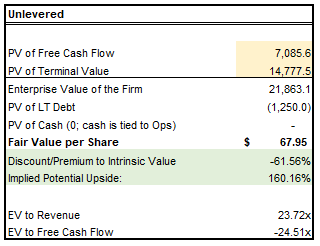

Our Discounted Cash Flow analysis calculates that Wolfspeed's stock is worth $67.95 per share. That represents 160% upside from today's current price.

February 2, 2024

Wolfspeed (NYSE: WOLF) is one company who’s running far ahead of the pack.

The pure-play silicon carbide material and device manufacturer is shifting into a higher gear when it comes to preparing for next-generation electric vehicles. By using silicon carbide as the material for the traction inverter (one of the most important components of the drivetrain), electric vehicles can store charge at higher voltages and have up to 20% longer range. Range anxiety is one of consumers’ largest concerns about electric vehicles. So this solution of building upon silicon carbide instead of regular silicon is quite significant.

Yet rather than coasting on the EV highway, Wolfspeed has suffered some speedbumps during the past few years. It is concurrently building three state-of-the-art manufacturing facilities, and its attempts to to get them quickly up to capacity has resulted in several short-term startup costs. That was evident in the $35 million of “underutilization costs” it recognized in the most recent quarter, which took a 1,700 basis point hammer to gross margin. Its aggressive issuance of convertible debt — which now totals more than $3 billion — will also result in substantial shareholder dilution between 2026 and 2030.

All of the reasons above have caused Wall Street’s analysts to raise a skeptical eyebrow. Wolfspeed is telling a good story of how silicon carbide will be the accelerator of the EV revolution. But Wolfspeed is still a risky bet, chock-full of uncertainties that they (right now) aren’t willing to commit to or invest in.

This is where the opportunity arises for individual investors like us. These risks are already more-than-represented into Wolfspeed’s stock price. And that makes it well-worth the potential reward.

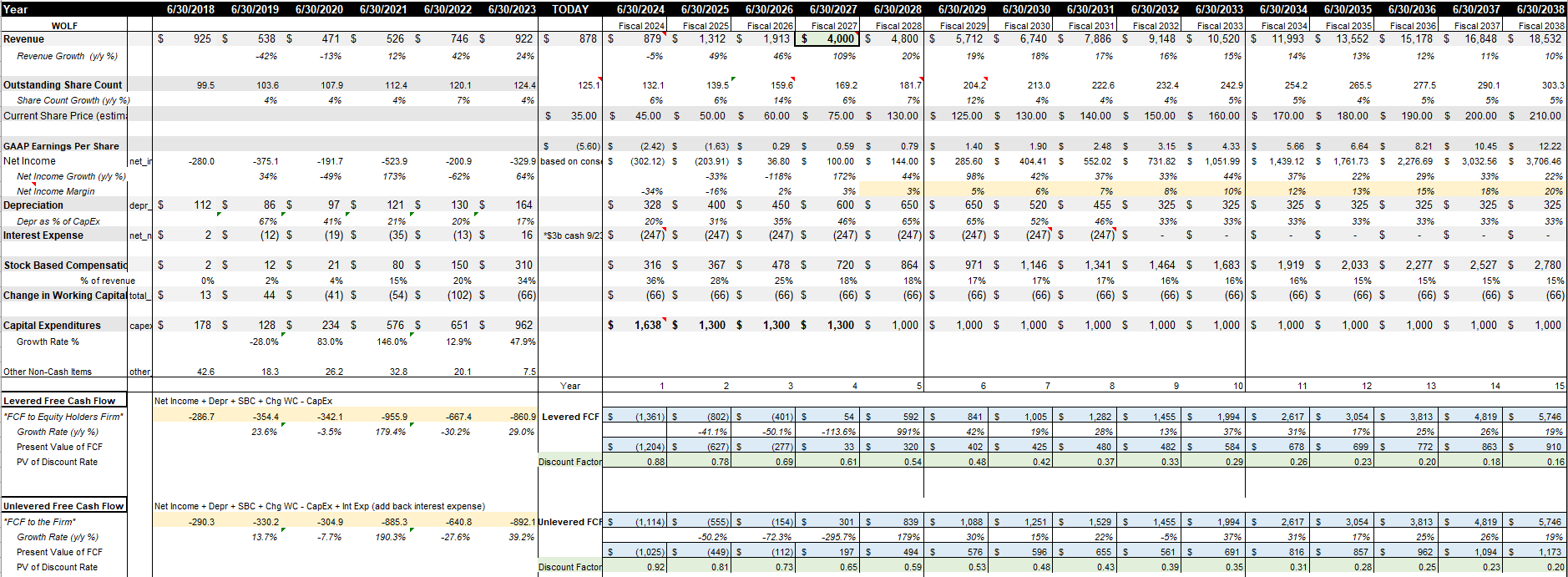

To quantify what that means, I recently ran a discounted cash flow analysis (“DCF”). A DCF discounts future cash flows to the present day, to determine an intrinsic value of what Wolfspeed’s equity is worth right now.

I’ve now run three iterations of the model, updating several of the assumptions and the inputs. In my most updated version, I’ve calculated that Wolfspeed is worth $67.95 per share. That represents 160% upside from today’s price of $26.06.

Here’s why.

DCF models are the primary way that Wall Street firms set price targets for stocks. They’re not simple, and those price targets are often all over the map because they’re so dependent on the assumptions being used. Here’s a quick look at the financial magic and voodoo that’s being run in the models.

