Long-Term Investing Ideas in a Volatile Market

Simon recently spoke with a $35 billion global asset manager about how they're navigating the market volatility. The key takeaways are to think long term, tune out the noise...

7investing lead advisor Matthew Cochrane is joined by managing editor of The Street, Daniel Kline, to discuss the state of the American consumer as well as four brick-and-mortar retailers.

September 15, 2022 – By Samantha Bailey

Retailers felt the pinch from myriad directions this year, from inflation taking a bite out of consumer wallets and supply chain constraints to rapidly changing consumer spending habits. Many stocks have taken a hit through this turmoil, even as they’ve navigated these tricky waters reasonably well.

Joining 7investing lead advisor Matthew Cochrane to discuss how some of the largest and best operators are doing in the retail space is Daniel Kline, managing editor of The Street. Cochrane and Kline discuss the state of the American consumer from a high-level view before diving deeper and taking a closer look at Walmart (NYSE:WMT), Target (NYSE:TGT), Five Below (NASDAQ:FIVE), and Dollar General (NYSE:DG).

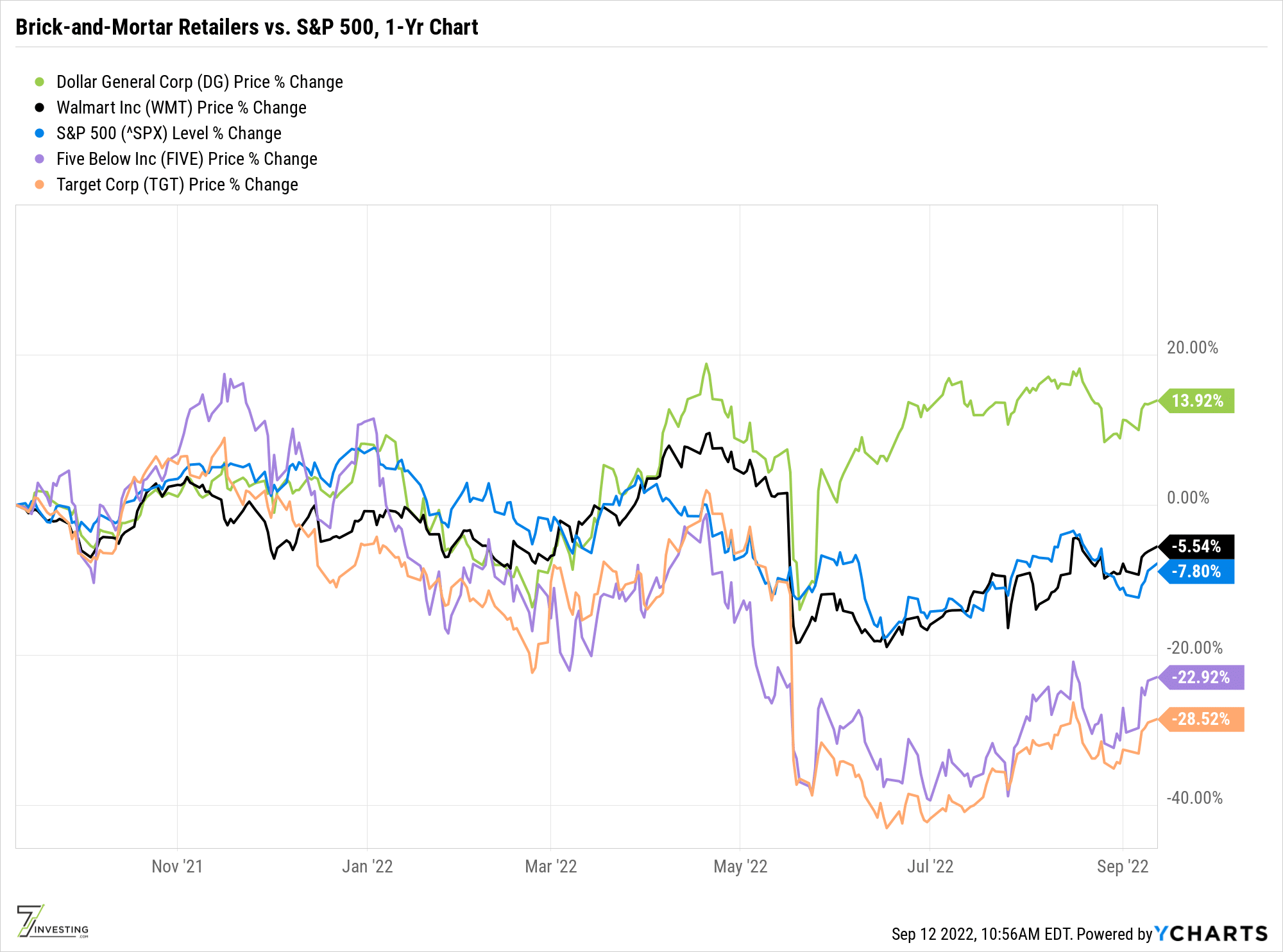

Though all four of these retailers have a history of outperforming the S&P 500, only Dollar General has given shareholders a positive return over the past year.

Has the market left behind these former darlings, or should shareholders hold on to these companies as they attempt to right the ship? Kline gives his answers, believing these companies’ management teams have made the best of a bad situation, even as they’ve made unforced errors along the way.

At the end of the interview, Cochrane asks Kline seven questions in lightning round-fashion that touches on ESPN, Starbucks’ new CEO, a dying big box retailer, how cruises are looking to differentiate themselves in a post-COVID world, and the movie industry.

Matt Cochrane 00:09

Greetings, fellow investors. I’m Matthew Cochrane. He lead advisor at seven investing where it is our mission to empower you to invest in your future. We do that by providing monthly stock recommendations to our premium members and educational content that is freely available to everyone, listeners. Today, I am very excited to introduce Dan Kline, my good friend, former colleague and managing editor of the Street, there are few people have a better feel for the state of the US consumer than Dan. So we’re going to talk about investing in retail. More specifically, we’re going to take a closer look at Walmart, Target Five Below and Dollar General and how these companies are navigating treacherous macro waters. At the end of the show. We have something fun and last Dan, seven questions. We liked that number around here. So we’ll ask him seven questions and rapid fire succession that might touch on the topics of coffee, movies, robots and cruises. But we’re gonna save that for the end. I can’t wait for this talk. So let’s get to it. Dan, welcome to the show.

Dan Kline 01:10

Good to be back. Hello, seven investors. It has been a while very happy to be here. Man. I was confused. I thought we were talking only about seasonal Halloween stores. Like if you’re gonna make a short term bet right now, I would bet big on spirit Halloween. I don’t think they’re public or there’s any way to invest them. But that’s going to be a big successful store

Matt Cochrane 01:30

if they weren’t public with their stock chart like peak every October 30. And then like crash November 1.

Dan Kline 01:36

Every time I drive by what I pictured the Simpsons, it was an early early season episode, where homers broker tells him, Homer, I told you, you have to sell your pumpkin futures book for October 31.

Matt Cochrane 01:48

He’s like, I’m just gonna write it out.

