Dominion Freight Line (Nasdaq: ODFL) and Worthington Industries (NYSE: WOR) might be intriguing opportunities for investors to add to their watch list.

Publicly-traded companies mentioned in this podcast include Costco, Old Dominion Freight Line, Procter & Gamble, Starbucks, Uber, and Worthington Industries. 7investing’s advisors and/or its guests may have positions in the companies that are mentioned.

Don’t miss out on future conversations like this! 7investing will be publishing upcoming interviews with the CEOs of PubMatic, Rocket Lab, and more. Join 7investing’s free email list to get our podcasts and investing insights delivered directly to your Inbox.

Simon Erickson 00:00

Hello, everyone, and welcome to this edition of the 7investing podcast where it’s our mission to empower you to invest in your future. You can learn more about our long term investing approach and see our favorite stock market opportunities each and every month at 7investing.com. My name is Simon Erickson. I’m very excited to welcome my guest to the program today. Todd Wenning is a lifelong Investment Analyst. He’s worked on the buy side, he’s worked on the sell side, he’s worked on the retail side. And he’s now the founder and writer of flyover stocks, which is a newsletter you can find out more about at flyover stocks.com. Also joining us today from up in Ohio. Todd, welcome to the 7investing podcast.

Todd Wenning 00:37

Hey, thanks, Simon. Great to be here.

Simon Erickson 00:39

Now Todd, can you tell us a little bit about the name of the newsletter? You know, I know that that’s kind of in some ways a tribute to to Ohio. But what let you do this. And also tell us a little bit about your background, if you would.

Todd Wenning 00:50

Sure. So flyover stocks was a combination of a couple different things. One, I’m about 40 miles south of Dayton, Ohio, where the Wright brothers are from, and my wife’s family is down in the Outer Banks of North Carolina, where they did the first flight. And so that I have that association. And that was part of it. That’s also the inspiration for my logo, which is the original Wright Flyer. Also, I think when I was at Morningstar, I wrote a series of articles called seeking small cap Moats. And really, these are stocks that I thought had economic moats, but weren’t being talked about, we didn’t cover them formally. And so I thought those were that was a great kind of premise to think about, or a framework to think about finding opportunities in companies that aren’t discussed a lot in popular circles and are nevertheless really strong companies actually went back and looked at the series of stocks that I discussed from 2013 to 2015, at Morningstar, and of the 16 companies, six of them went on to be acquired. And three of them went on to have over 400%, returns through August 2015. And or, I’m sorry, August 15 2023. And so that, to me, is a pretty interesting signal that even though I wasn’t doing any in depth work on it in terms of valuation, just kind of highlighting these over flowing over stocks, that been kind of ignored by the broader market can produce some great results. And you find some really interesting companies, you know, for the companies that got acquired, the acquiring business, thought they were had a great asset, and otherwise, they went on to do great things. And there were some flops in there for sure. But you know, there were some also some really good, good producers, like Winmark was one of them. Badger Meter was another one. So there’s a couple of companies in there that people wouldn’t have really thought about. I mean, just looking through the wall Street journal every day, but nevertheless went on to do very well.

Simon Erickson 02:55

Yeah, and Todd, you are a very in depth and thorough analysts, like you mentioned, you know, writing on behalf of retail investors, kind of looking at things a little differently on the institutional side of it. I do like how you framed your goals for flyover stocks, you’ve said that you’re looking for overlooked quality companies, led by thoughtful stewards of shareholder capital. Of course, each one of those words in that means something and I’d like to maybe dig a couple layers deeper into the onion here and this conversation you put out a couple of years ago, kind of a neat Venn diagram, maybe to frame this, where you’ve got the three circles. For everyone who knows the Venn diagram, there’s kind of three circles for what you look for, for strong buy opportunities. And you’ve labeled them as management, moat, and price. And so perhaps, for this conversation, let’s dig into those a little bit deeper for each one of them. And then also maybe talk about a couple of companies that are intriguing, or at least worthy of putting on your watch list. But the first is, is the the moat part of it. You know, I know that you’ve written extensively about moats over the years, but how do you actually identify a good business? What stands out as a strong moat for a company?