I’ve followed Wolfspeed for several years and have kept up-to-date on the progress it has made as a business and on its strategic roadmap.

That said, here are the assumptions and the underlying context that I have used for my model (now’s a good time to grab a fresh new cup of coffee):

I’ve followed Wall Street’s consensus estimates for revenue in all years up until Fiscal 2026 — which comes from the 18 sell-side analysts who have a consensus price target of $43.68. They are calling for $879 million of revenue in 2024, $1.31 billion in 2025, and $1.91 billion in 2026.

These seem to be fair assumptions, as WOLF just reported $208 million of sales in its most recent second quarter. It is also doing admirably at ramping up the production volumes from its new upstate New York silicon carbide facility, whose $12 million of device revenue was 200% higher than the previous quarter. The NY fab now accounts for 5% of its total revenue.

For Fiscal 2027, I’ve shifted from Wall Street’s guidance to management’s guidance. They’ve publicly stated that they expect to do $4 billion in revenue in 2027. This is why you’ll see a delta in my model — between the conservative guidance from Wall Street through 2026 and then the higher forecast directly from management for 2027.

I’ve then estimated 20% revenue growth in 2028. And then gradually reduced the revenue growth rate for all years onward, to 15% in Fiscal 2033 ($10.5 billion) and then to 10% in Fiscal 2038 ($18.5 billion).

So in short, I believe I’m being pretty conservative in Wolfspeed’s revenue forecast.

I’ve again followed Wall Street’s consensus for Earnings Per Share estimates through Fiscal 2026: ($2.42) in 2024, ($1.63) in 2025, and then $0.29 in 2026. Wolfspeed has reported a net loss of ($4.31) per share during the past six months, though this has also been weighted down by one-time startup costs of its fabs. If we look back to the trailing twelve months, EPS has been ($5.60).

I’ve then estimated $0.59 of EPS in Fiscal 2027, based upon $100 million in net income.

Beginning in Fiscal 2028, I’ve modeled earnings to be a percentage of overall revenue — ramping up from 3% of revenue in 2028 and reaching 20% of revenue by 2038. This is also a conservative assumption; Wolfspeed’s competitor onsemi (Nasdaq: ON) is recognizing 27% net income margins.

Capital Expenditures (“CapEx”) are money spent on assets that show up on a company’s balance sheet. It’s things like corporate buildings, chemical plants, machinery, or anything else that has value that can be depreciated over time.

In Wolfspeed’s case, it’s the cost of the equipment and machinery for its manufacturing facilities. The company is in expansion mode and management expects to spend $6.5 billion in CapEx between 2023 and 2027.

Wolfspeed spent $962 million on CapEx last year. I’m modeling $1.6 billion this year and then $1.3 billion annually between 2025 and 2027. After that, I’ve estimated $1 billion per year — mostly on maintenance and upkeep for their fully-utilized facilities.

Depreciation is often modeled as a percentage of CapEx, increasing during years when capital is deployed aggressively (as equipment typically followed accelerated depreciation in its earliest years) and then slowing down when the CapEx is primarily just upkeep and maintenance. I’ve modeled peak depreciation of 65% of CapEx in 2028, which declines to 33% in the later years of the forecast.

Above: 7investing CEO Simon Erickson’s Discounted Cash Flow model for Wolfspeed

Net income isn’t the same thing as cash flow; and it’s the latter that DCF models really care about. So we need to make adjustments to the reported net income, to figure out how much cold-hard cash is actually going into the bank.

WOLF has been raising capital primarily through convertible debt, with a balance of $3.075 billion today. It also has a fair amount of long-term debt ($1.25 billion)

The convertible debt has a much lower interest rate — which ranges between 0.6% and 2.2%. Though it would convert to equity in 2026, 2028, and then in 2029. 2029-2030.

I assume that all convertible debt does convert to equity, which removes the debt burden by $3.075 billion by 2030 but also results in the share count rising from 140 million in 2026 to 213 million in 2030.

Wolfspeed’s $1.25 billion of long-term debt was issued with an interest rate of 9.88%. The debt is due back and is fully repaid in 2030. I have not modeled that the company will raise any further debt or convertible debt after 2030.

Through the combination of the above, I estimated the company’s overall weighted average cost of capital to be 13%.

Due to its successful scale-up of its New York, North Carolina, and Germany manufacturing facilities, WOLF becomes FCF positive by Fiscal 2027.

Wolfspeed does not make any acquisitions of other companies.

All cash is dedicated to operations and is not added back to the final valuation.

I used a terminal growth rate of 3%, for the cash flows in the years beyond 2038.

If the preceding sections either caused your eyes to glaze over or put you directly to sleep, here’s where I’ll hope to win you back with the punchline.

All of the assumptions and inputs detailed above resulted in a present equity value of $67.95. That’s what the fair value of Wolfspeed’s stock is worth today.

Its shares are trading hands in the market right now for a shade over $26. By my evaluation, the stock currently appears to be significantly undervalued and represents an excellent opportunity for investors.

Want to discuss Simon’s assumptions on Wolfspeed with him directly? Join 7investing’s free Community Forum.

I really appreciate the work you are putting into this, @7innovator (Simon Erickson)! Especially for this recommendation that seems to be quite contrarian – at least the market believes so. I would be interested in what the market currently expects in terms of the revenue growth (or combination of revenue growth and margin, in the end, FCF is what matters).”

– Community Forum post from a current 7investing member

Already a 7investing member? Log in here.