Dan Kline 01:51

A little bit. But it has been a really bizarre few years for retail. One of the things we’ll talk about a lot, one of the things I’ve talked about a lot, is the challenge has been for all these retailers that past results are not indicative of what you need in the future. What do I mean by that? I’ll go back to an example that we can all relate to remember the beginning of the pandemic, man, when everyone went mad max about toilet paper? Get couldn’t get toilet paper anywhere? And there were all these questions. Why can’t we get toilet paper? Where’s the toilet paper? Are we 14 toilet paper? The answer is pre pandemic 50% of the toilet paper supply went to offices, you could always go to Office Depot during the worst of the pandemic and buy the giant terrible roll of one ply toilet paper that every office has, you could always do that. But we couldn’t shift our production. But now if you’re a toilet paper company, which you might be on the side, for all I know, but I don’t think you are. But if you’re a toilet paper company, it is very difficult to decide what percentage of toilet paper production is going to go back into offices. And the reason offices use different toilet paper is because of the stress of the plumbing, you can’t have the cushy, you know Quilted Northern, you know with hundreds of people in an office building. But that’s the issue everywhere across the retail chain, you know, we’re going to talk about Target and Target right now is like the cheapest place on earth to buy a TV because Target bought too many TVs because during the pandemic we all bought TVs and I’m not disparaging their ordering people. But it didn’t occur to them that we all bought TVs. So we might not need another TV next year.

Matt Cochrane 03:28

generally don’t buy TVs back to back years. Yeah, it’s

Dan Kline 03:32

the problem. It’s the problem that we don’t know what the supply cycle is going to be like a lot of people painted rooms in their houses. Because of the pandemic your home, you got to turn your abandoned room into an office or a nursery or whatever it is. So you painted it. Well, you’re not going to need to paint it again. So is that going to affect Home Depot and Lowe’s and what they should order. And I used to run a store as we’ve talked about on many occasions, when I did the Christmas order at the toy store, I’d look at how many Legos we sold last year, how many train sets how many slot car sets. And I’d say Well, our overall business is 12% Bigger, I’ll get 14% More Legos and trade sets and whatever or Gee, I’ve seen a lot more interest in this area. So maybe I’ll get 25% more, but you’re basing it on something right now. History doesn’t matter.

Matt Cochrane 04:20

And day until another really big thing affecting consumers and it’s You can’t escape it in the headlines is inflation. So we have like you can’t help but notice it when you go to the grocery store. The prices are higher you go out to eat, the prices are higher gas prices, they’ve come down a lot from their peak, but they’re still up from like, you know, two three years ago. So how much is this impacting like the US consumer when it comes to like, I mean, some of the retailers we’re talking about, but like, I can’t buy a TV right now even if I didn’t buy one during the p&l Because I’m spending more on groceries.

Dan Kline 04:51

So I think some of it is over reported and some of it is real. And I know this is a tough thing to say but If you have younger kids, so you are going to the grocery store, and there are things you have to buy, you can’t opt out of milk. You can’t opt out of whatever you send your kids for lunch

05:11

or whatever it evens milk bread, hold cuts as I go

Dan Kline 05:15

to the grocery store, and I’m mostly making dinner. That’s what I’m shopping for. If I look at filet mignon is a little expensive. Maybe I made burgers that week, like some of us who can make substitutions. And I gotta be honest, I’ve gotten to a point economically where I don’t think about like, what a gallon of milk costs, like, I always thought that was like a dummy. Gotcha question for political candidates. Because I’m not sure once you hit a certain income level, you’re really going to think about whether it I don’t know if it’s five bucks or seven bucks or four, I’m really not sure. Now, I intimately know if Starbucks raises their prices. Because you see, it’s right in front of you every day. But I think inflation, if you’re not buying a house or a car, which are things both of us have done, you bought a car and I bought a house over the past 12 months. We had to move we couldn’t afford to live where we were living in the house we would have wanted to have, and we’re lucky we’re both portable. We both you know mostly work from home, my wife goes into the office a couple of times, and now it’s a much longer drive. And we haven’t had to buy a car which we will have to soon. Gas prices were a factor for us. But I drive a Prius, my wife drives a Nissan Sentra. They’re pretty fuel efficient cars. So is it great that filling up now cost me 18 bucks instead of 30? Yeah, it’s it is. But I don’t think it’s as real as we’ve played it across many things. Because there are still deals. Like if you need a TV right now, I just bought a 43 inch TV because my wife thought the TV in our bedroom was too big. It’s a whole other problem. But a 43 inch TV for $149. Because there are too many places with TVs during the pandemic, you could not get a laptop at a reasonable price. I used to think it was CNET’s, you know, top 10 laptops under $500, because my son needed a new laptop, and I was able to buy one of the 10. And it was slightly more than $500. Now, there’s no shortage of choice because they built up and they went well. We’re all home robbing any laptops, it’s all relative, we’re going to see gas prices keep falling, we’re going to see the supply chain sort itself out. We’re also going to see some of these unexpected shortages. So I’ll give an example Matt, you’ve been to our our vacation property in the in the Disney area, my wife and I are lucky enough to own a two bedroom condo in a very nice resort. And it’s about four miles from a target. A year ago, July, everyone in Florida decided they were going to drive and travel locally. Because delta was going around people didn’t want to get in planes there were there were a lot of reasons. And my resort, which is usually very slow in July sold that as I assume all the other resorts in the area did. So the target near us, which has a beautiful Disney section and a lot of like travel and pool stuff right in the front, sold out a towels, you could not buy like a $5 like, like Mickey Mouse knockoff, they’d probably real Mickey Mouse towel at Target. And it’s not because targets dumb. It’s because last year in July, there wasn’t heavy demand for towels. So you’re gonna see a lot of those things get even out, as we sort of figure out like, you know, when exactly are people getting in line at Starbucks, for a while, it wasn’t 8am it was like 1130 or two, and you’d be like, wait, I’m waiting in a 45 minute line at two o’clock. At Starbucks, we’re gonna see those normal patterns start to settle in. And I think that is going to make it easier to not have like what I would call artificial shortages, like Target doesn’t have something simply because they didn’t order it. Because in the past, there wouldn’t have been enough demand for it. And those things are going to sort of shake themselves out. You might also see retailers who do better with a little bit more. And then you might also see some retailers like Best Buy, get caught in. Nobody needs anything Best Buy sells right now, that is not a fault of Best Buy management. We all bought the appliances, we needed the electronics we needed, and we’re probably not going to replace them. You know, if you’re gonna buy your kids and Xbox, you bought it when they couldn’t leave the house for a year, you aren’t waiting to you know, so the demand prompt? Does that mean best is not a good investment? No, it just means that Best Buy is going to struggle for a year or two until we were out our refrigerators our televisions or or something new comes along that we have to have none of this is absolute. No one’s like they’re not going to sell them no stoves or no refrigerators. They’re just going to sell less of these things. And there is other demand we’re seeing travel demand increase, you know, so as the demand for travel goes up, well it’s target gonna sell at a bathing suits maybe like you know, they have to figure that out and things like I haven’t seen my relatives in the Northeast for years my mom has visited but I haven’t seen a lot of them. Well do I need a new winter coat does the target here need to stock up on winter coats which they normally wouldn’t sell we both live in, in beautiful sunny Florida. A lot of this is just Uncharted ground. And and yes, there’s obviously pressure from rising interest rates and money’s getting more expensive. There are things causing prices to go up. But there’s also just everything isn’t where it’s supposed to be. We didn’t have the infrastructure in place to support this to support everybody being at home and not eating in restaurants and all the things that were happening. And we have weird artificial economies that don’t work like food delivery, you know, where essentially, that’s a subsidized business that you shouldn’t be paying 9099, you know, for your delivery. And it doesn’t work just just like taking an Uber like that. We’ve talked about this a lot. Uber should have either been more convenient or cheap. It didn’t have to be both. And the reality is because they have competition, it’s both and neither one of them can make any money. So I think the strong retailers, there’s nothing to worry about. Like I certainly would do a bottom line. But I kind of think that’s the bottom line here.