Todd Wenning 03:59

I think the easiest way to think about moats and you know, we can talk about the different sources, whether it’s network effects, or switching costs, whoever it might be. But if you’re just a non professional investor, and you’re looking at a company, the question need to ask yourself is what is this company’s unfair advantage? What can they do sustainably that their competitors can’t do? It might be that they have a network of service terminals, that would take 10 years for someone to replicate. It might be that they have some intellectual property that’s patented, it might be something that just makes it really difficult for anybody, either a larger company or a smaller company or a startup company to you know, eat away at its profits. And so that’s, that’s the moat part of it. And I think a lot of investors look at that. And they might say, that’s great. It’s got a moat. It’s, it’s good for a long time. But what often happens, the reason that moats erode in my experience is primarily what happens on the inside of the business, you typically hear about companies falling apart. And the reason is because of new technology, or it’s a new competitor, whatever it might be. But all that starts behind the castle walls to kind of continue that that analogy that Warren Buffett coined. It starts with management not thinking long term for whatever reason, or they’re not. They’re not agile, they’re not responding to new technology, they’re not, you know, there’s a culture of continuing the inertia of what they’ve been doing, it’s been very successful. why would why should we disrupt ourselves, and so that, that sort of snowballs over time, and it creates a very toxic internal culture, and that just opens the door for competitors to eat away at that moat over time. So I think a lot of competitive analysis, a lot of competitive strength analysis is focused on. Okay, how does this company fit in with, you know, competitors, external threats, but I think you also need to spend a lot of time thinking about management, and how they’re allocating capital, how they’re creating a vibrant internal community where people can thrive in their careers and help deliver on a purpose or a mission. That’s, that’s bigger than themselves.

Simon Erickson 06:17

Let’s double click on that a little bit, because the concept of mode is fairly easy to comprehend. But then it’s a little bit harder, actually was a lot harder to actually quantify it and dig into the the thing that you mentioned that I’d like to talk a little bit more about as capital allocation, we’re talking about internal candidate management decisions. So you’re going to find a great company that has got a moat, it’s capturing profit margins, it’s capturing, you know, operating efficiencies, the business itself is fine. But that’s only one part of it right now management has to figure out what are they going to do with that profit stream for the good of investors. And so when you mentioned capital allocation, I know that you and I have chatted before about dividends, and that you’ve written a lot about dividends, but there’s kind of different options aligned with what the business itself is. And then kind of you know, what the type of mode is, you’ve referred to this as a reinvestment versus a legacy moat, in some of the things that you’ve written about. But how do you think about that the tie between the moat of the business, you know, the profits of the business, and then the capital allocation of what to do with that from a management team.

Todd Wenning 07:17

So there’s a really strong link between moat and management and how to think about so one way to visualize a moat is to have a moat, you have to be generating returns on invested capital, above your cost of capital. And so when we think about it, as you have like a printer, and if you put $100 into the machine, and let’s say it spits out a 15% return, you get out $115, but it costs you eight, to run the machine, and you’ve got 107, right. And now you can take that and reinvest it over time. And so when that happens, you want to be continuing to put money back into the machine as much as you possibly can. And that, that’s, to me a reinvestment mode. You know, legacy mode, is when you don’t have the opportunities to reinvest back into that business and continue to generate those that spread over cost of capital. So in that situation, you know, to the extent and, and not every company, it’s not like, for most companies, it’s not like a 0% or 100% reinvestment rate every company’s probably usually somewhere in between, like, especially for a more established company, they might have 40%, to reinvest in the business, but the other 60% that has to get allocated, whether that’s knights opening the door to m&a, that’s opening the door to dividends and repurchases. And so how management prioritizes those things, the reinvestment, the dividends, the share buybacks, or the m&a is of utmost importance. I mean, we’ve all we all know stories of disastrous, transformational m&a deals. And that just, you know, can really, again, going back to what I said before about the moats eroding behind the castle walls is that, you know, major trends, major acquisition, transformational management get distracted, maybe they’re dealing with, you know, antitrust or whatever. And so it can become a very, very distracting time. And that can open up an opportunity for competitors to eat away at the moat. And so, again, that all comes back to you know, that connection between management and moat, you know, the moat provides the cash flow to management. And then it’s up to management to reallocate that capital in a way that perpetuates the moat and obviously, you know, hopefully makes it makes it wider over time rather than narrower.

Simon Erickson 09:39

Yeah, and if we go back a couple of decades, you know, this is kind of now blurring the line between moat and management. But the kind of the middle ground there is that, you know, you go back a couple of decades that seemed to be like dividends were the way to return capital to shareholders, right, tech companies would go out produce profits, pay it back out to their investors in the form of cold hard cash. We’ve certainly seen in the digital age m&a Picking up a lot more, and it seems like technology with AI and everything else we’re talking about in the headlines right now is progressing that pace of innovation even faster. Now, how do you how do you think about dividends? Now, Todd? Are there certain companies that should still always be paying dividends? Or is this a different era that, you know, is a little different that companies don’t choose dividends as an allocation strategy anymore?

Todd Wenning 10:24

Yeah, I think dividends continue to be the strongest signal to investors that the board is confident in the coming years because this is in our system, typically, it’s a progressive dividend policy. So in other parts of the country, or other parts of the world, excuse me, they might have like a flexible dividend policy where they pay 40% of net income that year, and it might be that income might be low, it might be high, but you’re getting 40% of that. Whereas in the United States and UK and some other markets and other companies, it’s more progressive dividend policy, so they’re raising their dividend each year with the expectation that they’ll be will continue to pay that through cash flow and earnings over the next 510 years beyond because what you don’t want as a board, or the management team is to have to cut the dividend or not grow it. So that helps, you know, investors to identify, you know, companies and boards that are competent. Now that confidence may be misplaced, right. And that’s and that’s our job as investors to decide whether or not that’s a smart move. But that’s to me a great signal of growing dividend is that the board continues to be confident in their ability to pay at least that much over the next five years, which means that they expect earnings, and cash flows to be at least similar to today. And so that’s a very good signal. Whereas with buybacks, there’s less of a commitment implied. So you can one year pay 2 billion next year do nothing. And so there’s not a lot of signal in that. Someone might say, Well, if you think they’re buying back the stock at a good price, that’s a that’s a good signal that the stock is undervalued, but it doesn’t really tell you necessarily as much, to me, at least as a dividend does with with their expectations with future cash flow, because the next year, they might stop the buyback and do an m&a deal to increase their their sales increase their earnings increase their incentives are there, their financial incentives, or whatever it might be. So there’s different reasons for that. But I think dividends also are a way to shrink the size of the sandbox that management has to play in is the phrase that I often use with dividends. And that’s not to say that you don’t want management to do anything in terms of you want to tie their hands. But by limiting by rationing, the amount of cash flow, it’s available to them in a given year, they have to be a lot more thoughtful about how they’re reinvesting. It’s not they don’t have an empty, blank check. They have to really think through, okay, I’ve got, you know, whatever it is 40% of cash flow this year to make buyback decisions or do m&a deals. I gotta be really thoughtful about that. There was a great paper done. It was it’s been a couple of days in a while, so the data may need to be refreshed. But there was an article by Arne Rob Arnott and Cliff Asness, the title is surprised higher dividend payouts lead to higher earnings growth. And one of their theories was just that, that the the management teams have a smaller sandbox sandbox to play with. And so they have to be more thoughtful about how they allocate the remaining cash flow. And so I think there’s, you know, there’s, I’ve heard great arguments for buybacks. I need I see the value in them. I’m not anti buyback. You know, I’ve invested in companies that only did buybacks. But I think dividends are a very continue to be a very relevant way to signal to investors that the company has cash, right, and they’re generating cash flow because you can’t pay out earnings at the payout cash flow. And so that’s that’s a really another important thing to think about when looking at a dividend payer versus another non dividend payer.

Simon Erickson 14:21

Yeah. And is there a sweet spot you look for Todd and you’re looking for a dividend payer? Are you looking for a company that’s paid maybe paying a two or 3% dividend that’s still growing 10 or 15% per year, you’re looking for a higher payout, maybe a five or 6% that’s growing in single digits or doesn’t matter either way?

Todd Wenning 14:37

Well, to me, you know, the market doesn’t give away free yield. There’s, there’s a trade off. There should be a trade off, you know, whatever the situation is. So if a company is yielding six to 8%, you know, the market is not just going to give you a free six to 8%. There’s a trade off there somewhere along the lines, either it’s low future dividend growth, or there’s something going on with the company where the future cash flows are in question. And on the other hand, a super low dividend yield doesn’t really give you much income. So, to me, it’s a balance, I think, if you are looking to set up a dividend portfolio, starting in the middle and working your ways outwards is probably the best way to do it, you know, the two to 3% dividend yield, there’s, and again, it comes back to your confidence in the moat. Right, you have that. And that’s one key thing about dividend investing is you have to be confident in the moat, which provides the company with the ability to generate the cash flows that will help you you know, that will increase your payouts, you know, for years to come. So it’s all, it’s all related and linked. So even though I wouldn’t consider myself a dividend investor, the way I might have in the past, I continue to think that it’s an incredibly important part of thinking through businesses and using the other tools at our disposal like moat analysis and management analysis to think through how dividends might play out and how it might benefit our portfolios.