Matt Cochrane 11:01

All right. Well, that’s a great overview. So you mentioned strong retailers probably have nothing to worry about. So let’s talk about like, what might be those strong retailers. So like I already said, Today, we’ll be talking about Walmart, Target Five Below and Dollar General a little bit more in depth. So let’s start with the biggest of those companies. I Dan, I guess the good news for Walmart shareholders is that in the last year, they’re still beating the market. But the bad news is they’re still down 6%. The company when they reported, though, like the revenue was still up 8%, same store sales were up six and a half percent, which I was actually, I was very surprised by that number. I thought that was a pretty good number. They said the sales growth was led by strengthened food and like grocery sales increased in the high teens on a two year stack, but that they were soft this in this just what you were just saying but like in those discretionary categories, such as electronics, apparel, and home products, Dan, how is how is Walmart doing?

Dan Kline 12:03

I mean, they’re doing as well as any company can be. And that that same store sales numbers, incredibly impressive. But I think what has happened with Walmart, is they’ve won some grocery customers, they may not have had a shot at pre pandemic. I think we all shopped grocery sort of as ritual. We live in Florida, you probably go to Publix, there’s like eight Publix within, you know, any, any place you live here. There’s like one on each side of where I live here. They’re really the only grocery stores where we live. Now though they’re building a fresh market, Walmart became really convenient curbside pickup, which they spent a lot of money on was very valuable. Their delivery programs were very valuable during the pandemic. So I’m going to assume that Walmart grabbed some people who otherwise weren’t going to be Walmart, grocery customers, and converted them. And those people might have said, well, if I’m going to buy groceries from them, because it’s convenient, maybe I will look and say, see if they’re cheaper on a TV or a lawn chair, or, or a bookcase or clothes or whatever it might be. There’s some weirdness. You know, you remember the story is somewhere early in the pandemic, where Walmart CEO came out and said, We’re selling a lot of tops, and not a lot of bottoms. And it’s because most people were zooming in and zooming through now I’m wearing a polo shirt, Under Armour shorts, like I haven’t put pants on in three years, including, like, you know, a year of hosting live television, in our former employer, it’s just so those trends are maybe reversing. And you might see in the next few months, as companies are quietly getting rid of any sort of vaccine mandates or rules. And even if they’re not mandating back to the office, they might be offering it or having meetings in person, you might see some people that had two years of the pandemic where perhaps they didn’t take care of themselves, or perhaps they used it to work out and become you know, a different party type in a good way. Well, they’re going to No, don’t go need to buy some nice clothes. And might they do that at Walmart and Target like there’s a limit to what you can buy at those places. But I do think you’re going to see, you know, a little bit of variable spending. But I think it’s fair to say that Walmart and Target very specifically increased their customer base by leaning into what people needed during the pandemic targeted been doing this anyway, and really pivoting its business. Walmart really embraced it, and has sort of figured out this model where they don’t need to spend as much as Amazon for fulfillment because they can leverage their stores and that was laughably bad when it started. I think I told you once I I placed an order for five items that came in four separate boxes and for the fifth item it demanded I go to the store to get it it was like a pencil like it wasn’t, it wasn’t you know, it wasn’t anything important. Or my wife ordered a cooler for her office and it was in the store and I was walking around the store and they said that they would send me an email when it was ready. I got that email four days later. They fixed a lot of those problems and really have become a very reliable way to buy them. And I’m a dedicated Amazon guy, mostly because I pay for Prime and, and it just becomes easy. But there were times during the pandemic where I was like, You know what Walmart has the taco shells I’d like I’d like to get, I’ll just place a $40 order from Walmart and go go pick it up because they have something I can’t get or I don’t want to wait 24 hours even for Amazon, or maybe I didn’t want to brave the target during some of the worst of the pandemic where perhaps you didn’t want to be around other Floridians. But I feel really bullish on Walmart, there are some pain points here. This is a company that chased away Mark glory, it’s its top digital executive. And I’m not 100% Convinced that they’re fully committed to the money it will take to continue to evolve and grow that business, I sort of watched how that happened and how we had to sacrifice like every lieutenant to force them to get where they were going. So I do have some worries that I don’t have with some of the other players on this, this. But the numbers have been incredible. They’ve reinforced their bonds with their existing customers, they’ve taken less margin in some cases in order to keep prices low. And they’ve really remembered what they are. And you know, Walmart’s are very hit and miss, there’s one near our vacation place, that’s beautiful. And there’s the ones where we used to live that we’re not, and we’re not particularly clean or well taken care of I’d love to see some of that get ironed out. But I think largely, you know what you’re getting, you know, the prices are going to be good, you know, you know if hey, if I stopped by a Walmart liquor, because I’m coming to Maxx house, and I want to bring a 12 pack and and a bottle of bourbon. And that’s just for Matt. You know, I know I’m gonna get a good price, as opposed to just the liquor store in the strip mall. And there’s an incredible brand equity there that they’ve really they would have been fine. If they’ve done nothing digital, they would have been a legacy brand that was a bad investment, but still would have chugged along. And now they’ve really become this omni channel store after a lot of bumps like the pickup kiosks and just things that were like too hard to deal with. They’ve really figured it out and pretty much have the model down.

Matt Cochrane 17:02

The curbside pickup for groceries is like that’s what we use. Now. We’re in Florida. We shopped at Publix, which is like, you know, a Florida mainstay for decades. Yeah, we shopped at Publix store for four years. And then we finally switched over, because the value was just it was just significantly better than Publix offered. And, and to your point, like what you were saying like, it’s true, like sometimes, like, I needed some socks for for work, you know, the other day, and she was going to pick up the groceries and she was like, well just go in, you know, and buy the socks you need, you know, while I’m there picking up groceries and that worked out. So it’s things like that, like they are, they can be pretty convenient

Dan Kline 17:41

for No, it’s a really smart model. Because the reality is if I go to a Walmart for groceries, and I’m actually going to walk around the store, I’m probably going to walk through electronics, I’m probably going to walk over and you know, look at, you know, the cold medicine and whatever and see if there’s anything I need or maybe pick up a toothbrush or whatever it is. And they sell a lot of those things at Publix. But I’m not going to randomly walk by the public and going, oh, you know, we really need a patio umbrella. Like, you know, hey, there’s one and it’s only 40 bucks, maybe I should just buy it or take a picture of it. Next time. Being everything is not a bad business model, and Walmart and Target, which we’ll talk about later, they’re pretty much everything.

Matt Cochrane 18:20

So let’s take that cue and let’s talk about target. Dan target struggled a little more in the last year than Walmart, it’s down almost 30% in the last year compared to the market there, but if you take if you just zoom out a little bit over the last five years before 2022 came, I mean, they were humming pretty good. On the left here, you see their total revenue just increased every year at a good consistent pace. And 2021 You saw their earnings like just explode in that like post COVID Shopping Boom. That’s kind of probably what’s causing the problems now. But if you zoom out over three years, it’s still outperforming the market. They recently like wave their rule for the age of their CEO so that he could stay on.

Matt Cochrane 19:09

Dan, house target doing

Dan Kline 19:13

so target made the mistake of following the legal requirements of the SEC. And being honest when they reported earnings. And they said we have a bunch of bulky inventory that is selling slower than expected. It was televisions it was it whatever limits of furniture they sell, you know maybe some patio stuff. It was the big and they said what we’re going to do is we’re going to sell this off at a lower price and lower margin to clear out our warehouses for the holiday season. We think ultimately that will lead to better holiday sales than just having super discounted stuff you kind of don’t want at the holiday TV prices are at Target were so good that I almost bought one before I realized my wife actually wanted a television and I was literally I’m going to put the box in the garage until like our TV wore out because it was so inexpensive. But the reality here is, target had a short term glitch. They’re correcting it. And they’re strengthening their relationship with their customers. Because as a target customer, I don’t care what their inventory is. I’m thrilled that they’re saying, Hey, we’ve got some excess stuff. Now it’s cheap. It’s the same thing as like, you know, when the great day to buy Halloween candy, November 1, you go to target, it’s all 50% off. And you know what, it’s candy. It didn’t go bad. It’s not you know, produce. So that’s kind of what’s happening here is target hagit, they made some mistakes. And frankly, I think some of those mistakes were avoidable. So I would look at the person who thought we were going to replace our television that we’d sold it getting, you know, ridiculous numbers. Now, some of that might have been based on they felt there was still demand because there were the chip issues and it was hard to get. But I think target is an incredibly well run company, getting rid of the ridiculous age rule for the CEO to keep a good CEO and I’ll ask you the question, man, would you rather Bob Iger or Bob chapek was CEO of Disney right now.

21:15

I would take Bob Iger.

Dan Kline 21:16

I think any person including Bob shape, it would take Bob Iger and was was target really going to get rid of a transformative CEO who has shown that he can handle terrible times I don’t know many of you remember this listening the pandemic pretty awful, Matt and I used to have to go and like meet for dinner outside, afraid that we’re gonna like get each other’s kids if we got too close to each other, like it was not a good time. And for retailers, you had to deal with being closed in some markets only being able to do delivery. You know, the demand for curbside pickup and delivery skyrocketing what people wanted figuring out how to deal with like paper towels, shortages of hands, Brian Cornell did an incredible job of that. So for him to be there for three more years. And it really should be up to him if he continues to perform as long as he can do the job. And there shouldn’t be a look put a succession plan in place. It’s always good when you know who the next boss is. But if the existing boss is still doing well, you know, the Patriots didn’t get rid of Bill Belichick just because John, Josh McDaniels was a good offensive coordinator. And we’ll see how good he is in Las Vegas this year. But this was a smart move this company is well run, he’s dealt with a lot of problems, a lot of change. You know, I love the biggest thing I think he did, was pivoting to the owned and operated brand model. And what does that mean, when you go into Target, they have everything from like their Britain gather food brand, to their Magnolia partnership with Chip and Joanna Gaines. These are brands that target bones. So target doesn’t have to go to Nike or whoever and say like, well, our terms aren’t great, we want more like they used to sell champion, which I think is a Reebok brand. They don’t have to do that, because they made reasonable quality brands at good prices. And in some cases, you know, celebrity partnerships and other big names that make you want to go to Target. And then you have things like the long standing Starbucks deal, I would walk to target when I at our last place in West Palm Beach in and get a Starbucks most mornings because the real Starbucks was across a four lane highway. So it was easier to walk in there. They’re adding Ultra beauties in hundreds of stores, which are incredibly sticky and give you a reason to be there. You’ve heard people say this before, but in many ways target is the new mall. And you know, I still kind of believe in the old Mall. But I’ve spent a lot of time just walking around the target with Starbucks in my hand and sort of believe that there’s, you know, there’s a lot of cachet to that brand. And Brian Cornell was the one who saved it who revived it. So I’m very glad he’s gonna be there.

Matt Cochrane 23:47

How similar are Walmart and Target because to my untrained eye, the Excel especially a Super Target that sells groceries, they’re very similar. Yet I’ll say this, like, it feels like people go to Walmart for value out of necessity, but they want to go to Target. Like it just seems like it has done a very good job of reaching the suburban wife, mother, you know, so to speak. My daughter’s like their their ideal date with with my wife is to go to Target and get a Starbucks and buy like a new outfit for $20.

Dan Kline 24:23

Yeah, my son and I have done the same thing. Maybe not so much on the outfit side. But you know, he’d want to go get a snack at Starbucks, I’d get a coffee. He’d want to look at, you know, whatever collectible magic cards or video games he was into at the moment. I might buy, you know, whatever a t shirt or who knows what Walmart is arguably a better grocery store. Maybe not the super targets and target definitely has a better house brand. But there’s generally more like a Walmart is almost a full grocery store. Whereas a regular Target’s grocery store is still sort of a limited grocery store. There’s not that much fresh meat, there’s no fresh fish. I mean, there’s a little bit of packaged, it’s fine. I’ve cooked many a meal from Target. But if I was, you know, somewhere there wasn’t a Publix and there was a Walmart, I’d be perfectly happy going to the grocery store there knowing they’re gonna have everything. When it comes to apparel target is a clear step above, you could buy a bathing suit or dress shirt from Target and no one’s going to be a little nicer. I think of Walmart as where you get your kid stuff for camp that you know is not coming back. And you know, it’s getting washed all in either hot water or cold water. So it’s all going to turn pink anyway. You know, and there’s a real place in the market for that. And I’m not saying I don’t own like a pair of sweatpants from Walmart. I’m sure I do. But every bathing suit I own is from Target. And I’ve owned them for five or six years. So the value in the where I live in Florida and I travel to places with pools and beaches a lot. I wear a bathing suit a lot of the time. I have lots of things from target now some is target clothing, a step below Kohl’s and a lot of cases. Yeah, yeah, it probably is. I’m wearing a Kohl’s polo, not a not a target Polo. But I think you could do just fine buying most of your stuff from Target. And with Walmart, I’d say it’s a little bit less than that, you know, the bookcase is more likely to be particleboard than it is sort of like even like laminate, let alone wood.

Matt Cochrane 26:24

Alright, so our next company we’re going to look at is five below. Five Below is down 23% In the last year. This company though, Dan, we both we both liked this company, its second quarter results. I’m sorry. It’s a you know, it’s second quarter results kind of highlighted the trials, though, that it’s facing, because they sell so many discretionary items. And that’s kind of what’s been like, like felt the pinch the most, like by consumers, like when during the conference call their CEO is talking about the macro environment, and talking about like inflation cutting into consumers budgets, and just how consumers are traveling more and spending less on discretionary products. I still believe though, and I correct me if I’m wrong, though, that it’s still it’s still a differentiated retailer. And I LOVE IT strategy of like targeting teens and tweens, you know, and having the right products for that add a good value so that they can go there on their limited budgets and still pick up the trendy item that they want. Whether that’s like a fidget spinner, or slime or squish Mallos or Lita like the new thing. I just liked that strategy. Dan, how’s Five Below doing? Yeah, I

Dan Kline 27:43

think five below will benefit from a tough economy ultimately, heading into Christmas, where else would you get your stocking stuffers other than five below? Like, the reality is they target teens, but they also target you and I because my team isn’t nostalgic about Big League Chew or Hot Tamales are whatever other candies they might have. And they have every candy from our youth. And it’s all really affordable. They have, you know, the fun Japanese drinks, My son likes that are like $8 when you get them at a sushi restaurant that are like two bucks and five blow, you can go in with your kid and hand them $5 and know that they’re going to have fun trying to figure out what to buy. And they might be able to buy more than one thing that we’ve talked about this many times. But are you going to buy your 15 year old like $30 headphones are you just gonna go to five below and buy like 10 pairs of semi disposable headphones, because you know, they’re going to chew on them and lose them every

Matt Cochrane 28:36

time every time we buy like we get I just stocked up on headphones every time I’m there, no doubt.