Simon Erickson 16:10

Yeah, and then the final piece, then Todd would be the external, you know, the investor. The third part of the Venn diagram is price, right? We talked about Mo, we talked about the management now, what’s the right price to pay for a stock? I’d like to hear your thoughts on that personally, first, or in a minute. But first, since you’ve seen the buy side, you’ve seen the sell side, you’ve seen the retail side of it? Can you maybe introduce this by broadly talking about how retail investors think about the right price? Or how to value a company? Is that any different than how institutions tend to price a company to figure out what’s a good bargain? And then kind of maybe settle it up with how you personally think about the right price to get in it? Sure.

Todd Wenning 16:49

I would say there’s, there’s sometimes there’s commonalities, it really depends on what the investors are trying to do, whether it’s retail or, or an institutional investor, I would say for most quality, long term investing institutions, they all use discounted cash flow models, and then that helps them inform how they think about the valuation. On the other side of that is multiples right? So this P E, is this, the price the book is this. And that’s really a shorthand for what the markets implying. And so that’s that’s a key thing, I think, that gets misunderstood is that a P e is just an implied DCF. And so I think to the extent that you can grow comfortable and, and skillful at modeling companies in the future, that will help you understand what’s going into the multiples in the market today. I really recommend Michael Nelson’s book on called expectations investing, which I think is a great entry point for people to he explains things so well. And what he’s trying to do in that book is help you understand what’s priced into the stock through a DCF model. So here’s, here’s some assumptions, here’s how, you know, the discount rate, the net operating profit after tax and no, Pat, and that all kind of goes into what’s priced into the stock today.

And then then you can make a decision to say, I think that’s too low. Or that might be too aggressive for my taste based on what I think about it. I think either way, I think one of the reasons that DCFs are so valuable is that they are explicit. And you know, like any model, they’re flawed, right. There are flaws with everything. There’s downsides to everything. But I do think one of the key advantages is being able to explicitly see, okay, the market is down 30% on a stock. What does that imply about the out years? Because that’s really where, you know, I think [that matters].

I used to subscribe to this theory, and I changed my mind on it. Is that, you know, the market is tough. So short term, and it’s not what’s really happening, is the market is adjusting its long term outlook on the company based on near term information. So they’re important if they’re doing it intentionally or not, what they’re saying is that I now have doubts about how this company is going to look in 10 years. Because when you run a DCF, it will show you that the bulk of the company’s value is in the out years. You know, what your terminal assumptions are.

And so, if that changes, if the risk goes up, about you know, the discount rate goes up or the expected expected cash flows go down because of concerns about competition and eroding moat. That’s why the stock’s down. And so, to the extent that you can continue to have some reduction in that long term outlook for the business, you can say that I think it’s undervalued. And here’s why I think the long term relevance of this business will, will play out in the end. So I think that’s one way to do it, you know.

Again, so I think multiples are fine for what they are. But just understand that they’re implied. DCF. And so having an explicit forecast, you can make changes. You can alter your outlook, without trying to say, is this P/E right? You can actually see, you know, okay, margins are coming down. But does that mean, sales are going or implied going down? What does that mean? And so you can start asking questions.

And I think it’s a great way to also grow as an investor and experience is thinking through those, those unit level economics of the business. So you know, sales per store or profitability per per store. You thinking through those metrics, and trying to understand the business at a deeper level than what you might get from just using a back of the envelope piece.

Simon Erickson 21:03

Yeah, that’s, that’s some great insight. So you see a stock that sells off 30% by missing earnings by a couple of pennies. It’s so easy to dismiss it like Oh, geez, you know, this is a short term hiccup, obviously, the company’s just fine. You know, this is a buying opportunity knee jerk reaction, you’re saying there’s actually a couple layers deeper than that of why was the expectation off? Why did the company not hit what it was kind of transparently forecasting to do? There’s a couple of layers deep to that. Are you just saying it’s more in the out years than just in the quarter that we’re looking at right now?

Todd Wenning 21:31

That’s right, you know, there’s an expectation of, you know, if a stock falls 30 40%, it’s not because they missed earnings. It’s, it’s what the guidance was, or what the expectations in the market have changed, that guidance is down. And that implies that competition has increased or whatever it might be. So the extent you can think through that, is really the key to identifying when the market might be wrong might be a great time to take a position in the stock that you’ve been following for a long time. But the markets not stupid. There are times there are times where there’s, you know, emotions take over and crazy things happen. But you know, all in all the the markets pretty rational when it comes to thinking through challenges. And so sometimes those are overblown, sometimes they’re wrong. But our job as investors is to have conviction in those in that long term outlook that we that we believe in, and you either believe it, or you don’t if you don’t believe it, and you get out. So I think that’s really the key to thinking through some of those big drops in the market as an individual stocks is just thinking through, you know, to have that conviction going in, because you can’t build conviction in a crisis, right? You build a conviction ahead of time, you get to know management, you get to know the product, the service, what the offering is, what the value is. And then when the crisis happens, you can say, Okay, I’m going to stand behind this, or something really has changed, and I need to get out. So I think that’s awesome challenge for for investors to process, especially when in terms of market volatility.

Simon Erickson 23:10

That’s a great point. Now, one more question before we jump into some companies, you know, that investors could put on their watch list. But can you jump into what we’re talking about this? Can you chat a little bit more about how you’ve seen the institutional market? I guess, embrace innovation or like, think about risk, because, you know, we know that it’s, it’s challenging. Sometimes if you’re running a fund, you don’t want to stick your neck out too far, and take a huge risk on something that is still uncertain or unproven. But there is innovation and things do happen fast. Of course, you want exposure to that. We certainly seen as retail investors, no growth style, investors are often eager to kind of get at the cutting edge of what’s new out there. But we’re not dealing most of the time with with hundreds of millions or billions of dollars like institutions are, could you maybe chat a little bit about how institutions think about, you know, innovation and stuff that is not as established not paying dividends? Not a sure thing? With a strong moment? How’s it go up with the growth style companies out there?

Todd Wenning 24:05

Well, I think especially if you’re, I would say a growth minded investor. Again, the value is in the out years. And so thinking about how innovation today might impact long term value creation is so critical, you know, just just for example, you know, thinking about autonomous vehicles, you know, if you have autonomous taxis, what does that mean for Starbucks? Right? Will Starbucks have drive? throughs will it need drive throughs you know, how might that change the stores and how they’re set up and you can kind of see that already with a lot of the digital only type of stores? You know, maybe they’re planning for that will digital Taggable they have ads coming in to the taxis you know, to say hey, you can get $1 off your ride if he’s not the Starbucks or whatever it might be. So I think any any serious investor who He is concerned about long term value creation has to think about innovations. Okay, well, like is this really a game changer or not. And a lot of times, it’s too early to tell. But, you know, I think you need to be sensitive to that. Because once it becomes clear to the market, that something is changing, they’ll sell way before, it becomes like a completely revolutionary, you’ll see the market respond, because all of a sudden, it becomes apparent. And it’s like, let’s say, two or 3%, penetrated, you know, something’s happening here. And we need to, you know, again, thinking about the long term, you know, sell down the position, at the very least until we have more confidence. So, and then, like any serious long term investor has to think about the technological risks, but also understand, especially if you’re invested in thoughtful, driven companies, they’re going to react and respond to that. So, you know, if if, you know, if your Starbucks or whatever it might be, you know, they’ve been on the cutting edge of technology for a long time. And they were early in the mobile payments, and they were early in different things. And I have no position in Starbucks, by the way, I’m just, there’s just one that I remember off top my head, but you know, they’re gonna respond to it. And, and they’re going to try to make it work for them. So just to like to sell just because oh, well, that’s going to change things. That’s not a great approach. either. You need to think about, you know, how willing would this company be to disrupt itself or to adjust? Because if you’re in a very calcified business, and technology comes along, we’ll be it’s going to be easy pickings, right? So you have to, you have to find companies that are willing to change and adapt. And if you look at a lot of the incumbents, a lot of the winners from the internet age, it was the incumbents, right? Who adapted into web 2.0. and adapt it. I mean, we for every, every Uber, there’s a Procter and Gamble, right who use the internet to its to its to its benefit. So I think you just have to be confident in the company’s ability to respond to to change, if not easy to have either a smaller position or not being positioned at all.