Dan Kline 28:41

Yeah, like I literally will go look at see and when they have that like really cheap, I’ll just buy a bunch of them my son’s at now. And he’s gotten better at this. And like some things like maybe I’m traveling, and I’m gonna go to the gym and I want a yoga mat. And I’m not going to put that yoga mat in my travel bag. Well, you’re gonna find below, get a $4 yoga mat and just be done with it and throw it away after the fact. There’s so much stuff there, that’s a value. And even back to school, I’d be pretty surprised that they’re back to school numbers weren’t good, because maybe people aren’t buying the LL Bean or the Nike backpack that costs $50 made for their kid to lose or destroy. Maybe they did go to five blow to buy some of their school supplies and some of that stuff. This is a company with a brilliant strategy because unlike your typical dollar store and they’re not $1 store, they sell things you know generally one to $5 a few things above that. But they’re bright they’re airy, they’re fun to be in. You don’t feel you know weird taking your you know, sort of snobby or friends or relatives there. It’s not like you’re I hate to say we’re talking about Dollar General but like taking them to $1 General. It feels like an upscale store that just happens to be inexpensive. There’s a real nostalgia retro feel to it. This is one of my absolute favorite companies both as an investment but also just like I was thrilled to learn there was a five blow down the Street when we moved because Sometimes it’s just fun to go walk around five below and come home with like, you know, you know alpha and seek of the wild Samoans from an old WWE figure line or, or you know a candy or nostalgic about or whatever it might be.

Matt Cochrane 30:12

They’re definitely fun. I think like my kids loved going there we always like every year we just stocked up on like pull toys, you know, at the beginning of summer, I just put them out and I know like, okay, they’re not gonna, they’re gonna last barely the summer and then we can throw them away because they cost five bucks each. Dan, one, I think the most heartening thing about their conference call in their quarter like even though it was kind of disappointing results, they still said their triple double long term growth strategy is still on track. And that’s tripling the number of stores by 2030 and doubling sales and EPS by 2025. This chart is from their annual report last year, since this chart came out, they have now opened their 1200 store in New York City earlier this year. And the company like they still believe that new stores can be the primary driver behind their growth. They’re on track to open 160 stores this year, a next year, for the first time ever, they’re going to open they believe they will open more than 200 new locations. Is it? Is it’s a market that big for five below.

Dan Kline 31:20

Yeah, I think it is because anyone can shop at Five Below. And this is a company that benefits from debt that benefits from density. So in West Palm Beach, where we used to live, there were at least two maybe three, five blows, because you’re not really going to drive to go to a five below. Like if it’s in the strip mall you’re at, you’re probably going to stop there. You’re probably unless you’re like going to the movies and need to sneak candy in like, like there aren’t that or that’s like specifically Christmas or school supplies. But it’s kind of an add on stuff. I think of it as like, you want to take the kids to someplace they don’t want to go and you bribe them like hey, we’re going to the dentist but on the way back we could stop the bullet but the more of them there are the lower cost it is to move around inventory to stock the stores to deal with distribution supply chain all the all the things so yeah, I think they can they can double they can triple you know that this is an in person business. They do very very little online, online business they pay a little bit but for the most part, this is all about the in store experience. And I don’t think people have tired of leaving the house. People want to go to stores they’re still excited about that. And I don’t know anybody like I don’t know my mom would probably want to go to five below and find something she’d be excited about. I certainly know my wife and kid are Yeah.

Matt Cochrane 32:40

So finally okay, we’ve done Walmart target Five Below let’s do Dollar General. Dan, this might be as an investment might be my favorite of the bunch right now. Over the last year while the s&p 500 has fallen 10% Dollar General has like soldiered on, and they’re up 11% their quarter results were great. Their net sales were up 9%. same store sales were up four and a half percent. And unlike Target and Walmart that also increased sales, their earnings were up to you know, we’re going to talk I’m sure we’re going to talk about this but their store count is kind of like they’re they’re to me, they’re their economic moat, I think used to call this the like the, the moat of convenience or the loyalty of convenience. They I forget how you worded it exactly, but they have eight more than 18,500 locations now across the US. And rural consumers make up about 30% of the country. And there is really no one in better position to reach those consumers than Dollar General with their their vast, vast footprint. And they can do that because each store has a smaller footprint.

Dan Kline 33:56

That’s about a mile. Like right, right, right, right. Dollar General is a different model than other stores and that’s important to know when you’re evaluating they open a store that store gets to I forget the number but let’s say 1.4 million in annual sales might be 1.7 It’s some number in that range. And then they open another store a mile or two down the road based on where populations are a lot of the people Dollar General is the only place they can get to and Dollar General understands their audience they sell things like a half a roll of toilet paper and just enough food for the next meal. Because sometimes that is their customer but Dollar General is also convenient. There’s a there’s $1 General about maybe less than a mile from from our vacation place. And the reality is if you want to stock up on things like pool noodles and and bottled water and other stuff that you know is not going with you when you leave. That’s where you go you’re not even gonna go next door. There’s a CVS next door and a Publix across the Street, the value of Dollar General now what’s the trade off, Dollar General Stores are messy. They’re poorly staffed. They’re, they’re generally they’re empty shelves, it’s not a great experience a lot of the time, and I’d like to see them improve that. But they know their audience, they’re bringing fresh produce and more coolers into more stores, they’re really trying to lean into being a better option, you know, not just saying, Hey, you don’t have a lot of money. So frozen pizza, it’s like, no, you don’t have a lot of money here, you know, you can make a salad you can, you can buy, you know, some fresh chicken and grill it or whatever it is, they’re trying to sort of be good citizens, there were a lot of studies that they would have been the ideal place to do vaccination from, because they have such a footprint. And at the time, they didn’t really have the refrigeration necessary at all the stores, that’s something they’ve been working on and improving. I think this is a chain, they have a greater reach than Walmart, there are more people who live within like two miles, it’s probably better at 10 miles for Walmart. But Dollar General is dominant. They’re everywhere. They’re in every college community. You know, basically, they know their audience. And sure, there’s probably not a lot of dollar generals in rich neighborhoods. Also important to know Dollar General is not $1 store. Dollar General is a value based store that is working on selling as many items as possible for $1. That is a price point that they have acknowledged in the most recent call. But you might go to Dollar General and buy, you know, you know, whatever a power strip for eight bucks, because you need a power strip. And you also need a iced coffee. And three other things because you’re away or whatever it is, it is a really good store that has incredibly disciplined management, those stores are messy by design, they are not spending the money to do some of the things that I would like them to do as plus the target shopper that don’t serve the needs of their community. You know, they’re not terrible, they’re not awful, they’re just a little cluttered and sort of always seem like there should be one more person working. But I really like how this company is

Matt Cochrane 36:59

run. And you talked about management, Dan, so I call these charge X marks the spot where you just have a management team that like the dividend that keeps going up and the share count that keeps going down. And often as a shareholder, that’s a pretty good combination. Also, to your point, you know, by the end of the year, they think 3000 of their basically 19,000 stores will be able to serve fresh produce, and they want that number to keep going up. As you pointed out, the government defines a food desert, and the US as a rural consumer who doesn’t live within 10 miles of being able to buy fresh produce, and you know, or fresh food in Dollar General is it’s really it’s really the best solution to to fight that you know, so 3000 stores by the end of the year serving fresh produce that number keep going up. That’s really that’s another huge untapped need, they can meet.

Dan Kline 37:53

And there’s so many categories, they could grow it like they could grow in pharmacy, there’s no reason they couldn’t, you know, whether it’s partnering with an existing player like a CVS, you know, even some of these rural communities, you might not, you might not have a minute clinic that’s running, you know, nine to five, you might have a doctor who travels in a rural area, who has hours at different places, they haven’t suggested they’re going to do this, but there’s all sorts of things they can do, because in many ways, not in every community. But Dollar General is often like a Tractor Supply, a community hub, a store that’s kind of the lifeline. It’s the old general store, where just everyone goes to and there’s a lot of things you can build off that when they get to the point that they have, you know, achieved 30,000 stores or whatever they think their saturation point is in the US. I think they’re what like 19,000 now.

Matt Cochrane 38:43

Yeah, they’re they’re right on the cusp of 19,000. Yep. All right, Dan. So we did the four stores but I got like a lightning round for you. I don’t have any special effects of a lightning salvo. You know, um, so we got seven questions for you. And you know, like we’re not we’re not timing you. We don’t have a timer but but you know, we’re looking for like, quick like one minute answers. All right. So here we go. First question is Cole’s Dan earlier this summer cold rejected a $53 per share takeover bid from the vitamin shop owner Franchise Group. You know, the Colts chair, you know, like board, they described that they went through the exhaustive strategic review process, and that they had discussions with more than 25 Interested parties. Dan, I’m not a mathematician, but their their shares are down to about $30 today, so $53 Sounds pretty good. Was this a mistake?

Dan Kline 39:43

Well, first of all Franchise Group sounds like the name of a generic company where a Spider Man villain works like that. That is a bit of a red flag for me. But the second piece of this here is management and boards don’t generally make decisions that cause them to lose their jobs. and CEOs generally believe they can turn it around. I don’t think Kohl’s is a disaster. I shop at Kohl’s. I do think Kohl’s is tired. I think a Kohl’s Amazon relationship that spotlights Amazon owned and operated brands would be a good way to refresh the merchandise but Kohl’s has not made a lot of the moves. That target is made to make it stores interesting. So I don’t know that Franchise Group was going to fix Kohl’s. I do think from an investor point of view. Yes, they made the wrong move for a future of Kohl’s, maybe they didn’t. But management has not shown me that they’re really understanding. They’ve done some things. The Sephora deal is interesting. They’ve had a couple of different clothing lines and deals they’ve tried. But Target has 80 of those things. 100 of those things, we really need to see just just a brightening and awakening of what they do at Kohl’s and it’s possible, but it’s difficult and they probably should have taken the body.

Matt Cochrane 40:56

All right, next Royal Caribbean partnered with SpaceX Starlink for onboard internet. Now, Dan, I’m not I don’t really go on cruises. But this partnership is an effort to combat I guess, historically Bad Internet connectivity when cruise ships are at sea. Is this a big deal or even a competitive advantage for Royal Caribbean? Or is this just like one of those headlines, that’s a lot of noise.

Dan Kline 41:20

So it’s a big deal for me. And I’m not sure how many people it’s a big deal for. So I travel Royal Caribbean a lot. And the internet goes from functional to useless. If there’s a lot of people on board and it’s not a newer ship. When you’re at sea, you might not even be able to check your email Starlink will make it I would call it like Starbucks, like where it’s just a pretty good experience, you could do a zoom meeting, you could you could do most things you would do most of the time. So for someone who is often on a cruise ship, but actually working like me, it’s amazing. But I don’t know how big that audience is. I think there’s a competitive advantage that lots of people want to be able to send photos home, want to be able to in a down moment watching YouTube video, whatever it might be. But I’m not so sure that people are going to decide, hey, I could go on Carnival, I could go Norwegian, I could go on Royal Caribbean. And I’m gonna go on Royal Caribbean because the internet’s awesome. I would make that decision like I cruised on Virgin, a few weeks back. And there were only about 900 people on board. But the internet was was functionally good. It was it was was very, very usable, which made me book another virgin trip, I do think I am not the norm. I don’t think the average person is you know, staying up till two in the morning and then getting up at 7am and riding all day and managing a team from a cruise ship, or has to attend meetings from a cruise ship. But I do think they’re setting a new standard. Carnival had already begun working on better intranet by tying in multiple services. Virgin had done the same thing when they launched. So I do think it will become sort of table stakes to at least have functional internet. I am surprised that this isn’t a premium offering on Royal Caribbean, where it’s just going to become their intranet, maybe prices will go up a little. I thought this was going to be something aimed at people like me that truly need or parents who are traveling without their kids that really need a great connection. This is actually going to be how it works and all reports are and then they’ve been testing this on freedom of the seas, which is a ship I’ve been on, I don’t know, six or seven times. All reports are that it’s absolutely fabulous. And so it absolutely has me booking more Royal Caribbean Cruises. I’m just not sure I’m the typical customer.

Matt Cochrane 43:37

All right, fair enough. All right, Dan, Starbucks Starbucks is hiring a new CEO. And Howard Schultz says I am never coming back. That’s what all the headlines said. But the rest of his quote was, because we found the right person. And so Dan, I just can’t help but wonder, like Howard Schultz has come back several times before the Starbucks need Howard Schultz to succeed the new CEO. Oh, I hope I don’t butcher this name. I’m trying my best Laxman near C Mon. Is the current CEO of Racket, which is like the Leisel. Owner. And I know they’re a conglomerate. They own other companies. But I’m not sure if that’s maybe the best fit. But he’s going to take the office, the CEO office in October.

44:25

The Starbucks need Howard Schultz Damn,

Dan Kline 44:28

well, it doesn’t need who had hired and I look, people surprise you everyone was very down myself included on humor Joe Lee, who actually turned around and saved Best Buy. He came from an entirely different industry. And it seemed like an odd fit turned out to be a great pick. In this case. I think it should have been somewhat internal. And I understand that Howard Schultz believes there’s there’s a need to change at Starbucks, but I actually think that functional functionally he’s wrong. Of course, you need to get better at delivery. Drive thru and all the new things that they’re doing. But Howard Schultz seems to have soured on the idea of third space. And in a time where we don’t have offices where we aren’t going to work, people just go to Starbucks, like, I go to Starbucks three days a week, and probably go to a local coffee, place the other three, just to be around people for a bit. And I might, if I have a meeting, I don’t have to talk a lot. I might just do that meeting from a Starbucks, yes, they need to change, they need to get more efficient, they need to sort out their labor issue. But Howard Schultz seemed like exactly the right leader to do that. If he actually believed in the vision he had, when he when he sort of evolved the company. I’m not sure Starbucks needs this major pivot, I think they mostly need to figure out how they’re dealing with workers figure out automation, and some of the things they’re doing, figure out the product line a little bit because I, I think it was a pretty big screw up with the chicken sandwich that made people sick. And frankly, their food is a little bit uninspiring, for the past few years, there’s a lot more opportunity in premium, and dinner, and other things, you know, after dinner dessert in certain markets that they’ve never quite figured out. And boy, I’d rather Howard Schultz was there, you know, building out the premium brand, and the roasteries, and all of that, where I go in and pay $30 for a coffee and feel grateful I was able to do that. You know, the restaurant in Seattle is tremendous. And I really think the Howard Schultz strategy that he left his chairman, because the previous CEO, Kevin Johnson, I believe his name was that that, you know, they didn’t agree on those things. And on one level, Johnson was right, because he said, I want to focus on efficiency. And that turned out to be perfect for the pandemic. On the other hand, taking the 1000 best Starbucks in the best markets, and putting in a premium bar and selling really expensive coffee was a really good business model, and it was gonna work really well. So I don’t like this move in either direction. I’m glad Howard Schultz is still staying on the board. But I would rather he was executive chairman and involved with the strategy here. Because when it doesn’t work, he’s absolutely coming back.