Simon Erickson 27:13

Netflix versus Blockbuster, a great point. Let’s chat about a couple of companies here. Again, a disclaimer, these are not necessarily strong buys or endorsements, from Todd, but just some ideas for the watch list. One that you cover for a long time is Costco. Tell us a little bit about this company. I think we know it pretty well. But you know, what’s interesting for investors about this one,

Todd Wenning 27:29

I think, you know, Costco is one of those stories, everyone kind of knows about it’s great company, et cetera, et cetera. But it’s such a wonderful business that it’s really hard to understate that, you know, their annual report is 86 pages long. That’s it. It’s an extremely simple business. And if you are just starting out as an investor, or you’re just starting to do financial modeling, it’s the prime one to look at, in my opinion, it’s just so simple and so consistent. I mean, they have the store cohorts, average sales, and it’s the same table every year, and it goes all the way back to like 1997, or whatever it was. And it’s just a consistently, they’re not changing segments. They’re not instead, it’s a very clean accounting. Charlie Munger, I forget the exact quote. But he basically said, if you’re ever in doubt about the world, just think about what Costco is doing. Right. And so it’s so I really recommend people look at look at Costco if they haven’t already, or to think about it in a different way. I mean, they’re doing some incredible things with executive memberships, getting people to upgrade from the basic gold membership to the executive. And I think it’s something like four times, executive members spend about four times more than gold members actually get to get the cash back. If you think about their growth runway, internationally, it’s very, very strong. In its, they are slow but methodical, about how they grow internationally. So even though I would say most companies that they had the opportunities that that Costco had, they would aggressively run out, build as many warehouses as possible, try to have the first mover advantage in some of these markets. But they’re taking their time, it’s key to them to build up the supply chain, and the supplier relationships so that they can leverage their strength to get lower prices for their members. And you see that in China, they started with one store, and they had like, this bowl over 100,000 members sign up for that store. And that that weekend, it was incredible. And now they’re opening I think to more in China in next 12 months if they haven’t already. But you know, they’re just a great business, you know, to study and and to listen to they have monthly sales updates. And you know, I think they’re just incredibly transparent, great company to to learn about it’s it’s something that’s it’s not that I’ve known for a long time in my portfolio.

Simon Erickson 29:55

And then have a one that’s a little bit less known maybe to a lot of investors in our audience is Worthington Industries. An industrial company that you follow.

Todd Wenning 30:03

Yes, this is a company that first one I profiled in flyover stocks. And it really resonated with me a number of ways, is just up the road in Columbus not too far from me. But it’s also a company with a rare sort of spin off story. So typically, when you hear about spin off opportunities, it’s the the new company, the one that’s getting spun off that people are interested in, that typically gets sold off, after it gets spun off, because the existing shareholders of the remaining company, don’t, they don’t want that piece. And so they sell it, and they keep the remaining company, but here, they’re doing the opposite. Worthington is getting rid of the the legacy business, which is their steel processing business. And, you know, I’ve looked at Ohio based companies again, and again and again over time. And I’ve never looked at Worthington before, until, you know, a couple of weeks ago. And it was because of this, it was a steel processing company. And, you know, I was on the basic materials desk at Morningstar from 2011 to 2015. And I saw firsthand what happens with steel prices, you know, plummeted for basically four straight years after the China boom. And just you know, there weren’t a lot of moats there. And so I just I just did wasn’t interested. But Worthington is spinning off that steel processing business. And it’s keeping a much smaller consumer products, building products business, and it’s higher margin. It’s much steadier business not not as cyclical as the steel processing business, the stock has been priced for a long time, like a steel stock, trading less than one times sales, very volatile. And so by kind of getting rid of that volatile element, and focusing more on a stable, more steady Michi type of business, with great margins, they can really create this cash flow machine. And one of the things are things I really liked about the opportunity is that Andy rose, the CEO, who started in the CEO role in 2020. But he came onto the scene in 2008, as the CFO, and since he has been the CFO, they retired about 40% of their shares, which is hard to do, when you’re running a steel business and you don’t know, you know, again, going back to, you know, flexibility with cash flows, you know, to be able to retire 40% of the stock over the last 14 years, that’s a pretty good, pretty good run. And so if he’s given a more stable cash flow business, you know, that could mean more m&a, he said he’s done 60 m&a deals in his career 20 of them at Worthington. So he’s comes from that, that background, and it strikes me as a potential kind of outsider CEO, who can come in and really do some create some value. So that to me, it’s a great opportunity, the balance sheets very strong, you know, they’ve been, they’ve been paying down debt and holding more cash coming going into this to the spin off, which is supposed to happen in early 2024. So it’s a really intriguing story to me, you know, so So in their consumer products business, they make, like propane tanks and gas tanks and things like that, which are, you know, not very sexy type of type of business. But you know, there’s, they have a strong relationship with Home Depot, I believe they just raised their price with Home Depot and Home Depot, you know, wasn’t like a big deal, they didn’t have a cut price. So that relationship is very strong. You can think about the propane tank business, that’s a big traffic driver for Home Depot. So it’s a strong relationship they have on the building side, they have got some good joint ventures, one of which is called a wave. And that’s with Armstrong. And they so you think about the acoustic ceilings, you have an offices and various buildings that have the checkerboard. And so Worthington makes the steel beams that go into that, that sort of checkerboard pattern. And it’s like, it’s a whole system where it makes it easier to install. And the the builders can get on to the next project. And so it’s a great business great, great profit margins, and it’s very steady. And one of the concerns I had was, well, we’ve had this building, boom, what happens next, but you know, the profitability and the growth has been there since before the pandemic. So that joint venture called wave is is a very strong contributor and I expect it to be in the coming years for that business. That’s one of the to look at. You know, if you’re interested in smaller businesses, it’s kind of spin off stories. It’s an intriguing one and I’ve got a lot more written up on my site if you want to take a look.