Matt Cochrane 47:08

All right, Dan, Amazon is acquiring or wants to acquire iRobot for $61 a share and an all cash transaction that values iRobot at about $1.7 billion. That includes AI robots net debt, this is a good move for iRobot shareholders or for Amazon shareholders, or is this a privacy nightmare?

Dan Kline 47:32

People are going to complain about Amazon having access to like maps of their house, you can go to town hall and get a blueprint for my house. I am not so sure Amazon didn’t have access to that information didn’t like isn’t that valuable for Amazon to know where I placed a lamp or a desk, I just

Matt Cochrane 47:49

know where your guest bedroom is. Yeah, I

Dan Kline 47:52

think that’s a little bit overplayed. It surprises me that Apple didn’t buy iRobot This is an apple esque product, it is a best in class. I have an iRobot as as our mutual friend that Steve Symington does on a subscription basis, and they send me all the stuff I need when they realize I need it. That is a technology, they could smooth out the website for it, I still haven’t figured out how to tell them I moved. But the actual product is top of the line. And I think it makes a ton of sense for Amazon, just as Amazon makes some products and they’re all just kind of mediocre. Having this is great, but it would have been a better fit at Apple. And I’m actually surprised this wasn’t a bidding war. Because they own this category. You’re not buying a shark, you know, robot vacuum, you’re buying a, you know, a Roomba. And the subscription model is an endless revenue model. I’m never getting rid of that I pay them 25 bucks a month, and every three years or something, they send me the newest model. And the newest model is always going to be super cool and better. And I’d be likely to buy other products. So I think it’s a great move for Amazon but it would have been a better move for other people.

Matt Cochrane 49:01

It does feel like you know, that Amazon if this acquisition goes through and is approved by regulators that Amazon will have kind of maybe one that home now, right? I mean, because with ring with Alexa with echo with fire. And now this I mean, it feels like this for $1.7 billion. There’s a lot of other companies I mean, Apple being one of them that could have bought this without I mean with the change in their couch cushions, you know in their in their lobby. It was not a big acquisition by any means. But you’re right it is a category leader and one that’s probably growing.

Dan Kline 49:36

It’s growing and there’s other things they can they can build with this technology. I don’t know where we’re going with with robots, but there’s absolutely other simplified you know, maybe it’s just like a shower cleaner. Maybe there is a small little robot that can stick to your wall because I don’t know about you. I have a tiled shower, the grout is never clean. There’s nothing you could possibly do. Other than that every time you’re taking a shower bring a MR CLEAN back Magic Eraser lucky to keep the grout clean. Maybe it’s that maybe it’s pool robots. Who knows there’s a lot of expansion that could happen here. This is the best product Amazon owns. I think it’s fair to say that and I like fire TV. I think iRobot is a step above because it’s Fire TV really better than roku? No, they’re about the same product. Apple TV is arguably maybe a little better. But this, this is a coup. I don’t think they held out for enough money as a shareholder. I feel like maybe they should have had a bidding war. But it is a good deal. And this will be an A good acquisition, you won’t even be able to tell how it’s doing because Amazon is so big. But Amazon should fix things like the clunky website. And some of the like, I had a clog earlier. And it was like directing me to the web when I’m like, I mean, your app, you can’t just tell me, they’re like, I think Amazon will fix some of that stuff pretty quickly.

Matt Cochrane 50:54

I don’t know about a shower clean robot. But there is probably no amount of money my wife would not pay for a laundry robot where she could come home. And all the laundry is done and folded. I think I just can’t imagine our mouths that would be too high for her.

Dan Kline 51:09

Not a bad idea. And also a robot that bleeds out behind your stove. So when we bought this house, Matt, it was a total like we ripped everything out. And we took the stove out the level of gunk that was back there.

51:24

I don’t want to think about my stove.

Dan Kline 51:26

Right. I’ve lived a lot of places other than when I’ve replaced my stove. I’ve never pulled my stove out for cleaning. I think we’ve put that on the calendar. Because it was so it to use a scraper. Yeah, it was horrifying.

Matt Cochrane 51:40

Okay. All right. Oh, no, I gotta put on my calendar. All right. All right, next activist investor, Dan Loeb, he recently took a $1 billion stake in Disney. And he wants Disney to spin off ESPN, a move that he argues would give the sports brand greater flexibility in pursuing opportunities like sports betting, a step that Disney already is allegedly exploring. Dan, is this a good idea?

Dan Kline 52:09

No, you can’t sell ESPN if you don’t also sell ABC. So the two are intrinsically tied together in the sports world. And the reality is there aren’t a lot of premium products out there. And I understand that what ESPN is changing, that we’re down to 72 million homes in the cable universe. And the vast majority of those have ESPN, but That’s down from like 104 million, like six or seven years ago. So the universe is shrinking. But at some point that will trigger deals where ESPN is allowed to is allowed to market, not ESPN plus, which is a collection of hundreds of extras of you know, just random shows and stuff that spillover, they’re actually going to be able to sell you an ESPN standalone subscription. That will be the next big valuable streaming product. Because if you’re a sports fan, you need to have ESPN. And you don’t necessarily want to buy Sling TV to have it pay 35 bucks. You don’t necessarily want to have to get a cable subscription. I think I live in an HOA and you may too. So I have a cable subscription that comes with TV Anywhere. So I have a really cool access to ESPN wherever. But ESPN is going to have to figure out its model. It probably can’t afford to pay all that many anchors all the money they’re paying. And I think that’s why you see them move to a model where it’s like Stephen A Smith and Mike Greenberg are kind of the stars. I don’t think the Joe Buck Troy Aikman, $20 million deals make a ton of sense, or 30 or whatever those numbers are. But I do think ESPN is a Cadillac. Disney has done a terrible job job of integrating ESPN into the rest of its universe. Yes, there’s the Disney Wide World of Sports Complex and large, right? Yep. But why is ESPN not integrated into one of the theme parks? Why does magic kingdom not have an interactive sports land where you can like throw a football into a net and suit? Like, how cheap is that and like fun and ways to get your kids energy out when they don’t have to stand in line. There hasn’t been since they failed with the ESPN Sports zone. So it’s actually a pretty cool Sports Bar. They haven’t done much but with the brand. There’s so much they could do. It’s the premium brand in sports. I’m surprised they let the New York Times by the athletic would have made a lot of sense for Disney and ESPN to own that. There is a lot of investment that can be made in content for them and I don’t think they have but selling it does not do ESPN any favors because they’re part of a giant conglomerate. And that gives them all sorts of leverage with with cable providers and whatnot. There’s a lot of people that get ESPN plus because of the bundle. That would not be ESPN plus subscribers if you weren’t throwing in, you know Hulu essentially for free. So no selling is a terrible idea. And it’s the kind of thing you say to get on CNBC or get people to talk about you. Okay?