Simon Erickson 34:47

Yeah, any other any other final thoughts? You know, it’s an interesting time out there crazy macro. You know, we talked about ad nauseam last year to Todd but any other final thoughts for retail investors that are that are looking to buy some stocks out there.

Todd Wenning 34:58

I think you just need to stay focused on the business. I, you know, the, if you think about, think about home builders, right? If you had if you would talk to home builders in fall of 2022, and tell them what the macro setup would be today, with, you know, higher interest rates, you know, cooling jobs, they would be like, Okay, we’re, we’re not going to have a very good 2023 And it’s been gangbusters for the home builders. So, you know, I minored in economics, as you know, in college, and none of this was in the textbook, right? It’s just, it’s, so did spend a lot of time on macro, I think this is a pretty common phrase that Peter Lynch use is basically you’re, you’re spinning your wheels, you’re not generating a lot of insight from that worrying about inflation, or interest rates. I mean, those are those are facts of the matter. And again, going back to having faith in management, you know, can they respond to different different markets? Can you trust them to respond and make the right decisions? Do they have pricing power, can they pass on higher costs? And these are all questions that if you can answer yes, all those questions you shouldn’t be too worried about what the macro environments doing, you know, if anything, you know, these companies will get stronger in downturns, you know, the weaker hands fall away, the weaker hands are worried about you know, how do we preserve capital and the strong ones are investing through the cycle you know, this is another company that you know, self taught my head but you know, Old Dominion freight line is a great business to follow and if you’ve look at what they’ve done is they’ve been investing in in service centers and warehouses for their for their less than truckload network for years when they’re when their competitors have been pulling back. And guess what they’ve been winning a lot more business and getting a lot stronger. So I think it’s really important to have that confidence in management and the moat and the strategy regardless of the macro environment.

Simon Erickson 36:57

Old Dominion is ODFL for anyone who wants to follow that. Worthington is WOR and Costco is COST. Kind of a fun conversation here about moats about management and about price and about investing in general. Todd winning once again, the founder of flyover stocks and learn more about that at flyover stocks.com. Todd had a lot of fun. Thanks for being a part of the 7investing podcast today.

Todd Wenning 37:18

Same Thanks, Simon.

Simon Erickson 37:19

Thanks, everybody, for tuning in to this edition of our 7investing podcast. We’re here to empower you to invest in your future. I hope you have a great week.

Simon recently spoke with a $35 billion global asset manager about how they're navigating the market volatility. The key takeaways are to think long term, tune out the noise...

Anirban and Matthew were joined by Alex Morris, creator of the TSOH Investment Research Service, to look at seven former market darlings that have taken severe dives from...

On episode 5 of No Limit, Krzysztof won’t let politics stand in the way of a good discussion - among many other topics!