Matt Cochrane 54:57

All right. Next Amazon introduced by with prime, which is a new way for third party merchants to grow their direct to consumer stores. And they can do that by attracting converting shoppers with Kline which offers like gives gives these third party sellers access to Amazon’s logistics and fulfillment and delivery and checkout experiences that shoppers know and trust. And after first, like seemingly embracing the idea, though, Shopify has now kind of has now kind of done a 180. And they say it violates buy with prime violates, like their their terms of service. And that can have dire consequences for sellers businesses. Now they say it’s because of like fraud, and things like that. Dan, is Shopify scared a buy with prime.

Dan Kline 55:53

So I think everybody’s scared to buy with Brian, because as much as Amazon has been good for a lot of marketplace retailers, they also take their data. Like there’s a there’s a reason why retail stores didn’t want to use Amazon checkout. You know, your local toy store doesn’t want to tell Amazon how many copies of Settlers of Catan they’re selling are duds in Dragon Dice, or whatever it might be. And some of this is, Amazon controls the process in the warehouse, the items, there are costs associated with that. It’s not overly transparent. So I don’t know that it’s inherently bad. But I think a lot of companies are going to approach it rarely. And Shopify has found itself in a position where they underestimated how many billions they’re gonna have to spend on infrastructure. So they’re probably not super thrilled when Amazon does anything that might get it more market share. So, you know, I’m pretty sure that they’re not the ones who get the big voice in criticism here. But this is it’s really going to be the merchants that decide whether this is successful, because there are costs associated with it and warehousing and all of that. And do they make more money? Or does Amazon use it to create new products or sell their own products or whatever it is? Amazon’s been accused of that it’s hard to know exactly how often it’s happening. So there’s a lot to watch here.

Matt Cochrane 57:13

All right. And last one, Dan, last one. Top Gun Maverick as of last week had gross $1.4 billion worldwide. It just been an incredible smash it I will say personally, I saw it. And I loved it. Dan, is Top Gun Maverick proof that movie theaters still have a viable business model on a post COVID world? Or is it closer to the industry’s last hurrah.

Dan Kline 57:42

So it’s not a last hurrah, but the movie industry has to figure out what to do when they don’t have a Top Gun Maverick or a spider man or a very small list of movies. We’re just not going to a movie theater anymore to see a mid level romantic comedy. I don’t even try to make like Sandra Bullock and Ryan Reynolds you know, hate each other and then fall in love or whatever it

Matt Cochrane 58:03

is go straight to streaming now. Right? Like I think there is a Sandra Bullock Rom Com on like Paramount plus, or one of those.

Dan Kline 58:09

Right? So it’s one of those things where, sure, we’re gonna go see Dr. Strange, it’s actually just watched, but I watched it home on my television, we’re gonna go see the big movies. But I think there’s fewer and fewer of those that matter because I’m a huge Marvel guy. And I didn’t see Thor or dr. strange, because I knew they were coming to Disney plus in a few weeks, and I think you with, you know, last I counted for kids. But if you haven’t seen it, like a couple of months, if we’re gonna work it, that’s a huge expense to go to the theater. So that’s $60 in tickets conservatively. If you’re sneaking in candy, that’s another like 10 bucks. If you’re buying candy there, it’s like another 40 bucks.

Matt Cochrane 58:51

Yeah, that becomes 100 $100. Now you can tell $100 Night, yeah,

Dan Kline 58:55

that’s very different than being my son go. Be You know, so the economics of it. But that being said, it takes a lot to make me to want to go to the movies. When I know that like, in a month or two. After my wife goes to bed, I’ll have another thing I really want to watch that I could watch over a couple of nights like I think Thor comes out tomorrow on Disney

59:18

today or tomorrow, maybe today. Yeah.

Dan Kline 59:21

And I know my son’s on the theater with friends actually. But I know I’m gonna watch it and I’m going to be excited to watch. So I do think the movie theater business is gone. And that we might have some new model of like two or three screens that Do you know, UFC pay per view is like, near near me in Danville port Florida in Kissimmee, technically is a God was it’s a movie theater grill, and my son and I went there about a year ago to watch a wrestling pay per view. And it was kind of awesome like there were there weren’t a lot of other people there. We did it because we wanted to be around other people for a sporting event. But Uh, you could order a beer, you could order food, the food wasn’t bad. Like, it was a really enjoyable experience for something that if I bought it at home, it would have cost me 50 bucks. So spending 25 bucks for the two of us for ticket was a wash, and we would have ordered food, I would have taken a beer out of the fridge, like, it was just a really nice way to do it. I think you’re gonna see that for like, things like here in Florida. You might see patriots or Yankees games that are just regularly on a theater somewhere that sort of replaces the bar experience or, you know, there’s a lot of people from the Northeast here, you’re gonna see more like concerts where like The Rolling Stones only play 10 or 11 gigs on a tour. And maybe eight of them are broadcast, and you can go see them a certain way. But the model of like, 18 Oh, Plex screens, there’s nothing to show off. So the whole thing is dead. And people get very mad at me when I talk about you know, AMC wants to pretend they have a business, but like investing in like mining and just throwing around the word crypto @7investing. You’re right, right, right. This isn’t a business. And you know, look, I don’t know about you, Matt. But I have a 65 inch television in the other room. It’s pretty awesome. It’s not back when we had a 32 inch technically, exactly. The home experience is great. And I haven’t seen Top Gun yet. Just wasn’t my favorite movie the first time. So I wasn’t that excited about it. But I’ll absolutely watch it when I probably never would have paid for it. So they’ll in some way or other make make that money from me or, or you know, at least monetize me in some way. The business is changing. We’re going to see more small movies and Giant Movies, we’re not going to see as many middle movies.

Matt Cochrane 1:01:42

Alright, Dan, thank you so much for coming on and joining us. If people are interested in following you and seeing more of your content, where can

1:01:51

they find you?

Dan Kline 1:01:52

Well, you can find me and my team at the street.com I do write a lot about the cruise industry about travel about Disney about Las Vegas sort of all the things those of you who who know me over the years know I love to write about. And you know, what’s different about the Street from some of the other places I’ve been, is it sort of embraces all types of investing? You know, it’s not just long term investing. There are people who write about technicals and some of that stuff. I look at it as these are all tools for long term investing because I I don’t do any short term investing. But all of that is kind of there and available for you. We’re growing. We’re evolving. It’s been a ton of fun, man, this was fun to do.

Matt Cochrane 1:02:32

Well, let’s get dinner again soon.

Matt Cochrane 1:02:35

I’m Matthew Cochrane. We’re seven investing and we’re here to empower you to invest in your future. Have a great day, everyone.

Simon recently spoke with a $35 billion global asset manager about how they're navigating the market volatility. The key takeaways are to think long term, tune out the noise...

Anirban and Matthew were joined by Alex Morris, creator of the TSOH Investment Research Service, to look at seven former market darlings that have taken severe dives from...

On episode 5 of No Limit, Krzysztof won’t let politics stand in the way of a good discussion - among many other topics!